It’s been some time since we discussed the situation on the USD Index from the long-term point of view and since all of our trading positions are in the currencies that are included in the index, it seems that today is a perfect day to catch up.

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3256; the initial downside target at 1.2923)

- USD/JPY: half of the long positions (a stop-loss order at 112.47; the next upside target at 114.03)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

In other words, we decided to close half of our long positions and take profits off the table as USD/JPY reached our next upside target.

On Wednesday, we provided you with the following comments on the short-term outlook for the USDX:

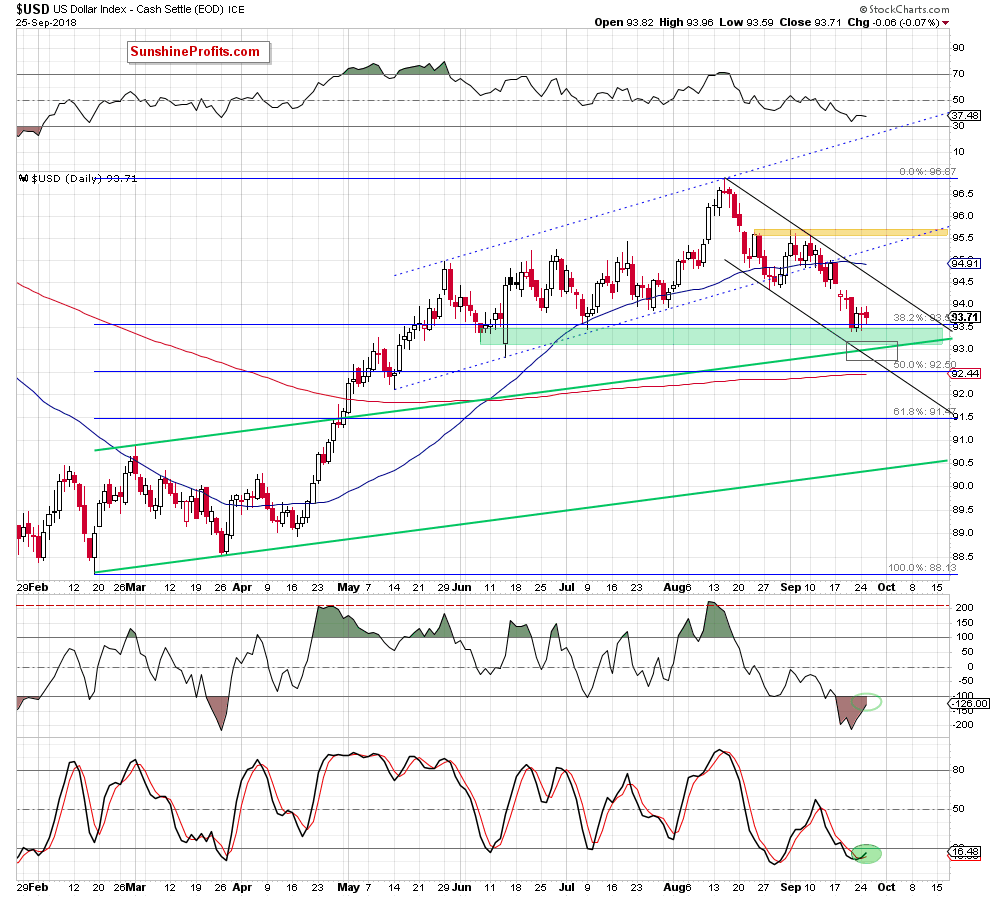

From today’s point of view, we see that September declines took the greenback to the green support are created by the 38.2% Fibonacci retracement and the June and July lows, which resulted in a consolidation around the upper border of the zone.

Such price action usually means that the forces of the sellers and the buyers are starting to balance, and it can bring the upcoming change of the direction in which the index has moved until now - even if we see one more downswing first (in our case, the greenback could test the previously-broken upper border of the long-term green rising trend channel or even the lower line of the short-term black declining trend channel, which has formed since mid-August).

Finishing this part of today’s alert, it is also worth noting that the pro-growth scenario is reinforced by the current position of the daily indicators as the Stochastic Oscillator generated a buy signal, while the CCI is very close to doing the same.

As far as our more long-term comments are concerned, here’s what we posted earlier, in our September 21, Gold & Silver Trading Alert:

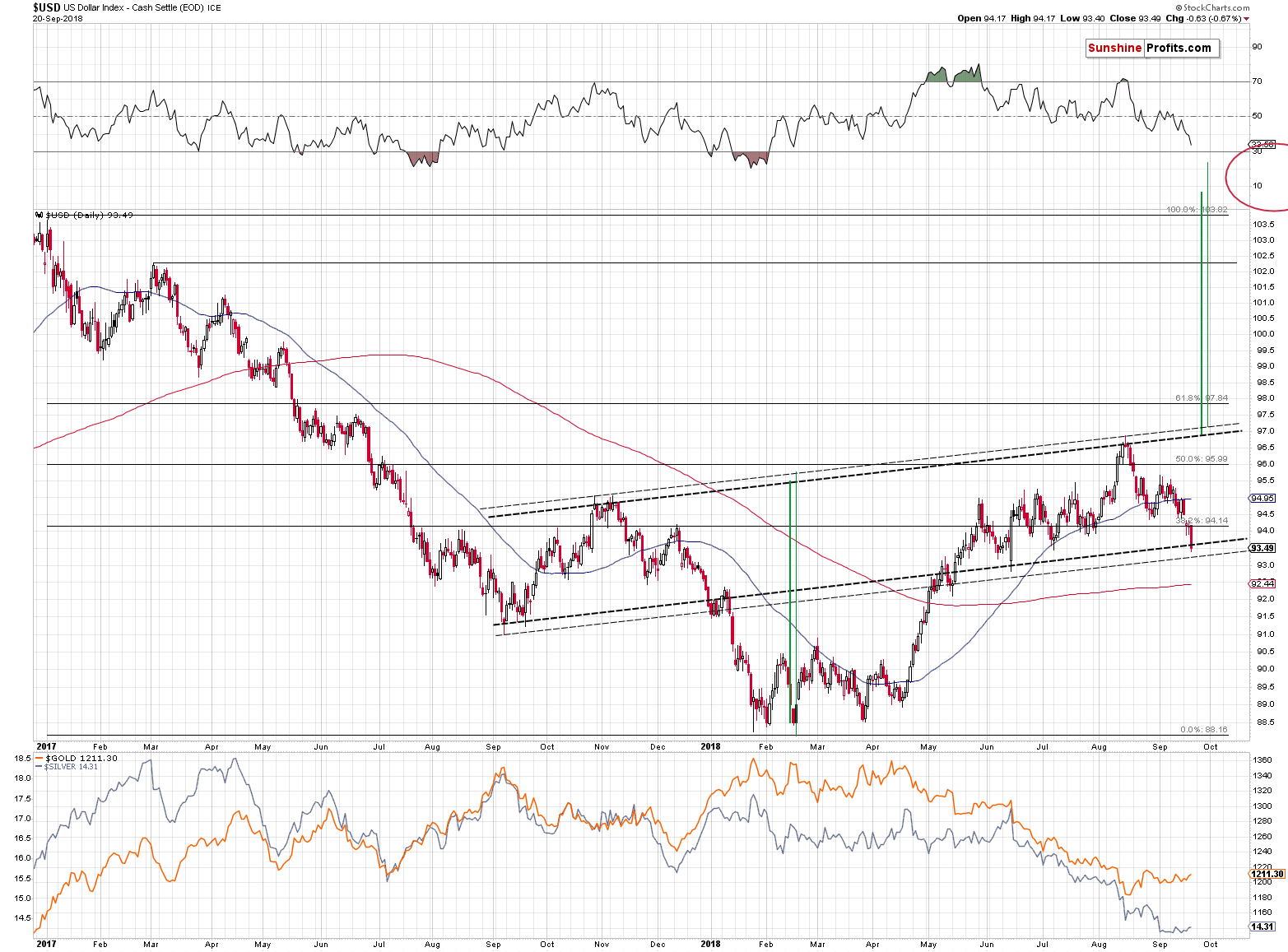

In short, the USDX moved to one of the rising support lines and at the same time it seems to have completed a zigzag correction. Interestingly, the rally that started in the first quarter of this year is symmetrical to the decline that preceded it. The April – May 2018 rally is similar to the December 2017 decline and the same goes for the rest of the move. The October – December 2017 top took form of a head-and-shoulders pattern and it seems that we have also seen a similar pattern in the USDX (July high being the left shoulder, and the early September top being the right shoulder). And, just like the September – October 2017 zigzag started the previous correction, the August – September 2018 zigzag might be ending the current one. The implications of this specific symmetry are bullish for the USDX and bearish for the precious metals sector.

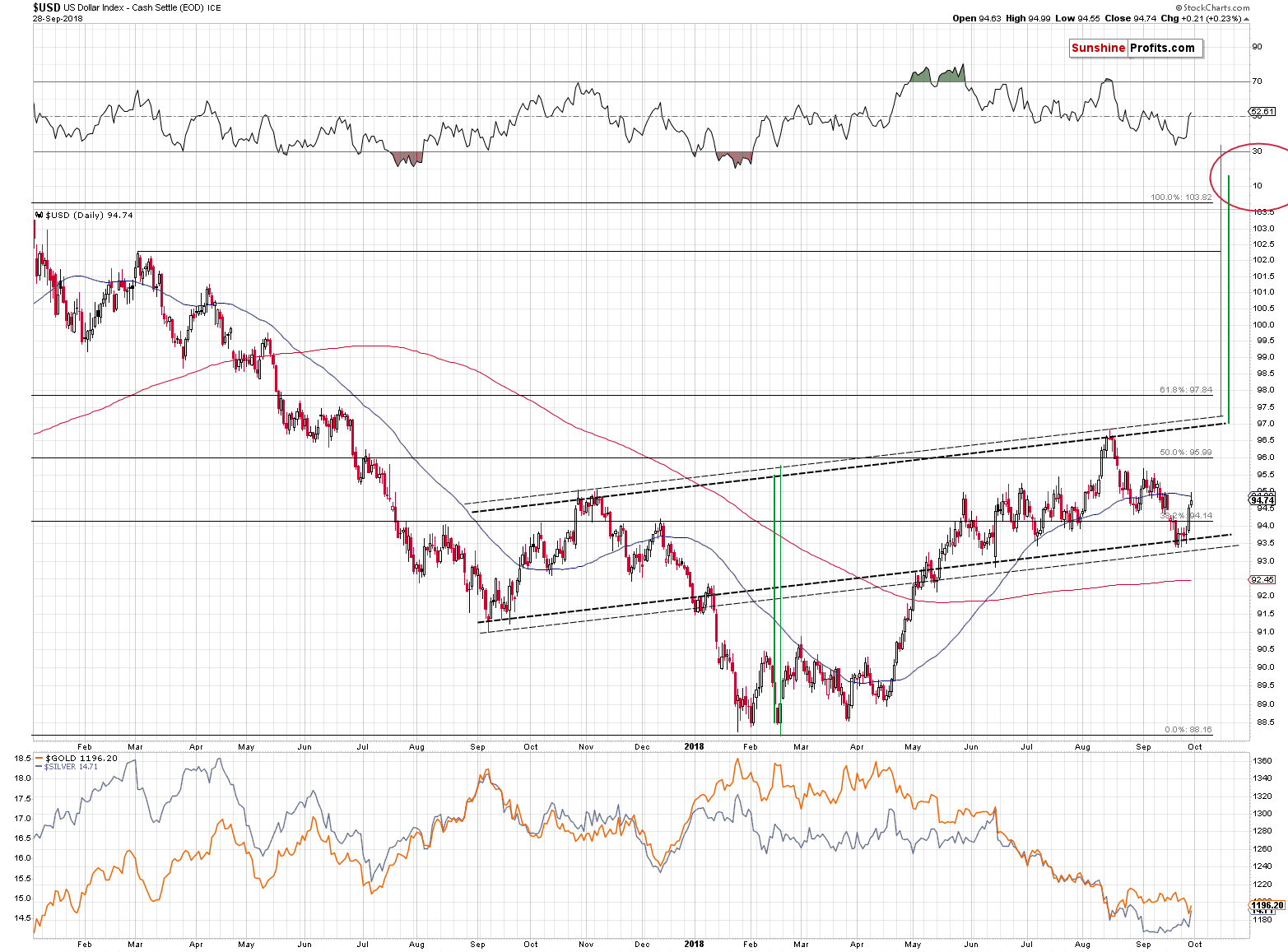

The USD Index moved higher since we posted both commentaries and it may appear that it’s time for a longer breather, but this may not be the case. Conversely, based on the symmetry in the patterns we may see the continuation in the rally followed by a breakout above the rising medium-term dashed resistance lines. When this happens, it will complete the multi-month inverse head-and-shoulders pattern, which would then point to the upside target well above 100. The implications would be very bullish.

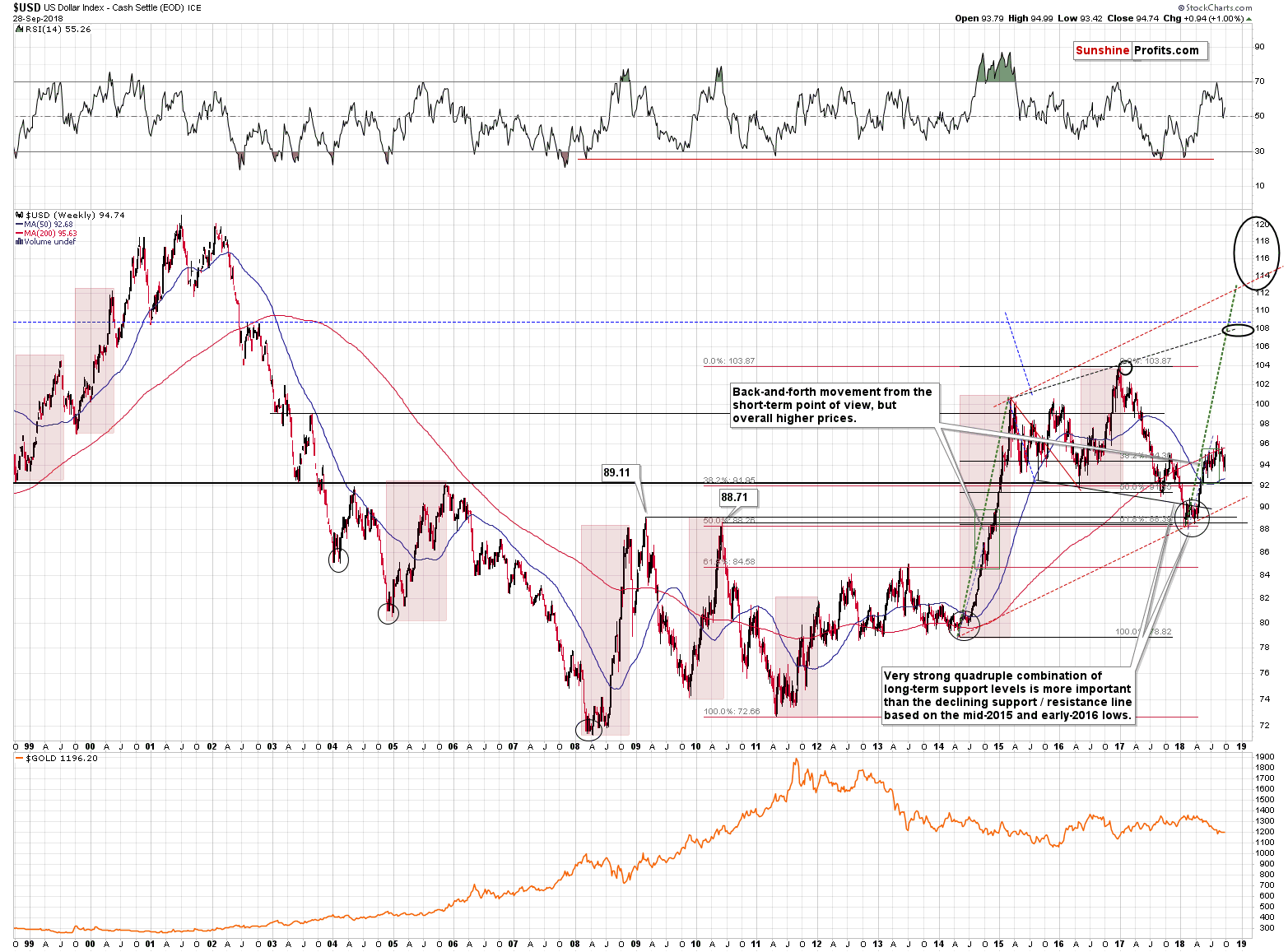

The long-term analogies continue to point to much higher USDX values as well. This year’s upswing is still similar to what we saw in 2008, 2010, and 2014-2015. Sure, the decline that we saw this year is bigger than what we saw in the late 2014, but it’s also smaller than what we had seen in 2008. Overall the long-term similarity that started with the size of the rally, place of growth and the low RSI levels remains in place.

Summing up, since the outlook for the USD Index remains bullish based on short-, medium-, and long-term factors, it seems that our trading positions will greatly benefit in the upcoming days and weeks. Perhaps even months.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts