The currencies are trading cautiously prior to the G20 meeting conclusion. The Trump-Xi talks will also shed more light on the state of the global trade ahead. But what about now? Time to prepare for the upcoming moves and check on the existing ones! Did they change the outlook in our closely-watched pairs anyhow?

In our opinion, the following forex trading positions are justified - summary:

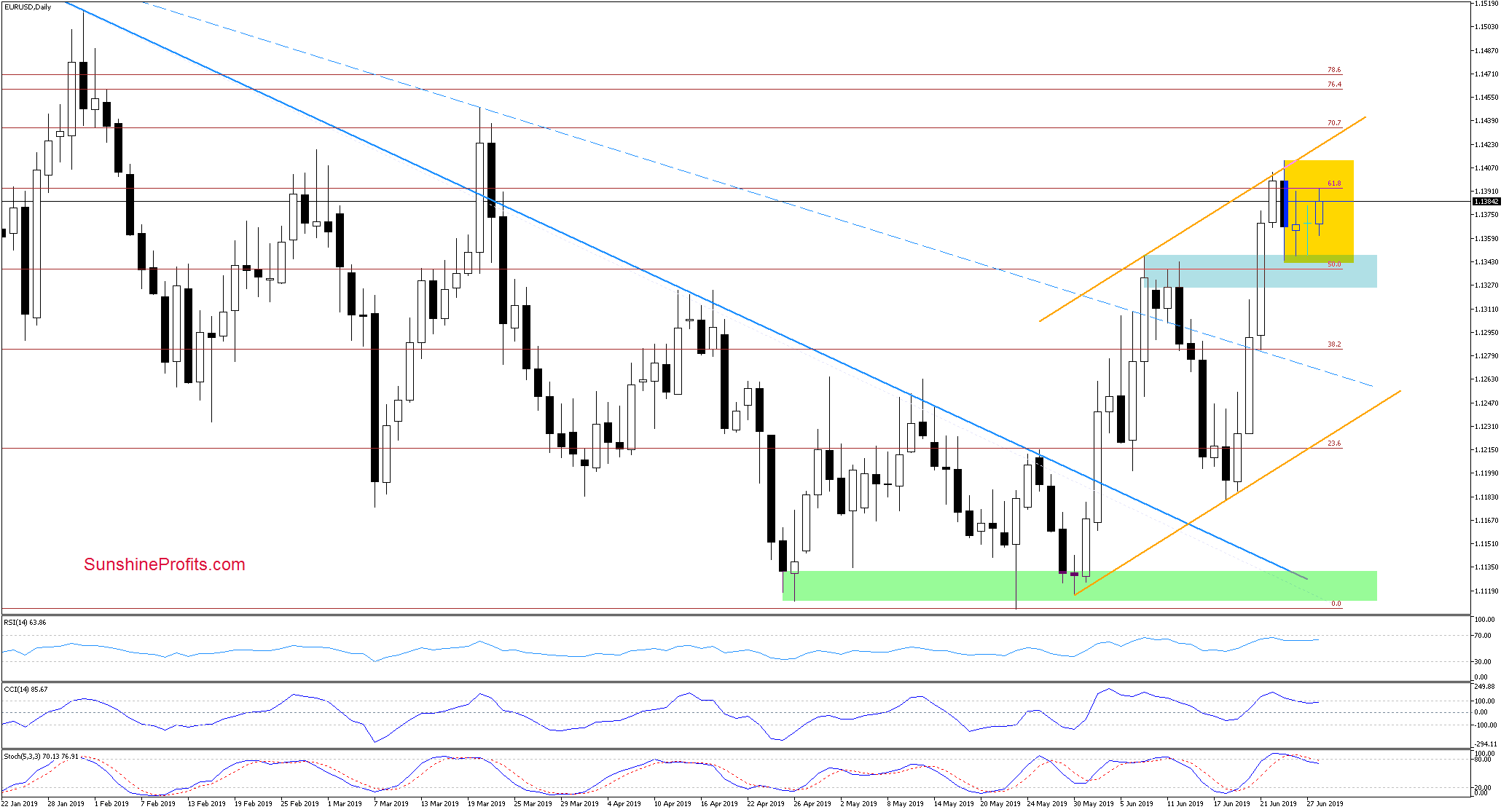

EUR/USD

The price action in EUR/USD has been confined to the yellow consolidation in recent days. These are our yesterday's observations:

(...) Another test of the blue support zone remains probable. While the daily indicators' position supports the bearish scenario, one more upswing targeting a retest of recent resistances can't be ruled out as long as the pair still trades above the blue support zone.

The pair trades modestly higher today and remains well above the blue support zone. It's definitely closer to the retest of recent highs than to the blue support.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

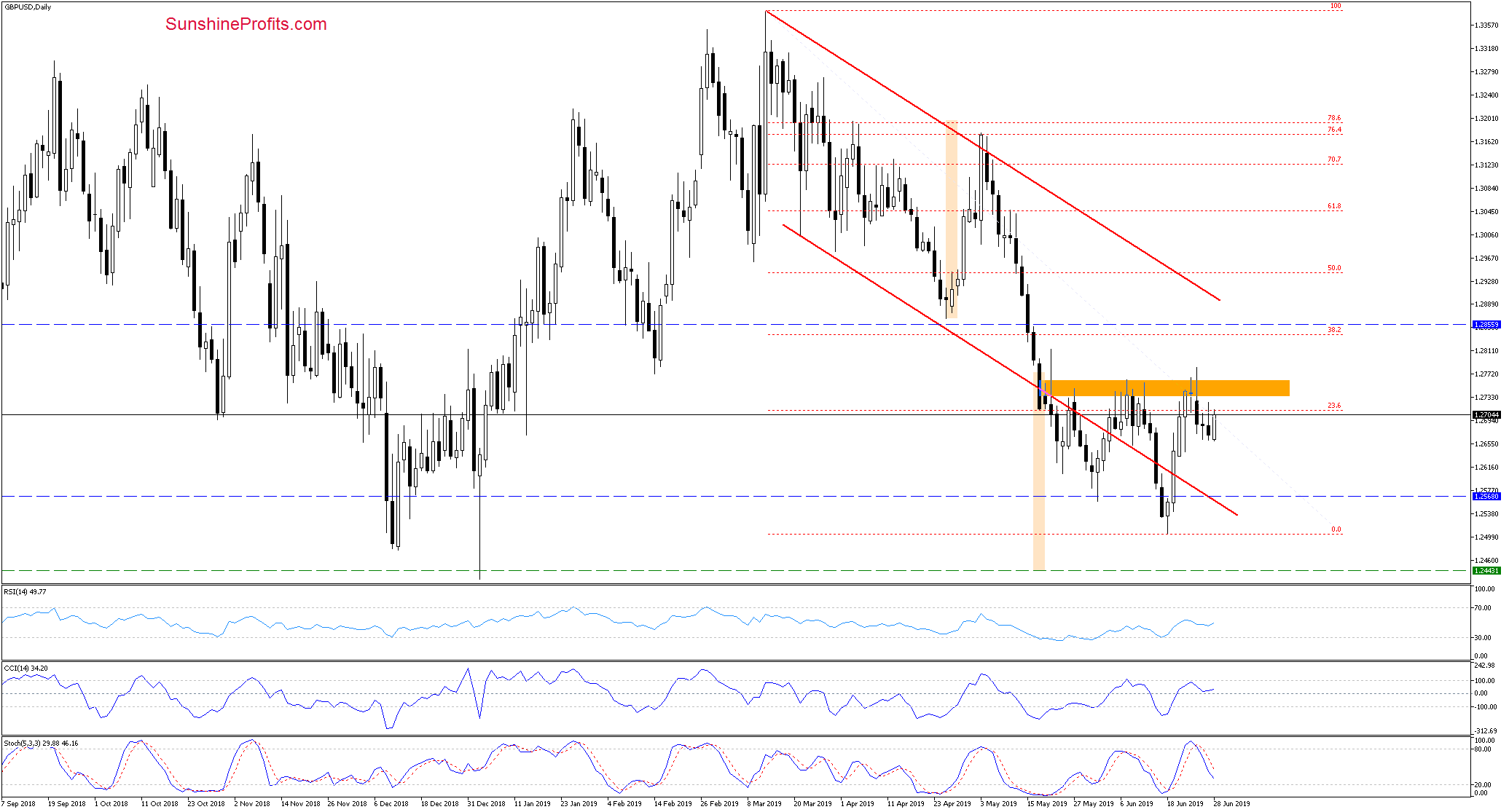

GBP/USD

While GBP/USD has bounced off yesterday's lows, it remains far from challenging the orange resistance zone again. Let's recall what we have written about the daily indicators' sell signals on Wednesday:

(...) Universally, they're pointing to a similar outcome down the road this time, too.

Should it be the case and GBP/USD extends losses from here, we're likely to see a drop to approximately 1.2568. This is where the lower border of the red declining trend channel currently is. Prior to that however, one more upswing verifying the strength of the orange resistance zone can't be ruled out.

As for now, the exchange rate is on an upswing, which fits the above-mentioned scenario.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

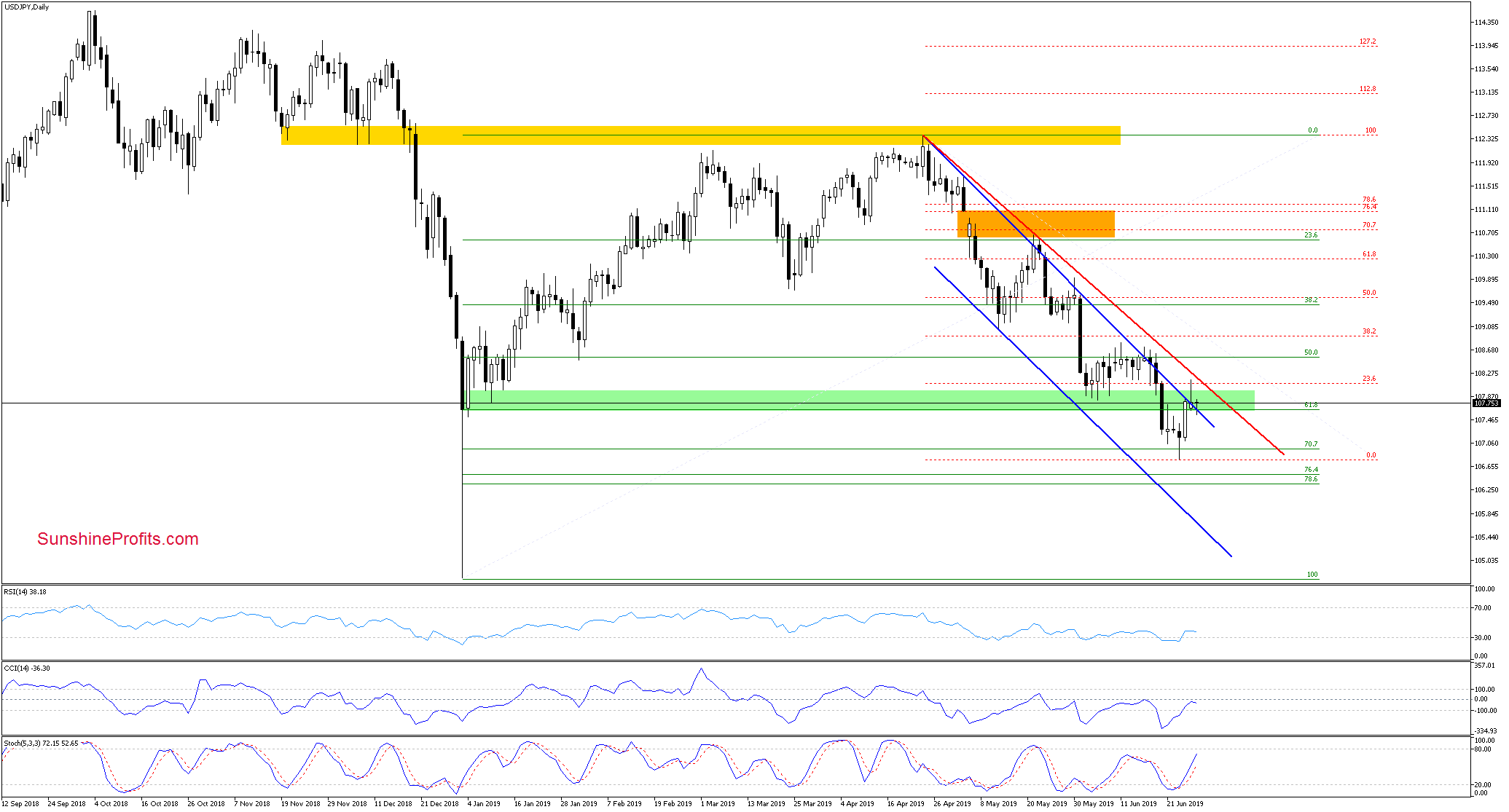

USD/JPY

USD/JPY has moved higher during yesterday's session, breaking above the upper border of the declining blue trend channel. This proved to be a fleeting achievement as the 23.6% Fibonacci retracement and the proximity to the declining red resistance line encouraged the sellers to act.

A pullback followed, yet the pair has closed the day slightly above the upper border of the blue trend channel. Earlier today, the selling pressure continued but the pair has rebounded back above the upper border of the blue channel.

Let's take a look at the daily indicators. Their buy signals remain on the cards, supporting the buyers further on.

Today's closing prices will be very insightful. If the bulls do not manage to close above the blue trend channel, one more downswing at the beginning of the coming week targeting the area around 107.20, remains likely. Should the buyers win the day, we can expect another attempt to break above the red declining resistance line in the coming days.

As long as there is no breakout above the declining red resistance line, a bigger move to the upside is not probable and reliable enough to justify opening long positions just now.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the currency pairs are trading in a tug-of-war fashion, within a narrow range. Such a seesaw action doesn't allow for opening any kind of positions with confidence. Therefore, there're no opportunities worth acting upon in the currencies and capital preservation remains the kingmaker. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist