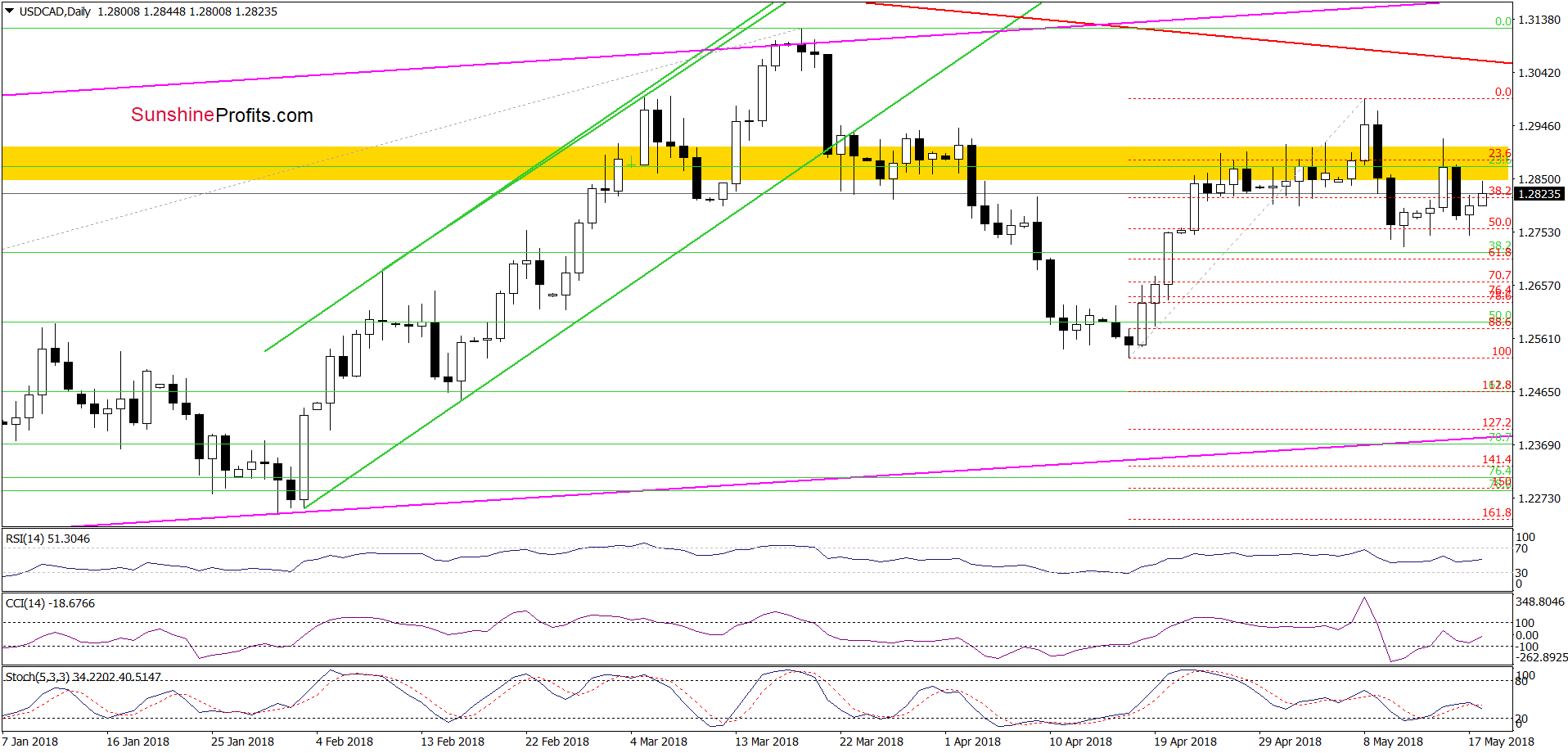

Since the beginning of the month currency bulls try to break above the nearest resistance zone. Although 10 days ago they managed to close the day above this zone, maintaining acquired levels exceeded their capabilities and ended with a pullback. Will they try to push USD/CAD above 1.2900 once again in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: small short positions (a stop-loss order at 1. 2000; the next downside target at 1.1735)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

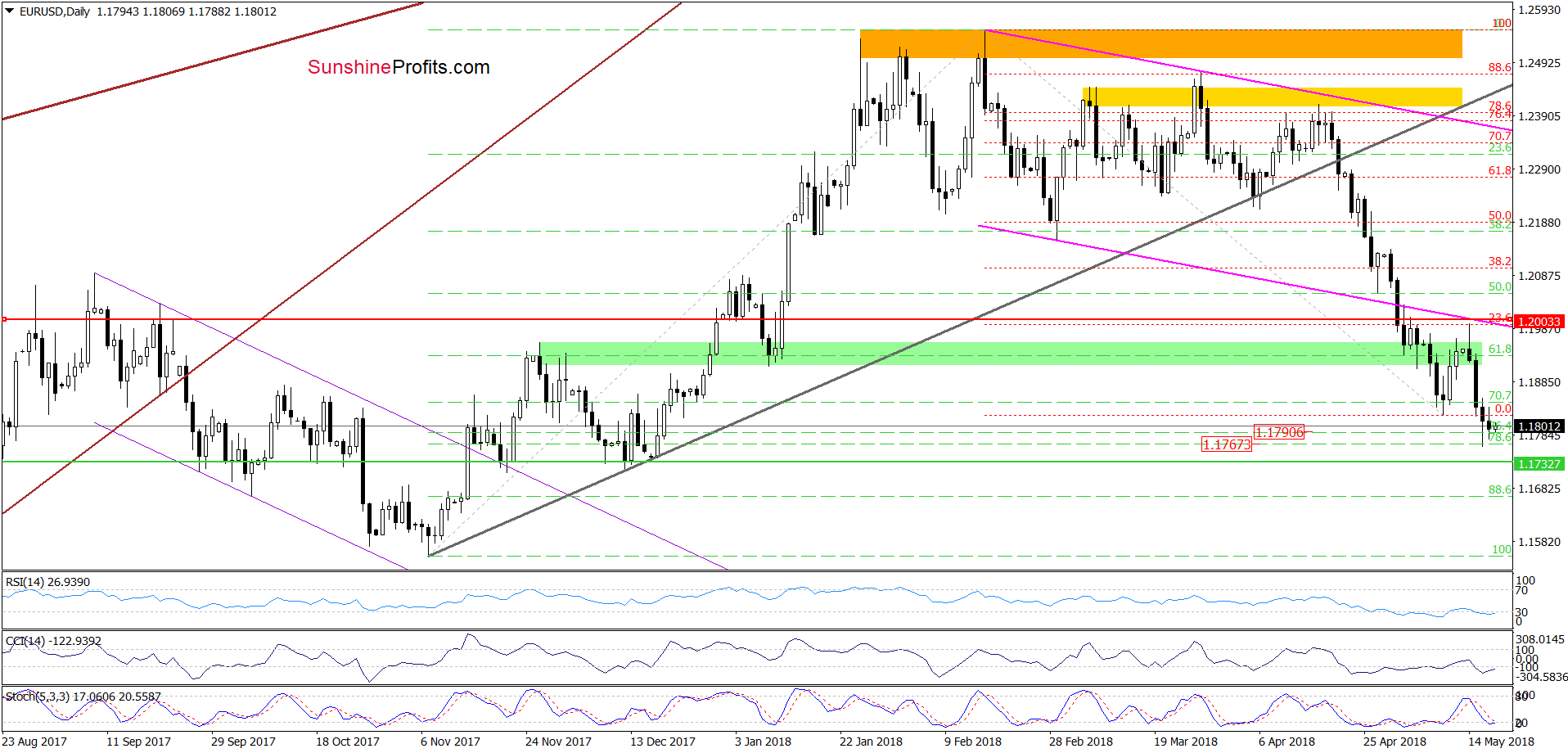

EUR/USD

From today’s point of view, we see that the overall situation hasn’t changed much since our yesterday’s commentary as EUR/USD remains in a narrow range between the 76.4% and 78.6% Fibonacci retracements.

Taking this fact into account, we believe that what we wrote on Thursday is up-to-date also today:

(…) Although the pair could rebound from here, there are no buy signals at the moment of writing these words, which suggests that one more downswing may be still ahead of us.

If this is the case and the pair drops once again, we’ll likely see a test of the mid-December lows (around 1.1732) in the coming day(s). Taking all the above into account, we decided to lower our next downside target once again to 1.1735 and the stop-loss order to 1.2000. We will keep you informed should anything change.

Trading position (short-term; our opinion): Small short positions (with a stop-loss order at 1. 2000 and the next downside target at 1.1735) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Although currency bulls tried to climb above the yellow resistance zone earlier this week, they didn’t manage to do that, which resulted in a quite sharp pullback on Wednesday. Nevertheless, the buyers didn’t give up and the exchange rate came back to the above-mentioned resistance area once again.

What’s interesting, at the same time the Stochastic Oscillator generated a sell signal, which suggests that one more move to the downside is just ahead of us. If this is the case, we’ll see a test of the recent low or even the 61.8% Fibonacci retracement (based on the mid-April-early May upward move) in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

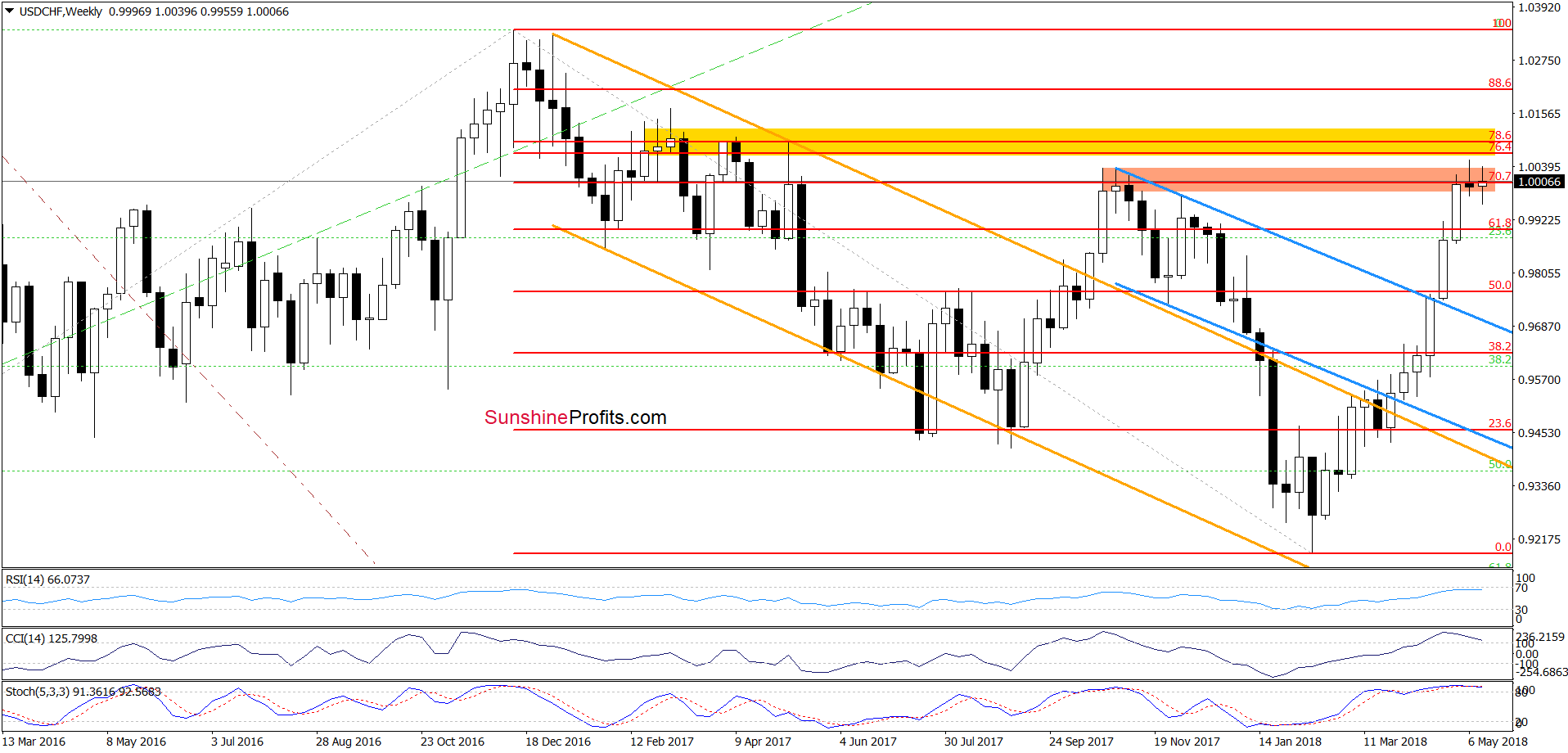

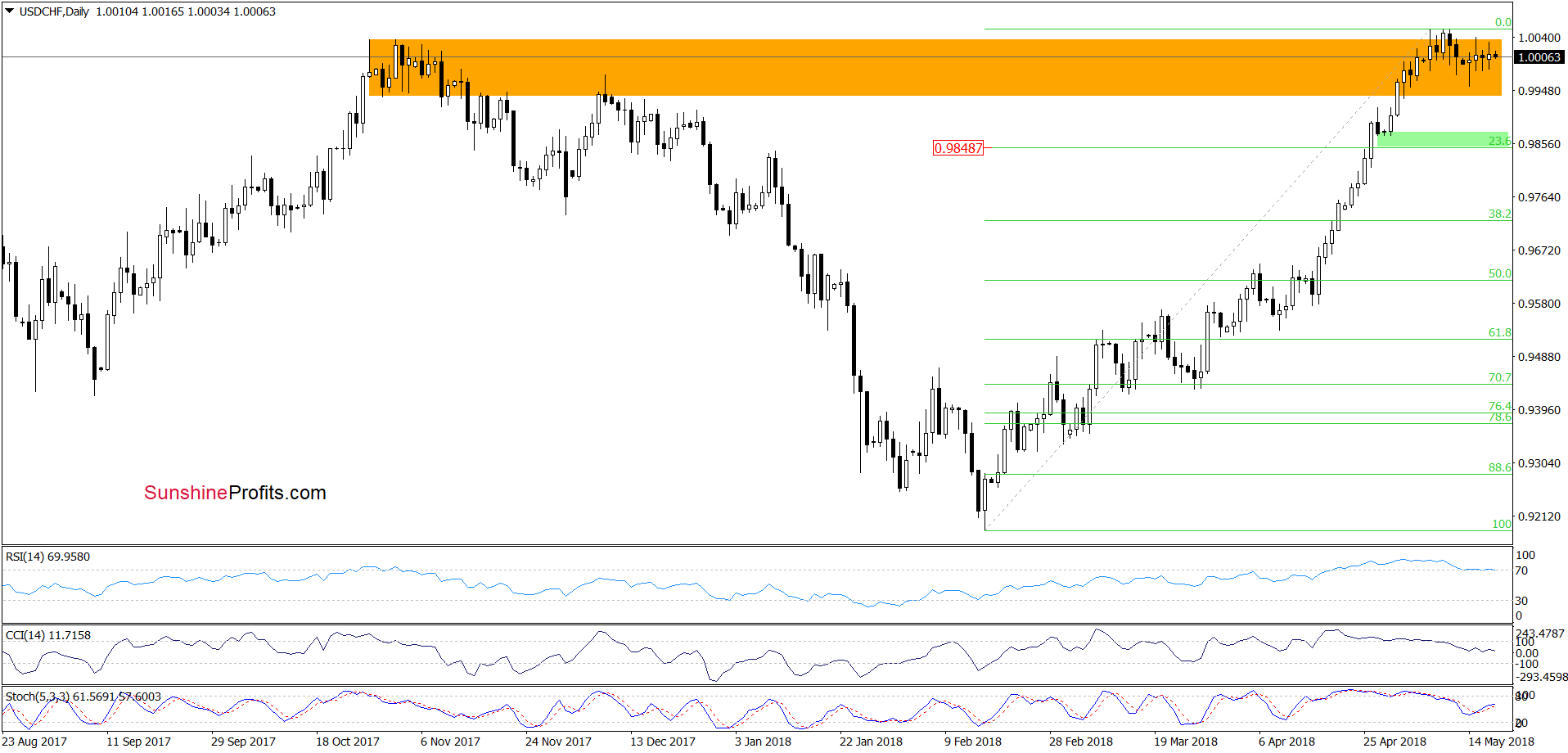

USD/CHF

As you see on the daily chart, the situation in the short term remains almost unchanged as USD/CHF is still trading inside the orange resistance zone. Therefore, our last commentary on this currency pair is u-to-date also today:

(…) we believe that as long as there is no breakut above this area or a breakdown under the previously-broken 88.6% Fibonacci retracement another bigger move is not likely to be seen.

Nevertheless, we should keeo in mind that even if the buyers push the pair higher (using the buy signal generated by the Stochastic Oscillator) the way to the north is blocked by the 70.7% Fibonacci retracement and the yellow resistance zone (seen on the weekly chart), which stopped the rally and triggered a pullback in the previous week.

And what could happen if USD/CHF drops under the orange zone? In our opinion, if the exchange rate slips under the lower border of this area, we could see a drop to around 0.9850-0.9875, where the green support zone (marked on the daily chart) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts