Recent days was very good for the bulls as the greenback extended gains and came back above the level of 90. Does everything good have to end? Where are currency bears?

- EUR/USD: short (a stop-loss order at 1.2653; the initial downside target at 1.1710)

- GBP/USD: short (a stop-loss order at 1.4549; the next downside target at 1.3810)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

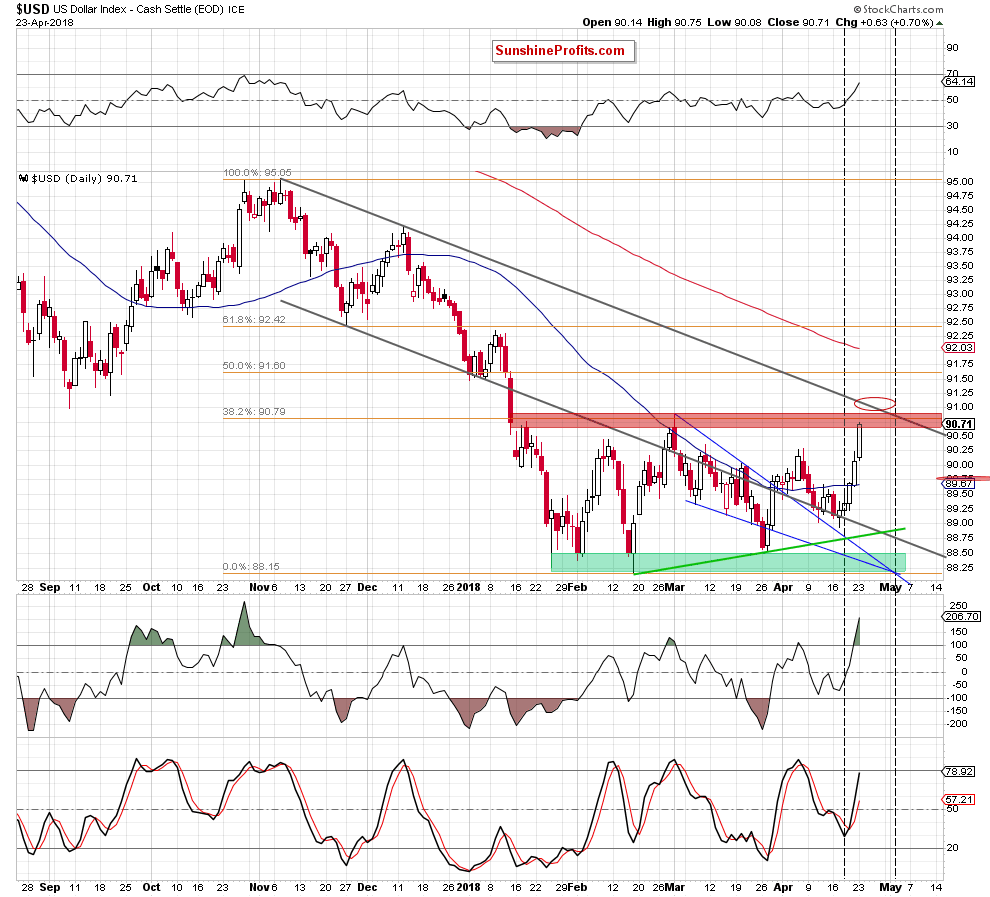

Today’s Forex Trading Alert, we start with the current situation in the USD Index.

Focus on the Greenback

On Thursday, we wrote the following:

(…) the current position of the Stochastic Oscillator says yes. Nevertheless, the triangle created by the resistance line based on the March peaks (the upper border of the blue declining wedge) and the green support line based on February and March lows suggests that we could see reversal later in the day (based on the triangle apex reversal pattern).

Connecting the dots, we think that the pro-growth scenario will be more likely and reliable if the greenback shows more strength (like a daily closure above the 50-day moving average) in the near future.

From today’s point of view, we see that the situation developed in line with the above scenario and the USD Index extended gains in recent days. Thanks to yesterday’s move, the greenback reached the red resistance zone created by the previous peak and the 38.2% Fibonacci retracement, which suggests that we could see reversal in the coming day.

Nevertheless, when we take a closer look at the shape of the recent candlesticks, we clearly see that they grew bigger every day, which shows that the currency bulls grow in strength. What could this mean for the American currency? In our opinion, a breakout above the March peak and the test of the upper line of the gray declining trend channel in the coming days.

How such price action could affect the euro and the Australian dollar? Let’s take a look at the charts below.

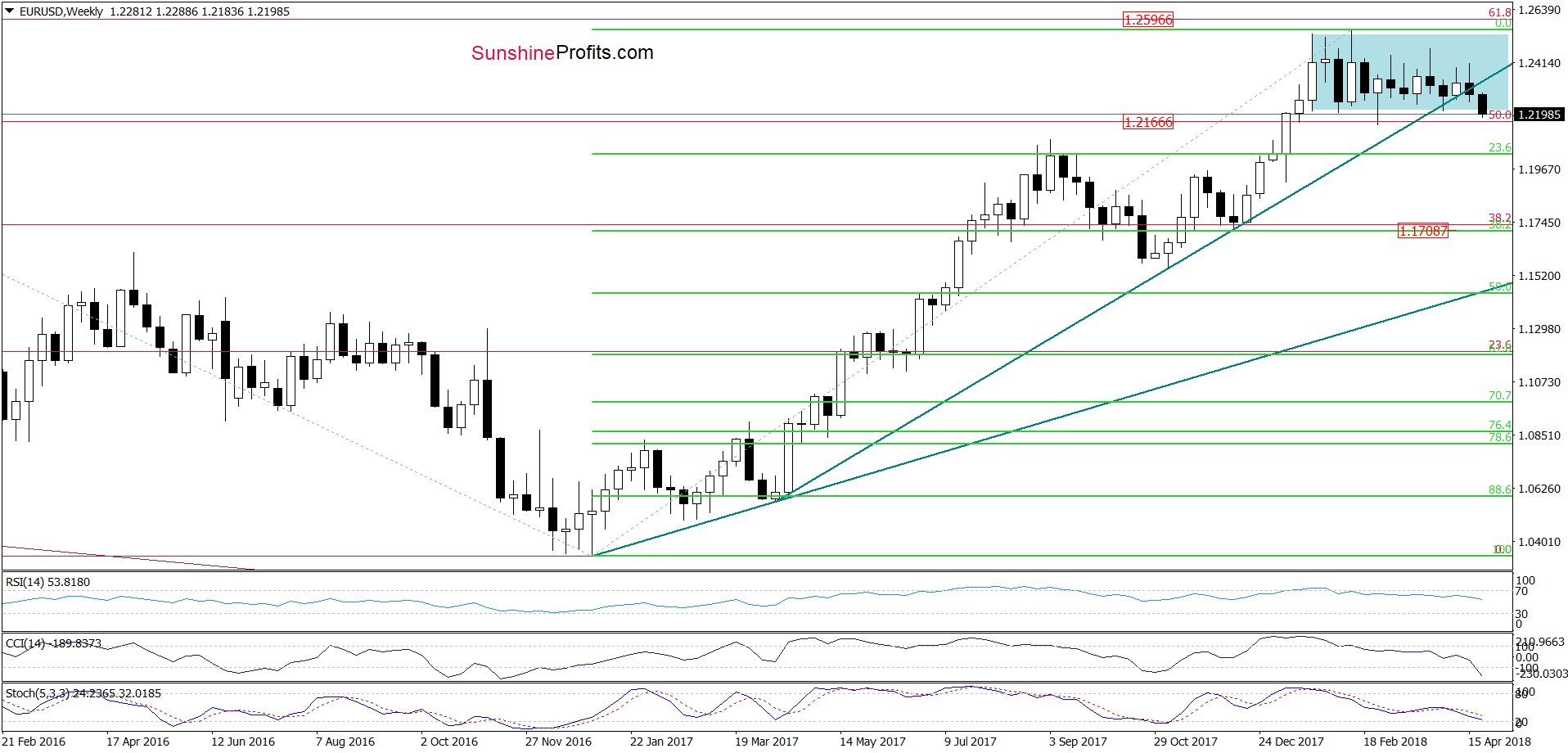

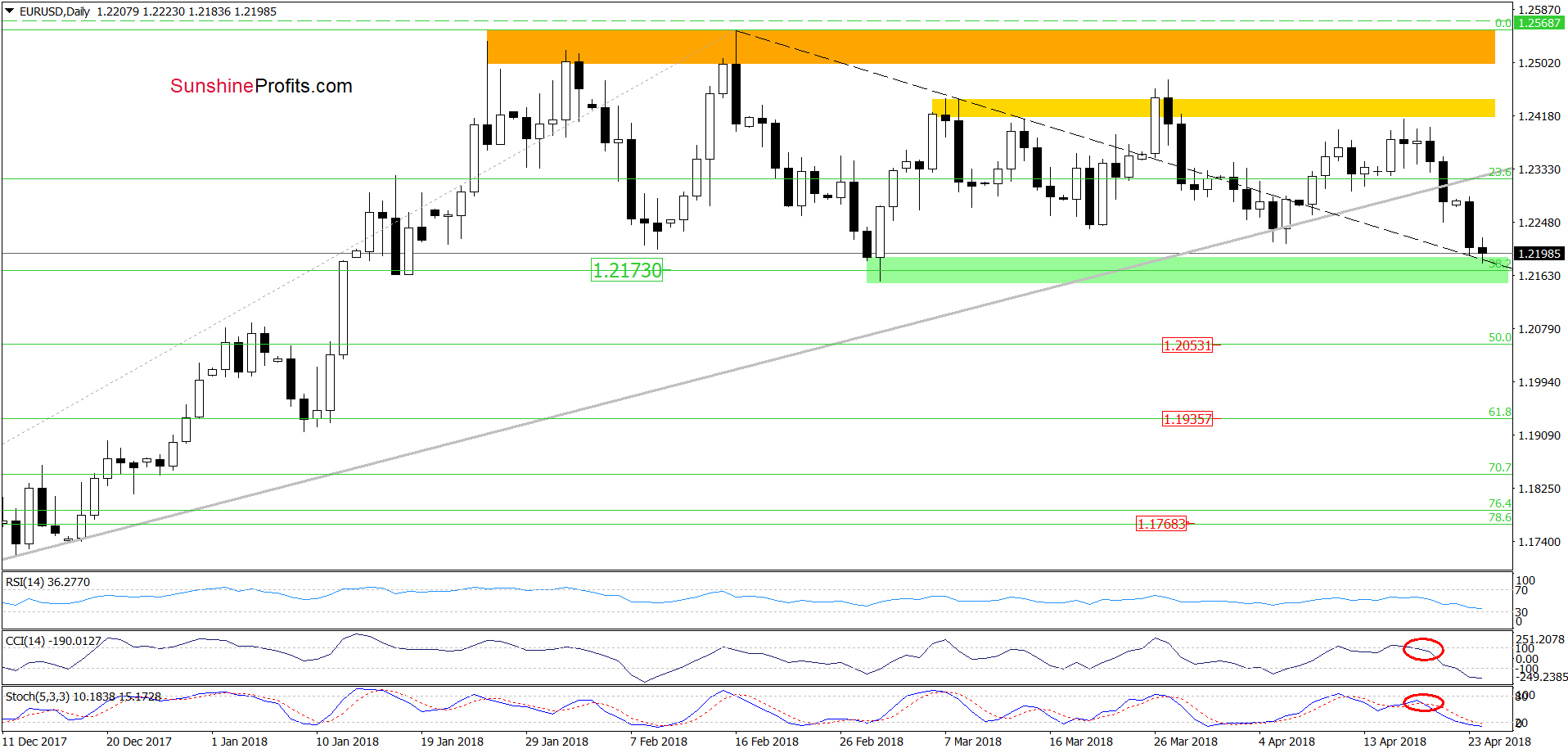

EUR/USD

Yesterday, we wrote the following:

(…) How low could the exchange rate go?

In our opinion, the first downside target will be the green support zone created by the 38.2% Fibonacci retracement, the March low and the previously-broken black dashed support line based on February and early March highs.

On the daily chart, we see that EUR/USD extended losses and reached our first downside target earlier today. What’s next? Although we could see a small rebound from this area, the current situation in the greenback suggests that we should see one more move to the downside in the very near future.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2653 and the initial downside target at 1.1710) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

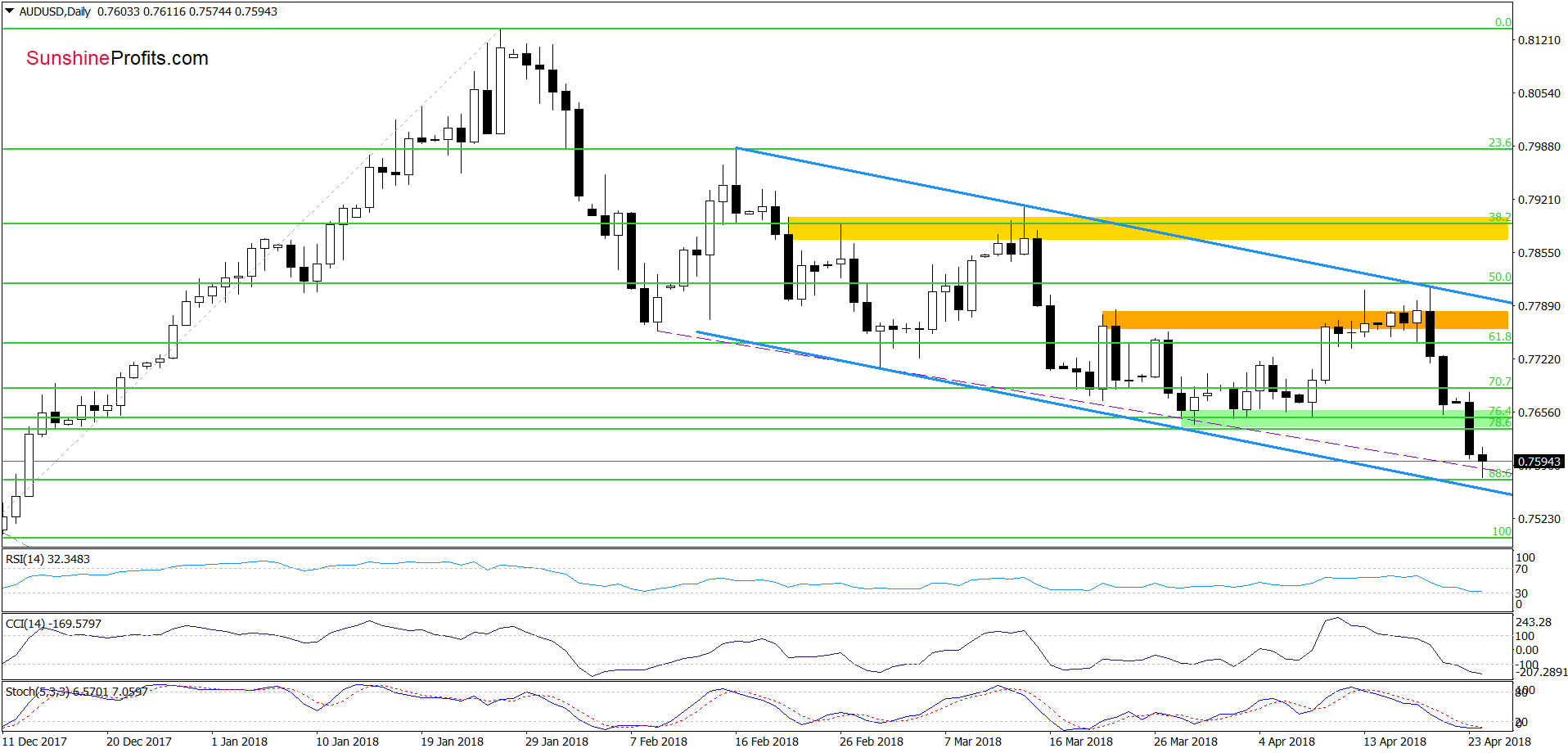

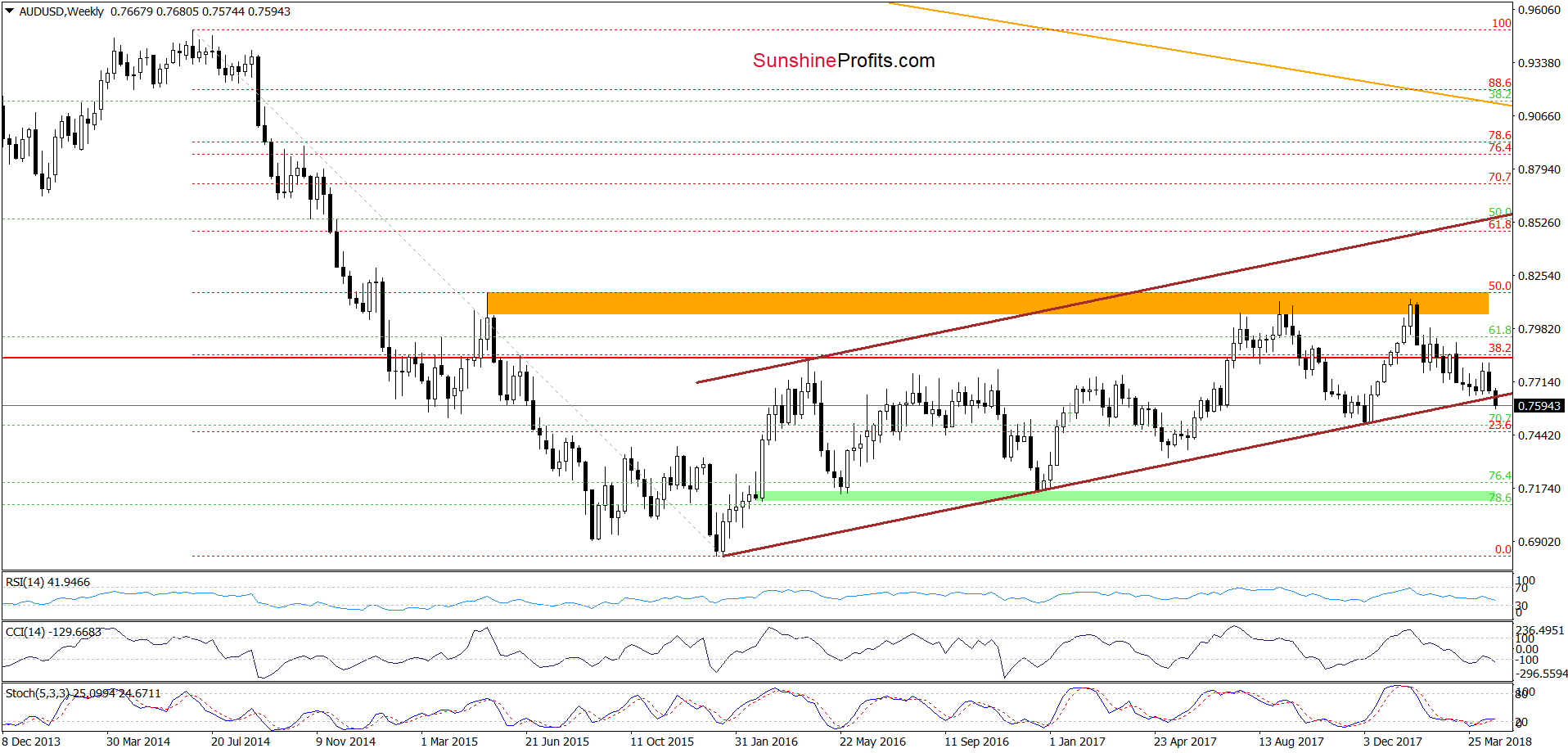

AUD/USD

Looking at the daily chart, we see that AUD/USD moved sharply lower yesterday, which took the exchange rate to a fresh 2018 low. Earlier today, the pair moved a bit lower once again and tested the purple dashed line based on the previous lows.

Although we could a small rebound from here, we think that the pair will move lower once again and test the lower border of the blue declining trend channel in the coming days. The pro-bearish scenario is also reinforced by the medium-term picture.

The first thing that catches the eye on the above chart is breakdown under the lower border of the long-term brown rising trend channel. This is a bearish development, which doesn’t bode well for currency bulls in the near future. Nevertheless, a verification of yesterday’s breakdown should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to your Editor’s travel plans for the rest of the week, the next few alerts will be shorter than the ones that we’ve been publishing recently. Of course, we will keep an eye on the market and we’ll keep posting the alerts on a daily basis, plus intraday alerts whenever the situation requires it.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts