In our opinion, the following forex trading positions are justified - summary:

EUR/USD: short (a stop -loss order at 1.1250; the initial downside target at 1.1082)

GBP/USD: long (a stop-loss order at 1.2802; the initial upside target at 1.3312)

USD/JPY: none (in other words, our positions were closed by the stop-loss order with a profit)

USD/CAD: long (a stop-loss order at 1.2877; the initial upside target at 1.3084)

USD/CHF: if the exchange rate breaks above 0.9749, we'll open long positions with a stop-loss order at 0.9662 and the initial upside target at 0.9813

AUD/USD: none

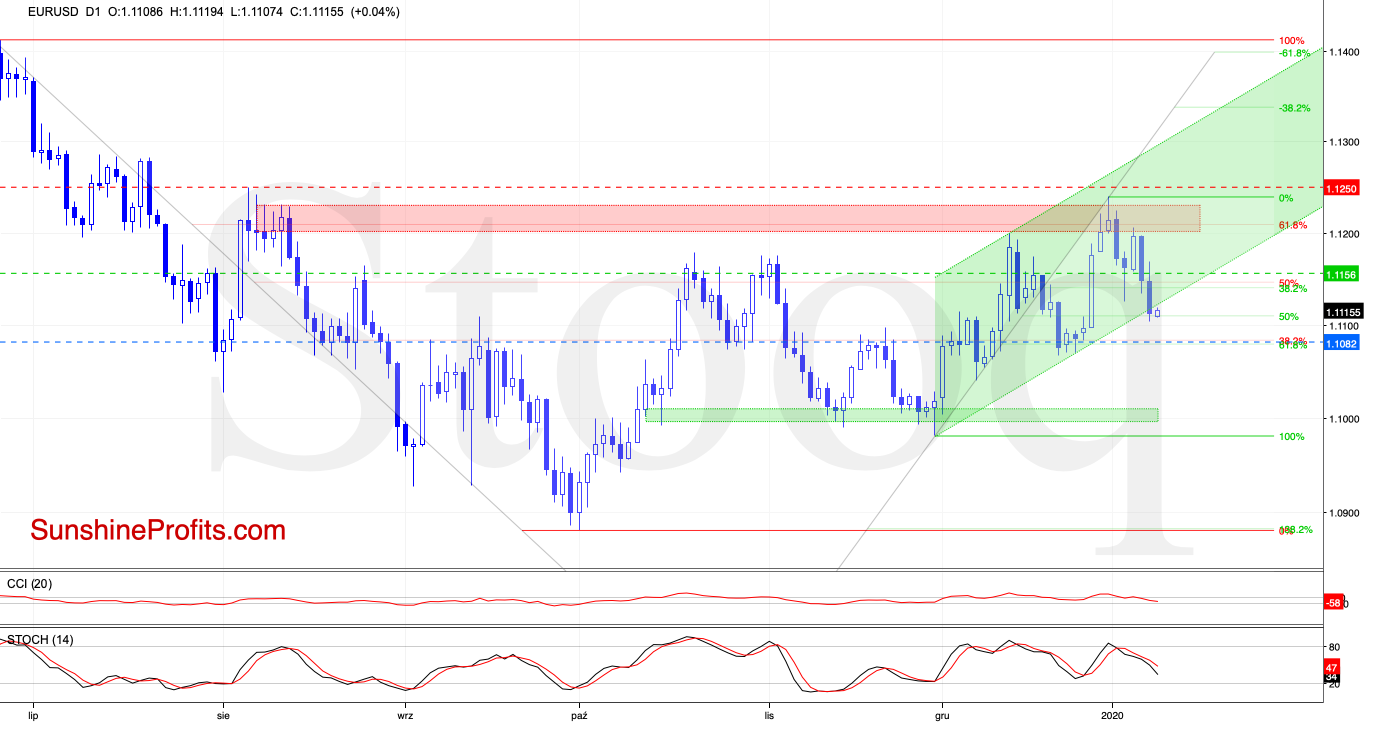

EUR/USD

EUR/USD extended losses during yesterday's session, dropping below the lower border of the rising green trend channel, which has made our short positions profitable.

Earlier today, the pair rebounded slightly, which appears to be a verification of yesterday's breakdown. The sell signals of the daily indicators remain on the cards, which means that our yesterday's observations are up to date also today:

(...) Nevertheless, a bigger move to the downside will be more likely and reliable only if EUR/USD drops below the lower border of the rising green trend channel.

Should we see such price action, the way to the late-December lows would be open.

Trading position (short-term; our opinion): Profitable short positions with a stop -loss order at 1.1250 and the initial downside target at 1.1082 are justified from the risk/reward perspective.

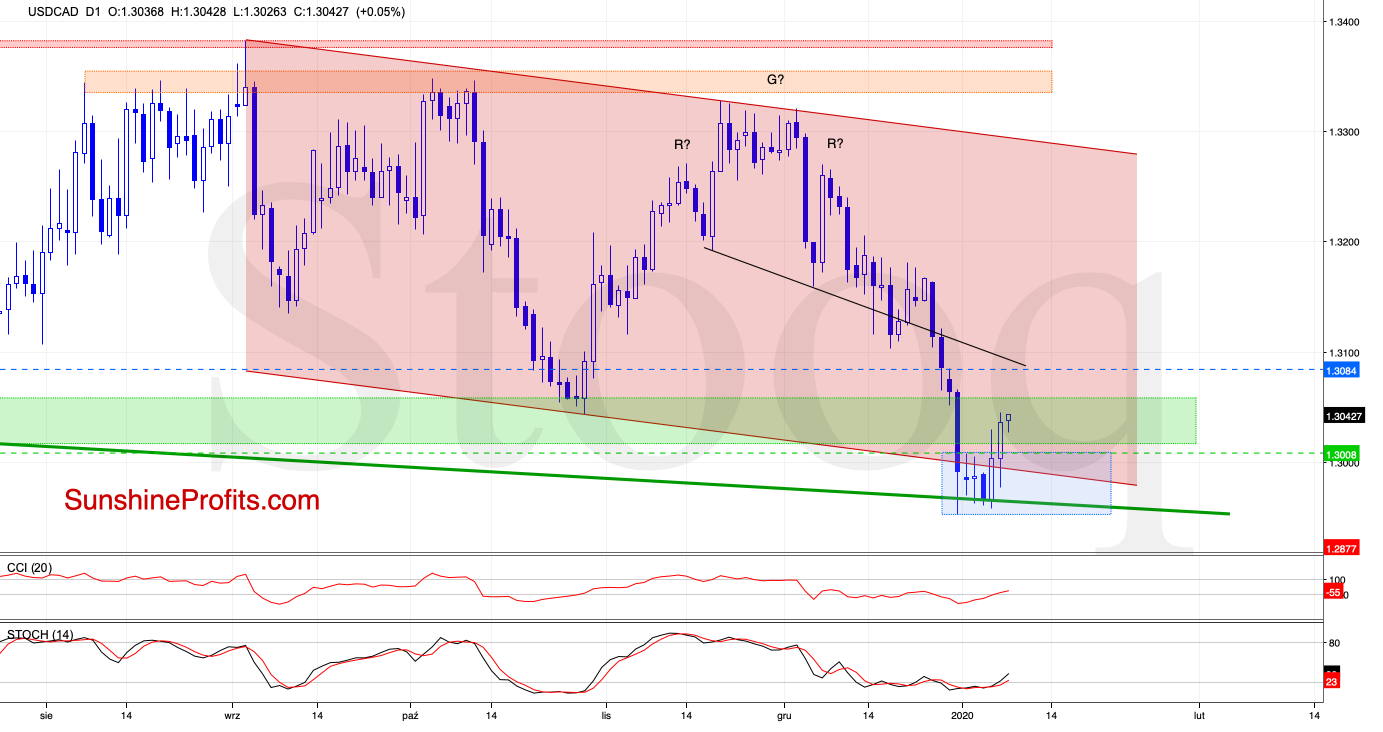

USD/CAD

The technicals indicated high likelihood of an upswing, and the pair obliged by moving higher recently. Great, but with quite a move behind us already, let's assess further appreciation potential as it stands right now.

Quoting our last commentary on this currency pair:

(...) we noticed another move to the upside, which not only invalidated yesterday's drop below the green line, but also the earlier breakdown below the lower border of the declining red trend channel. Both of these invalidations are bullish signs.

Additionally, the current position of the daily indicators suggests that further improvement is just around the corner.

The situation developed in line with the above scenario and USD/CAD managed to break above the upper border of the blue consolidation during yesterday's session. Earlier today, the pair extended gains, making our long positions even more profitable.

As the buy signals continue to support the buyers, this observation of yesterday keeps being still valid:

(...) Should this be the case and USD/CAD extends gains from here, the initial upside target will be the previously broken black line - that is the neck line of the head and shoulders formation.

Trading position (short-term; our opinion): Profitable long positions with a stop-loss order at 1.2877 and the initial upside target at 1.3084are justified from the risk/reward perspective.

USD/CHF

It's true that USD/CHF moved lower once again during previous sessions and that it broke below the green support zone during yesterday's session. This deterioration was quite temporary however, and the pair reversed before the day was over.

For the second time in a row, the exchange rate has thus invalidated the earlier breakdown, which together with the buy signals generated by the daily indicators suggests further improvement being just around the corner.

Therefore, opening long positions will be justified from the risk/reward perspective if the pair breaks above 0.9749.

Trading position (short-term; our opinion): if the exchange rate breaks above 0.9749, we'll open long positions with a stop-loss order at 0.9662 and the initial upside target at 0.9813.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist