The recent news of U.S. - China tariffs escalation has resulted in some pretty wild moves across the currencies. Now it's the time for the market to digest new realities and assess the expectations it held prior. For us, it means business as usual: a thorough and unbiased look at the charts coupled with acting on strongest opportunities only. Let's take a look what that means exactly.

In our opinion, the following forex trading positions are justified - summary:

EUR/USD

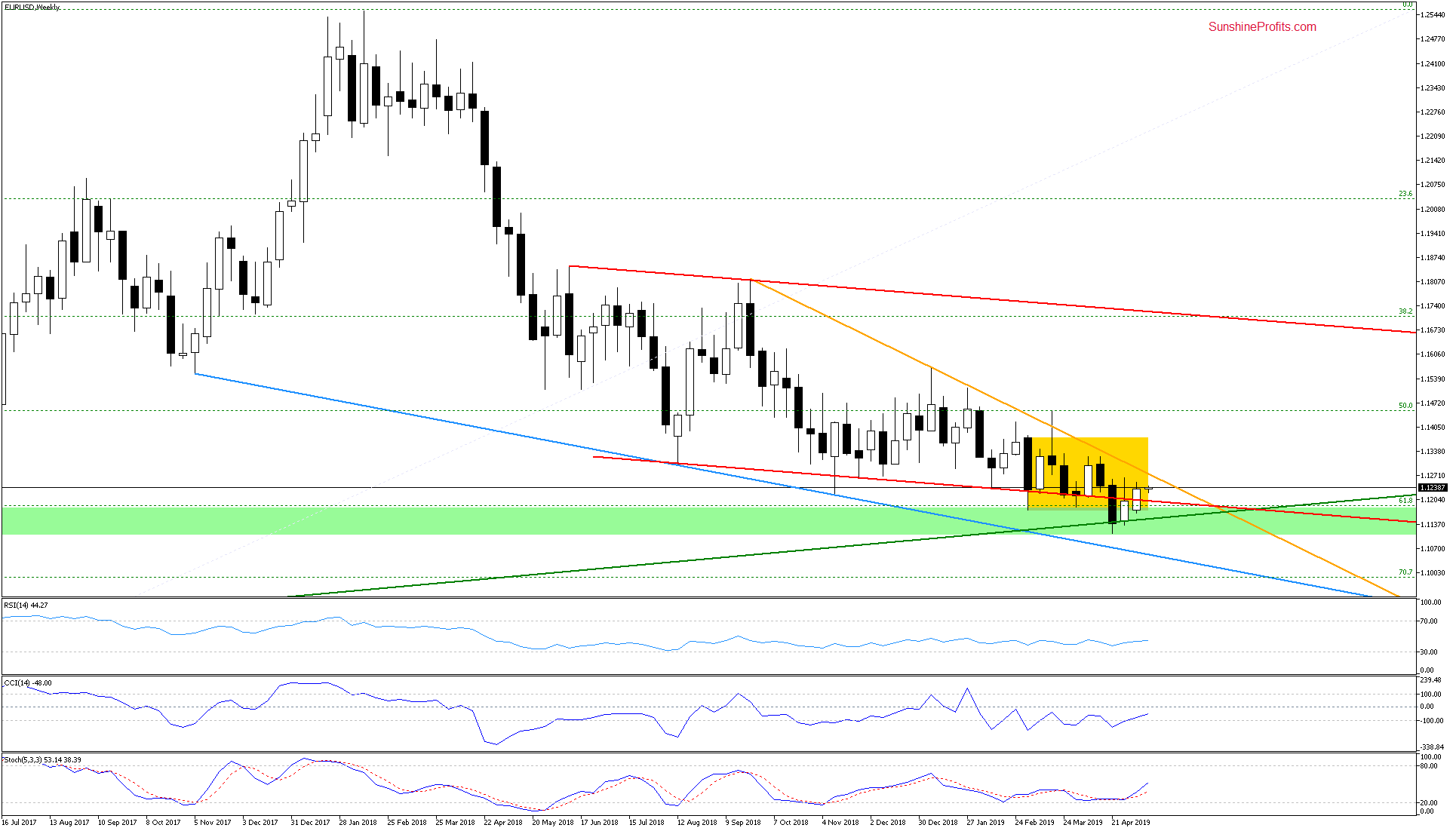

Let's start with the weekly chart. EUR/USD has closed the previous week above the lower border of the red declining trend channel. This means invalidation of the preceding breakdown. This is certainly a positive development for the bulls.

Additionally, the CCI and the Stochastic Oscillator generated their buy signals, suggesting further improvement. How does that reflect in the daily chart?

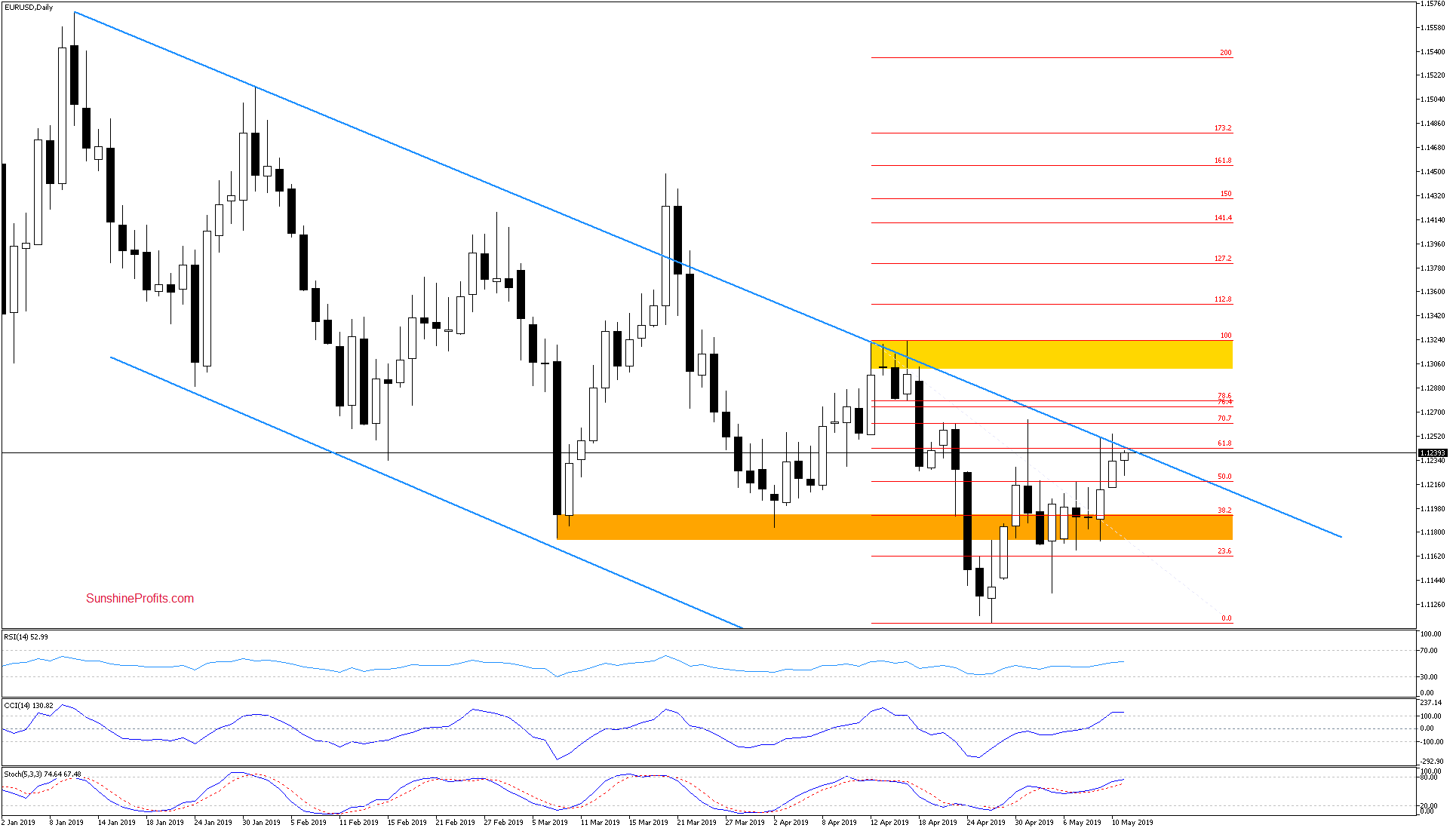

On Friday, the pair has move slightly above the upper border of the declining blue trend channel. This improvement has however been only temporary, and the earlier tiny breakout has been invalidated.

Although it's a negative sign for the bulls, price action earlier today points in the direction of a renewed breakout attempt. The rate currently trades at around 1.1260. As long as there's no daily close above this resistance however, another reversal lower is far from being excluded.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

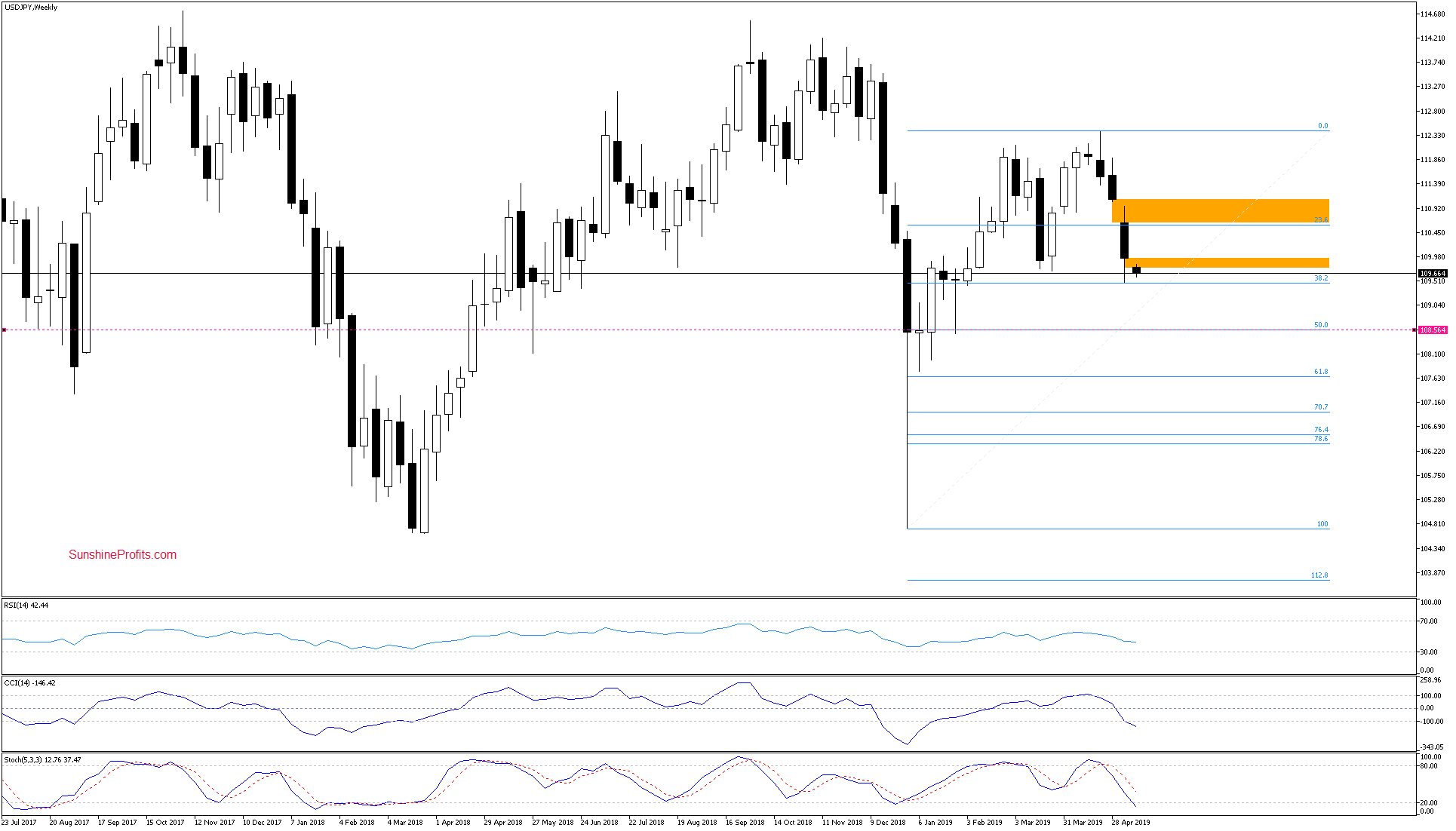

The weekly chart reveals another weekly gap opening as marked by the two horizontal orange zones. Similar price action in the prior week encouraged the bears to swiftly act and the resulting sharp decline doesn't bode well for higher values of the exchange rate in the coming days.

The weekly indicators are still on their sell signals, supporting the bears. Nevertheless, further deterioration will be more likely and reliable only if USD/JPY drops below the 38.2% Fibonacci retracement. Until that time, a rebound can't be ruled out. This is especially so when we factor in the situation on the daily chart.

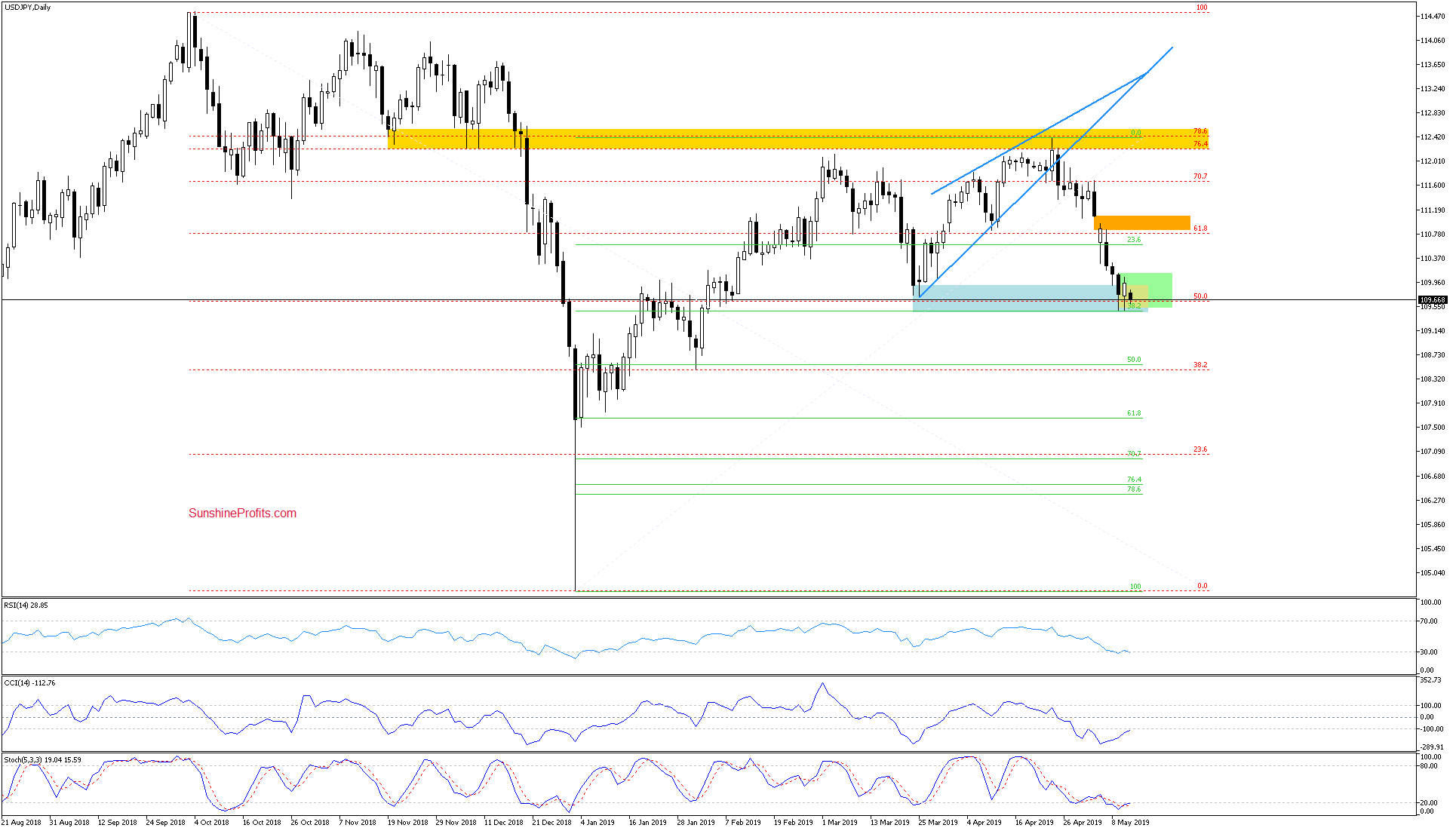

For much of today, USD/JPY has been trading inside the green consolidation that is just above the blue support zone. Prior to the U.S. open however, it has sliced through the support like a hot knife through butter and is currently trading at around 109.15.

This is despite the daily indicators having dropped to their oversold levels that would increase the probability of buy signals being issued in the next few days. Instead, we're seeing selling pressure that can take the pair to the 50% Fibonacci retracement (marked in green) and the late-January lows. If it prevails, bye-bye to the presumed rebound possibility as the rate would be below the weekly chart's 38.2% Fibonacci retracement.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

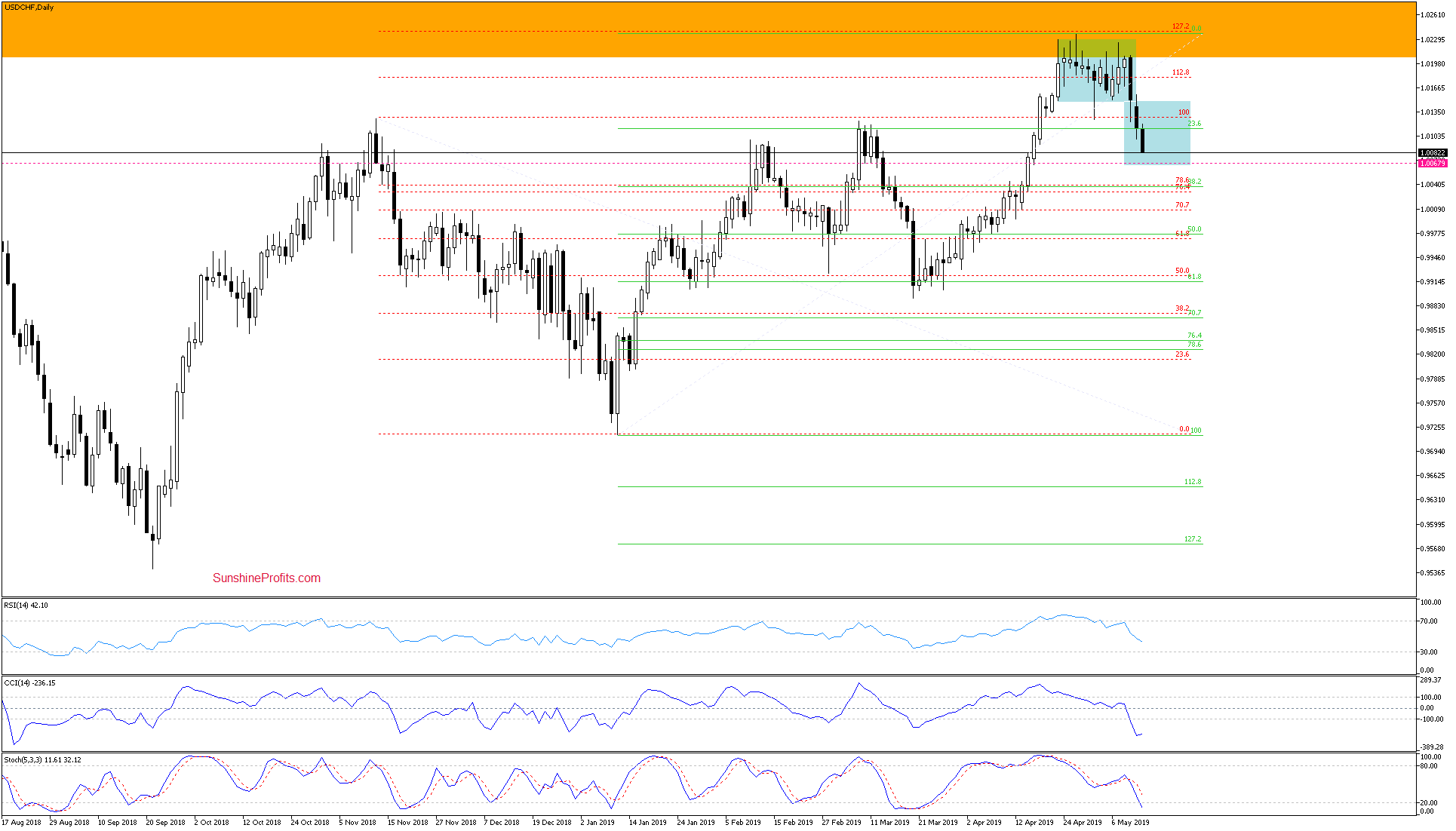

USD/CHF

It's apparent that the bulls still haven't overcome the major orange resistance zone as seen on the monthly chart. Instead, the rate keeps declining.

USD/CHF is building upon downward price momentum of recent days. Earlier today, the pair has reached the 1.0060 level. The daily indicators remain positioned in a negative way for the bulls and the lower border of the blue formation on the right is at hand. There, the size of the downside move would correspond to the height of the previous blue consolidation.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the strongly bearish close in USD/CAD beneath its recent consolidation hasn't materialized and a short position is therefore not justified. There're no other opportunities worth acting upon in the currencies. We remain keenly watching and as always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist