In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1057; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

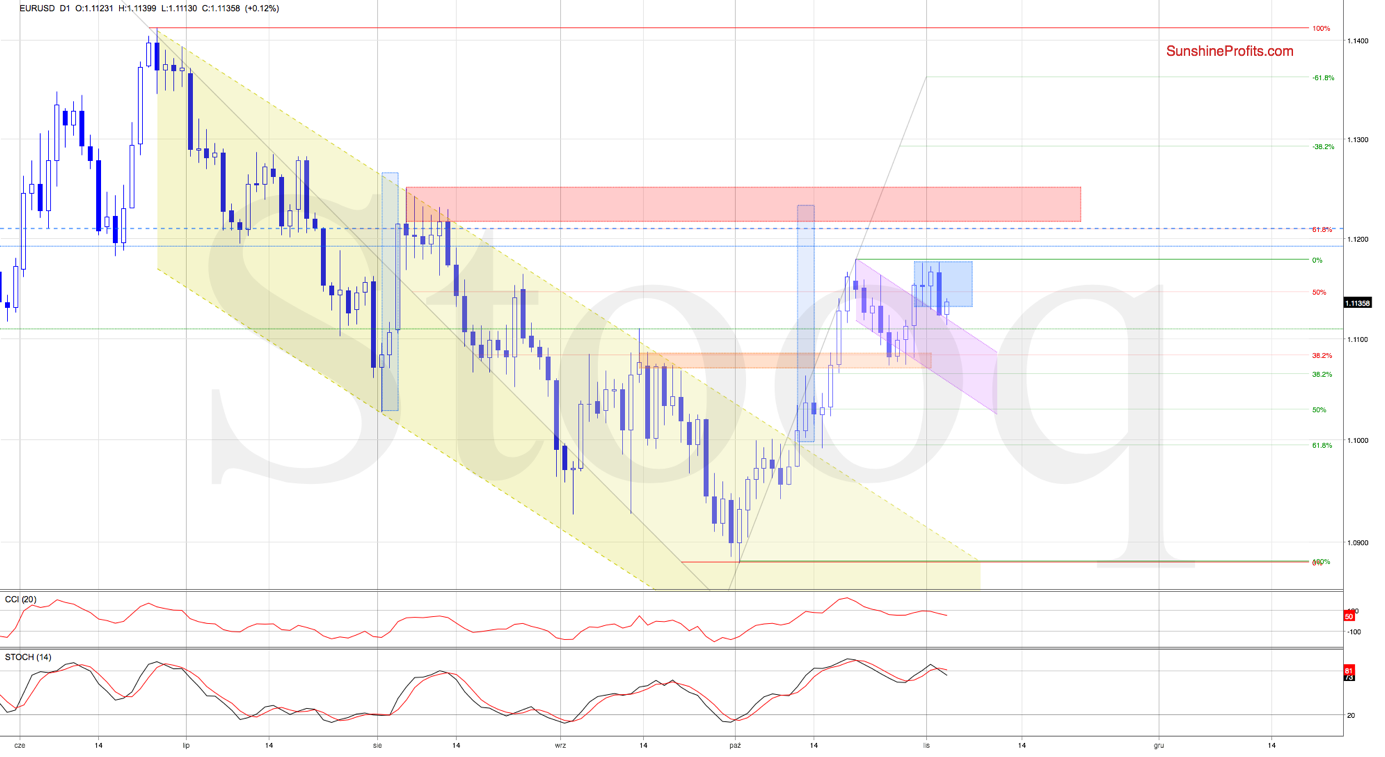

EUR/USD

Yesterday, EUR/USD broke below the lower border of the blue consolidation, testing the upper border of the declining purple trend channel it had earlier broken above. Today's session brought us a rebound higher, suggesting high likelihood of an upcoming retest of the recent peaks.

Trading position (short-term; our opinion): Already profitable long positions with a stop-loss order at 1.1057 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

USD/JPY

In our Thursday's analysis, we noted the reversal at the upper border of the green rising wedge. The pair ended sharply lower that day but has been rising since. What is going on?

Thursday's decline reached the lower border of the green rising wedge. This has stopped the sellers, and a rebound followed. At the moment of writing these words, the exchange rate is back at the orange resistance zone, which has been strong enough to stop the buyers a few times in the recent past.

Additionally, the pair remains below the upper border of the green wedge that serves as an additional resistance. All in all, it means that as long as there is no breakout above these resistances, another reversal may be just around the corner.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 109.66 and the initial downside target at 107.14 are justified from the risk/reward perspective.

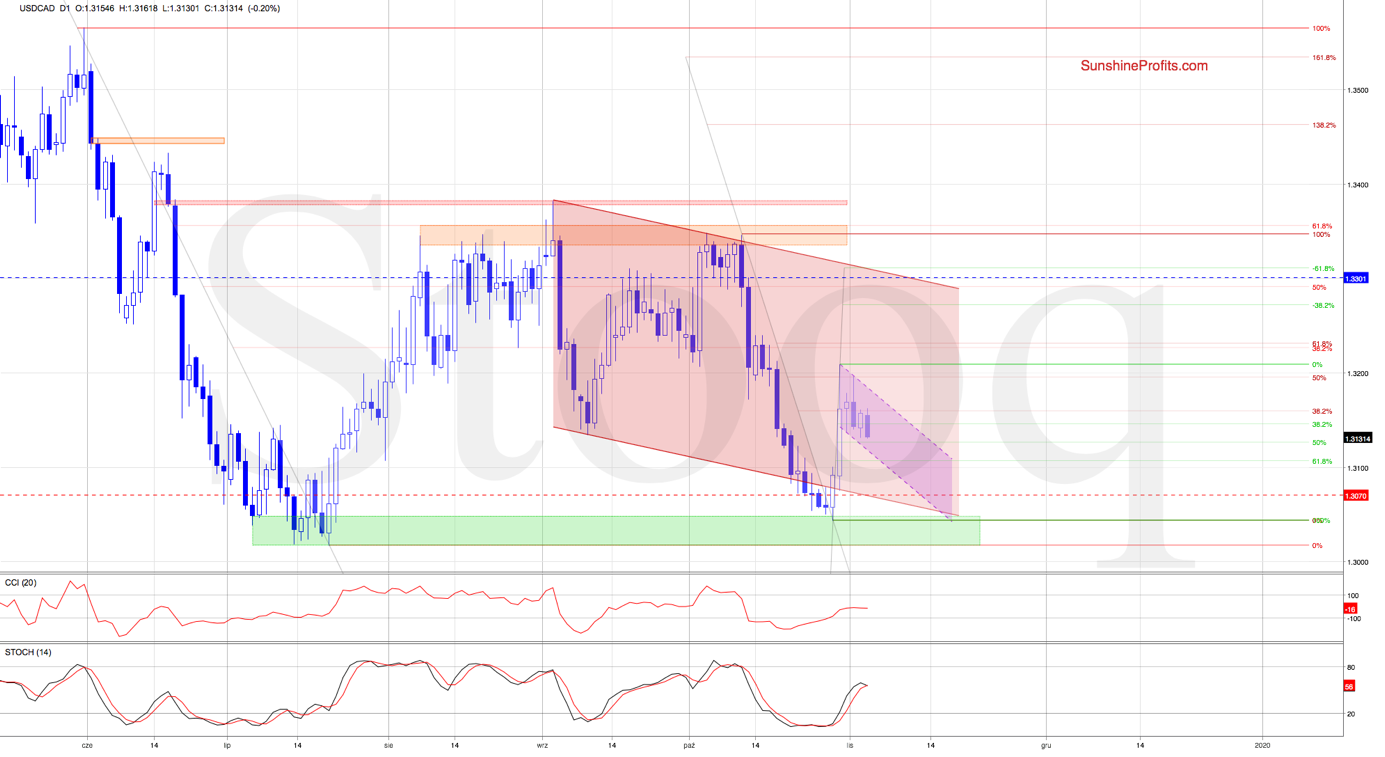

USD/CAD

After the earlier spike to the upside, USD/CAD has moved lower recently. The pair however still remains trading inside the very short-term declining purple trend channel. It suggests that the next target for the sellers may be the lower border of the formation and the 50% Fibonacci retracement slightly below.

As long as there is no daily close below these supports, a reversal and another attempt to move higher should not surprise us.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3070 and the initial upside target at 1.3300are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist