Yesterday, USD/CHF broke above December high, but is it enough to go higher? Where are currency bears and what can we expect in the coming days?

In our opinion the following forex trading positions are justified - summary:

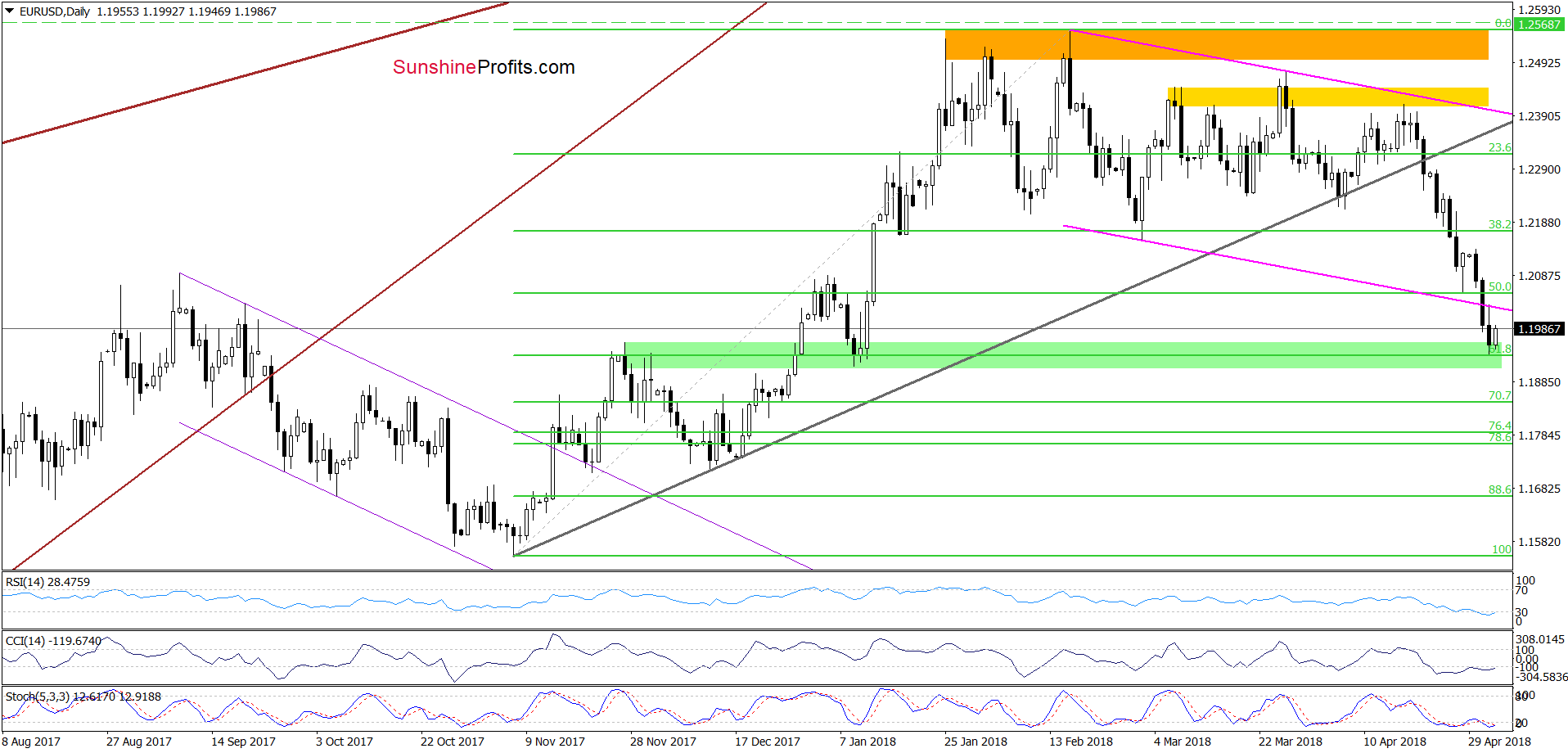

EUR/USD

Yesterday, we wrote the following:

Although the pair rebounded slightly earlier today, the lower line of the (…) trend channel stopped currency bulls, triggering a pullback. Additionally, the Stochastic Oscillator re-generated the sell signal, suggesting that we could see a test of the green support zone (created by the November and December 2017 highs, the January 2018 lows and the 61.8% Fibonacci retracement) in the very near future.

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD slipped to our downside target. Taking into account the importance of this support area and the current position of the daily indicators, we think that rebound is just around the corner.

When can we expect a comeback to the north? In our opinion, if the exchange rate invalidates successfully the breakdown under the lower border of the pink declining trend channel. In this case, we’ll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

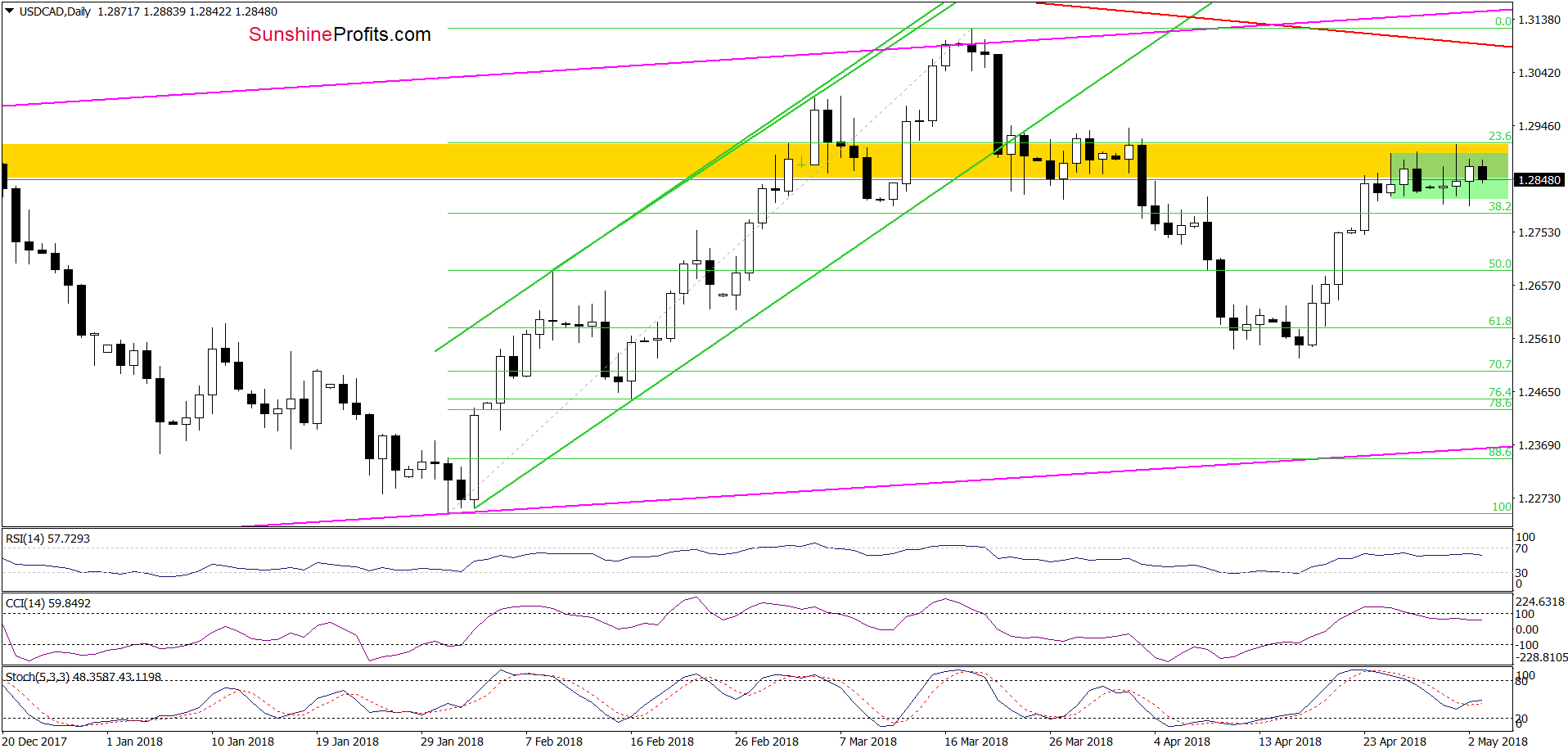

USD/CAD

Looking at the daily chart, we see that the overall situation remains almost unchanged since several days as USD/CAD is still trading in the green consolidation slightly below the yellow resistance zone (which is currently reinforced by the 61.8% Fibonacci retracement based on the recent March-April decline). This means that as long as there is no breakout above this area, higher values of USD/AD are not likely to be seen.

When can we expect a breakthrough? In our opinion, if currency bears successfully break under the lower border of the above-mentioned formation. In this case, we’ll consider re-opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

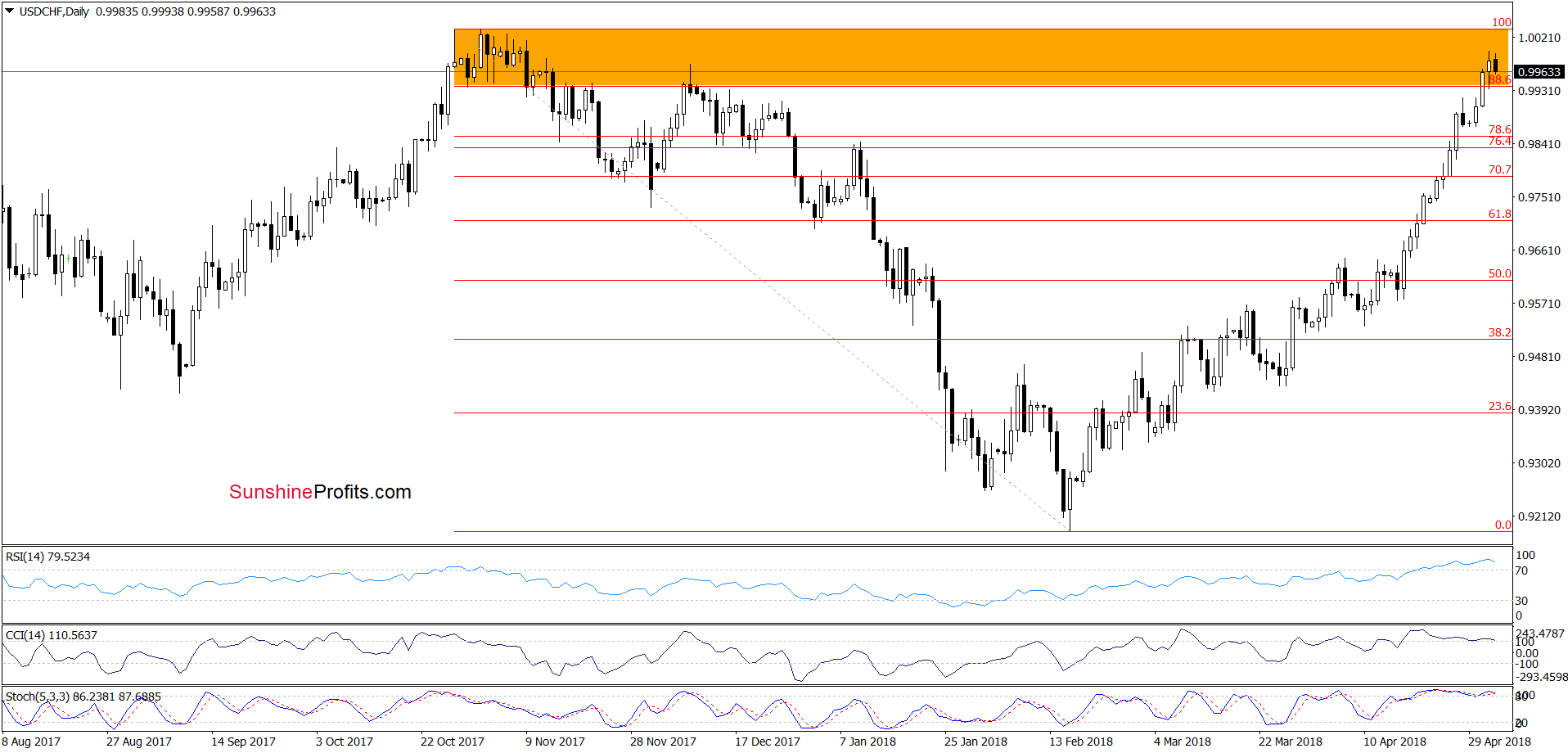

USD/CHF

On the daily chart, we see that USD/CHF increased to the short-term major resistance zone (marked with orange) created by the previous highs, which in combination with the current position of the daily indicators and the situation in other currency pairs (especially EUR/USD) increase the probability of reversal in the very near future.

If this is the case and we see reliable signs of the bulls’ weakness, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts