Although currency bears managed to push GBP/USD to the levels that we haven’t seen since mid-April 2017 at the beginning of the week, their opponents stopped them, triggering a rebound, which erased over 70% of the recent decline. Is it enough to invalidate earlier important breakdowns?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.68; the exit target at 112.34)

- USD/CAD:none

- USD/CHF: short (a stop loss order at 1.0192; the exit target at 0.9850)

- AUD/USD:none

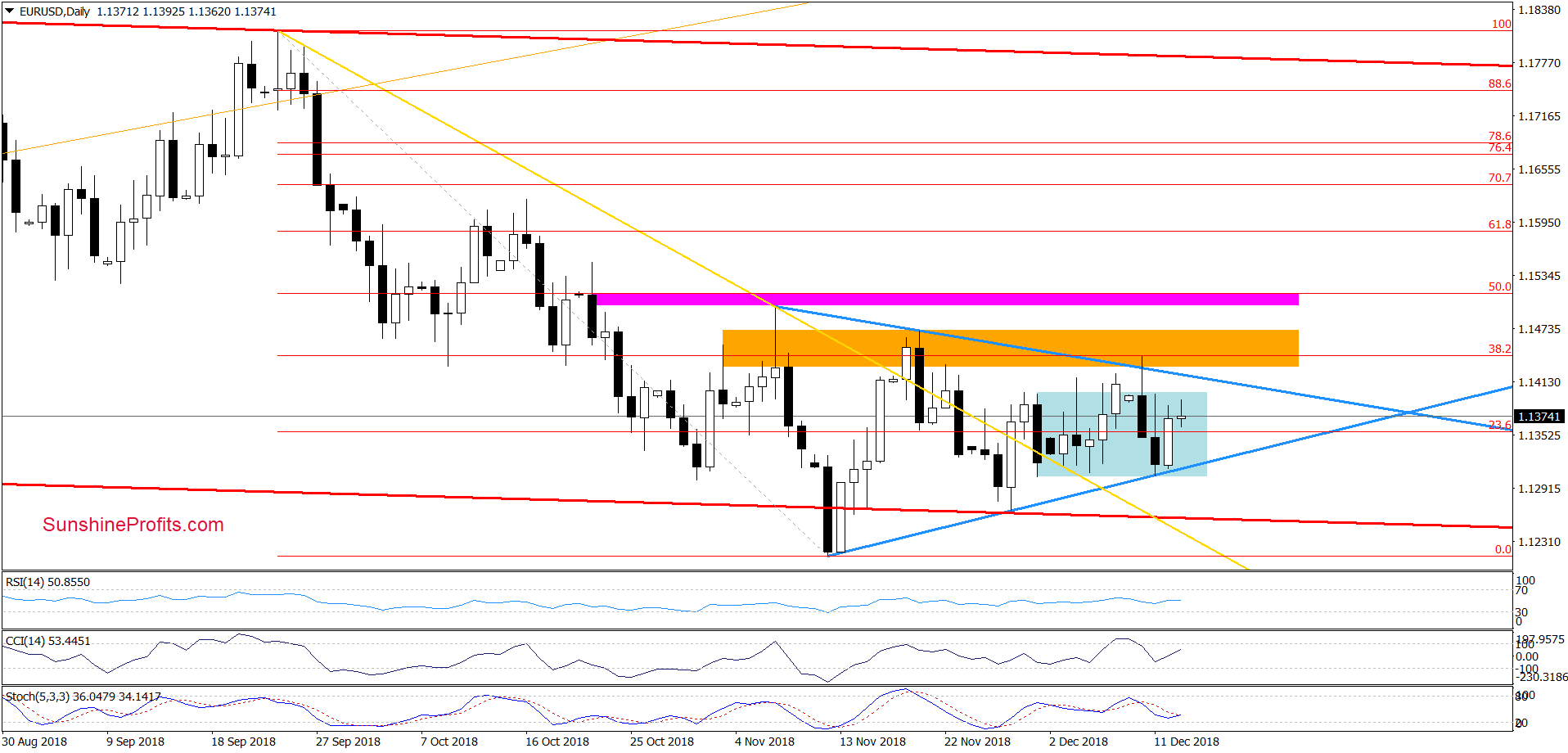

EUR/USD

From today’s point of view, we see that the overall situation in the very short term hasn’t changed much since we commented on it yesterday because EUR/USD is still trading inside the blue consolidation and the blue triangle. Therefore, we believe that what we wrote on Wednesday remains up-to-date also today:

(…) the proximity to the lower line of the consolidation and the lower border of the blue triangle encouraged currency bulls to act, which resulted in a rebound, which erased over half of yesterdays decline.

Although this is a positive very short-term sign (which can translate into further improvement and a test of yesterday’s high and the upper border of the consolidation), we should keep in mind that the overall situation in a broader perspective remains almost unchanged as EUR/USD is still trading inside the blue triangle.

Therefore, (…) we continue to believe that as long as there is no breakout above the upper border of the triangle (or a breakdown under the lower line) another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us in the coming days.

Finishing today’s commentary on this currency pair please keep in mind that we can observe high volatility today as the European Central Bank is set to formally announce the end of its four-year long easing program.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

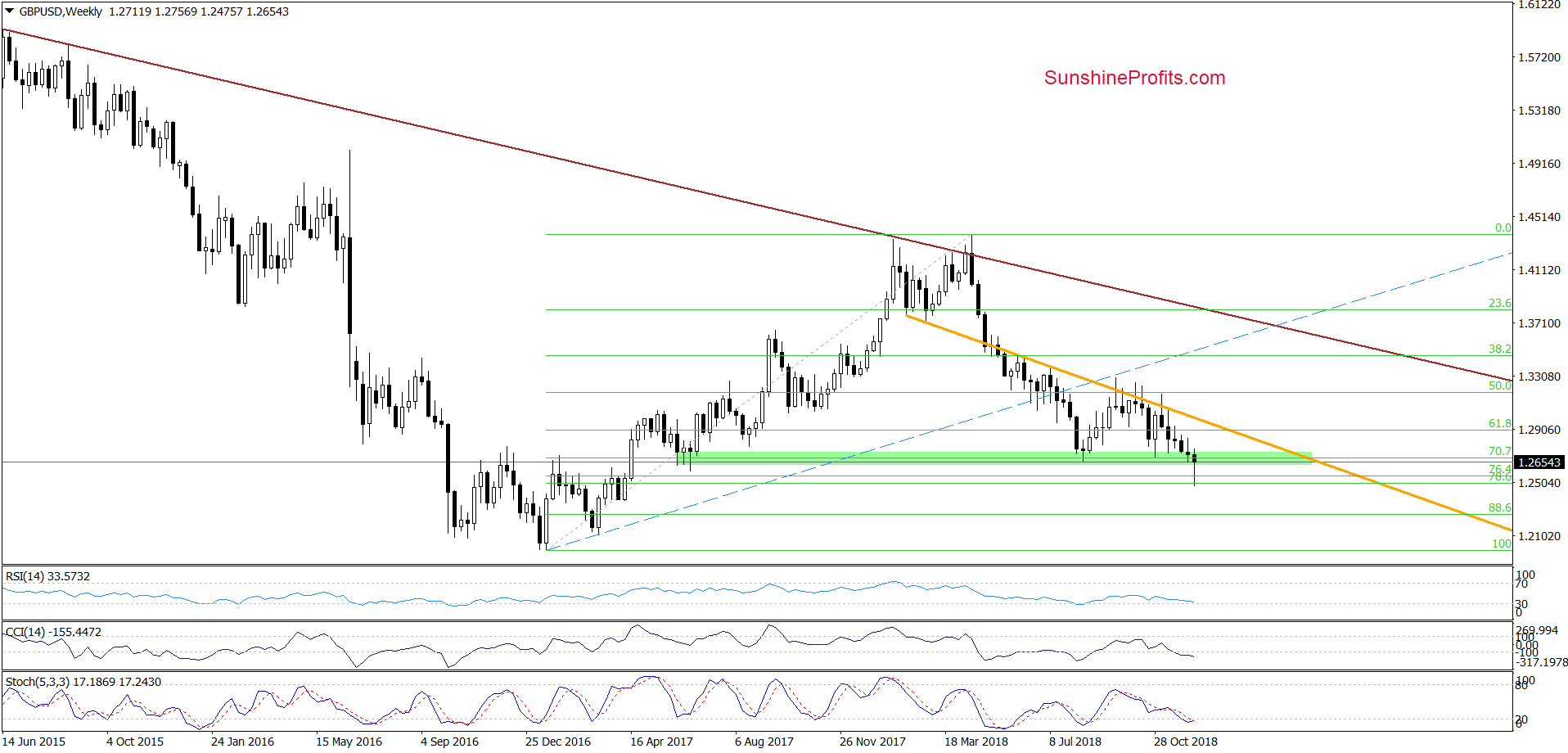

GBP/USD

Looking at the medium-term chart, we see that currency bears showed their claws earlier this week, which resulted in a sharp decline below the green support zone. Despite this deterioration, the combination of the 76.4% and 78.6% Fibonacci retracements encouraged the buyers to fight for higher values of the exchange rate.

As a result, the pair rebounded and climbed to the previously-broken mid-August low. On one hand, such price actin could be nothing more than a verification of the earlier breakdown (especially if the buyers do not manage to close this week above this resistance level).

However, taking into account the current position of the weekly indicators and bullish divergences between them and GBP/USD, it seems that higher values of the exchange rate might be just around the corner.

Will the daily chart give us more pro-growth factors? Let’s check.

From this perspective, we see that although the sellers took GBP/USD under the lower border of the brown declining trend channel at the beginning of the week, currency bulls triggered a rebound, which invalidated this breakdown on the following day.

This positive development in combination with the buy signals generated by the daily indicators pushed the pair higher and approached it to the red declining resistance line based on the previous peaks earlier today.

What’s next for the exchange rate?

In our opinion, if the buyers manage to break above the green horizontal line (based on the above-mentioned mid-August low) and close the day above it and the red resistance line, we’ll likely see a test of the early-December highs.

Nevertheless, if currency bulls fail and show weakness in this area, the way to the lower border of the brown declining trend channel (or even this week’s lows) will be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

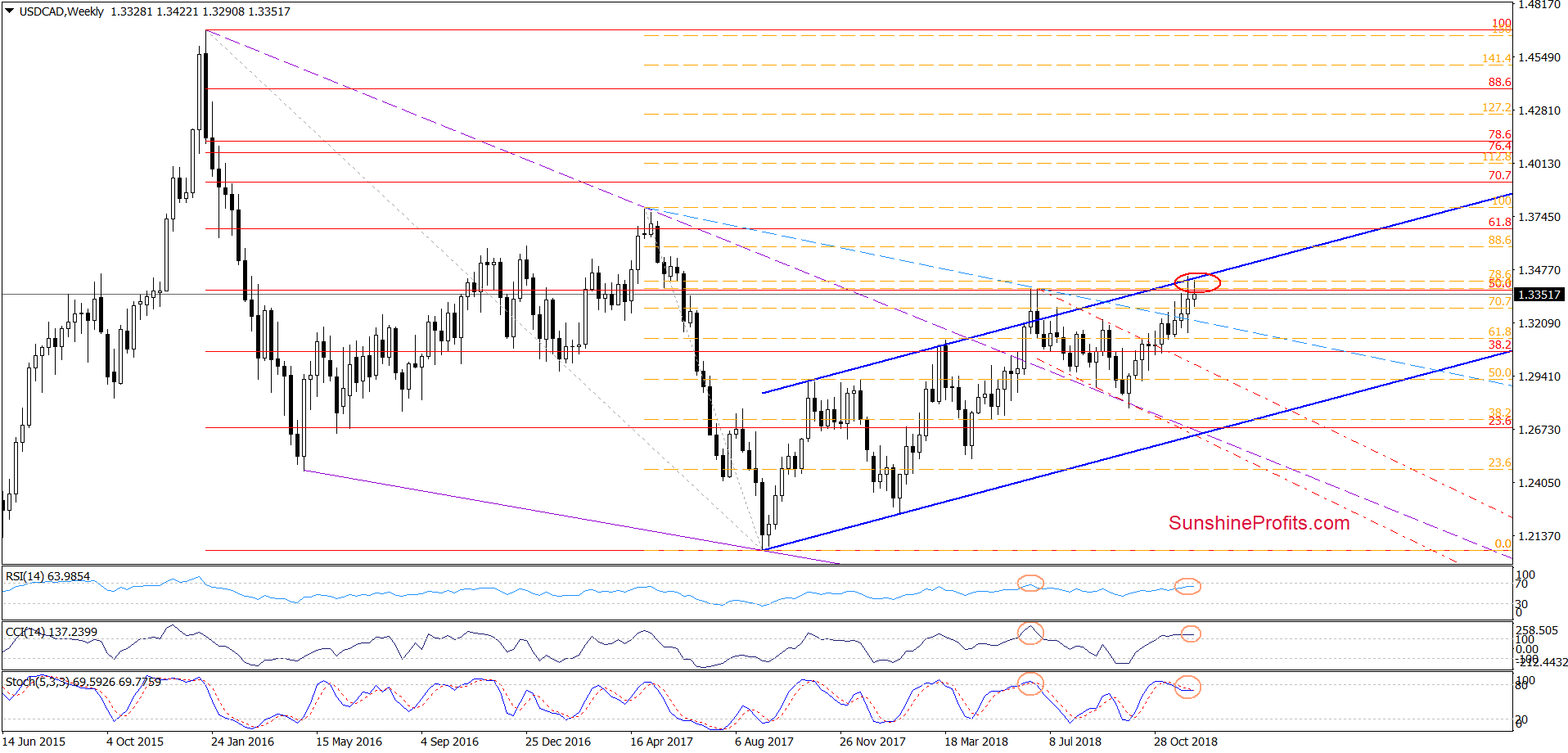

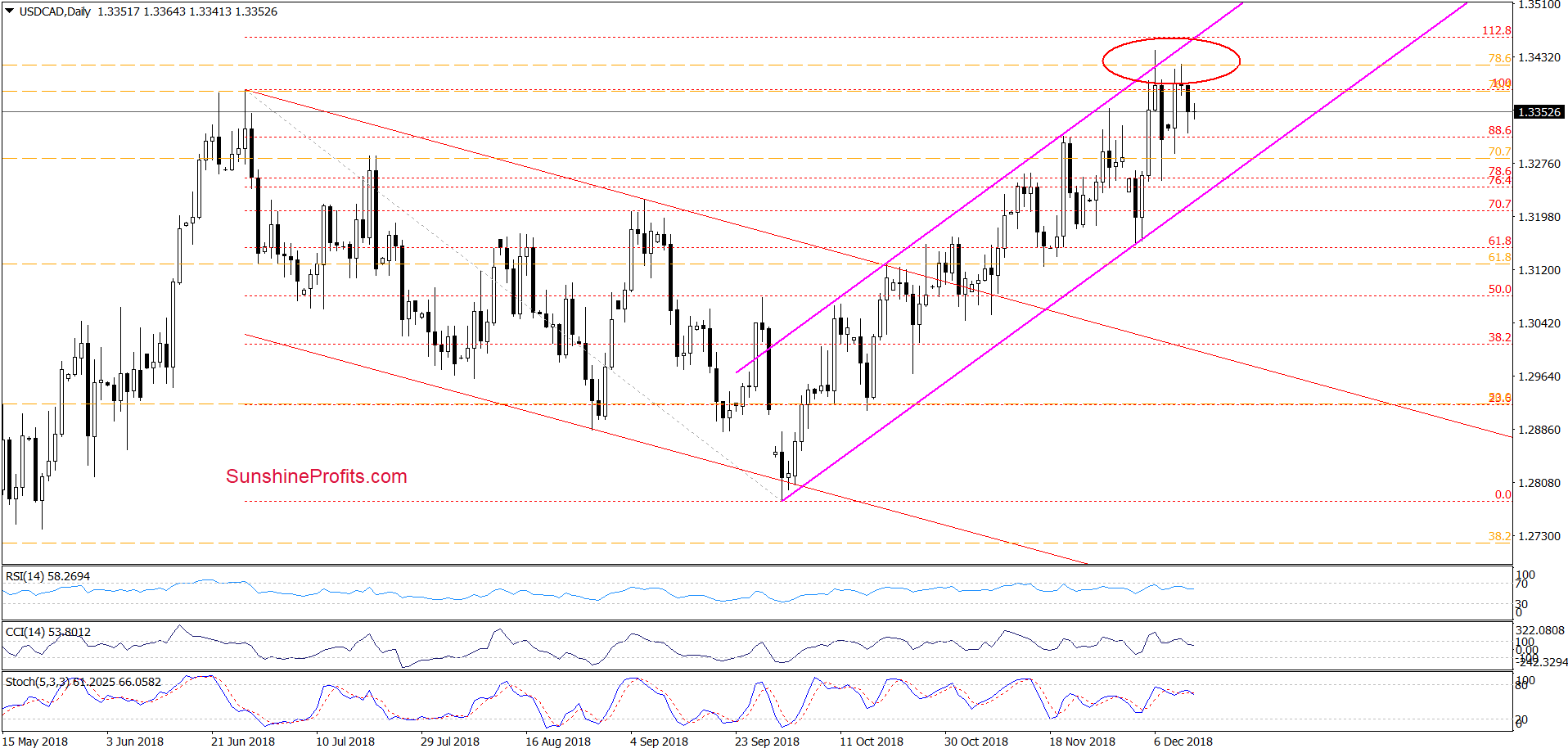

USD/CAD

The overall situation in the medium and short term hasn’t changed much as USD/CAD is still trading in a narrow range slightly below the major resistance zone. Therefore, we believe that our comments on this currency pair posted in Tuesday’s Forex Trading Alert remain up-to-date also today:

(…) USD/CAD climbed to a very important resistance area created by the 50% Fibonacci retracement based on the entire 2016-2017 downward move, the 76.4% and 78.6% Fibonacci retracements based on the late-April 2017- early-September 2017 declines and the upper border of the long-term blue rising trend channel (marked with the red ellipse).

Additionally, this area is reinforced by the short-term resistances marked on the daily charts below.

(…) the exchange rate increased to a red ellipse created by the upper border of the short-term pink rising trend channel, the above-mentioned medium-term resistances and the 112.8% Fibonacci extension, which together block the way to the north.

At this point it is worth noting that the combination of the Fibonacci retracements was enough to stop currency bulls two times in June and trigger a pullback, which invalidated the earlier small breakout above the upper line of the long-term blue rising trend channel seen on the weekly charts.

Taking all the above into account and combining it with the current position of the weekly and daily indicators (there are clearly visible bearish divergences) it seems to us that the history will repeat itself once again and we’ll see reversal in the very near future.

If the situation develops in tune with the above assumption and USD/CAD declines from current levels, currency bears will likely try to push the pair to the lower border of the pink rising trend channel in the following days. Nevertheless, as long as here is no successful breakdown under this support line a sizable move to the downside is not likely to be seen.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts