Yesterday's much-awaited FOMC day didn't bring much of a surprise in terms of Fed policy changes. However, one has to look at the charts, not just at the news. The USD has certainly reversed higher yesterday and dealt us new cards. Great, let’s take a look how they play into our open positions and also into the opportunities so near.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions; as a reminder, the position has been opened on April 18, and we have decided to close 50% of the profitable short position on April 24) (stop-loss order at 0.7074; the next downside target at 0.6960).

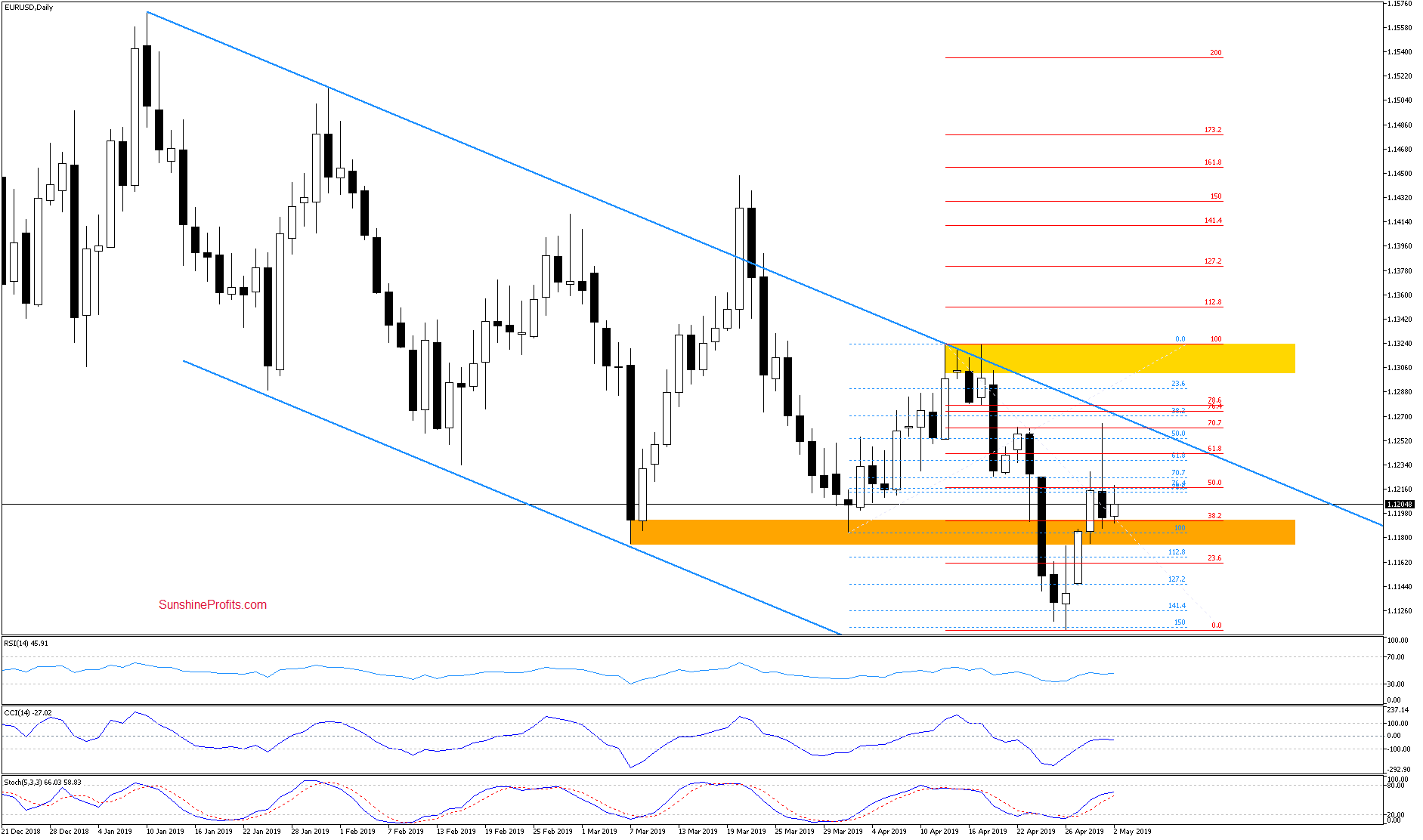

EUR/USD

EUR/USD gave us quite a volatile day yesterday. First, it tested the 61.8% Fibonacci retracement, and then went on to the 70.7% Fibonacci retracement. Before the day was over, the bulls however gave up all of their gains and then some. Such an invalidation of earlier breakouts is a bearish development.

Earlier today, the bulls have tried to retrace some part of yesterday's decline but look to have failed as the rate currently trades close to unchanged at around 1.1200. Could this be the attempt to move higher or can we look for another one down the road? The lack of sell signals by the daily indicators suggests that we may very well still see one more attempt to go north in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

The weekly picture doesn't look very optimistic for the bulls as they gave up half of their last week's gains. The pair reverted back into the yellow consolidation and has spent this week there. This means invalidation of the earlier breakout above it.

The daily chart shows that the bears took the rate below the green consolidation on Tuesday. The bulls countered with a swift upswing and continue to build on their gains in today's trading so far. This means that the price action came back to the previously-broken green consolidation and is currently midway through the yellow resistance zone (trading at around 1.3455).

This is exactly where the bulls have been stopped yesterday. Looking at the yellow resistance zone (the bulls haven't overcome it), the sell signals by the daily indicators and that breakout invalidation on the weekly chart, lower values of the pair are probably just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

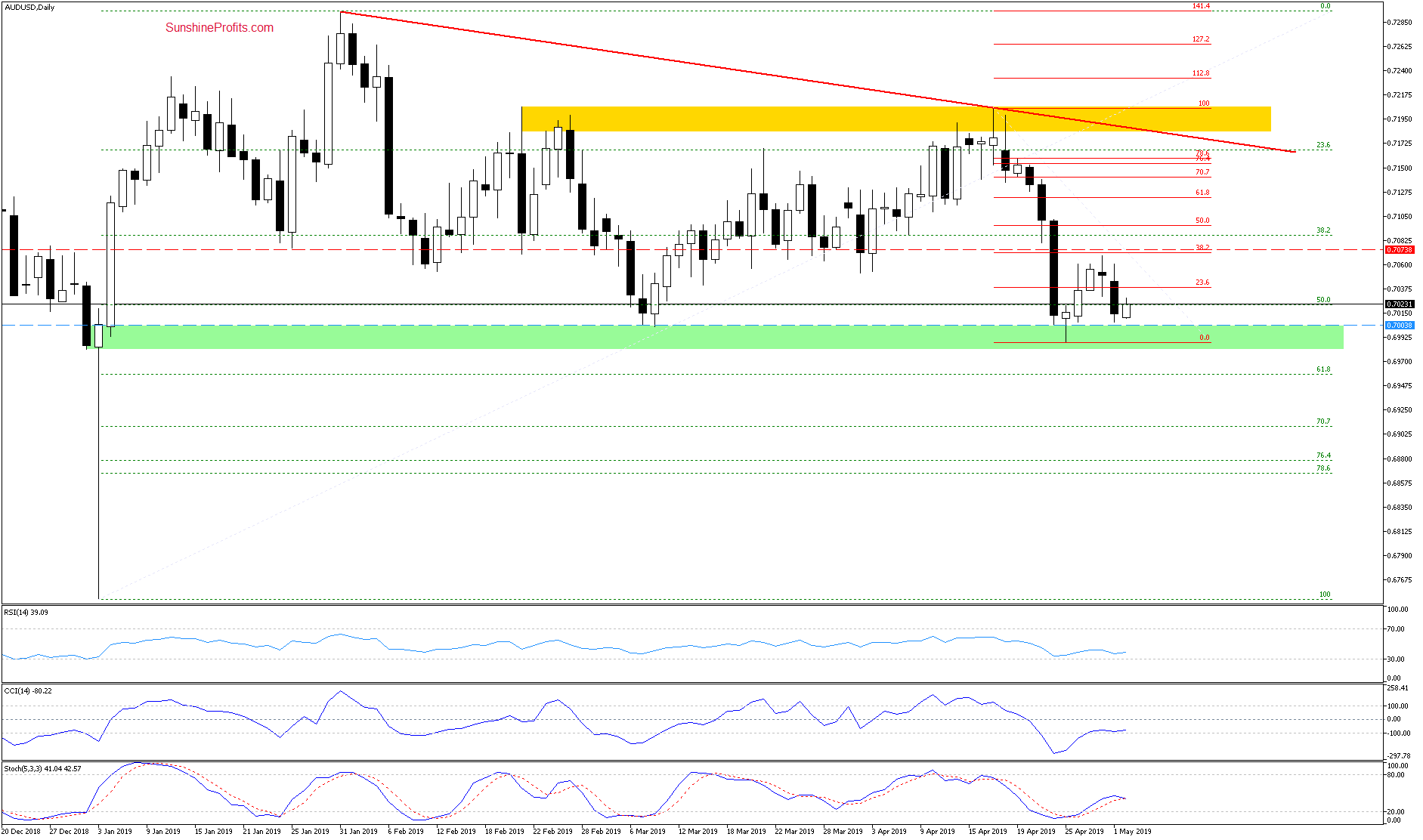

AUD/USD

The weekly perspective remains unchanged and our last commentary on the pair is up-to-date also today as the pair has:

(...) climbed to the previously-broken upper border of the red declining trend channel. It looks like a verification of last week' s breakdown that left the price trading back inside the trend channel.

The daily chart shows an unsuccessful attempt to come back above the upper border of the red declining trend channel as seen on the weekly chart. Its combination with the 38.2% Fibonacci retracement of the most recent downward move on the daily chart encouraged the bears to act.

The bears took the pair close to the green support zone yesterday. Earlier today, the bulls attempted to go north but their attempts look to have already fizzled out as the pair currently trades below yesterday's lows at around 0.7005. That value is also below the green support zone. One more downswing is supported by the sell signal of the daily Stochastics Oscillator.

Trading position (short-term; our opinion): short positions (50% of already existing short position that has been opened on April 18 and partially closed on April 24) with a stop-loss order at 0.7074 and the next downside target at 0.6960. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the remainder of our profitable short position in AUD/USD continues to be justified as the downside momentum has accelerated yesterday. In USD/JPY, we haven't seen yet signs of much strength, so a long position is not justified now. We also have to sensibly wait for signs of weakness in USD/CAD prior to considering a short position. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist