Although USD/CAD hit a fresh weekly high on Wednesday, three unsuccessful attempts to break above the upper line of the declining trend channel were enough to lure bears on the trading floor. What are the consequences of this event?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1437; an initial downside target at 1.1196)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

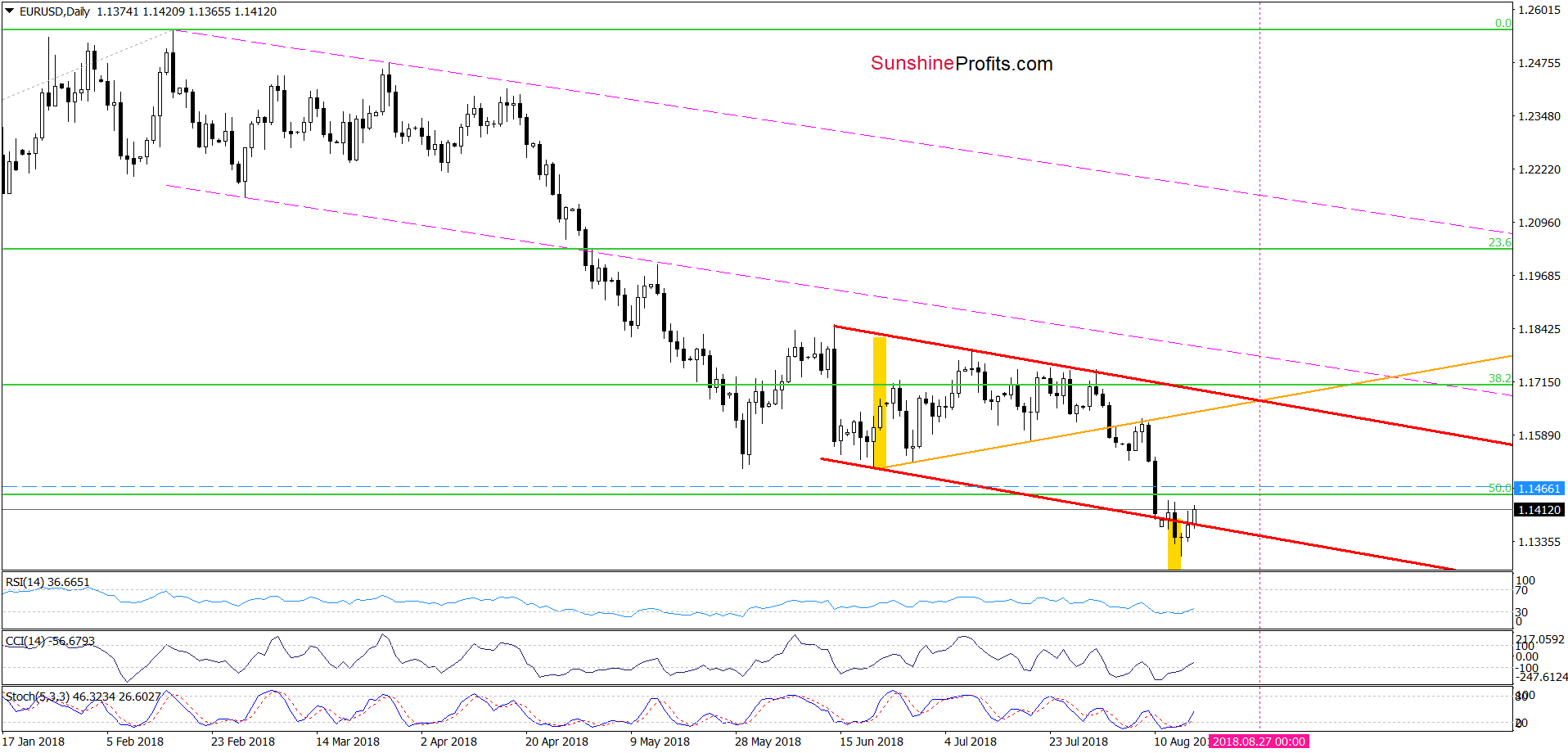

EUR/USD

From today’s point of view, we see that currency bulls extended yesterday’s move, which resulted in a comeback above the previously-broken lower border of the red declining trend channel.

This is a positive development, which will turn into bullish if EUR/USD closes today’s session above this line. If we see such price action, we’ll consider closing our short positions.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1466 and an initial downside target at 1.1196 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Quoting our last commentary on this currency pair:

(...) Although the exchange rate bounced (…) off (…), the sell signals generated by the daily indicators remain in the cards, suggesting that another attempt to move lower is likely - especially if currency bulls do not manage to break above the upper border of the (…) declining trend channel (…) in the very near future.

Looking at the daily chart, we see that the situation developed in tune with our assumptions and currency bears took control earlier today after another unsuccessful climb above the upper line of the red declining trend channel.

Taking this fact into account and combining it with the sell signals generated by the CCI and the Stochastic Oscillator, we think that the exchange rate will extends declines and we’ll see a test of the medium-term green line based on February and April lows in the following days.

Finishing today’s alert, please note that this support intersects the green support zone based on recent lows, which increases its importance for currency bulls and further moves. Why? Because if the pair drops below these levels, we could see even a test of the lower line of the red trend channel and the 61.8% Fibonacci retracement in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

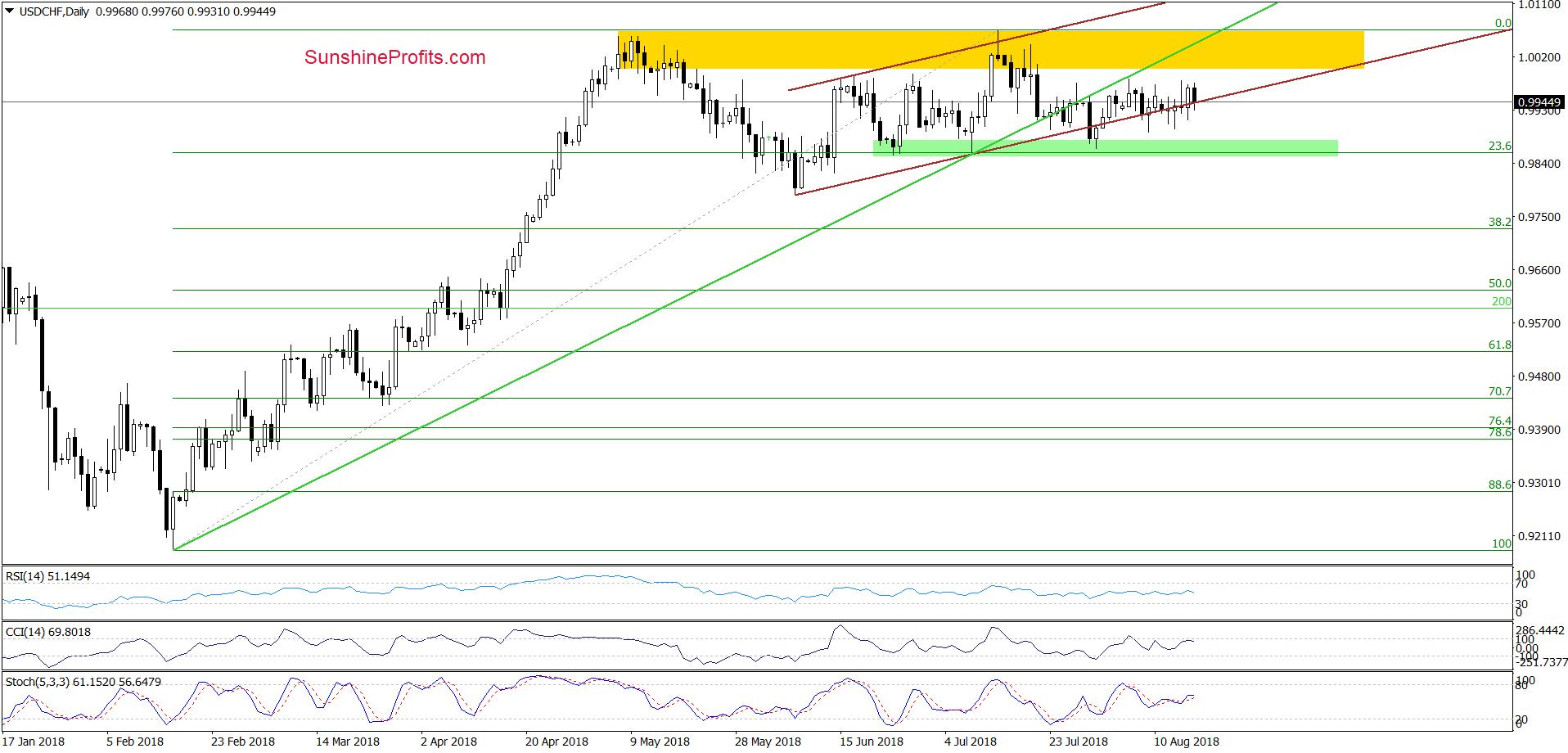

USD/CHF

As you see on the daily chart, the overall situation in the short term remains almost unchanged as USD/CHF is still trading around the lower border of the brown rising trend channel.

Therefore, in our opinion, as long as there is no invalidation of the breakdown under the previously-broken medium-term green line higher values of USD/CHF are not likely to be seen. On the other hand, as long as currency bulls keep the exchange rate above the 23.6% Fibonacci retracement and previous lows (the green support zone), another significant move to the downside is very doubtful.

In other words, waiting at the sidelines for more reliable clues about the direction of the next move is justified from the risk/reward perspective now.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts