As the USD keeps stubbornly near its highs, the euro bulls are aiming to recover some of the ground lost recently. With the pair still in a precarious position technically, will they prove their mettle and close the week on a strong note? We have quite a few points to tell you regarding this. Meanwhile, the Canadian dollar has again switched direction while the Australian dollar looks to have stabilized. But really, has it?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none (our short positions were closed with a profit by the stop-loss order earlier today)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3360)

- USD/CHF: none

- AUD/USD: none

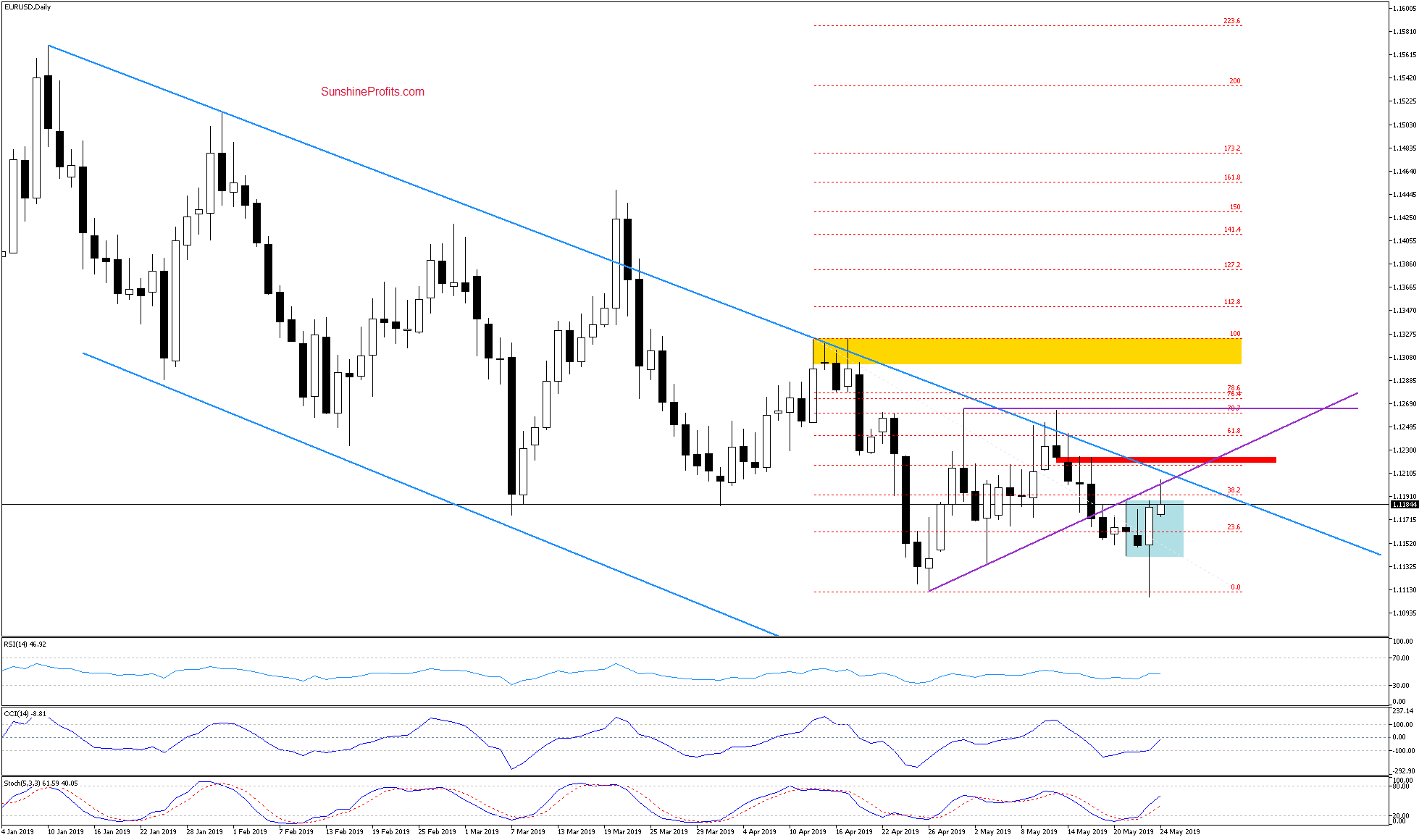

EUR/USD

Let's start with the weekly chart. EUR/USD moved temporarily below the long-term green support line yesterday, but then reversed and rebounded. It means invalidation of the earlier breakdown, which is a positive event for the bulls.

Nonetheless, the pair remains below the previously-broken lower border of the declining red trend channel. It suggests that as long as there is no weekly close above it, higher values are not likely to be seen.

Even if we see a breakout above this resistance line - similarly to what we saw earlier this month - a sizable move to the upside would require far more than that. Such a move will be more likely and reliable only if the exchange rate breaks above the declining orange resistance line based on previous important highs.

Talking resistances, there is one more obstacle for the bulls to overcome if they're serious about higher prices. Let's take a look at the daily chart below.

Here, we see that EUR/USD moved sharply higher yesterday. It went on to extend gains earlier today, reaching our stop-loss level and profitably closing the remaining part of the short positions.

The pair also reached the previously-broken lower border of the purple triangle and the 38.2% Fibonacci retracement (that's based on the recent decline). However, the bulls didn't manage to hold on to their gains, and the rate has pulled back since.

Let's connect the dots now. As long as there is no invalidation of the breakdown below the purple line, a breakout above the upper border of the blue declining trend channel and the red gap is closed, higher values of EUR/USD are not likely to be seen. Another reversal would not surprise us in the least.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

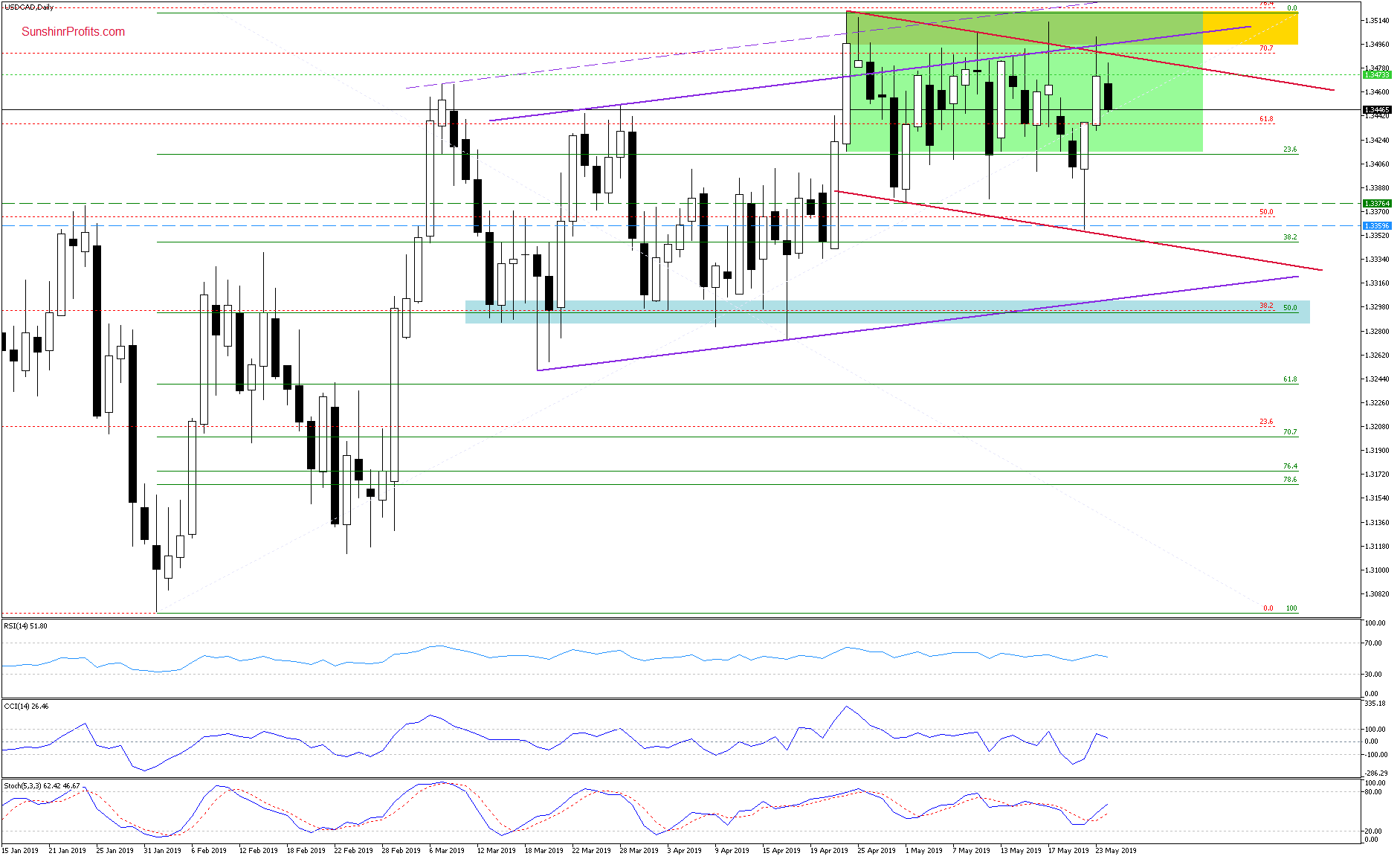

USD/CAD

The weekly perspective shows no change. USD/CAD is still trading inside the blue consolidation. Let's see the daily chart for more clues.

On Wednesday, USD/CAD bounced off its lows and went on to make another trip toward all three major short-term resistances. We mean the previous peaks, the 70.7% Fibonacci retracement, the upper border of the rising purple trend channel and the upper border of the declining red trend channel.

The bears withstood the buying pressure yesterday and sent the bulls packing earlier today. This is similar to what we have seen in all the previous cases since April.

As the pair trades currently at around 1.3450, the odds of the next decline went up. Such a move would target the recent lows or even the lower border of the declining red trend channel.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.3545 and the new initial downside target at 1.3360 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

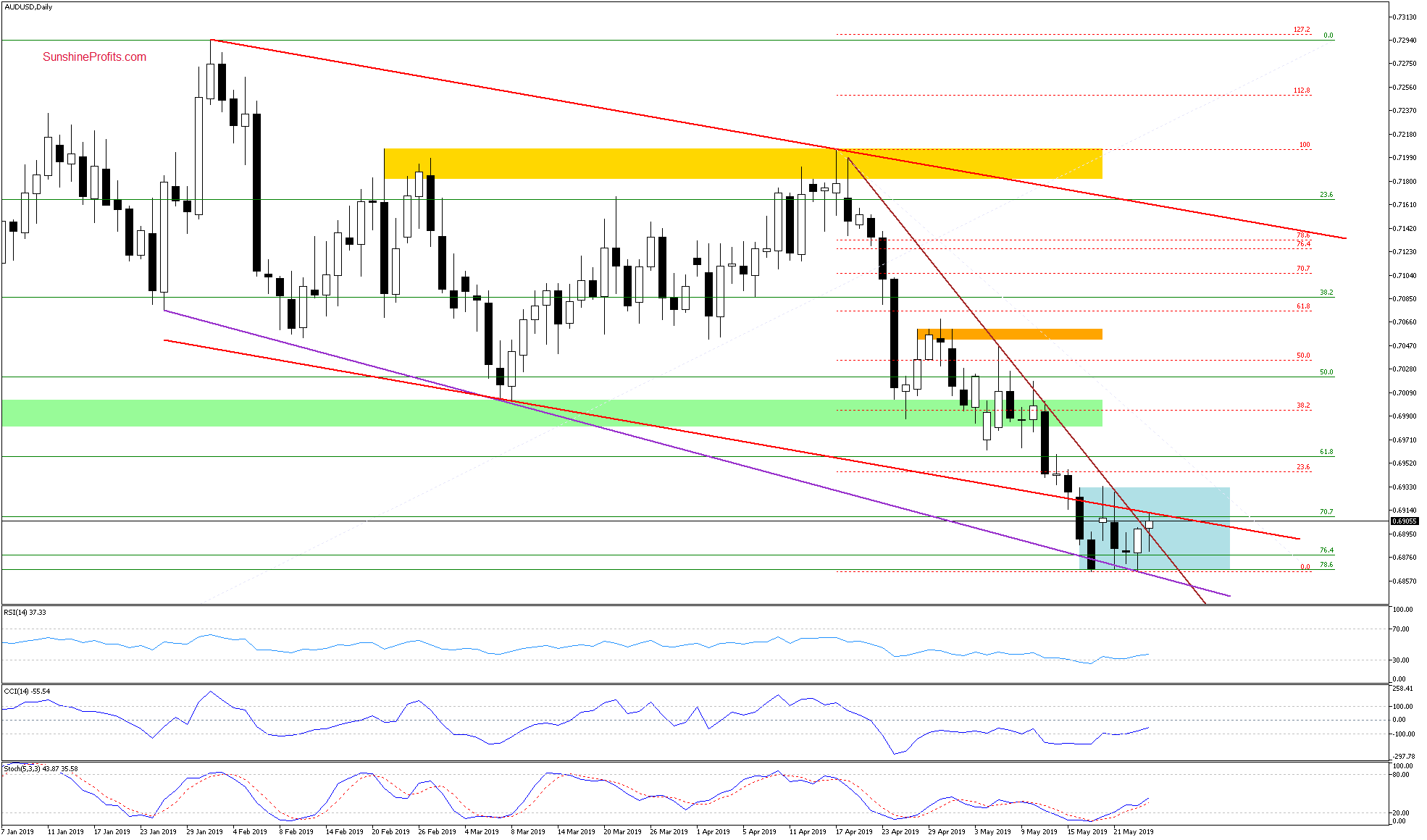

AUD/USD

AUD/USD has moved higher yesterday after the retest of a strong combination of supports. This support area is created by the declining purple support line (that is based on the late-January and early-March lows) and both the 76.4% and 78.6% Fibonacci retracements.

Earlier today, the bulls have been building upon their gains and the pair currently trades at around 0.6915. The daily indicators still point in the direction of an improvement. Such price action will be more likely and reliable only if we see a daily close above the lower border of the declining red trend channel coupled with a breakout above the declining brown resistance line.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but should we see a daily close above the lower border of the declining red trend channel and a breakout above the declining brown resistance line, we'll consider opening long positions. Stay tuned.

Summing up the Alert, EUR/USD had reversed higher yesterday and this move took us out of the market with profit. USD/CAD again approached the strong combination of resistances that have sent it south many times earlier already. And again, rolled over the next day. Our short position remains justified. AUD/USD is making tentative gains but unless we see the bulls in strength and overcoming both nearest resistances, opening a long position isn't the right call. Capital preservation and acting on the strongest setups only, still remain the right course of action. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist