The beginning of the week turned out to be very bad for the British pound, which extended its losses against the greenback as worries over Brexit encouraged the sellers to act. As a result, GBP/USD slumped to the levels that we saw almost a year ago. Are there any technical factors that can stop currency bears in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

In other words, we decided to close our short positions in EUR/USD and GBP/USD and take profits off the table.

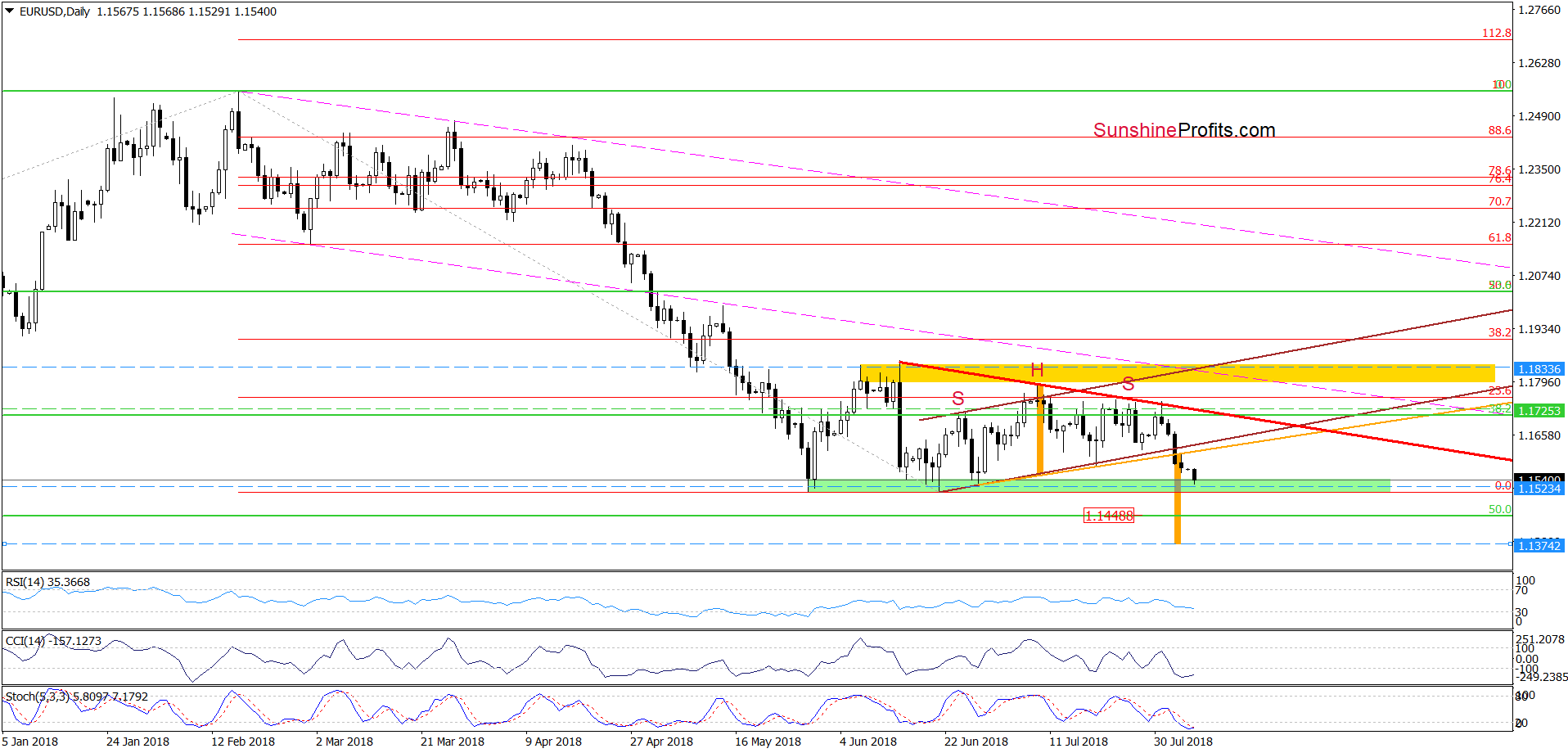

EUR/USD

In our last commentary on this currency pair, we wrote the following:

(…) What’s next? Taking into account the sell signal generated by the Stochastic Oscillator, we think that the pair will move even lower. If we see a drop below the orange support line (the neck line of the potential head and shoulders formation), EUR/USD will (at least) decline to the May and June lows in the following days.

Looking at the daily chart, we see that the situation developed in line with the above scenario and EUR/USD extended losses, almost touching our downside target earlier today.

Thanks to the recent decline, the exchange rate slipped to the green support zone, which was strong enough to stop the sellers in the previous months. As you see, they have fallen in this area so many times that there is a reasonable risk that history will repeat itself once again and we will see another rebound from here in the coming days.

Therefore, we think that closing our short positions and taking profits off the table (as a reminder, we opened them when EUR/USD was trading at around 1.1725 – we marked this level with a green dashed horizontal line) is justified from the risk/reward perspective.

Nevertheless, if we see reliable signs of currency bears’ strength (a breakdown under the green zone), we’ll consider re-opening short positions. So, stay tuned.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

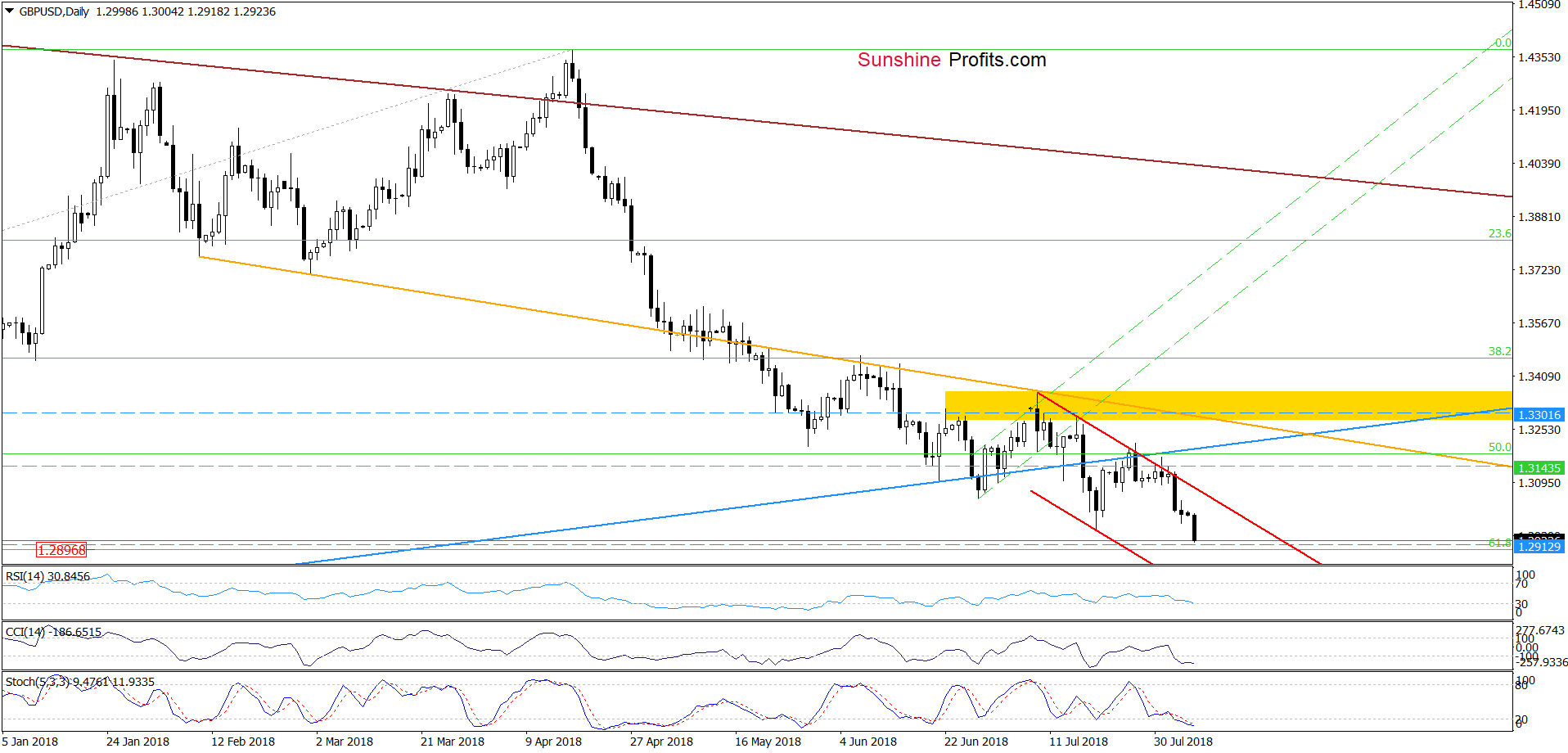

GBP/USD

Quoting our Forex Trading Alert posted a week ago:

(…) If (…) the pair extends losses from here, we’ll likely see not only a test of the recent lows, but also a drop to around 1.2896, where the 61.8% Fibonacci retracement (based on the entire January 2017 – March 2018 upward move) is.

From today’s point of view, we see that the situation developed in tune with our assumptions and GBP/USD almost reached the above-mentioned downside target during today’s session.

Considering the importance of this support level (the 61.8% Fibonacci retracement) and the current situation in EUR/USD (the pair reached to solid support zone, which will likely trigger a move to the upside), it seems to us that currency bulls could trigger a rebound from this area in the very near future.

Therefore, in our opinion closing short positions and taking profits off the table (as a reminder, we opened them when GBP/USD was trading at around 1.3143 – the green dashed horizontal line) is justified from the risk/reward perspective.

However, similarly to what we wrote in the case of EUR/USD, if currency bears break under this support, we’ll consider re-opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

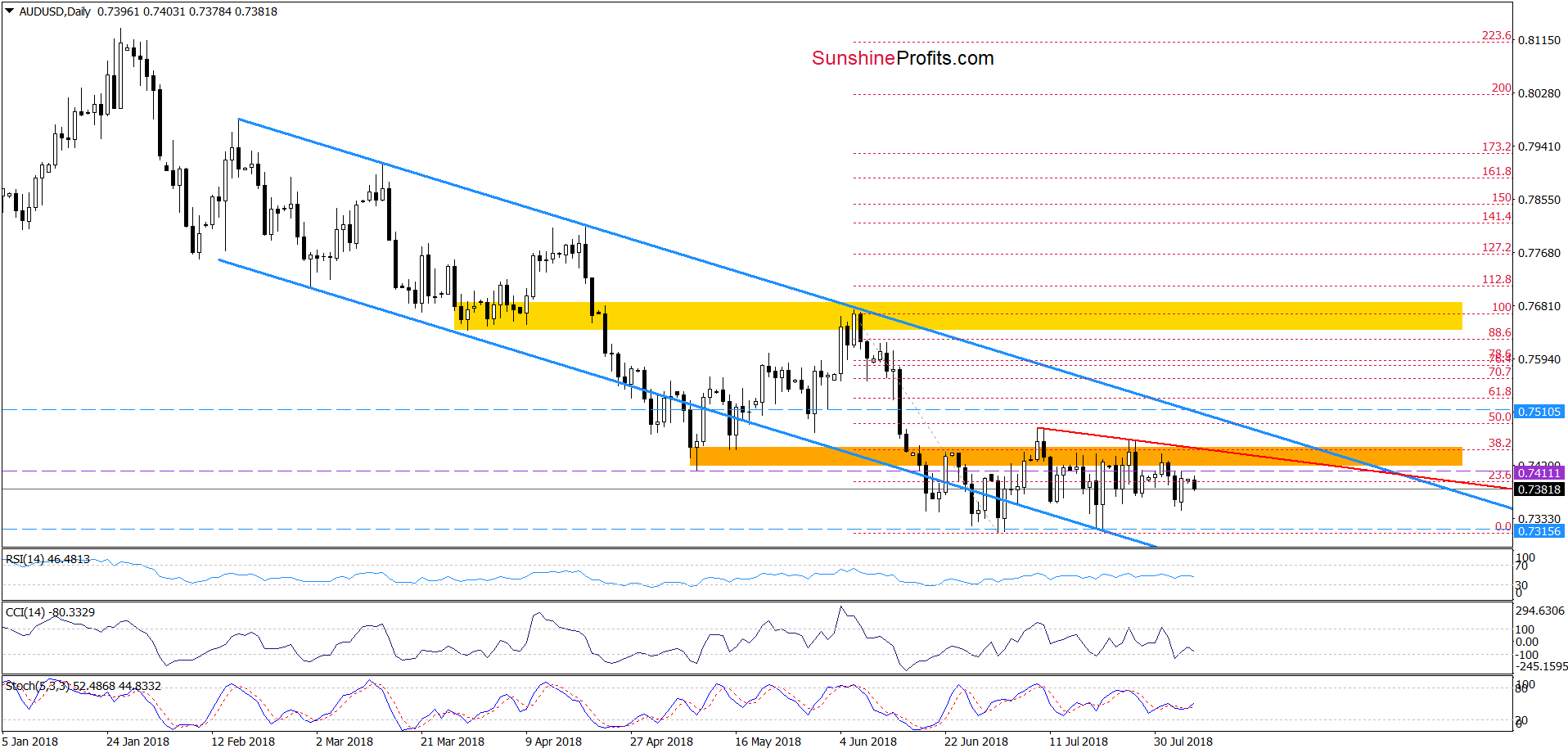

AUD/USD

From the daily perspective, we see that the overall situation in the short term hasn’t changed much as AUD/USD is consolidating under the orange resistance zone and slightly below the purple dashed horizontal line (AUD/USD was trading at around this level when we decided to open short positions).

However, in case of this currency pair, the space for declines is still quite big and the above-mentioned strong resistance zone continues to keep gains in check for almost a month, which means that maintaining these short positions is still justified from the risk/reward perspective.

How low could the pair go if currency bears extend losses in the coming week?

In our opinion, if AUD/USD moves lower once again, the exchange rate will (at least) decline to our downside target, which is currently slightly above July lows.

Trading position (short-term; our opinion): short positions with a stop-loss order at 0.7510 and the initial downside target at 0.7315 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts