The USD Index is hovering near its recent highs and many currency pairs are feeling the heat. After yesterday's reversal attempt, the euro finished lower. It continues to trade in the same fashion also today. Perhaps the bears are exhausted and ready to take a pause. Can the bulls hope for a turn of fortunes soon? In today's Alert, we deliver a pointed answer to these questions. Then, there are also the other pairs waiting.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1204; the next downside target at 1.1130)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the next initial downside target at 1.3352

- USD/CHF: none

- AUD/USD: none

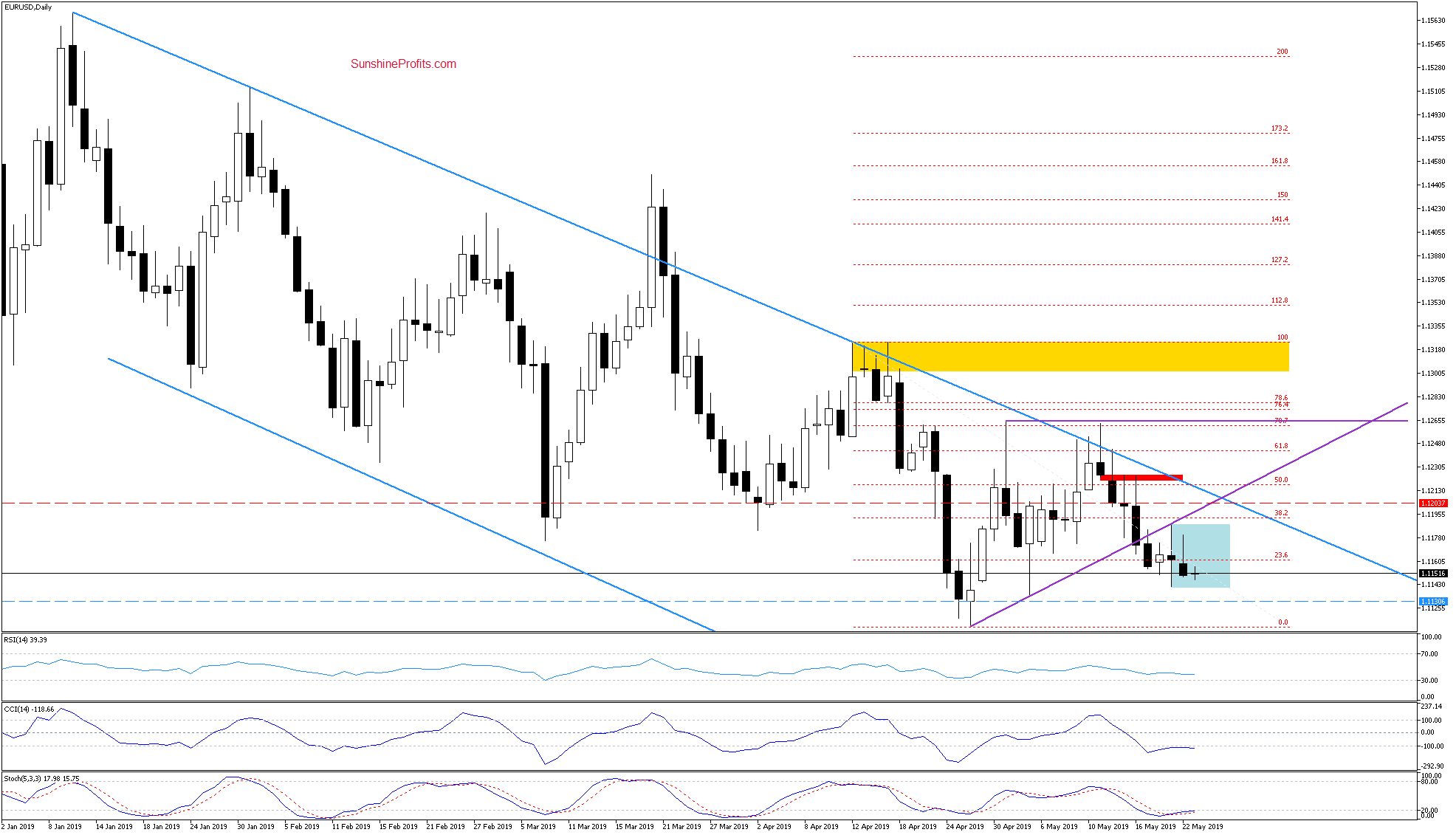

EUR/USD

The weekly chart shows that EUR/USD is still trading around the rising long-term green support line. Is the short-term perspective any clearer?

Yesterday's attempt to move higher fizzled out and the pair reversed down to finish the day close to its lows. Earlier today, the downside move continues and the exchange rate trades at around 1.1115. Have the weak German PMI figures have a hand in that?

EUR/USD is after a breakdown below the rising purple support line and the breakdown has been verified. That has bearish implications for the coming days.

Trading position (short-term; our opinion): 50% of profitable short positions witha stop-loss order at 1.1204 and the downside target at 1.1130 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

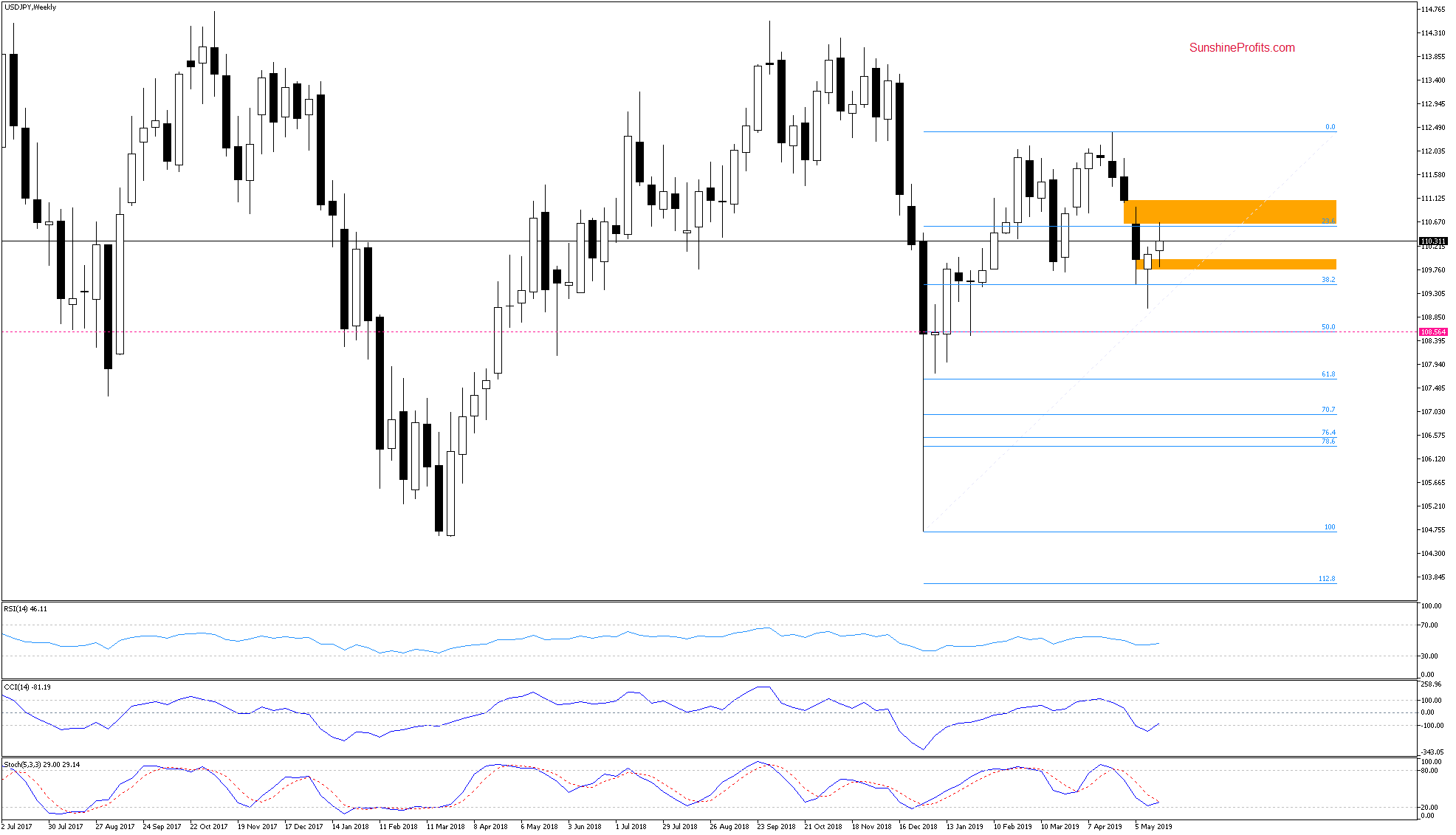

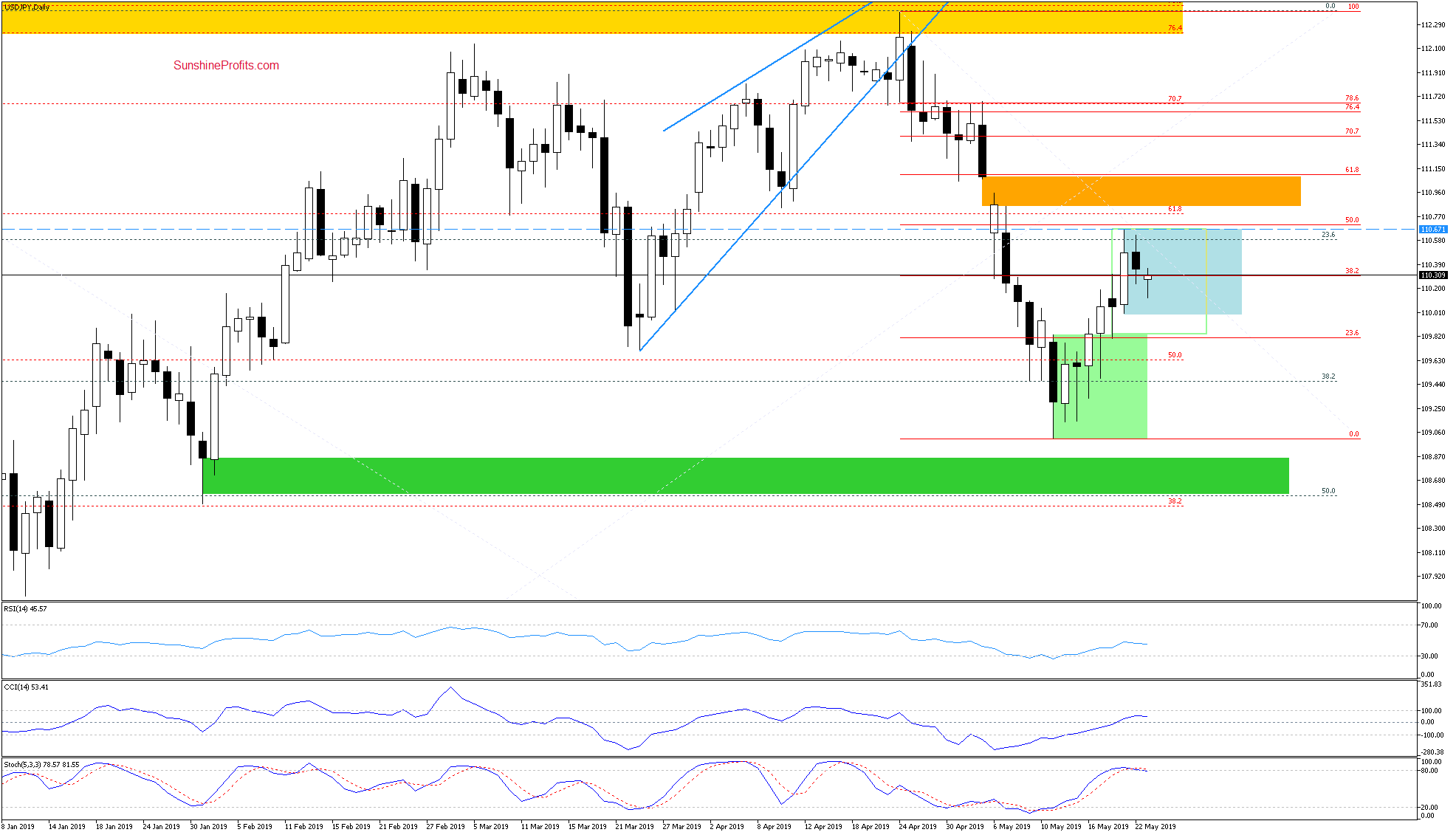

USD/JPY

USD/JPY rose earlier this week as seen on the weekly chart. The pair even reached the upper orange gap before pulling back.

We wrote these words in our Tuesday's commentary:

(...) the pair broke above the upper border of the green consolidation. Combined with the daily indicators having generated their buy signals, the pair could rise even to around 110.67. This where the size of the upward move would correspond to the height of the green consolidation it has broken above from.

After touching our upside target, the pair turned south. The proximity of the 50% Fibonacci retracement encouraged the bears to act and yesterday's downswing followed.

Today's opening gap suggests that further deterioration is just around the corner. Indeed, that looks to be the case as the pair trades at around 110.00 currently. Should the downside momentum continue, we're likely to see a test of the lower border of the blue consolidation (that's based on Tuesday's low) in the very near future.

Looking at the current position of the Stochastic Oscillator, we see it has ample room to decrease before reaching its oversold area. Considering that, the pair could move even lower and retest the 38.2% Fibonacci retracement (at around 109.46) in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

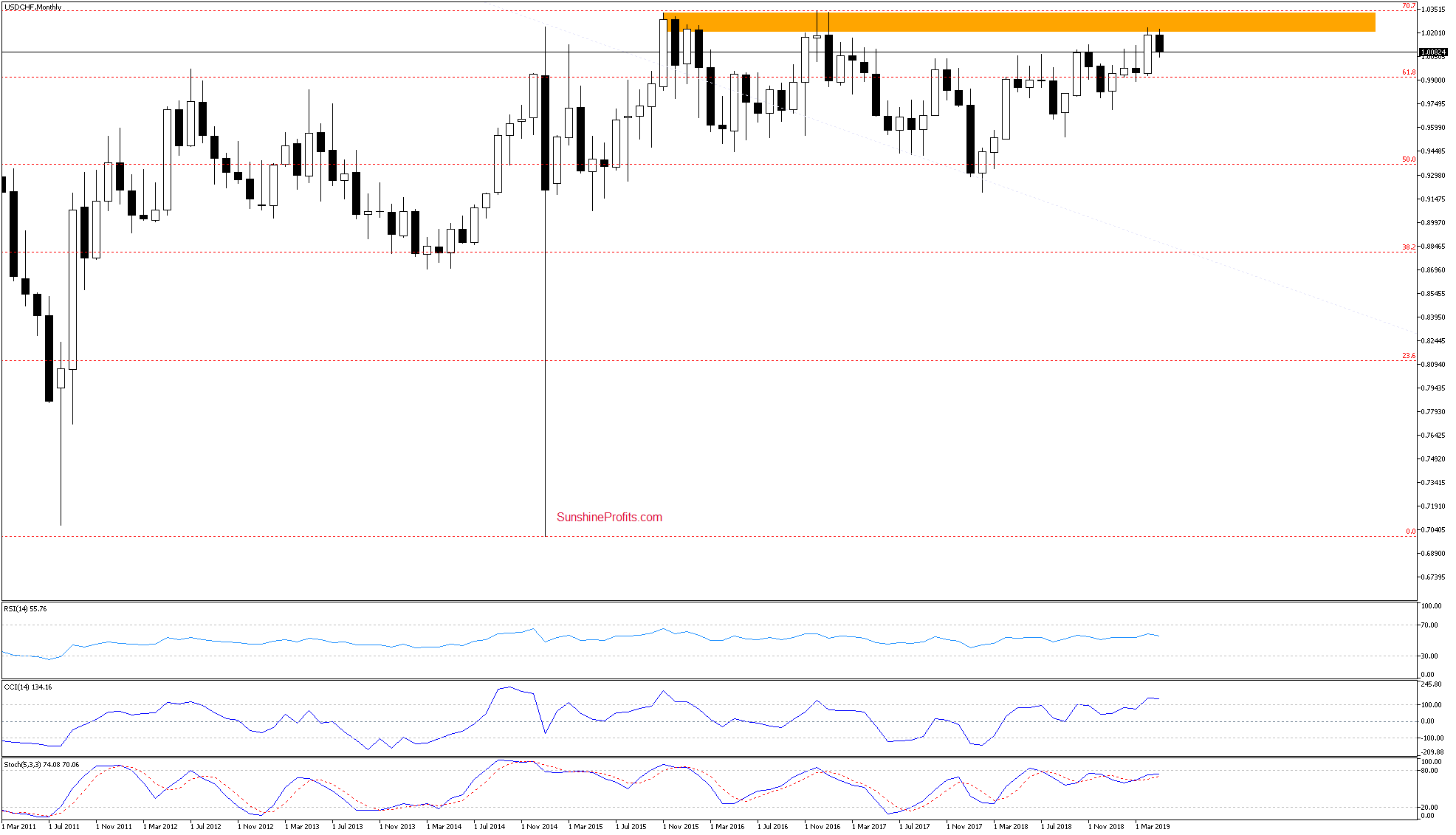

USD/CHF

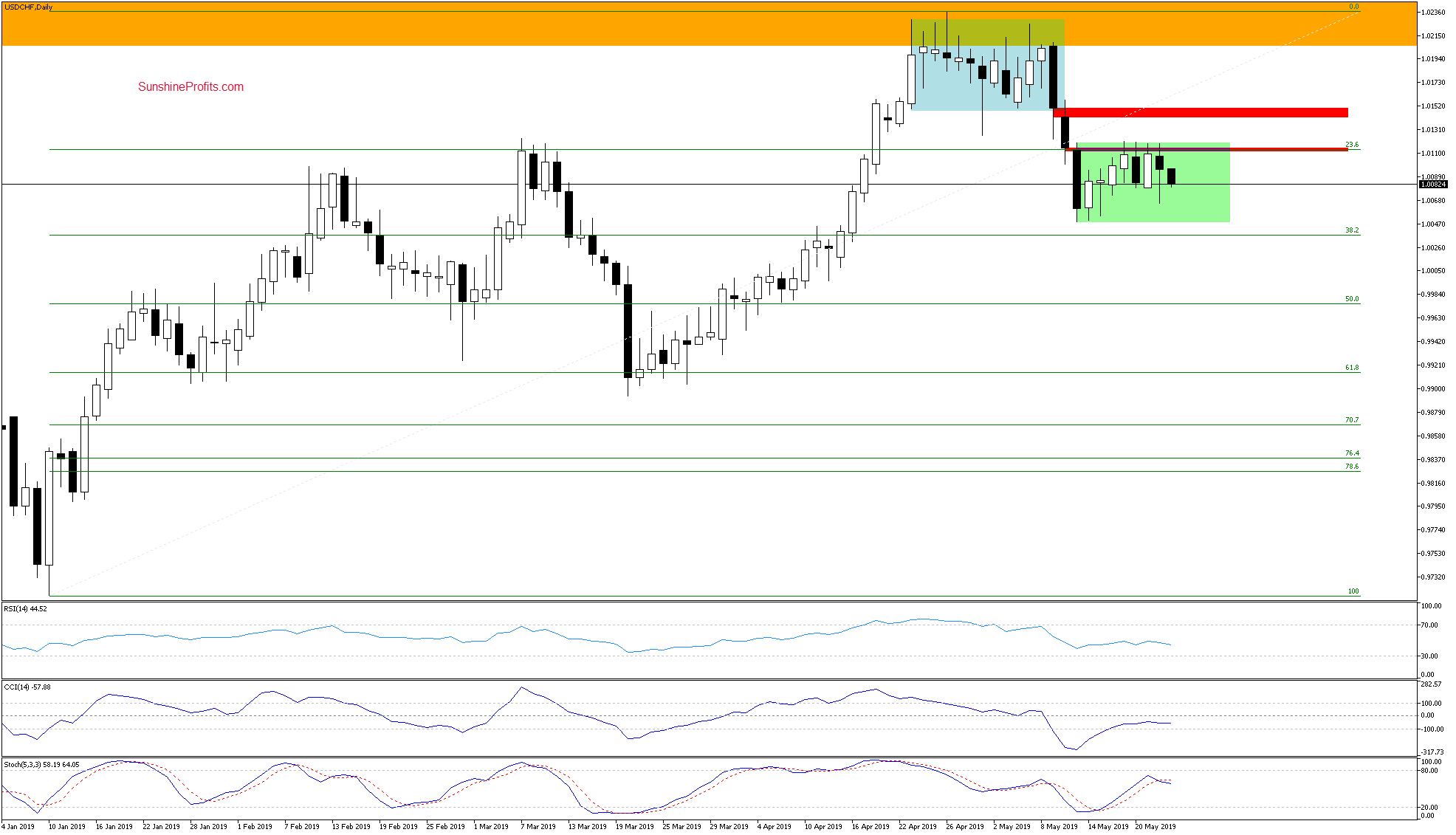

The monthly chart shows the orange resistance zone keeping gains reliably in check. For more details, let's take a look at the daily chart.

It shows that USD/CHF remains stuck in the green consolidation after another unsuccessful attempt to close the red gap above. In our Tuesday's commentary, we mentioned that absent a daily close above the red gap, another move to the downside remains likely. These words are also up to date:

(...) If USD/CHF extends losses from here, we could see it drop to the lower border of the green consolidation that marks recent lows. Even a test of the 38.2% Fibonacci retracement in the coming week isn't out of the question.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD had a downside reversal yesterday and the technical factors continue to favor the bears. Namely, the pair is after a verified breakdown below the rising purple support line. Our short position remains justified. USD/CAD trades as if on a seesaw and has again approached the strong combination of resistances that have sent it south many times earlier already. As there hasn't been any breakout let alone a verified one, our short position remains justified. AUD/USD has slowed its pace of decline but unless we see the bulls in strength and overcoming both nearest resistances, opening a long position isn't the right call. Capital preservation and acting on the strongest setups only, that is the right course of action. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist