Dear Readers,

Before starting today's analysis, I would like to thank you for the patience you have shown in the last weeks during my absence.

This time allowed me to recharge my batteries and I believe that thanks to it I will be able to serve you even better in the coming months.

Enjoy your Alert!

In our opinion, the following forex trading positions are justified - summary:

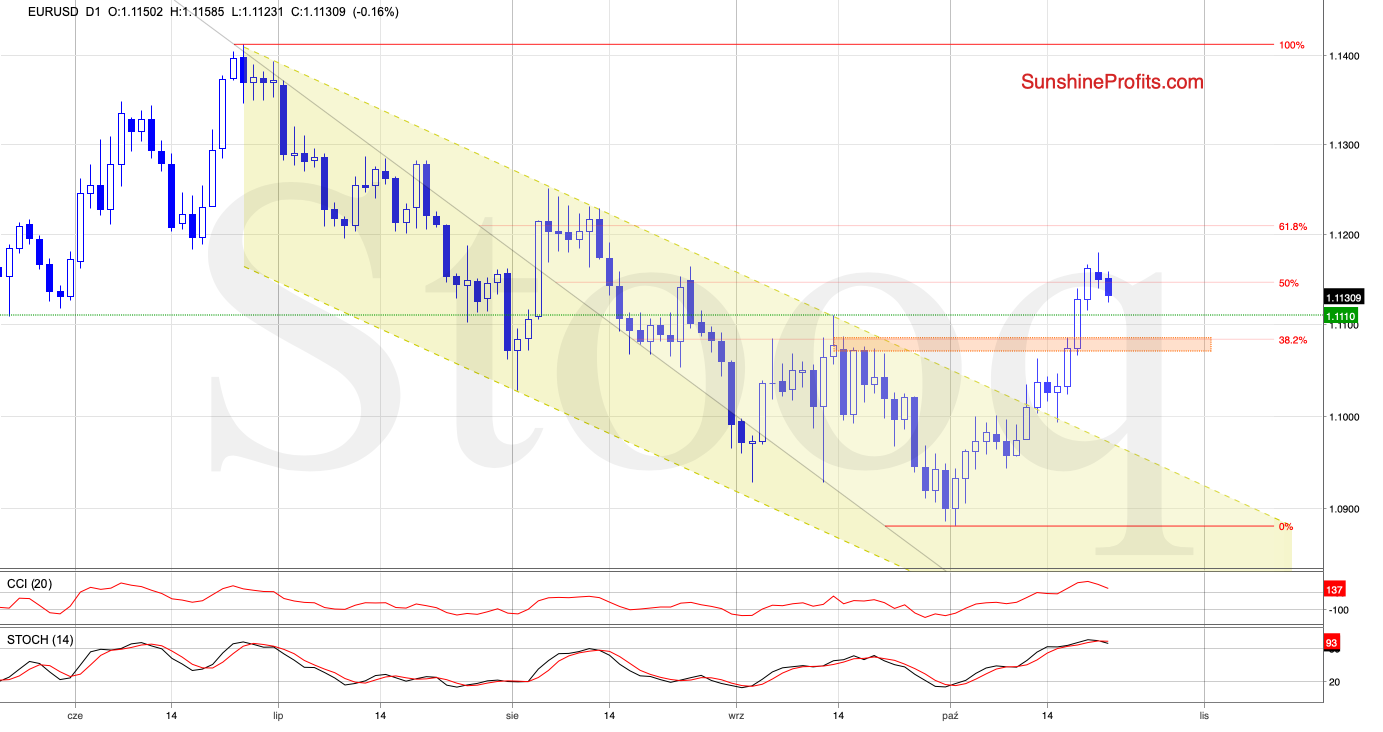

EUR/USD

EUR/USD broke above the orange resistance zone, which triggered further improvement. The pair climbed slightly above the late August peak and the 50% Fibonacci retracement.

Here, the bulls lost some strength, which translated into a pullback at the beginning of this week.

Earlier today, the exchange rate moved below the above-mentioned retracement, which looks (at the moment of writing these words) as an invalidation of the earlier breakout. Additionally, the CCI and the Stochastic Oscillator moved to their overbought areas (the latter even generated a sell signal), which suggests that further deterioration could be just around the corner.

On top of that, if the pair extends losses below the above-mentioned retracement in the following hours, this breakout invalidation would support the sellers.

What could happen if the bears take over? In our opinion, EUR/USD will likely extend its decline and test the previously-broken green horizontal line (based on the last month's peak) or even the orange area in the following days.

If the situation develops in tune with the above later in the day, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

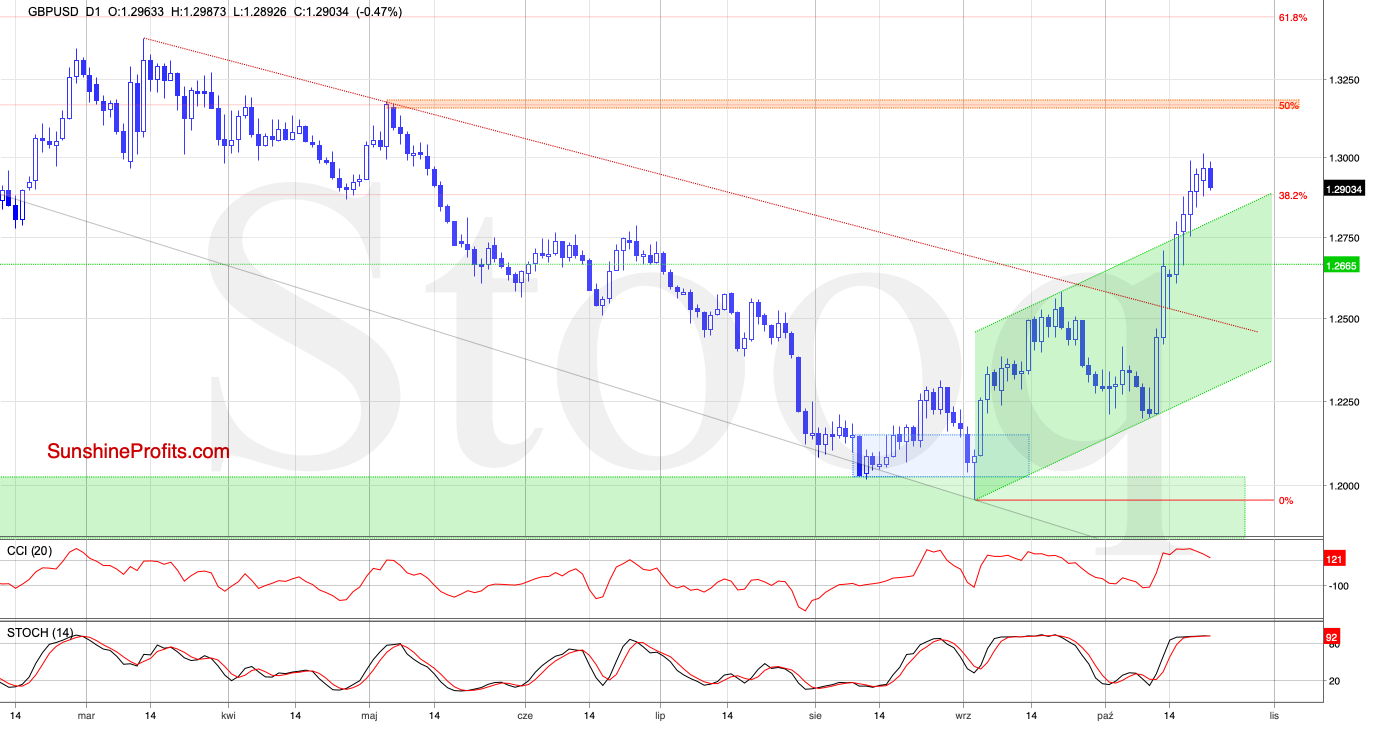

GBP/USD

The first thing that caches the eye is the breakout above the upper border of the green rising trend channel. GBP/USD also managed to climb above the 38.2% Fibonacci retracement based on the entire March-September downward move and tested the barrier of 1.3000.

As you see, the bulls have had some problems with this psychologically important level, which triggered a pullback earlier today. Additionally, the CCI and the Stochastic Oscillator moved to their overbought areas, which suggests that sell signals are just a matter of time (a very short time at that).

Therefore, if we see an invalidation of the breakout above the Fibonacci retracement, we'll consider going short (especially if the bears also manage to invalidate the breakout above the upper line of the channel).

What could happen if the bulls do not manage to hold the above-mentioned levels? In our opinion, the comeback into the channel could translate into a drop to around 1.2500 or even lower, where the previously-broken declining red line currently is (and serves as an additional support).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

On the above chart, we see that two unsuccessful invalidations of the breakouts above the upper border of the grey declining trend channel encouraged the buyers to act, which triggered a move to the north in the previous weeks.

Thanks to this increase, USD/JPY moved to the orange resistance area, which was strong enough to stop the bulls several times in the past (especially in June and July). As you see, the resistance zone is also supported by the 61.8% Fibonacci retracement, which is slightly above it.

Therefore it is our opinion that as long as they remain on the cards, the way to higher levels is blocked and reversal in the very near future should not surprise us - especially when we factor in the current position of the daily indicators: they both rose to their overbought areas and the Stochastic Oscillator even generated a sell signal.

On top of that, the pair started consolidation, which suggests that the bulls could have lost their strength and their rivals may take over in the very near future.

What about opening positions?

If the bulls break above the nearest resistances (which looks quite doubtful at the moment) we'll consider going long. On the other hand, if the bears push the pair below the lower border of the formation, we'll likely open short positions.

We will keep an eye on the market and let you know when signs strong enough to justify opening positions emerge.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

The first thing catching the eye is an invalidation of the earlier tine breakdown below the lower border of the declining red trend channel. Additionally, USD/CAD came back above the green support horizontal line based on the late-July low, which gives the bulls another reason to act in the very near future.

On top of that, the CCI and the Stochastic Oscillator dropped to their oversold areas, which increases the probability of reversal in the coming day(s). Nevertheless, the pro-growth scenario will be more likely and reliable if the pair closes today's session inside the red channel and above the green line.

Should we see such price action, we'll consider opening long positions.

What could happen if the bulls take control? In our opinion, the exchange rate could rise to at least the last week's peaks. However, if they are broken, the way to the upper border of the channel could be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

From today's point of view, we see that USD/CHF moved sharply lower in the previous week, breaking below the lower border of the rising green trend channel, which brought about a drop below the lower border of the declining red trend channel.

Despite this negative event, the green support zone created by the late-September lows and the 50% Fibonacci retracement stopped the sellers, triggering a rebound during recent session.

Additionally, the CCI and the Stochastic Oscillator are very close to flashing their buy signals, which suggests that the opportunity to go long may be just around the corner.

Nevertheless, a bigger move to the upside will be more likely and reliable if the pair closes today's session (or one of the following) not only inside the red channel, but also above the upper border of the blue consolidation.

Should we see such price action, we'll consider going long. As always, we'll keep you informed.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

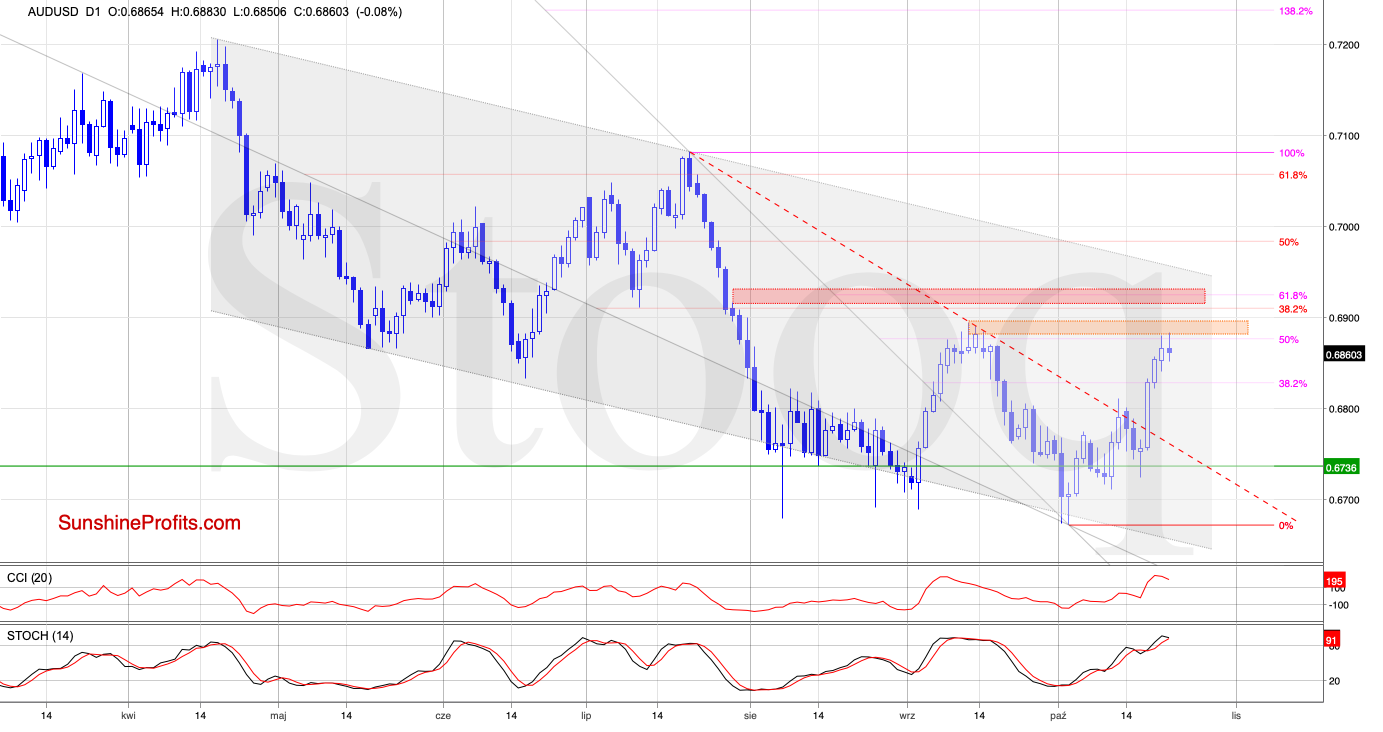

AUD/USD

As you see on the daily chart, the breakout above the declining red resistance line encouraged the bulls to fight for higher levels. As a result, AUD/USD broke not only above the 38.2% Fibonacci retracement, but also climbed to the next retracement and the orange resistance zone at the beginning of this week.

What's next?

Taking into account:

- the proximity to the resistance zone

- the current position of the daily indicators (just like in the case of EUR/USD, GBP/USD and USD/JPY they moved to their overbought areas)

- the size of recent white candles (getting smaller from session to session),

we think that reversal and lower values of AUD/USD are just around the corner.

Therefore, should we see more bulls' weakness and sell signals, we'll consider opening short positions. Stay tuned.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, should EUR/USD extend losses and invalidate its breakout above the 50% Fibonacci retracement, we'll consider opening short positions. If GBP/USD extend losses and invalidate its breakout above the 38.2% Fibonacci retracement, we'll also consider opening short positions. With USD/JPY, if the bulls overcome the nearest resistances, we'll consider going long - but if the bears push the pair below the lower border of its consolidation, we'll likely open short positions. If USD/CAD closes today's session inside the red channel and above the green line, we'll consider opening long positions. If USD/CHF closes soon not only inside the red channel, but also above the upper border of the blue consolidation, we'll consider going long. Should we see reliable signs of even more weakness of the bulls and daily indicators; sell signals, we'll consider going short.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist