After the U.S. - China trade war news, the dust is getting settled. The currencies are embarking on their next moves. Tradable moves, that is. Right now. Let's dive in straight to the action that we're taking.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1289; the initial downside target at 1.1147)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3363)

- USD/CHF: none

- AUD/USD: none

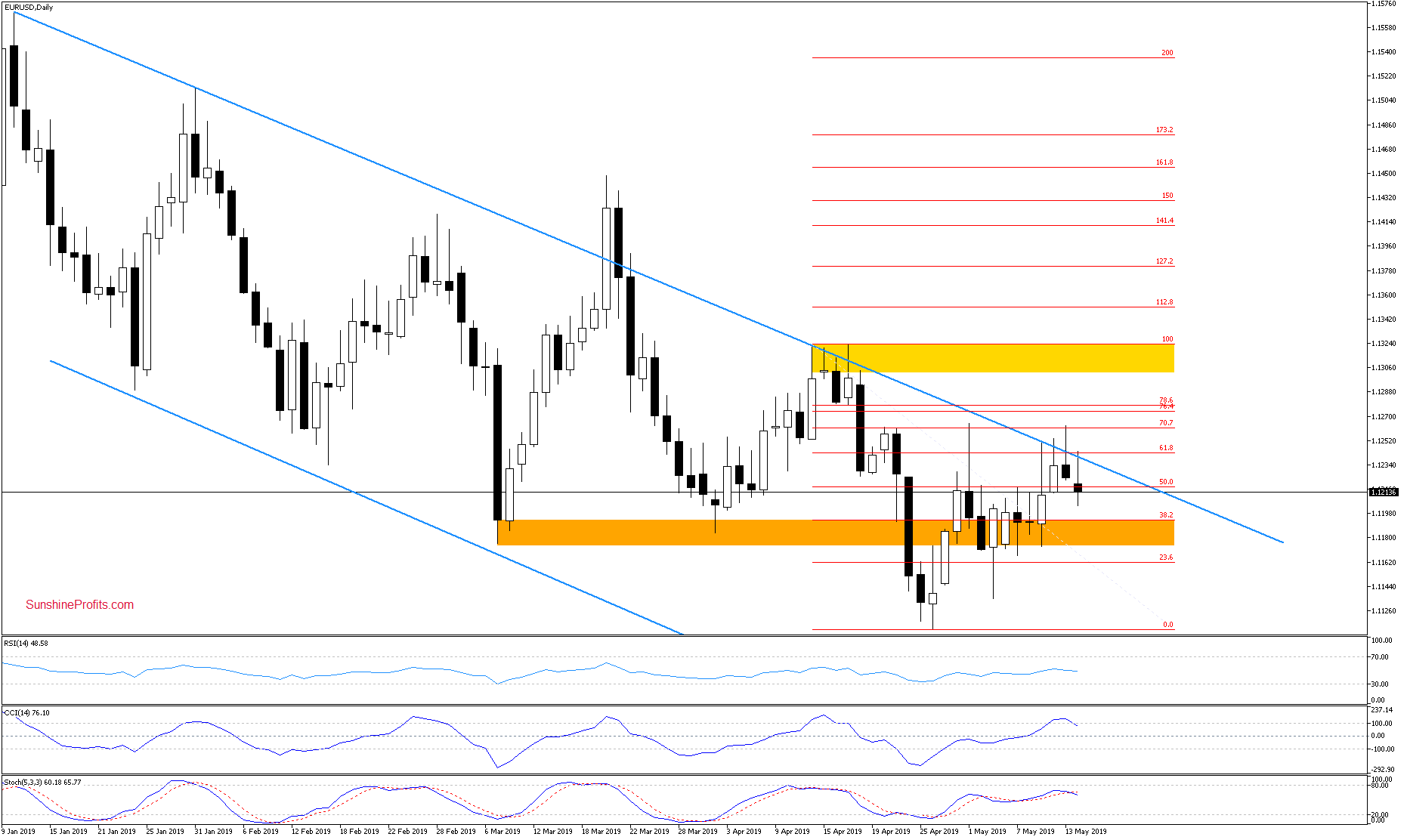

EUR/USD

The daily chart shows that the euro bulls have failed in their breakout attempts. The upper border of the blue declining trend channel stood still both yesterday and earlier today.

The exchange rate has pulled back for the third time in a row. Actually, it looks like the fourth consecutive candle of long upper knots. This increases the probability of upcoming deterioration. See for yourself the sell signals generated by the CCI and Stochastics.

Connecting all the dots, opening short positions is justified from the risk/reward point of view. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1289 and the initial downside target at 1.1147 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

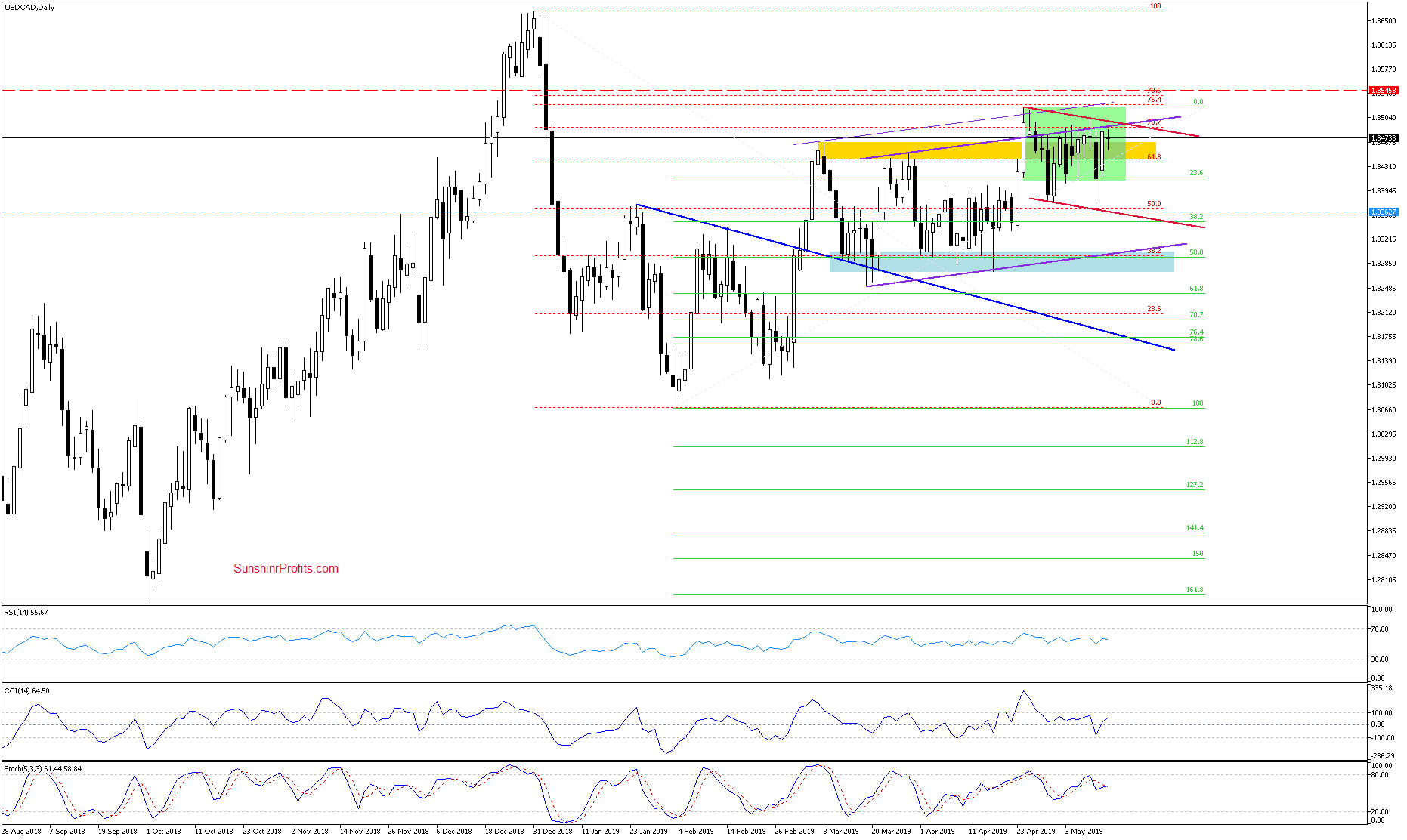

USD/CAD

USD/CAD has invalidated Friday's breakdown below the green consolidation. That's certainly a bullish signal. Indeed, it has carried the pair right to its major short-term resistance. This resistance is marked by the combination of the 70.7% Fibonacci retracement, the upper border of the purple rising trend channel, the previous highs and the upper border of the red declining trend channel.

In all previous instances, the bulls haven't had much success breaking higher. It increases the likelihood of seeing another reversal down the road this time, too. Lower USD/CAD values remain likely in the very near future.

All in all, opening short positions is justified from the risk/reward point of view. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3545 and the initial downside target at 1.3363 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Yesterday's session brought AUD/USD sharply lower. The exchange rate broke below the green support zone. This is certainly a bearish sign. How far down could the bears take the pair?

Actually, not that far it seems. Look at the lower border of the red declining trend channel and then the 70.7% Fibonacci retracement. Additionally, the RSI approached the level of 30, while the CCI and the Stochastic Oscillator moved to their oversold areas, increasing the probability of issuing buy signals in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the upside momentum of recent couple of sessions in EUR/USD looks to be exhausted and the pair appears to be on the verge of rolling over. Opening a short EUR/USD position is therefore justified. USD/CAD bulls have also made their run higher and look to be hesitating when faced with powerful resistances just ahead. USD/CAD short position is also justified. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist