We see the USD Index making higher highs, putting pressure against many other currencies. The euro is approaching its August lows, the pound isn't exactly the strongest either, and the Swiss franc has given up much of its recent gains. Trading ranges, or not, major supports nearby or not, where does the current trading leave the many pairs? What kind of opportunities have they been flashing?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3353; the initial downside target at 1.3144)

- USD/CHF: none

- AUD/USD: none

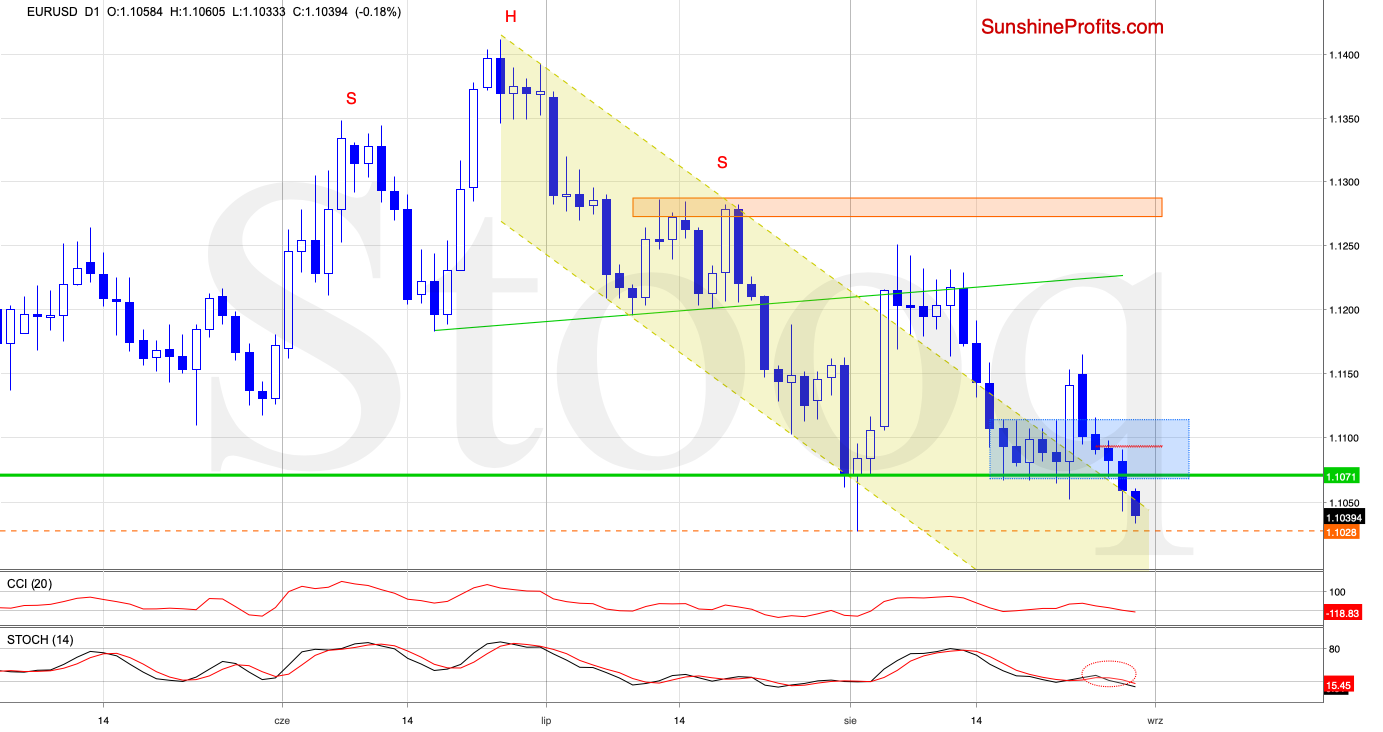

EUR/USD

EUR/USD broke below both the lower border of the blue consolidation and the horizontal green support line yesterday. This move has been supported by the daily indicators' sell signals - and they're still on today.

Let's quote our yesterday's observations. They discuss the downside target should the green support line fail to hold the bears:

(...) if it doesn't hold, Friday's lows or even the early-August lows are likely to be seen.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

While GBP/USD declined yesterday, the bulls still kept the pair trading above the upper border of the blue consolidation. Yet, the CCI and Stochastic Oscillator's sell signals are still on, regardless of the pair currently trading higher at around 1.2215.

Let's recall our Wednesday's observations - it's still valid today:

(...) the pound now trades close to the upper border of the orange zone. The current position of the daily indicators supports downside move's continuation, which may be just around the corner.

Should we see an invalidation of the earlier breakout above the orange zone, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

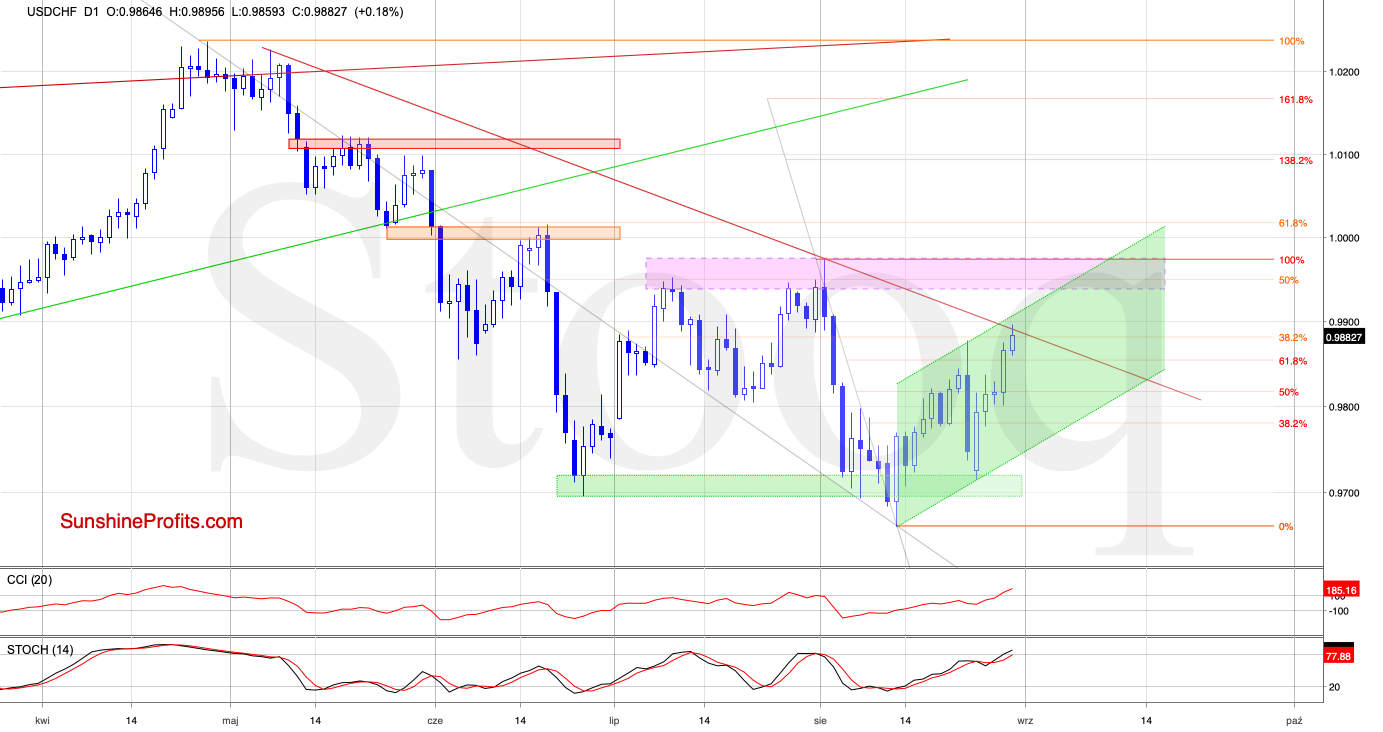

USD/CHF

After USD/CHF broke above its recent consolidation, we've followed through with these observations on Friday:

(...) Let's combine it with the current position of the daily indicators. They are in the bullish territory, and connecting the dots, a test of the 38.2% Fibonacci retracement or even the red declining resistance line based on the previous peaks is probable in the very near future.

USD/CHF indeed extended gains, and reached our upside targets. While the daily indicators are in their overbought areas, they've not issued any sell signals. This suggests a test of the upper border of the green rising trend channel in the very near future.

Should the bulls fail and an invalidation of a potential breakout above these resistances follows, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD downside targets have been reached, and the pair keeps going lower, approaching the August intraday lows. now precariously sitting at a key support. USD/CAD verified its earlier breakdown below the lower border of the black triangle, and is currently trading inside the blue consolidation. Its yesterday's upswing has fizzled out and the short position remains justified. We're keeping a close eye on the USD/CHF bulls - should they fail in their potential breakout efforts, we'll consider opening short positions. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist