In the wake of strong U.S. jobs gains, the USD is selling off. Quite a few currency moves have been reversed earlier today. Let's take an unbiased look at what has changed and what has not. Does it have any implications for our open positions? What about those opportunities in the making? These are the right questions to ask.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7074; the next downside target at 0.6960)

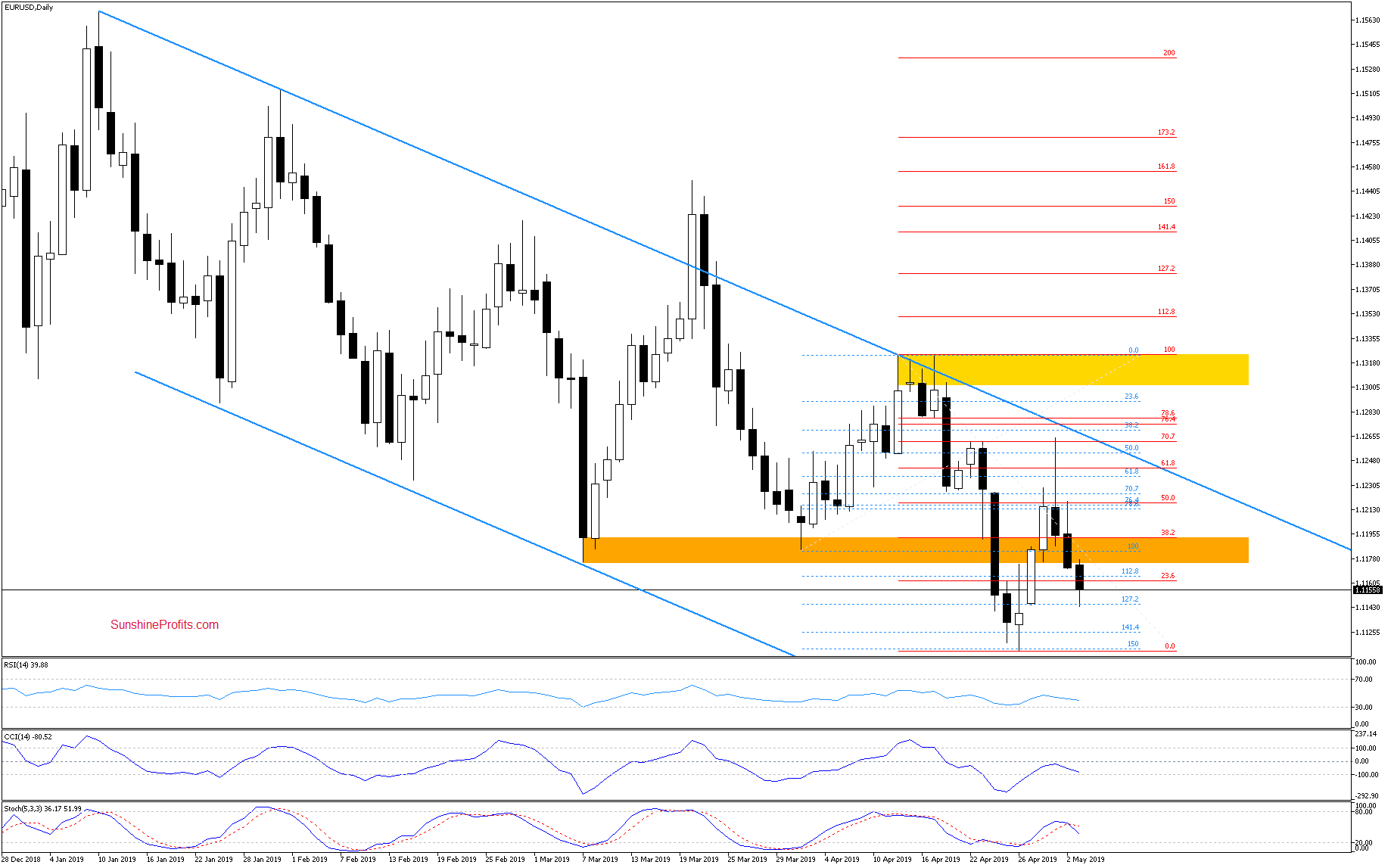

EUR/USD

Yesterday, EUR/USD has extended losses and closed the session below the previously-broken orange zone. The Stochastic Oscillator has issued its sell signal and that suggests we could see a test of the recent lows in the coming days.

Today's session looks to be a daily price reversal, however. We'll wait for the closing price and its reflection on the Stochastic Oscillator's sell signal. Nevertheless, if the pair closes the week below the very long-term green support line as marked on the weekly chart below, the probability of further deterioration will increase significantly. Current price of around 1.1190 is close to the upper border of the very long-term green support. Should we see the bulls failing in their reversal efforts, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

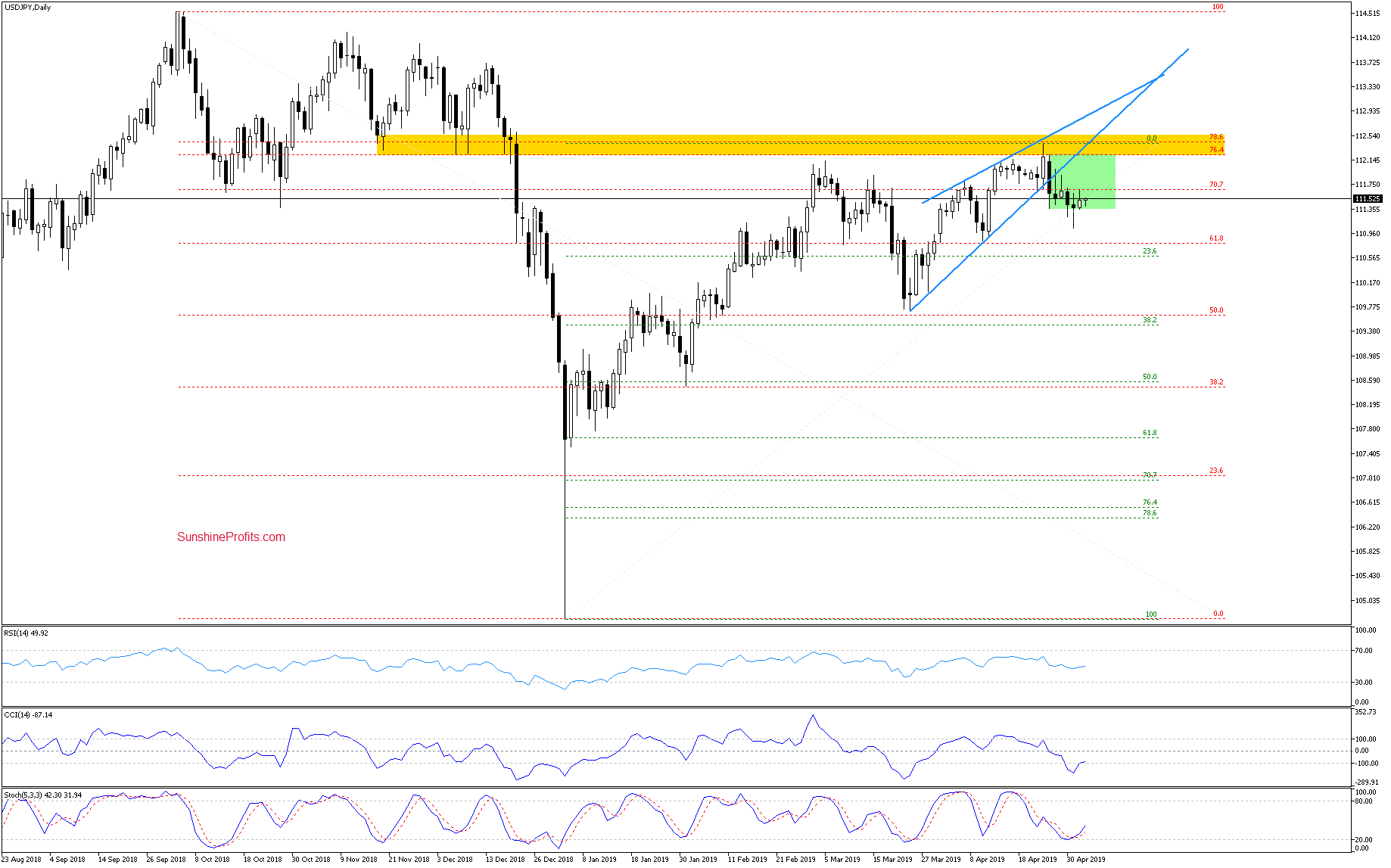

USD/JPY

Wednesday's session has been marked by USD/JPY reversing higher from the attempted breakdown below the green consolidation. Yesterday, the bulls modestly added to their gains. Earlier today, they've attempted to retest yesterday's highs. They've failed and the rate looks set to challenge Wednesday's lows as it trades at around 111.20 currently.

The Japanese Golden Week is still in progress today. The closing prices will reveal whether this breakdown is for real or not. The Stochastic Oscillator remains on a buy signal, supporting the bulls. Just like with EUR/USD, today's closing price will provide the clue as to whether the Stochastics' buy signal still remains on and what to do about the prospects of going long.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

The monthly chart still shows that the bulls haven't overcome the orange resistance zone. It continues to keep further gains in check.

The daily chart shows the pair still trading inside the blue consolidation. The orange resistance zone keep further gains in check and the pair currently trades at around 1.0180.

Quoting our Wednesday's observation:

(...) Combined with the orange resistance zone, the proximity to the 127.2% Fibonacci retracement and the sell signals generated by the daily indicators, it increases the probability of further deterioration. Should we see a breakdown below the blue consolidation, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the remainder of our profitable short position in AUD/USD continues to be justified, today's upswing notwithstanding. We'll have to wait for the dust in USD/JPY to settle: a long position is not justified now. We would also like to see further weakness in USD/CAD prior to considering a short position. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist