In recent days, the USD Index moved sharply lower, which resulted in the erasing of almost the entire February growth. What impact did drop have on the euro, the Swiss franc and the Australian dollar? Will the technical picture of currency pairs give us clues about the next greenback’s move?

- EUR/USD: short (a stop-loss order at 1.2806; the initial downside target at 1.2186)

- GBP/USD: short (a stop-loss order at 1.4548; the next downside target at 1.3685)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8222; the downside target at 0.7743)

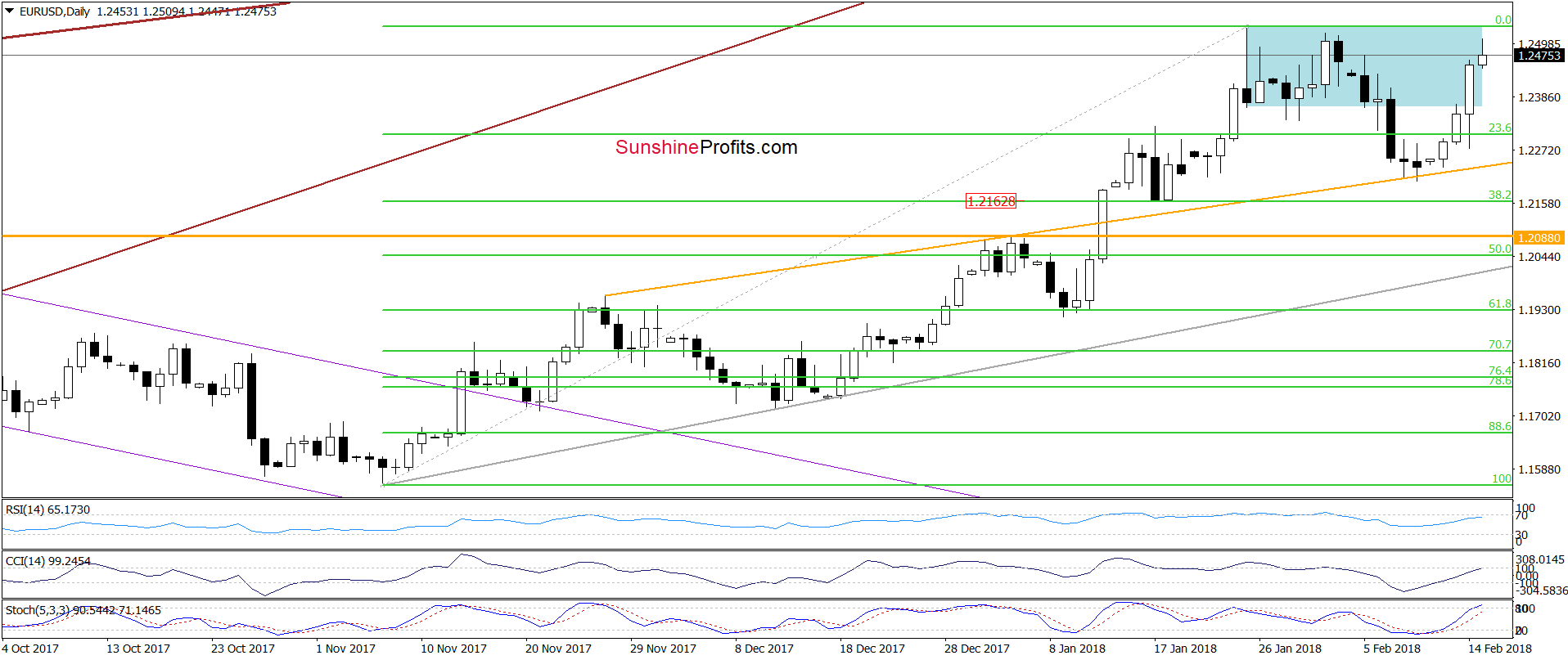

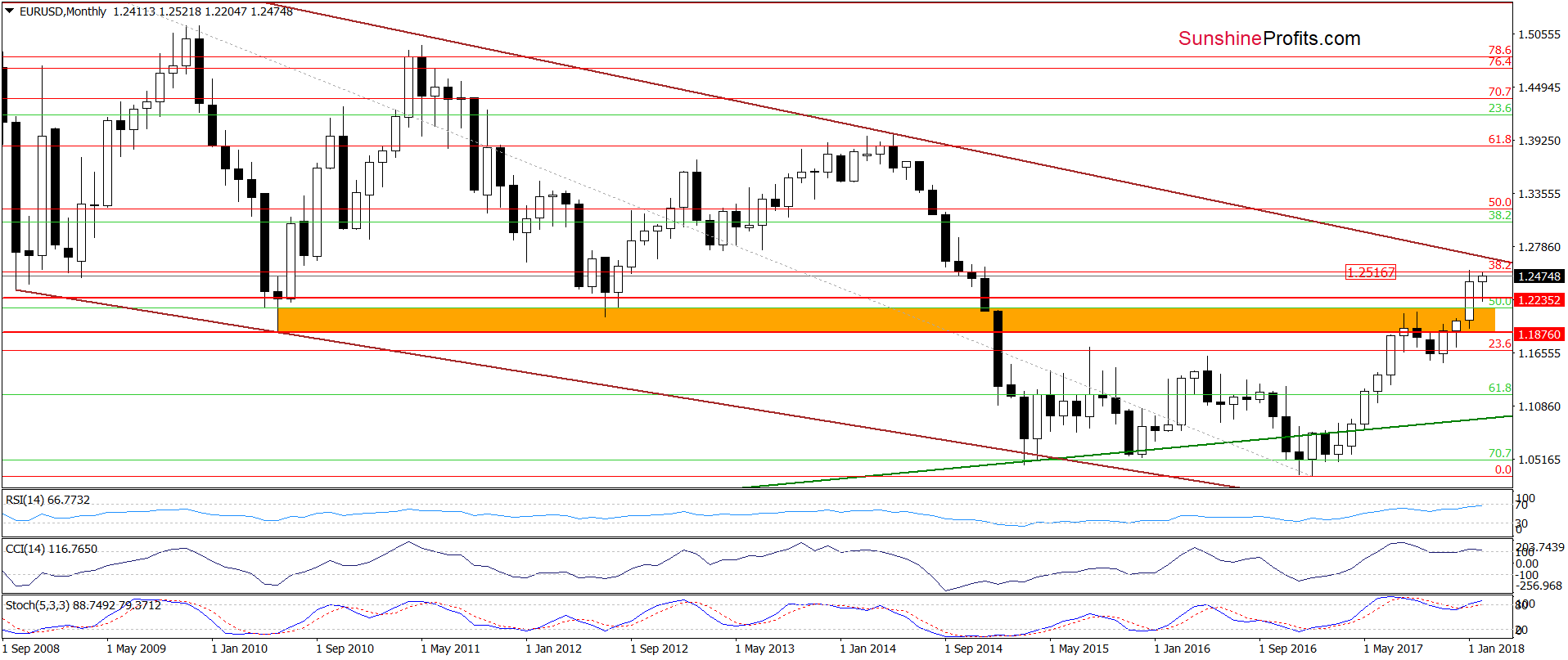

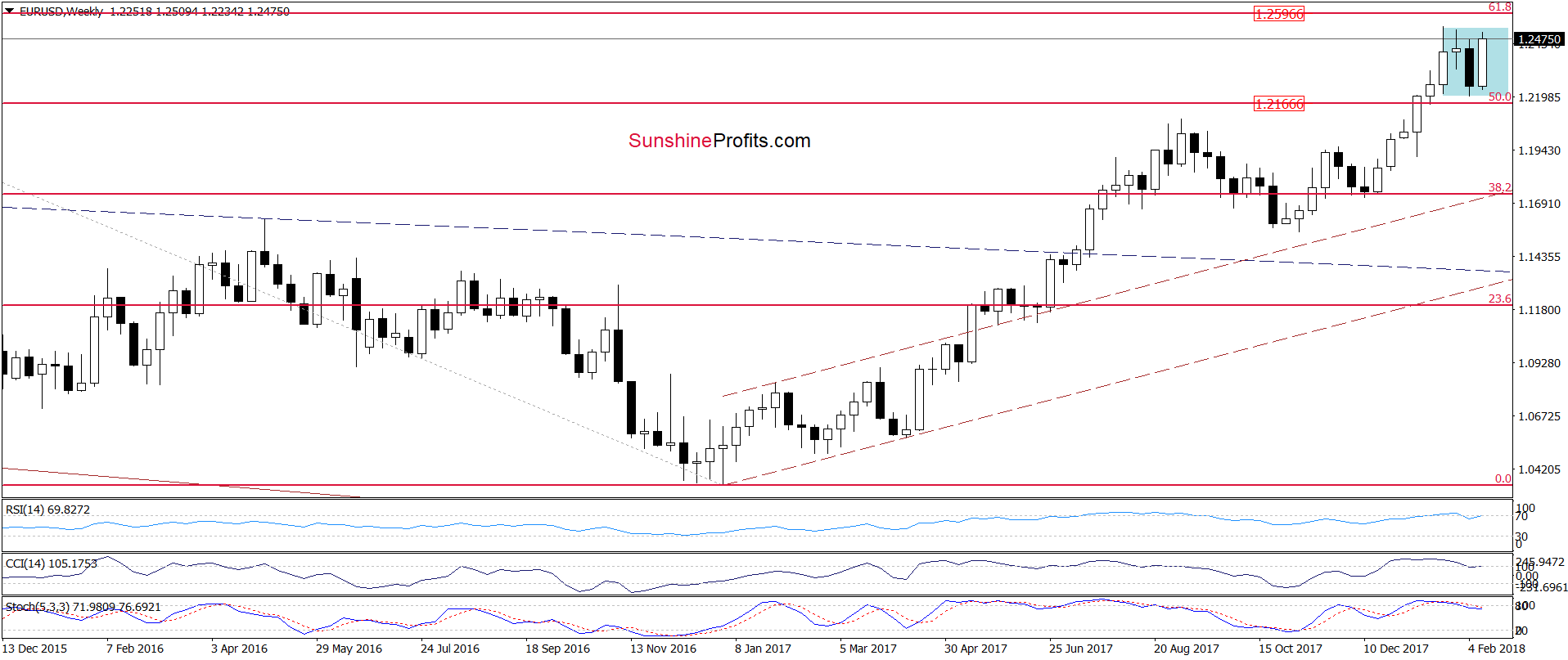

EUR/USD

Looking at the daily chart, we see that EUR/USD invalidated the earlier breakdown under the lower border of the blue consolidation, which triggered further improvement. Thanks to yesterday’s and today’s increase the exchange rate approached the resistance area created by the January and February peaks and the 38.2% Fibonacci retracement (marked on the long-term chart below), which suggests that we’ll likely see another reversal from this area later in the day or in the coming days.

Nevertheless, taking into account the fact that there are no sell signals at the moment of writing these words, we think that it would be wise to consider the worst possible scenario for currency bears.

What could happen if EUR/USD extends increases?

In our opinion, even if we see such price action, the space for gains seems limited as the 61.8% Fibonacci retracement marked on the weekly chart above is quite close from current levels and the sell signals generated by all indicators remain in the cards.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2806 and the initial downside target at 1.2186) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

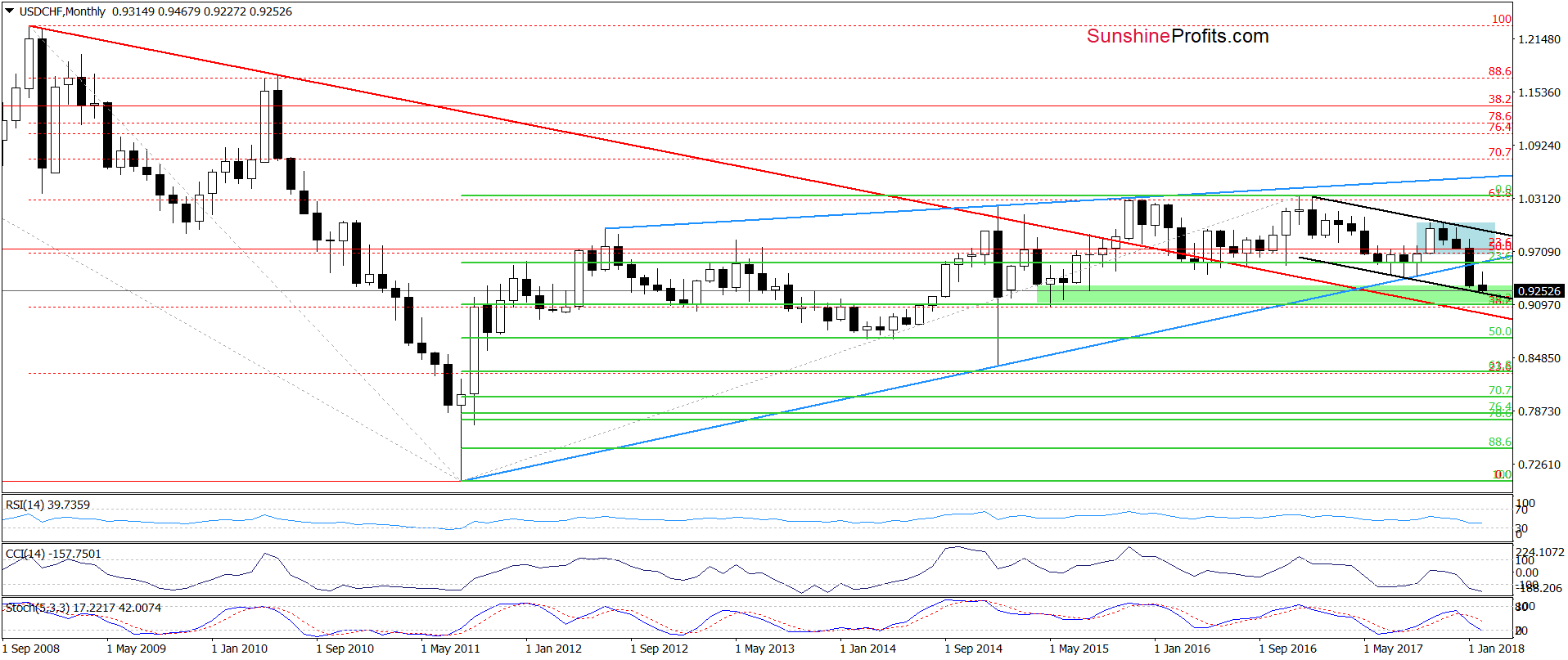

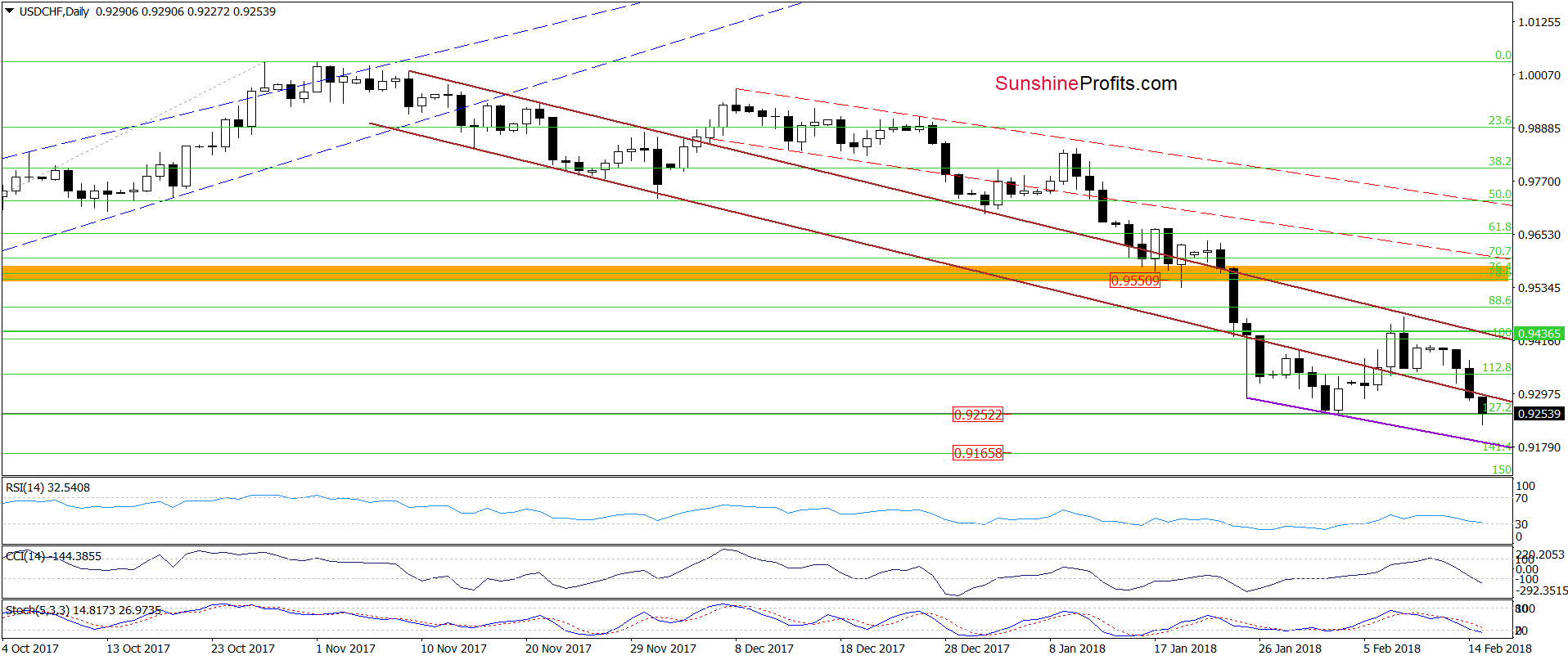

USD/CHF

On Tuesday, we wrote the following:

(…) the 23.6% Fibonacci retracement encouraged currency bears to act (…) the sell signals generated by the daily indicators do not bode well for currency bulls. What does it mean for us? In our opinion, even if we see one more downswing, the space for declines seems limited as the recent lows, the green support zone and the lower border of the black declining trend channel (seen on the monthly chart (…)) are quite close to current levels.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/CHF moved lower, hitting a fresh 2018 low earlier today. Thanks to this drop, the pair re-tested the lower border of the black declining trend channel and rebounded slightly, which increases the probability that reversal is just around the corner.

In our opinion, this scenario is more likely at the moment of writing these words, but similarly to what we wrote in the case of EUR/USD, let’s analyze what could happen if currency bears do not give up in the coming day(s).

How low could the exchange rate go? We think that currency bears’ victory could result in a drop to the purple declining support line based on the previous lows or even in a test of the 141.4% Fibonacci extension at 0.9165.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

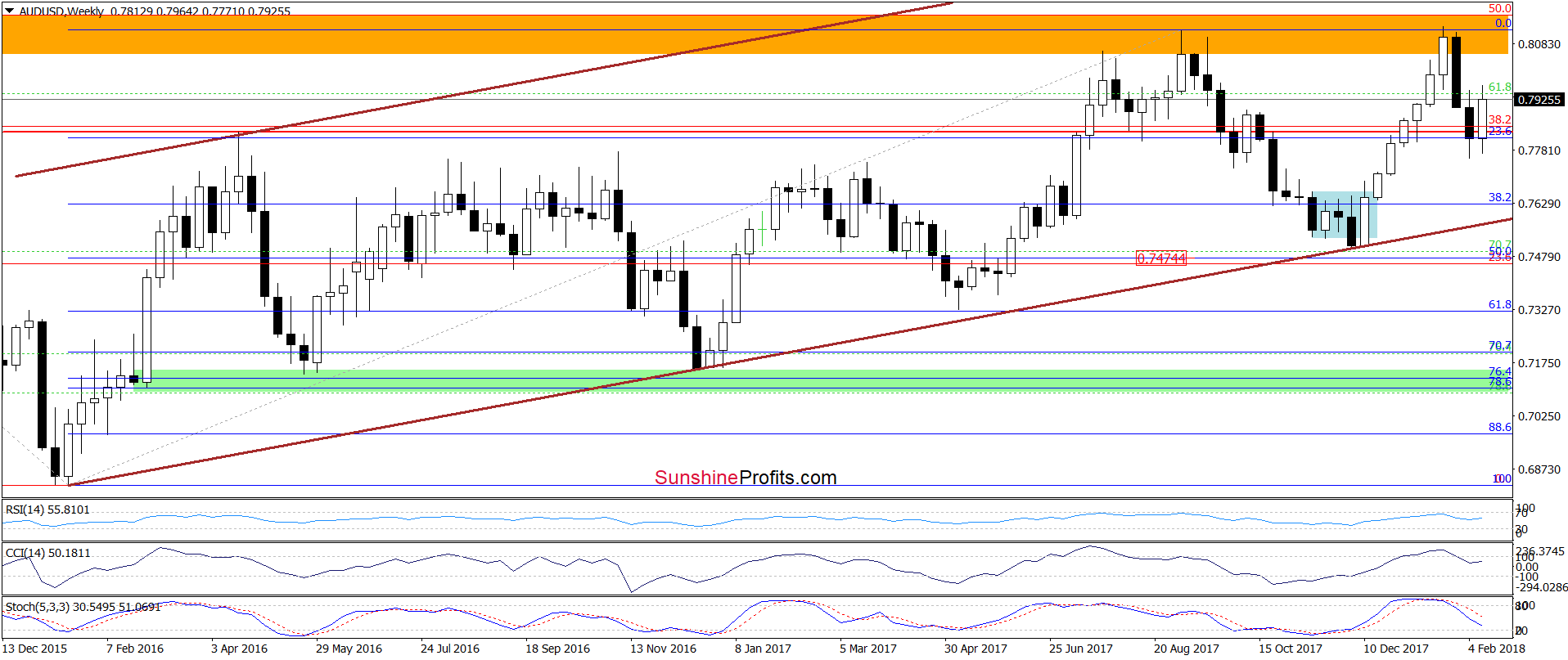

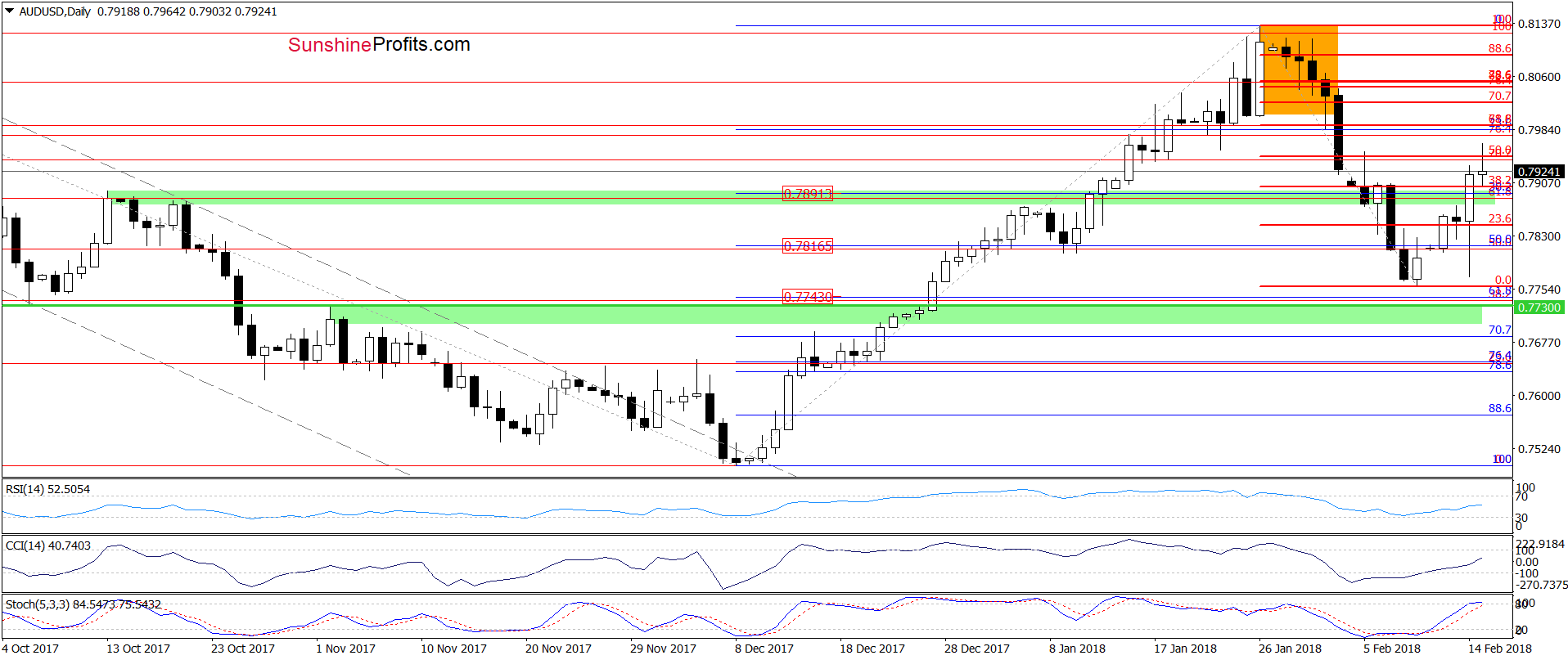

AUD/USD

On the above charts, we see that although AUD/USD moved sharply higher yesterday and even extended gains earlier today, currency bulls didn’t manage to push the exchange rate to the lower border of the previously-broken consolidation.

As you see, the 50% Fibonacci retracement stopped further improvement, triggering a pullback before the U.S. market’s open. Additionally, the sell signals generated by the weekly indicators remain in play, which suggests that reversal also in the case of this currency pair is just a matter of time (in our opinion, even a short time). Therefore, we continue to think that short positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.8222 and the initial downside target at 0.7743) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts