As you've read in the previous Oil Trading Alerts and Forex Trading Alerts, Nadia Simmons, who is the author of these reports has not been feeling well. This remains to be the case, and as it's been several days since you received crude oil or forex analysis from us, I (PR here) would like to help.

Consequently, I will be writing analyses of both: crude oil and the forex market and I will publish them combined, so that those, who normally enjoy access to only one of these reports, will get something extra. That's not much of a positive surprise for those, who already have access to both Alerts (for instance through the All-Inclusive Package), so if you have access through this package or you subscribed to both products individually, I will provide you with something extra. I will analyze any company of your choice with regard to its individual technical situation, and I will send you this on-demand analysis over e-mail. If this applies to you, please contact us with the name of the company that you're interested in.

On an administrative note, Nadia will be back and Oil Trading Alerts as well as Forex Trading Alerts will take their regular form tomorrow - on Tuesday, Oct 22. Thank you for your patience.

Having said that, let's take a look at the USD Index.

Forex Analysis

As far as the currency market is concerned, Nadia usually covers the individual currency pairs. However, that's not what I specialize in, so instead of the usual format of these analyses, I will maximize their usefulness and likely profitability. This means that instead of focusing on individual currency pairs, I will cover the USD Index, as that's what I've been following on a regular basis for years.

It's also tradable, as there are futures on it (DX symbol) as well as ETFs, for instance the UUP and the UDN.

The key behind-the-scenes development greatly impacting the USD Index is the Brexit-related turmoil.

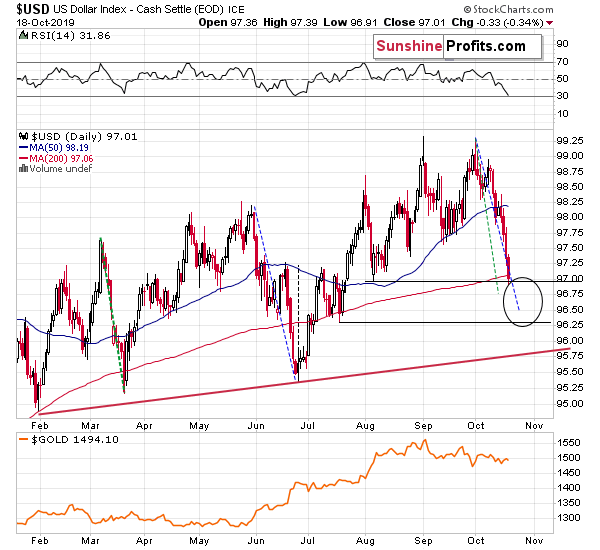

In Friday's analysis, we featured two support levels and the upper of them was reached on Friday. This means that the bottom in the USDX might already be in right now. However, it might also be the case that the USDX declines to about 96.3 before rallying first. A sustainable move below 96.3 seems very unlikely. We explained how we determined these two bottoming targets on Friday, so we'll quote what we wrote:

The USDX just moved below the September and late-August lows, closing below them. This breakdown opens the way to further declines, so the question becomes how far can the USDX slide. It seems that not much. The index has been trading in a specific manner in the previous months and nothing suggests that this short-term correction is going to be anything bigger than the previous ones.

We copied the previous declines (marked with green and blue) to the current situation and it clear that if the USD Index was to match these moves than it could decline some more, but the size of this move is not likely to be huge.

The nearest support levels are provided by the previous lows and the 200-day moving average. The upper target is at about 97 and the lower target is at about 96.3. There's also the rising red support line a bit below 96, but it's highly unlikely that the USD Index would drop as low.

There's also another line that's not visible on the previous chart and it's the blue line based on i.a. the mid-2018 low. It's a bit above 96, so it strengthens the support provided by the mid-July 2019 low.

So, in the more bullish scenario, USDX could rally once bottoming close to 97, and in the less bullish scenario, it could rally once bottoming close to 96.3. In case of the former, the decline would be smaller than the March 2019 decline, and in case of the latter, the decline would be a bit bigger than the May - June 2019 decline. Both scenarios seem possible, but the bottom at 97 is more probable in our view.

The scenario in which the USDX breaks below 96 and continues to fall for weeks is very unlikely in our view, given the resilience that the U.S. currency has been consistently showing in the previous months in light of bearish news like Trump calling for a lower dollar or significantly lower interest rates.

This means that right now, the situation in the USD Index is unclear in the short run, but it doesn't seem that we will have to wait for long before it clarifies. Perhaps we will have to wait just until Monday. The failure to confirm the Brexit deal during the Saturday vote could immediately reverse USD's decline. Or we might have to wait for a few extra days before the support levels are reached, which would then trigger the reversal.

For now, no positions seem justified, but once we get the bullish confirmations (and we are likely to get them soon), we will quite likely open a long position in the USD Index. We might open individual currency pair positions instead as that's what's more likely once Nadia is back (on Tuesday).

Over the weekend, the Brexit can (the vote) was kicked down the road again (and again appears on the menu today), but we doubt that anything major will change. Consequently, the above remains up-to-date. The same goes for the long-term trend and our comments on it:

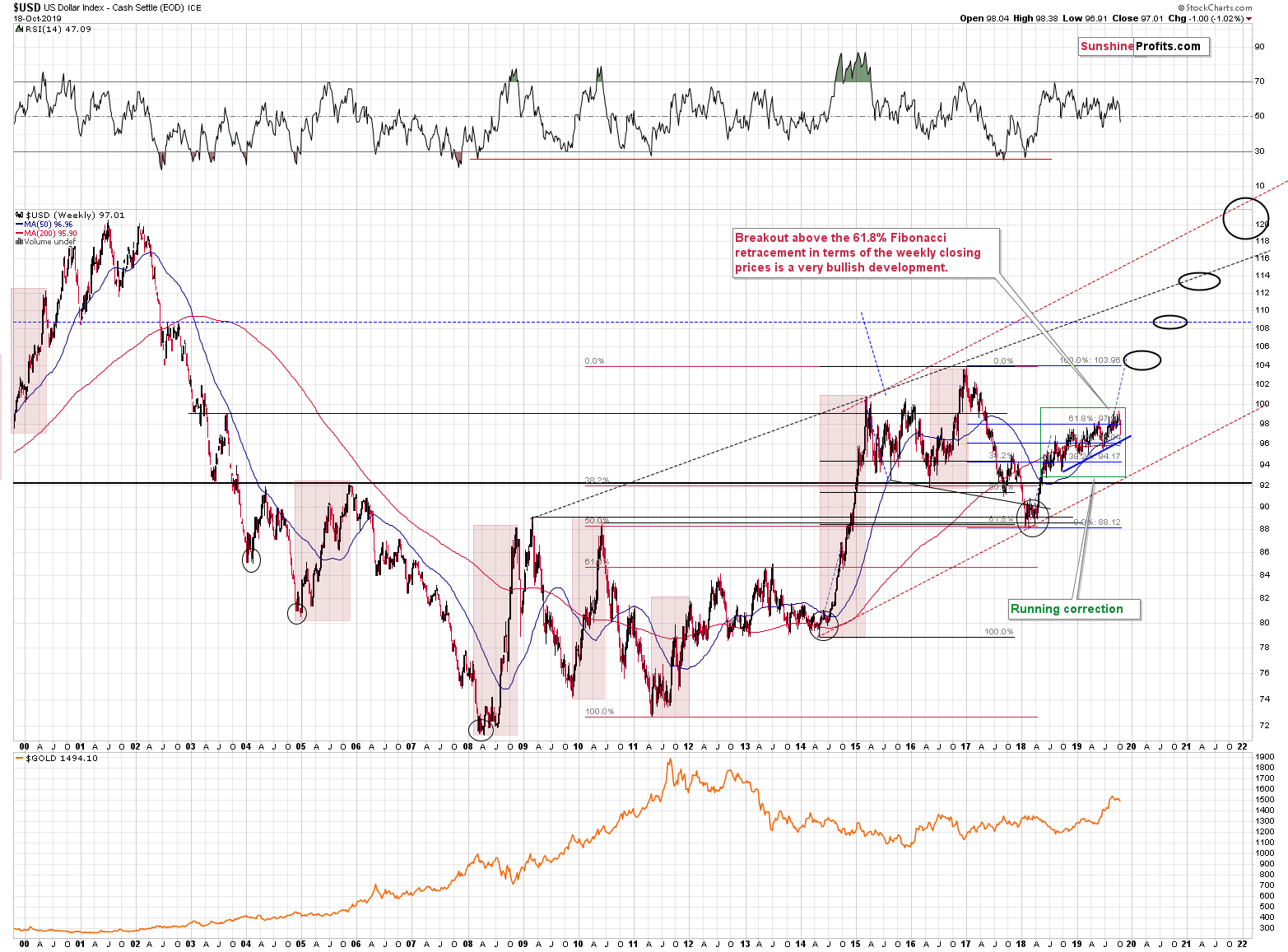

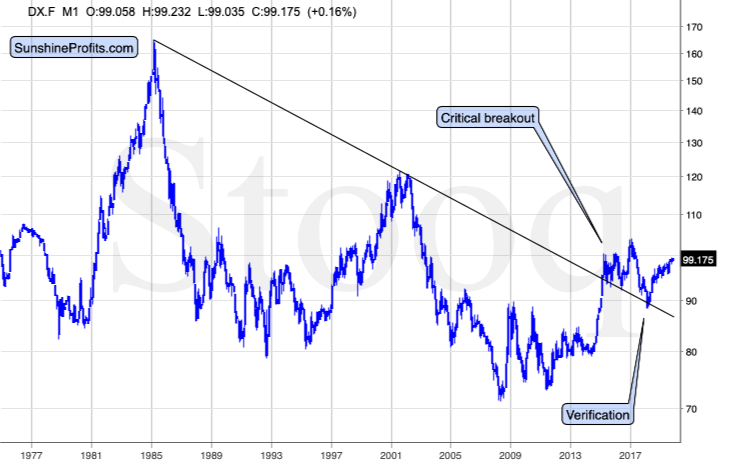

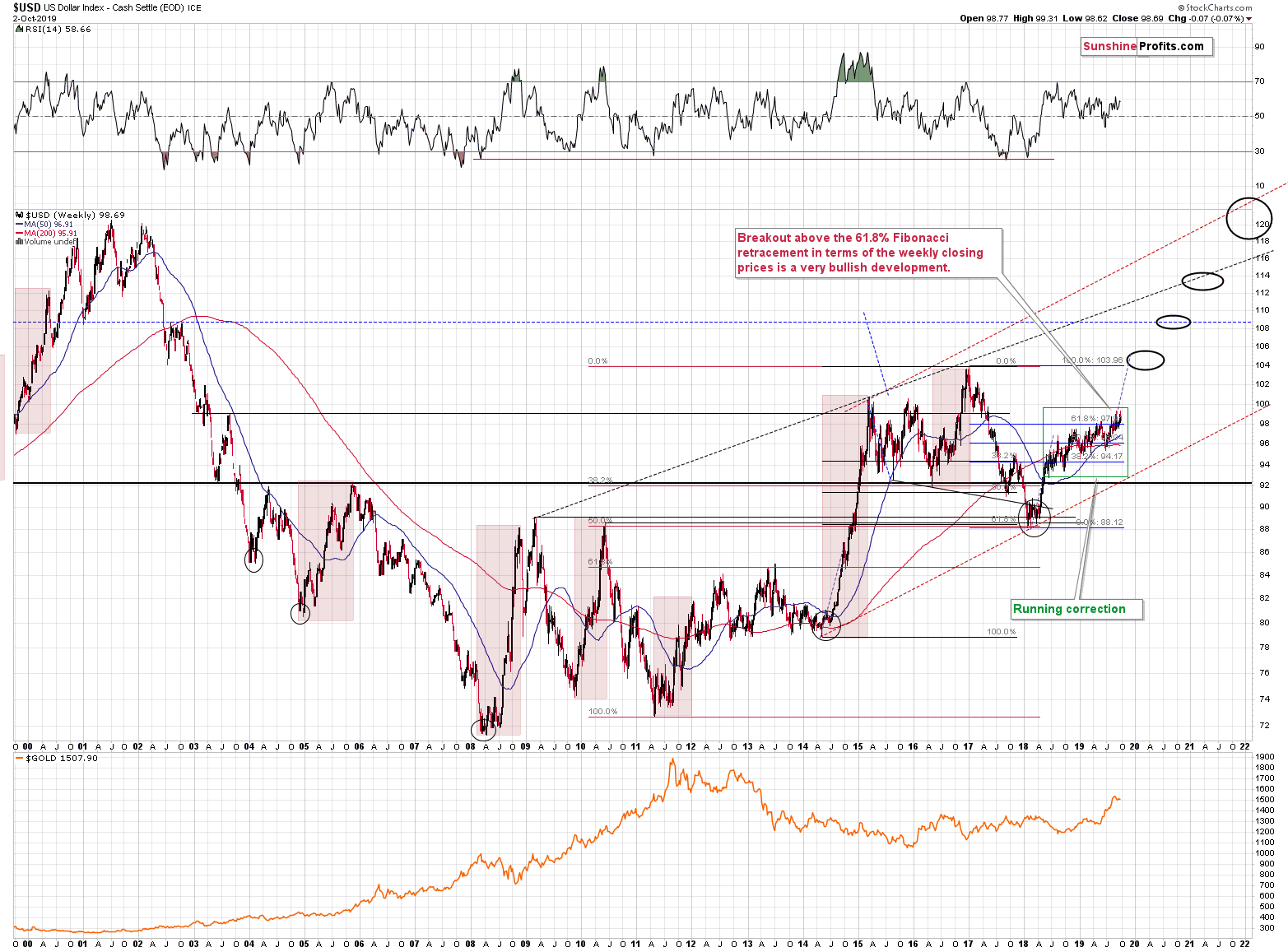

The USD Index is after a major long-term breakout and this breakout was already verified a few times. The most recent rally is just the very early part of the post-breakout rally. Much higher USD Index values are likely to follow in the upcoming months.

The long-term trend is up as even the dovish U-turn by the Fed, rate cuts, and myriads of calls from President Trump for lower U.S. dollar and much lower (even negative) interest rates, were not able to trigger any serious decline.

What we saw instead was a running correction that's the most bullish kind of corrections. It's the one in which the price continues to rally, only at significantly smaller pace.

Trading position (short-term; our opinion): No positions.

Crude Oil Analysis

We previously emphasized the link between the USD Index and the price of crude oil and it was one of the reasons due to which we stopped viewing long positions in oil as attractive. There were two reasons for it. First, in the previous days crude oil and the USDX moved in the opposite directions in a quite precise manner. Second, with each passing day, crude oil's strength of reaction to USD's weakness was lower. This reached an extreme on Friday and today as crude oil is moving slightly lower despite USD's decline.

This might be a very bearish sign for the crude oil and an indication that it's the final call to enter short positions. However, it may also be an indication that crude oil's and USD's link is waning away. After all, just because this link remained in place in the previous several days, it doesn't mean that it was the case at all times and that it will be the case for many days going forward.

Consequently, instead of acting immediately based on crude oil's weak performance compared to what the USDX is doing, it seems better to wait for crude oil's initial reaction to USD's strength. If the bearish case is really what's going on, crude oil would likely slide in response. If not, it shouldn't react in any specific way, or it might even rally alongside the USDX.

Of course, after the decline, the profit potential for the short position in crude oil would not be as big, but the risk associated with the position would be significantly lower. Overall the risk to reward ratio would be better - that's why we think it's now better to wait on the sidelines for the situation to clarify, before taking action.

Meanwhile, our comments on crude oil's medium-term outlook remain intact:

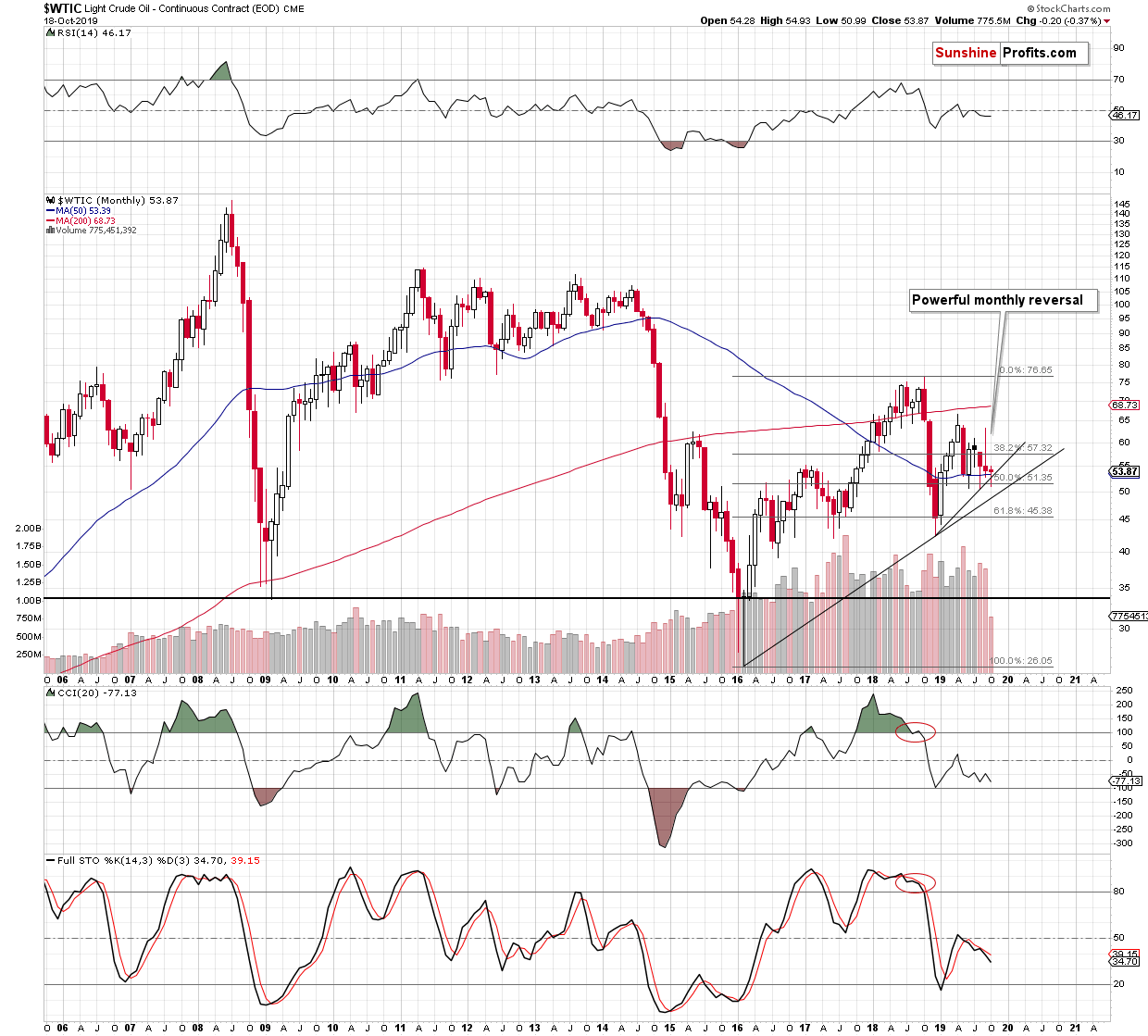

Crude oil reversed in a profound way in September, which suggests that lower prices are likely in the following months. The sell signal from the monthly Stochastic indicator also remains intact. That's in tune with the same indicator on the daily timeframe. The outlook is simply not as bullish as it used to be in the previous days.

Trading position: No positions.

As always, we will keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager