In recent weeks the U.S. dollar extended losses against its Canadian counterpart, which resulted in a decline to the long-term support line. Will this support withstand the selling pressure in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

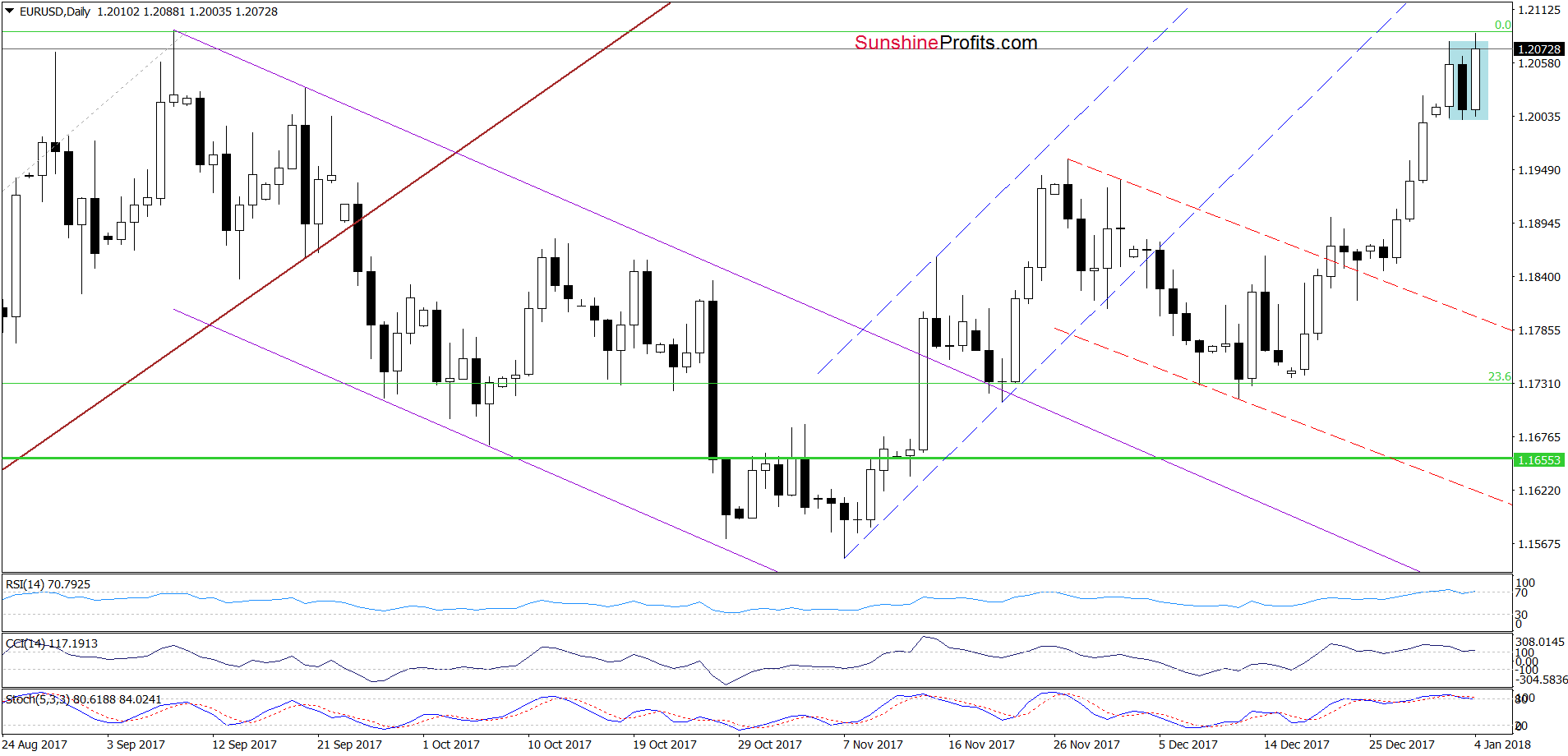

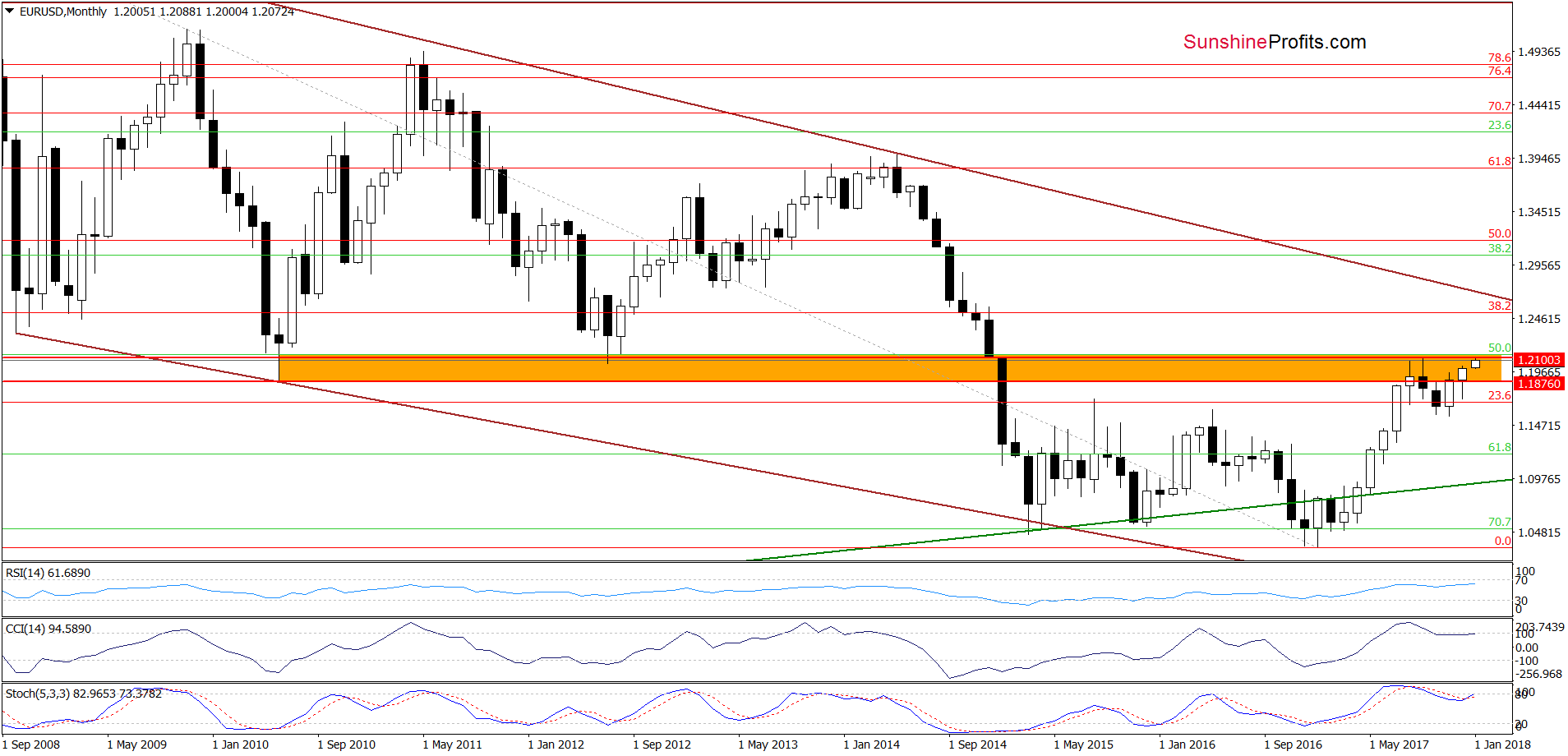

EUR/USD

Earlier today, EUR/USD rebounded and eased yesterday’s decline, which resulted in a fresh multi-month high. Despite this increase, the exchange rate remains below September peak, which suggests that another pullback is just around the corner – especially when we factor in the current position of the daily indicators and the orange resistance zone (marked on the long-term chart below)

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

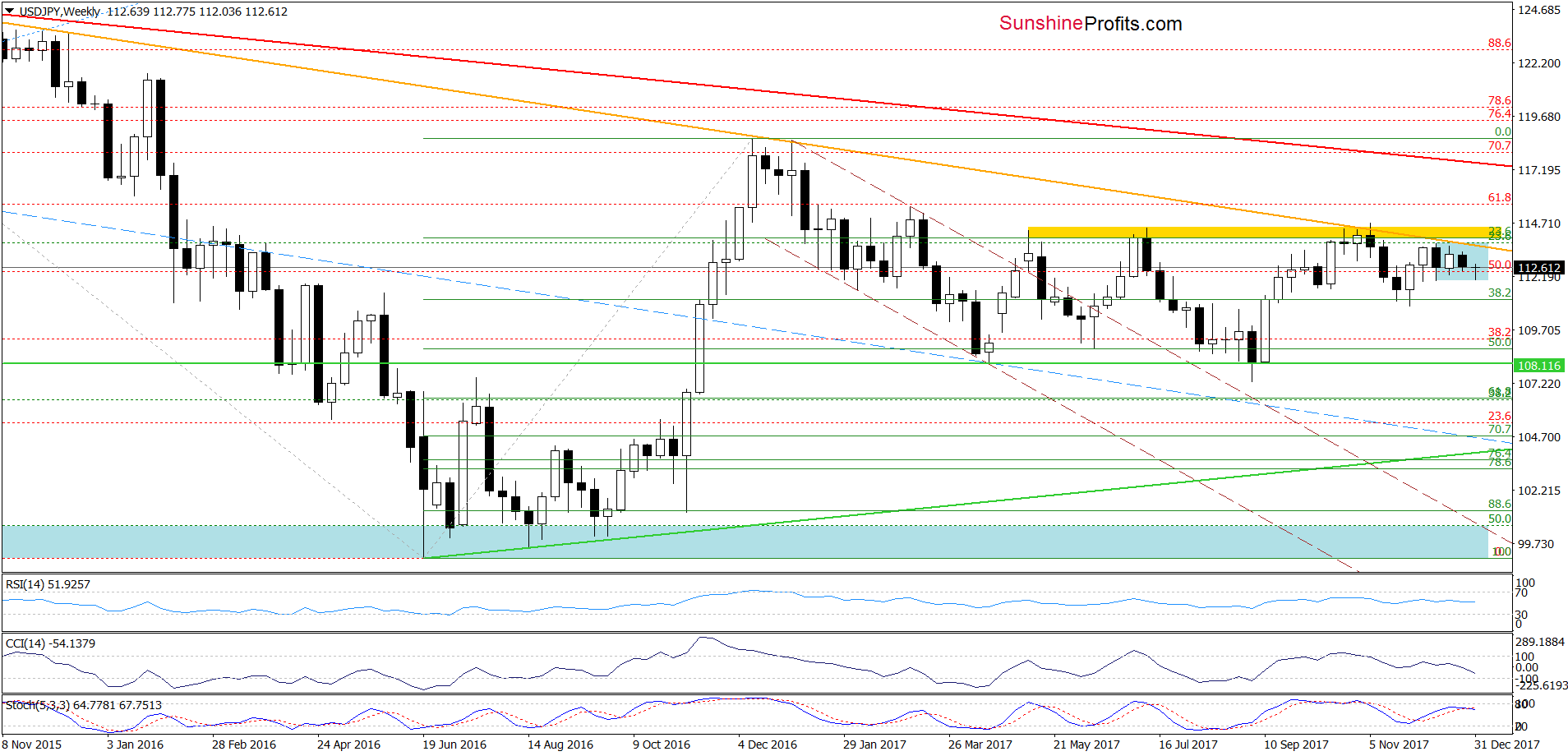

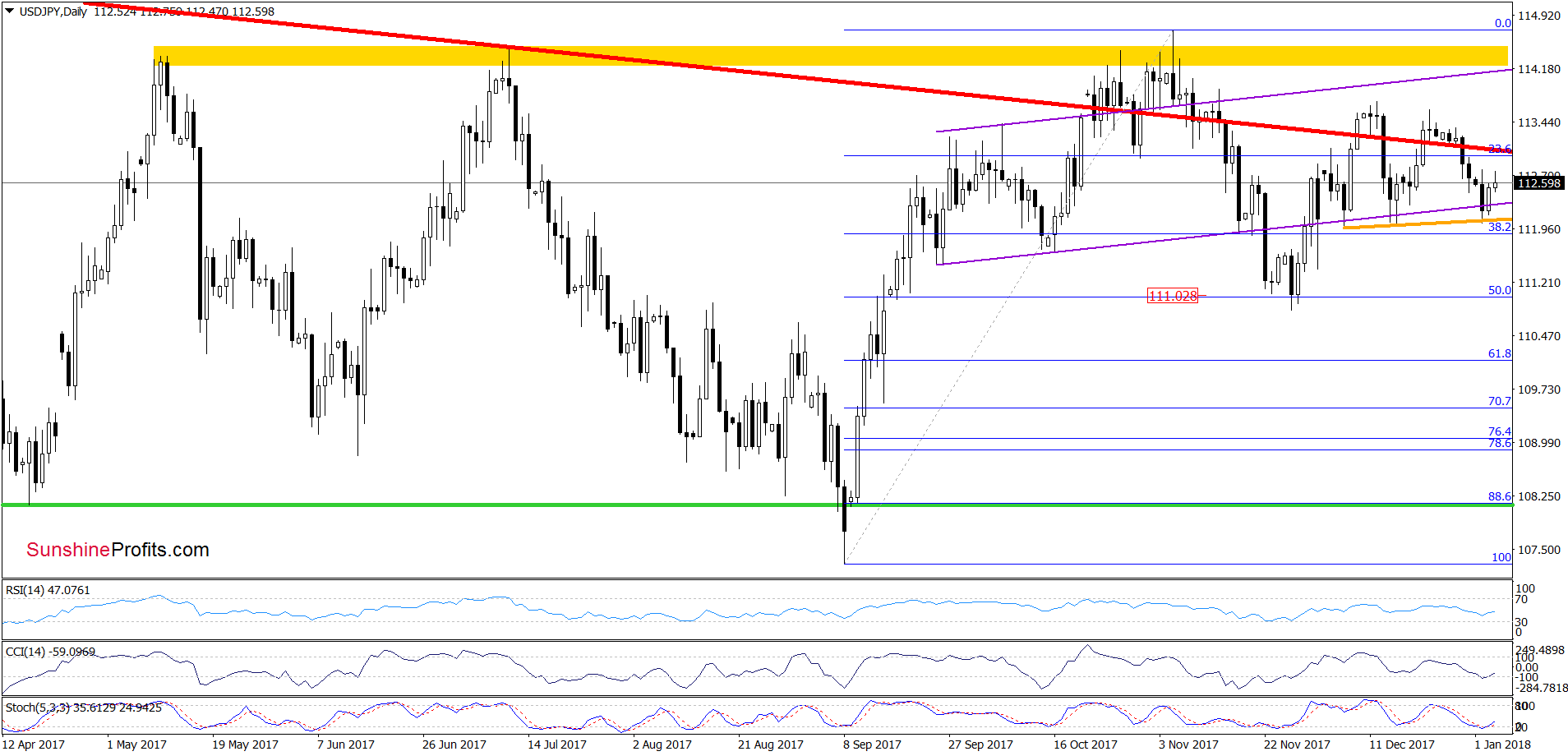

USD/JPY

From the medium-term perspective, we see that although USD/JPY moved lower earlier this week, the lower border of the blue consolidation encouraged currency bulls to act.

How did this price action affect the very short-term chart? Let’s examine the daily chart and find out.

A week ago, we wrote the following:

(…) if the exchange rate closes today’s session (or one of the following) under the red line, we’ll likely see a test of the orange support line based on the previous lows in the following days.

From today’s point of view, we see that the situation developed in tune with the above scenario and USD/JPY slipped to our downside target earlier tis week. As you see the combination of the lower border of the purple rising rend channel and the orange support line encouraged currency bulls to act, which resulted in a rebound.

What’s next for the exchange rate? Taking into account the proximity to the lower border of the blue consolidation (seen on the weekly chart) and the current position of the daily indicators (the CCI and the Stochastic Oscillator generated the buy signals), we think that the pair will extend gains and currency bulls will try to test December highs in the coming days. Nevertheless, such price action will be more likely if USD/JPY breaks above the red declining resistance line.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

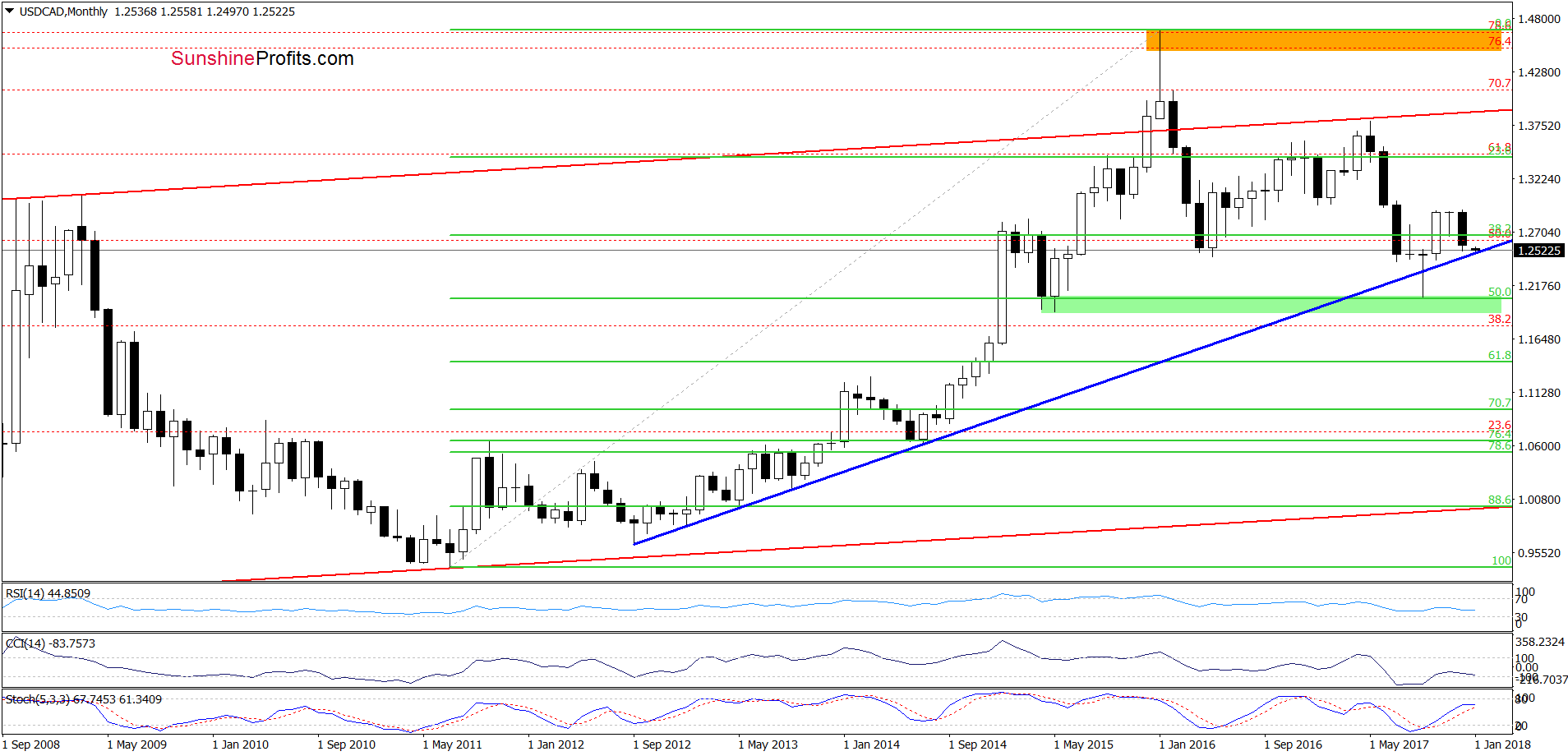

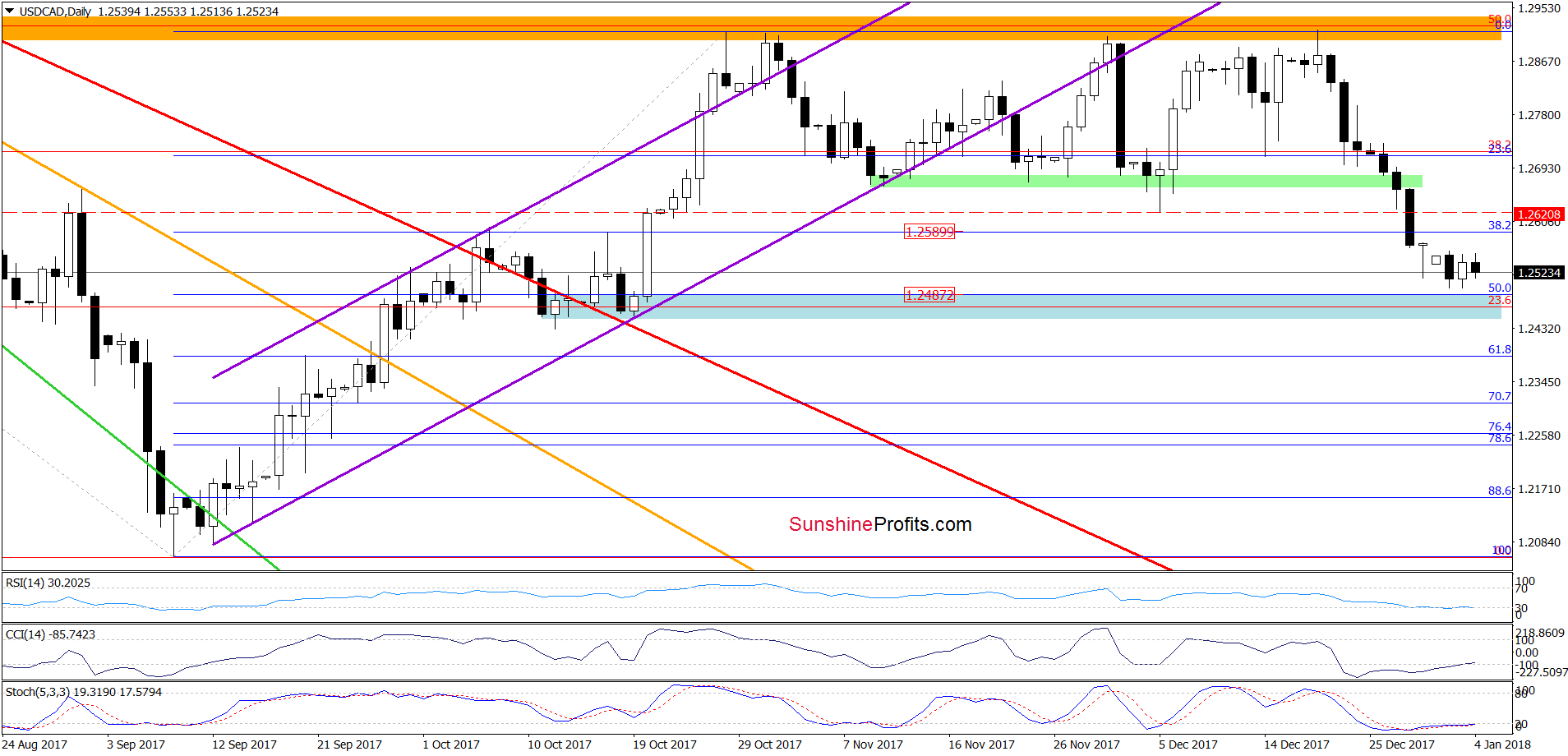

Quoting our Forex Trading Alert posted on December 27:

(…) what could happen if the pair breaks under this month’s low? In our opinion, such price action will result in a decline to the 38.2% Fibonacci retracement (around 1.2590) or even to 1.2525, where the long-term blue support line (seen more clearly on the charts below) currently is.

From today’s point of view, we see that USD/CAD not only dropped below the 38.2% Fibonacci retracement, but also slipped to our next downside target - the long-term blue support line marked on the monthly chart.

What’s next for USD/CAD? The current position of the daily indicators (the CCI and the Stochastic Oscillator generated the buy signals) suggests that reversal and higher values of the exchange rate are just around the corner (especially when we factor in the proximity to the above-mentioned long-term support line). Nevertheless, even if currency bears manage to push the pair lower and we see a one more downswing we should keep in mind that slightly below current levels is also the blue support zone (marked on the daily chart) created by the 50% Fibonacci retracement and October lows, which could stop currency bears in the coming days.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts