In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1057; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

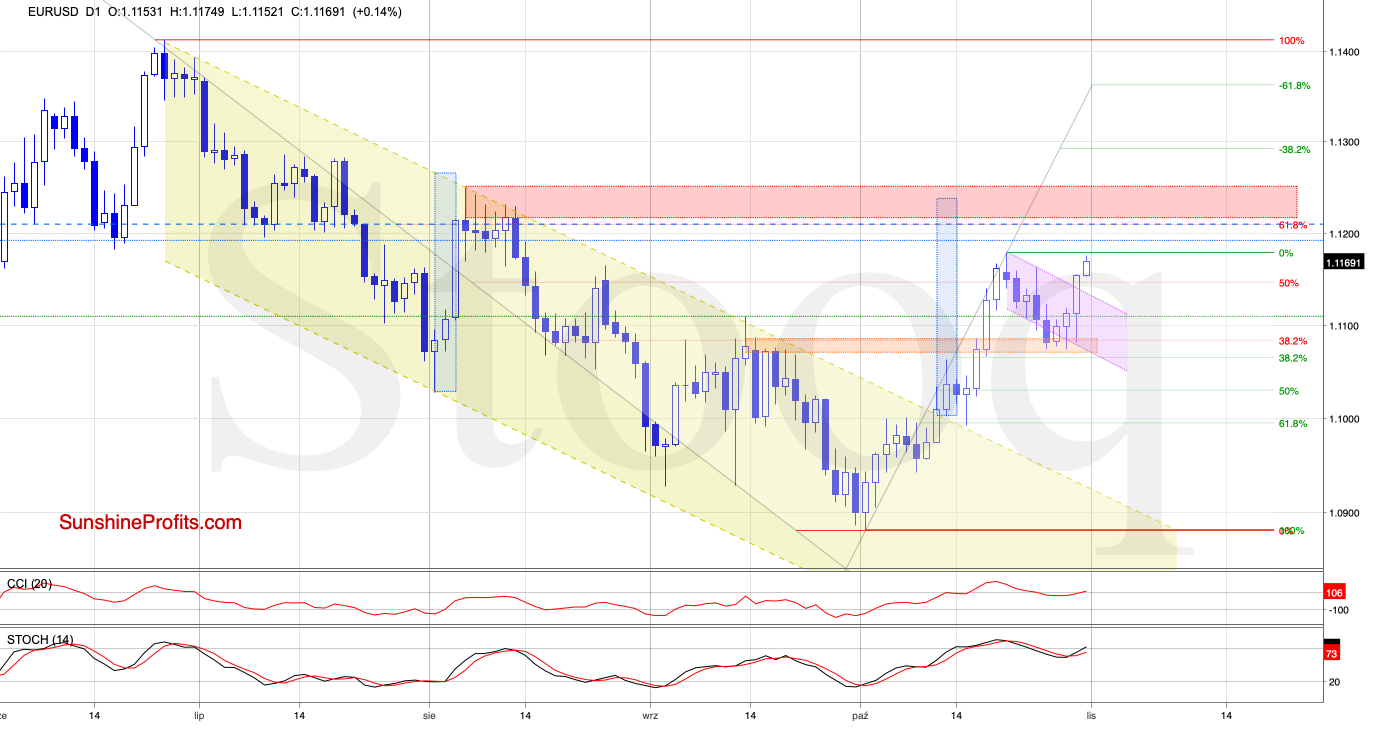

EUR/USD

Quoting our yesterday's Alert:

What could happen if the bulls show more strength?

(...) In our opinion, EUR/USD will likely test the upper border of the declining purple trend channel or even the recent peaks.

EUR/USD pulled back and retested the strength of the previously broken orange zone that continues to serve as the nearest support. Despite this temporary deterioration, the bulls triggered a rebound, taking the exchange rate above the upper border of the declining purple trend channel. This way, the buyers opened the path to the recent peaks.

Nevertheless, considering the breakout above the upper border of the declining yellow trend channel, EUR/USD could hit a fresh monthly high in the following day(s).

How high could the pair go?

In our opinion, the first upside target could be the 61.8% Fibonacci retracement or even the red resistance area created by the August peaks. This is where the size of the upward move will correspond to the height of the mentioned yellow channel (as marked with blue rectangle).

Trading position (short-term; our opinion): Already profitable long positions with a stop-loss order at 1.1057 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

GBP/USD

In our last commentary on GBP/USD, we noticed that the sellers had problems breaking below the upper border of the short-term rising green trend channel. Their visible difficulties encouraged us to open long positions.

What happened after our Alert was posted?

The daily chart show that despite several attempts to go south, the buyers didn't just give up - they pushed the pair higher and higher from session to session, making our long positions profitable.

As a result, GBP/USD approached the previous peaks and the upper border of the purple consolidation earlier today, highlighting the key question: will we see further improvement?

Taking into account the invalidation of the sell signal generated by the Stochastic Oscillator and the sellers' weakness in recent days, we think that a fresh peak is just around the corner.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.2720 and the initial upside target at 1.2976are justified from the risk/reward perspective.

USD/JPY

We wrote these words yesterday:

(...) When would be the right time to consider opening new positions?

Taking into account the buyers' issues with reaching higher values, we think that the decision to go short is just around the corner. Nevertheless, we will stay on the sidelines and wait for stronger clues, such like another daily close below the upper border of the consolidation.

Although USD/JPY moved higher and broke above the upper border of the green rising wedge and the orange resistance zone, this improvement proved only temporary. Before the day was over, the pair pulled back, invalidating the earlier breakouts and finishing another day inside the blue consolidation.

Taking all the above into account, we think that opening short positions is justified from the risk/reward perspective. All details below.

How low could the pair drop?

In our opinion, should we see a breakdown below the lower border of the blue consolidation and the rising green support line, the way to early-October lows could be open.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 109.66 and the initial downside target at 107.14 are justified from the risk/reward perspective.

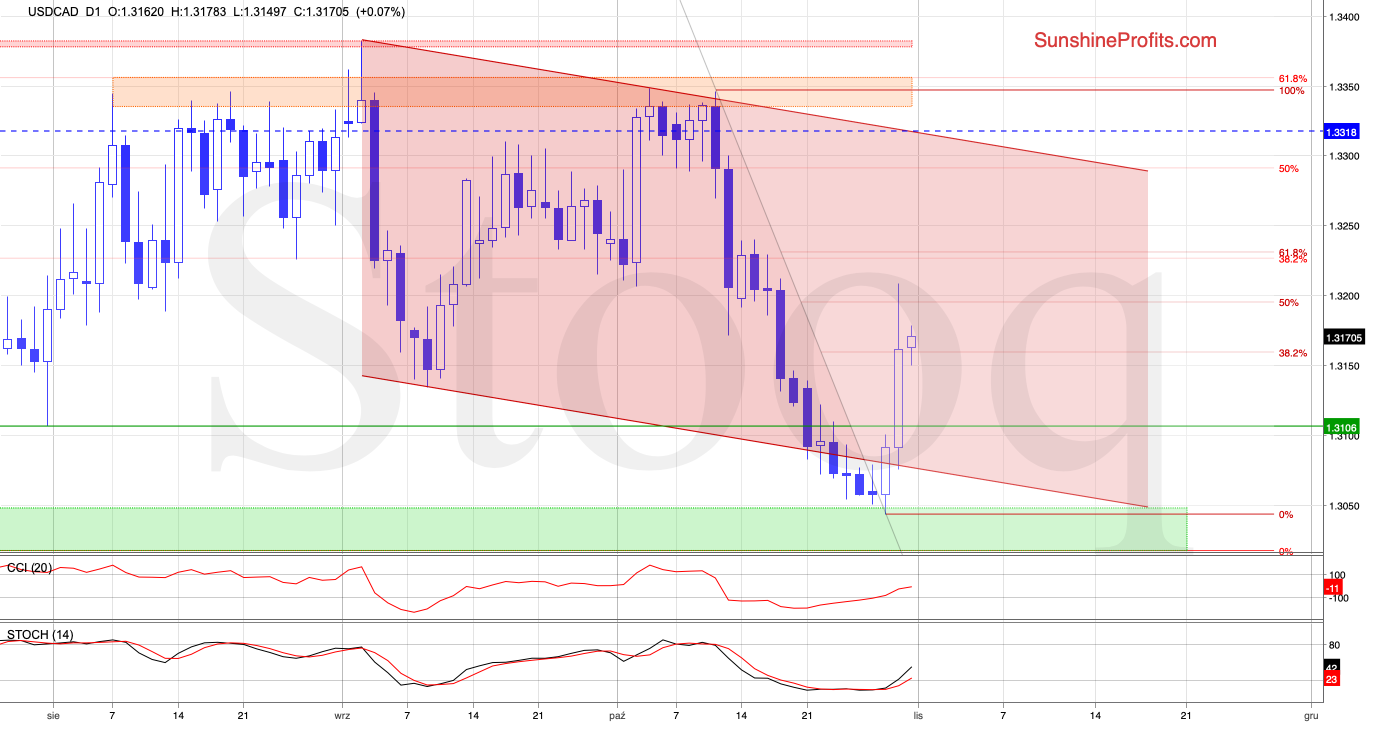

USD/CAD

Let's remember our yesterday's Alert:

(...) Earlier today, the pair pulled back a bit, but taking into account the buy signals generated by the daily indicators and the proximity to the green zone, we think that further improvement is just around the corner - especially if the bulls prove strong enough to close the day above the green horizontal line.

Should we see such price action, we'll consider opening long positions. (...)

The situation developed in line with the above, and the bulls proved their mettle. The buy signals remain on the cards, suggesting further improvement. Therefore, opening long positions is justified from the risk/reward perspective.

How high could the pair go? In our opinion, the first upside target for the buyers could be the upper border of the red declining trend channel.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3070 and the initial upside target at 1.3300 are justified from the risk/reward perspective.

Before signing off, please note that there won't be a regular Alert issued tomorrow - the service will resume again on Monday. Thank you for your patience and understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist