On one hand, the nearest support withstood the selling pressure and the U.S. dollar rebounded yesterday’s session lows. On the other hand, it closes the day under the previously-broken resistance. Which way next for the USD Index?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.2852; the next downside target at 1.2510)

- USD/CHF: none

- AUD/USD: none

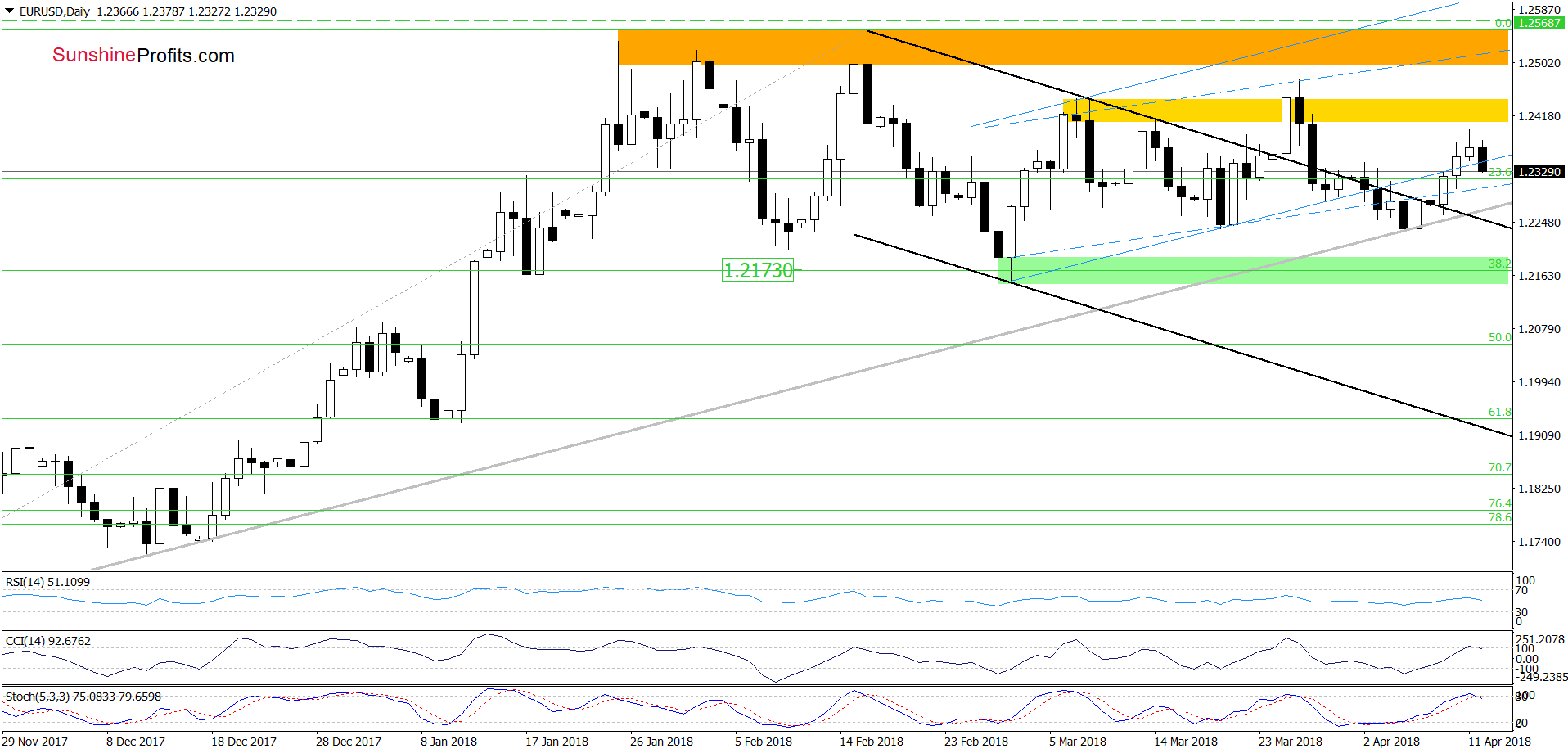

EUR/USD

Looking at the daily chart, we see that although EUR/USD came back into the blue rising trend channel, currency bears pushed the exchange rate lower earlier today. Such price action together with the current position of the indicators (they are very close to generating the sell signals) doesn’t look encouraging for the buyers.

Nevertheless, we think that as long as there is no daily closure below this formation one more upswing to the yellow resistance zone or even to the late March peak can’t be ruled out in the coming day(s).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

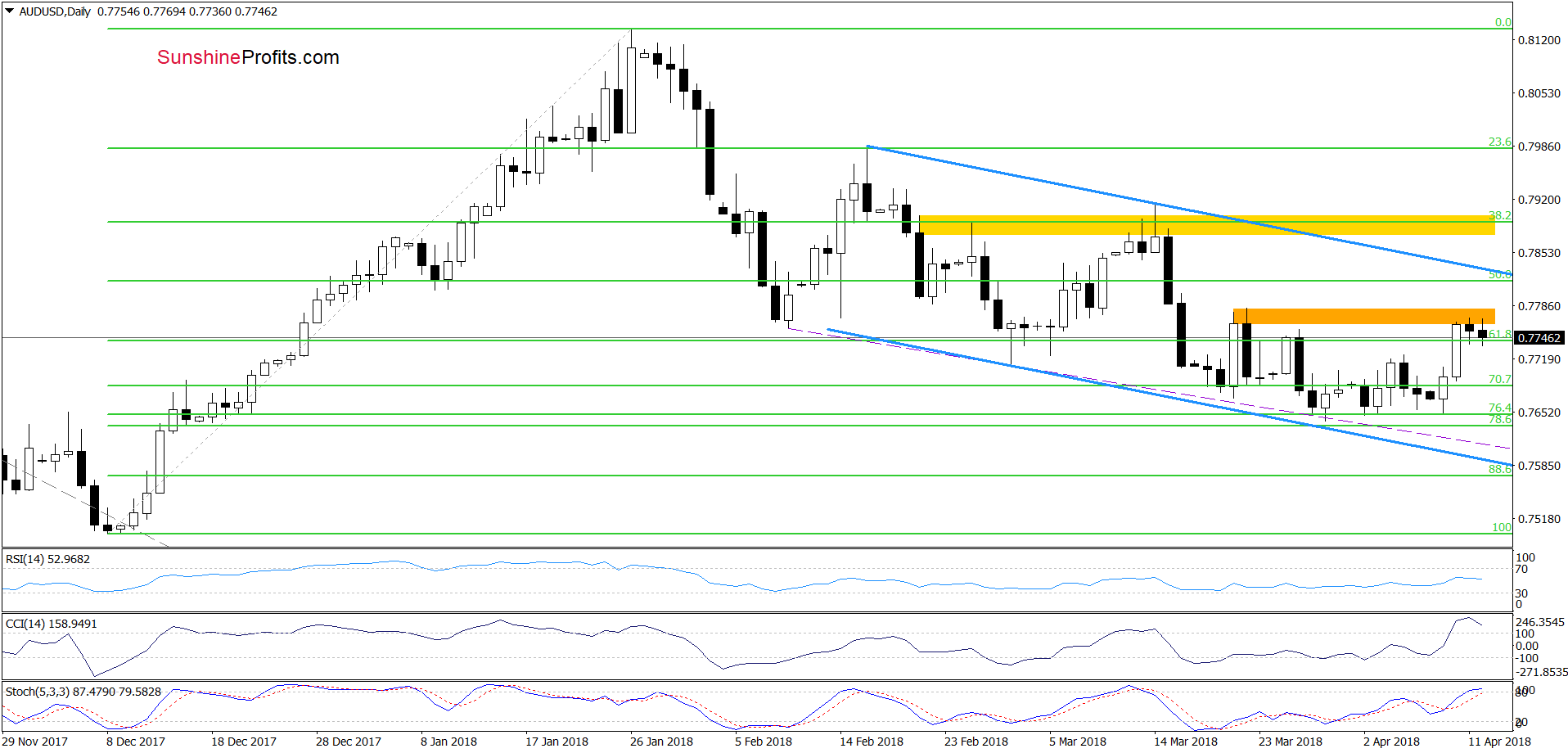

AUD/USD

On Tuesday, AUD/USD moved sharply higher and climbed to the first resistance zone created by the late March highs. Despite this positive event, the pair pulled back yesterday and extended a bit Wednesday’s losses earlier today, which in combination with the position of the CCI and the Stochastic Oscillator suggests that lower values of the exchange rate may be just around the corner.

If the situation develops in line with this assumption, we could see a test of Tuesday’s low or even the recent lows in the coming days. Nevertheless, such situation will be more likely and reliable if we see further improvement in the greenback.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

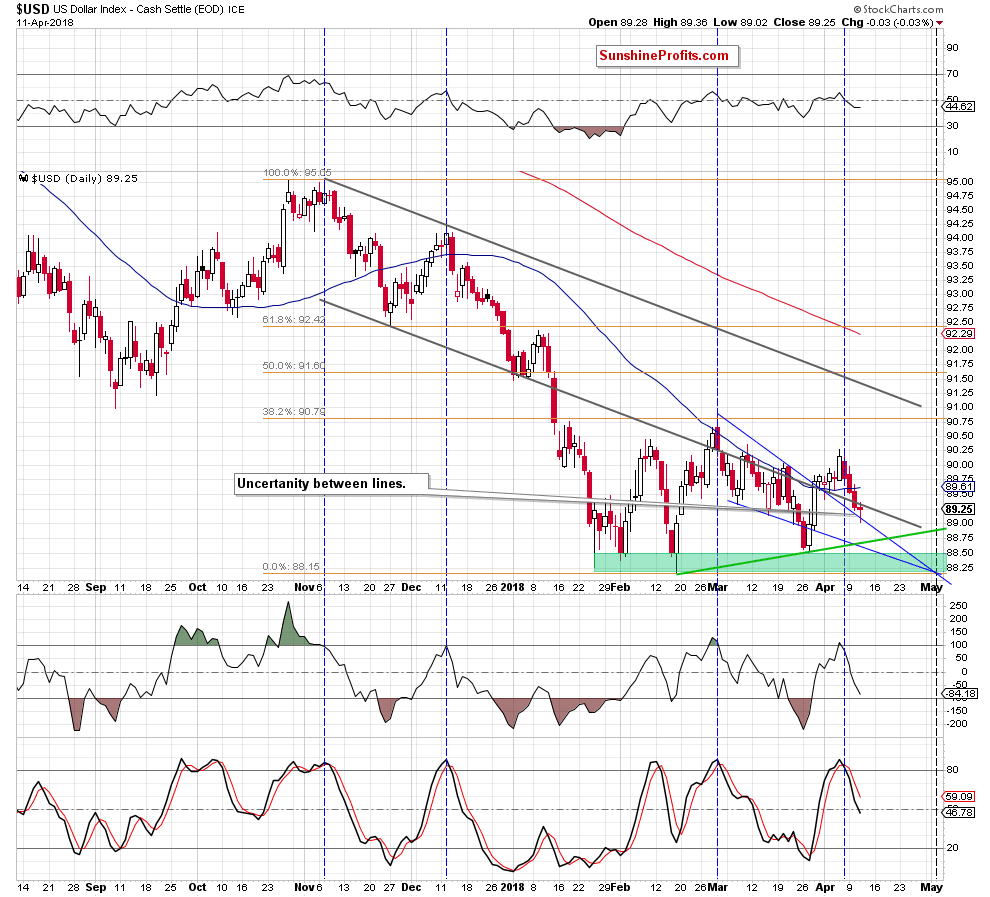

Having said the above, let’s examine the USD Index once again.

Uncertainty around the U.S. Currency

In our yesterday's alert, we wrote the following

(…) the USD Index extended losses and came back below the previously-broken lower border of the grey declining trend channel, which together with the sell signals generated by the indicators doesn’t bode well for the greenback.

(…) the only hope for the bulls seems to be the upper line of the blue declining wedge, which serves as the nearest support.

As you see on the daily chart, the sellers pushed the index lower during yesterday’s session, which resulted in a test of the above-mentioned important support. Although the greenback bounced off this line, it closed the day under the previously-broken lower border of the grey declining trend channel, which shows uncertainty among investors about the direction of another bigger move. This assumption is also reinforced by the shape of yesterday’s candlestick (a doji candle).

So, what’s next? Although the upper border of the blue declining wedge withstood the selling pressure yesterday, the sell signals generated by the indicators remain in the cards, supporting another attempt to move lower.

In our opinion, this scenario will be invalidated only if the U.S. currency comes back above the grey line and the 50-day moving average. Otherwise, however, if the buyers do not manage to hold this line, the way to the lower border of the formation (currently around 88.60) and the green support line based on the previous lows will be open.

Taking all the above into account, we think that opening short positions in EUR/USD and AUD/USD is not justified from the risk/reward perspective at the moment of writing these words. Nevertheless, if the greenback implements the pro-growth assumptions about which you read above, we’ll consider going short in these currency pairs.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts