In our opinion, the following forex trading positions are justified - summary:

- EUR/USD:none

- GBP/USD: long (a stop-loss order at 1.2802; the initial upside target at 1.3312)

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

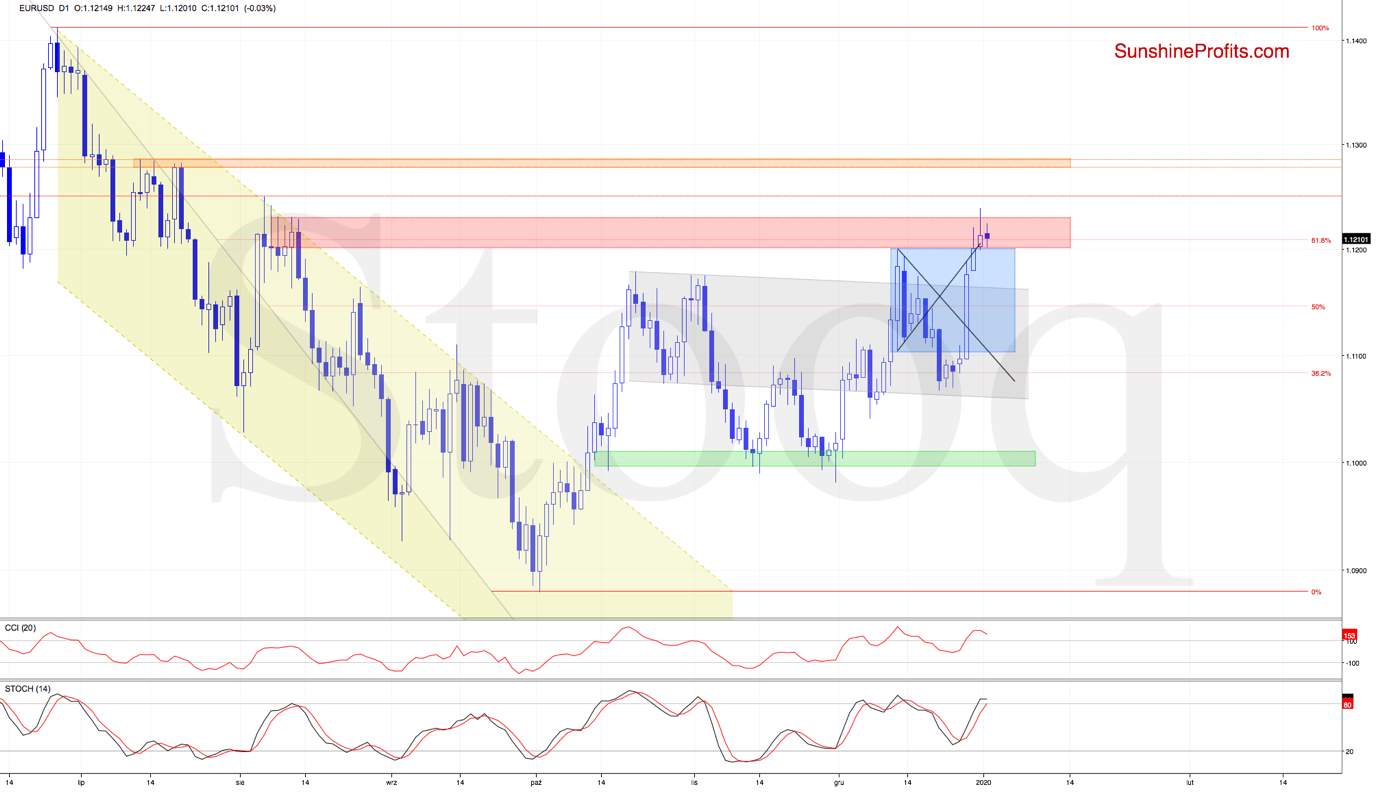

EUR/USD

Earlier today, EUR/USD pulled back somewhat, but mostly kept trading above the previously broken upper border of the blue consolidation. Should it manage to close above it, one more attempt to move higher can't be ruled out. It would be supported by the lack of sell signals by the daily indicators.

In other words, as long as there is no invalidation of the breakout above the mentioned formation on a closing basis, a bigger move to the downside is questionable, and a reversal from current levels wouldn't surprise us in the least.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

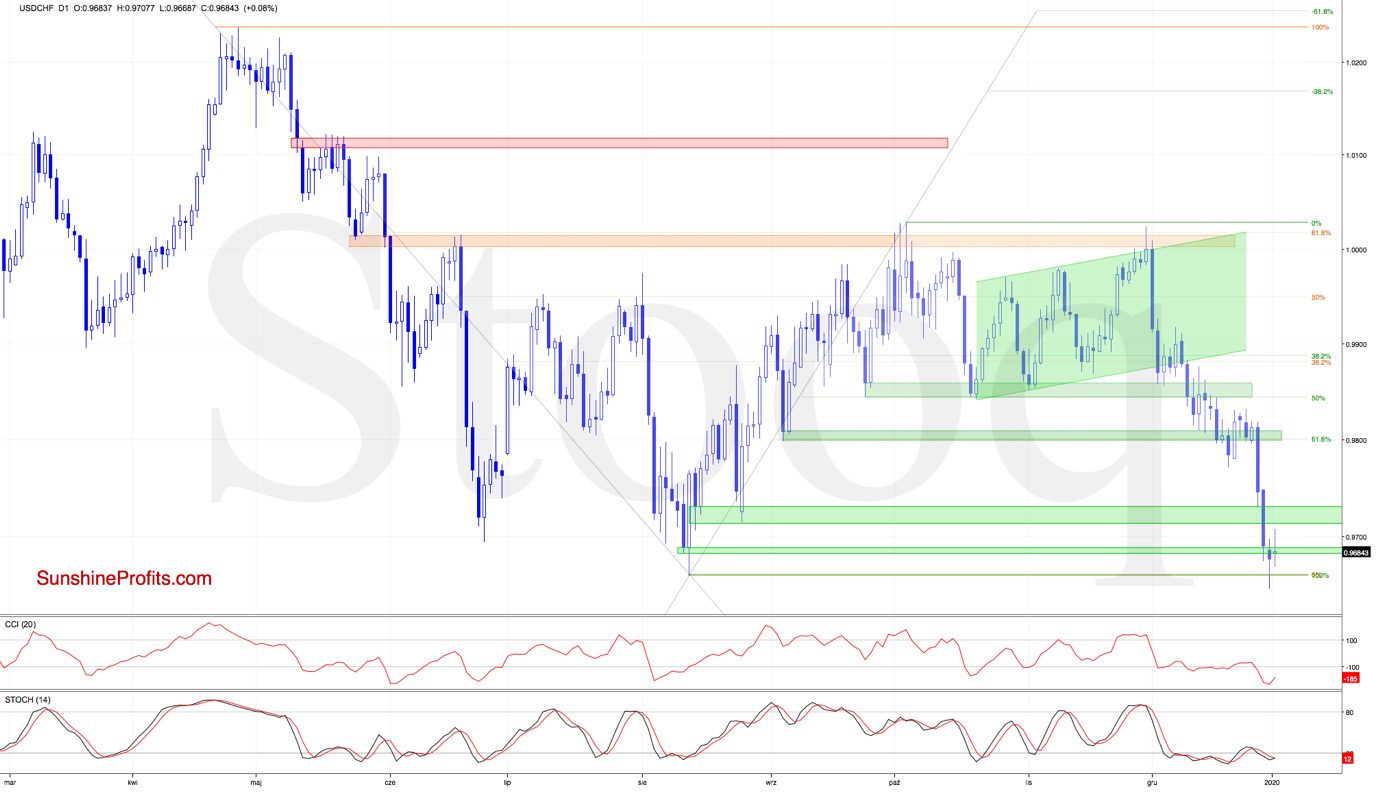

USD/CHF

In our Monday's commentary on this currency pair, we wrote:

(...) USD/CHF broke below the green support zone and the 61.8% Fibonacci retracement once again on Friday, which triggered further deterioration and a breakdown below the recent lows. Additionally, the Stochastic Oscillator issued its sell signal again, suggesting that a test of the next green zone and August lows can't be ruled out.

In line with expectations, USD/CHF extended losses, breaking below the discussed green support zone and the August lows. This deterioration turned out to be only temporary, and the exchange rate rebounded, invalidating the earlier breakdown.

Additionally, the daily indicators are close to generating their buy signals, and there is also a bullish divergence between the Stochastic Oscillator and the exchange rate forming. These suggest that a bullish reversal bringing higher values of USD/CHF may be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

Seemingly unstoppable, the Australian dollar has been on a winning streak recently. Yet the bulls wavered in their efforts not so long ago. Is it a sign that the tide is beginning to turn? Or, is it turning already?

We wrote on Monday that the recent AUD/USD upswing:

(...) brought the pair back above the two declining resistance lines, opening the way for further gains and to the resistance zone created by the 76.4% and 78.6% Fibonacci retracements.

Earlier today, the pair reached this area, and as the daily indicators haven't flashed any sell signals, it increases the likelihood of further improvement and a test of the upper border of the rising green trend channel in the very near future.

The situation developed in line with the above, and the pair overcame the mentioned resistance line on Tuesday. The bulls however didn't manage to keep all the ground gained, and a lower open followed earlier today. This means that a bearish gap has been created, invalidating the earlier breakout above the rising green trend channel.

This is certainly a bearish development that increases the probability of further deterioration in the coming days. But such price action will be more likely and reliable only if we see a daily close inside the channel coupled with the daily indicators generating their sell signals.

Should we see such price action, we'll consider opening short positions.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Forex Trading Alert - this analysis' full version. There, we discuss also the current situation in EUR/USD and USD/CHF. The full

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist