During the recent week, currency bulls tested the strength of the previously-broken lower border of a very short-term rising trend channel almost every day. Despite all these attempts and a breakout above the late-August highs they didn’t manage to invalidate the earlier breakdown. Will they try once again? Where can it lead them?

- EUR/USD: short (a stop-loss order at 1.1746; the initial downside target at 1.1343)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none (in other words, we closed long positions to protect our capital)

- USD/CHF: none

- AUD/USD: none

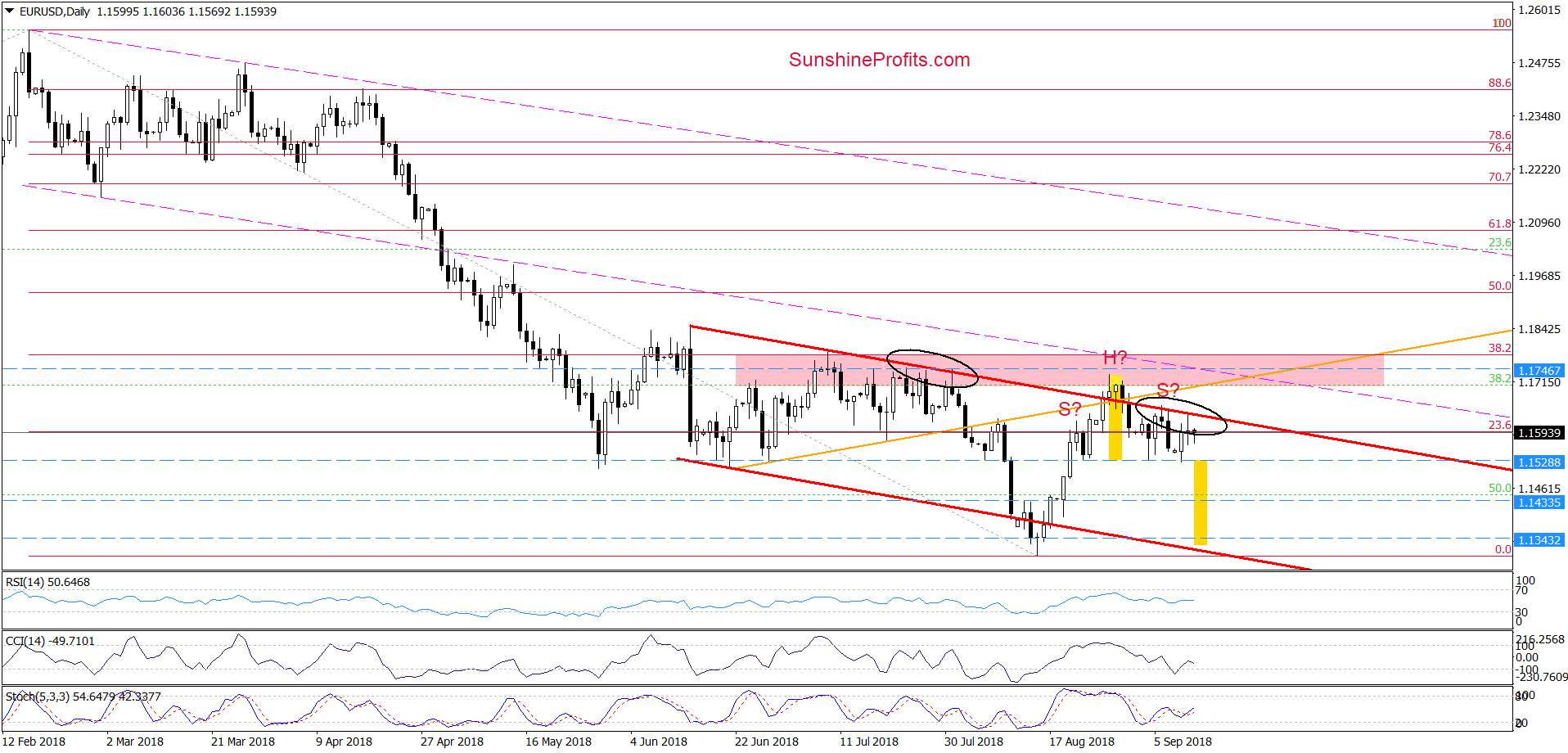

EUR/USD

From today’s point of view, we see that EUR/USD is still trading under the upper border of the red declining trend channel, which means that what we wrote yesterday remains up-to-date also today:

(…) When we take a closer look at the daily chart, we clearly see that similar situation we observed at the end of July, which increases the probability that the next bigger move will be to the downside and lower values of the exchange rate are just around the corner.

Taking all the above into account (…) we believe that as long as the exchange rate is trading under the upper border of the red declining trend channel, lower values of EUR/USD are ahead of us and one more test of the blue dashed horizontal line is more likely than not.

What could happen if we see a breakdown under this support?

In our opinion, EUR/USD will extend its decline not only to our initial downside target but will also test the recent lows (in terms of daily closures) or even the lower line of the red declining trend channel.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1746 and the initial downside target at 1.1343 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

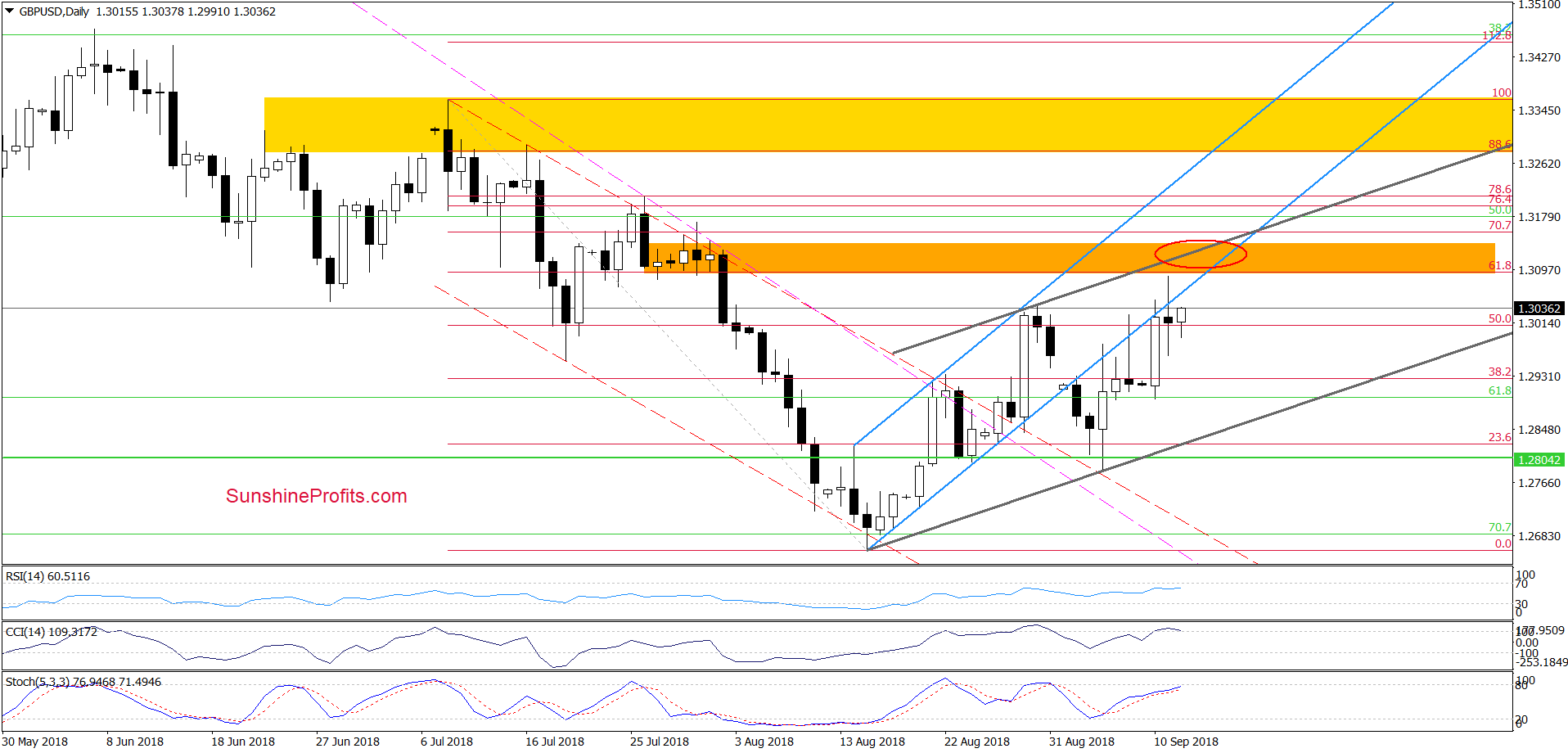

GBP/USD

Yesterday, GBP/USD extended Monday’s gains, which resulted in an increase above the late-August peaks and the lower line of the blue trend channel. Although this was a positive development, currency bulls didn’t manage to hold gained levels and the exchange rate turned south, invalidating the earlier breakouts.

Despite this deterioration, the buyers didn’t give up and pushed the pair higher earlier today, which suggests that GBP/USD will test the orange resistance zone (created by the late July and early highs, the 61.8% Fibonacci retracement, the lower border of the blue rising trend channel and the upper line of the grey rinsing trend channel based on the August-September upward move) in the very near future.

Nevertheless, the current position of the daily indicators shows that the CCI is overbought, while the Stochastic Oscillator approached the barrier of 80, which could translate into sell signals in the coming days.

Therefore, if we see currency bulls’ weakness in the orange resistance area and the above-mentioned indicators generate sell signals, we’ll consider opening short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

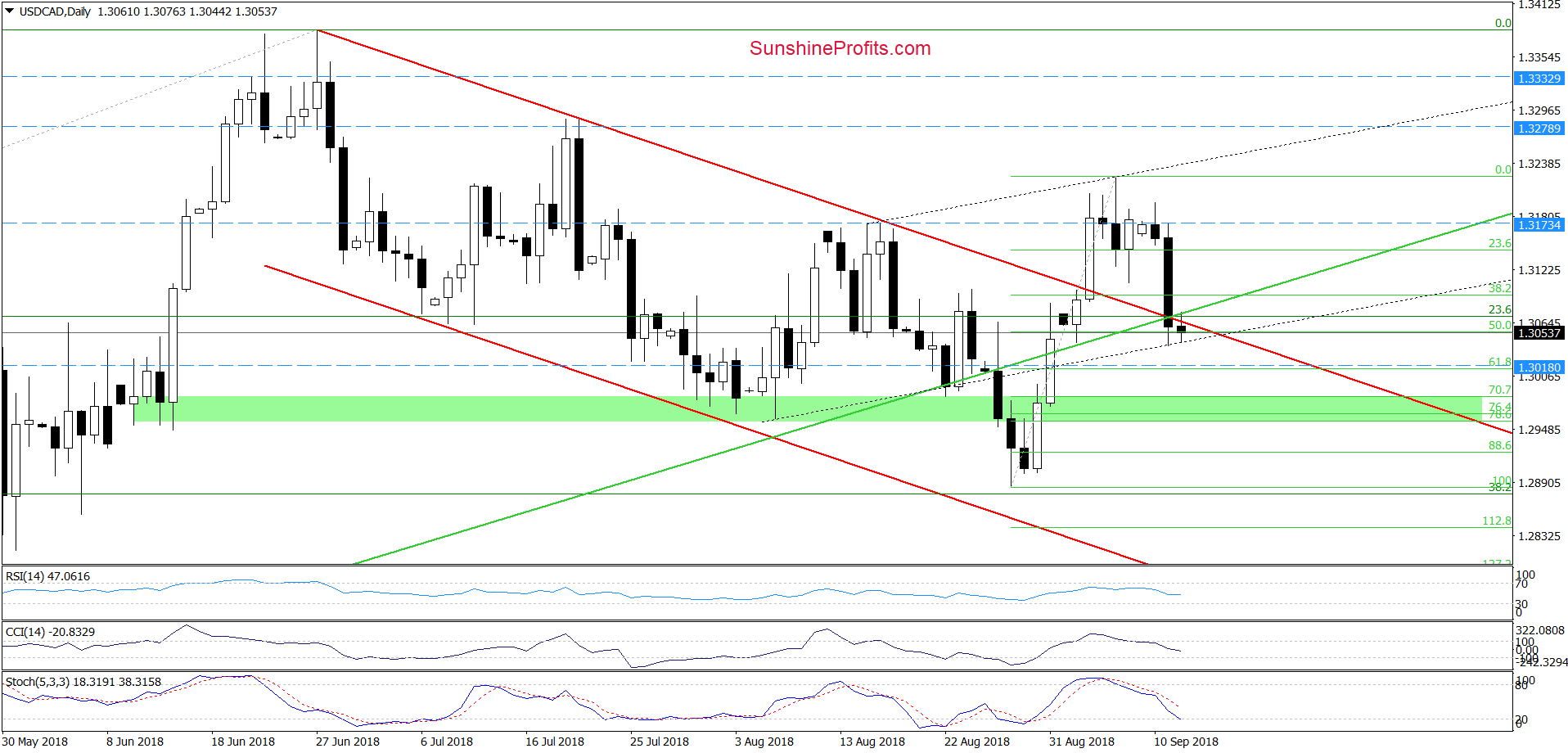

USD/CAD

The first thing that catches the eye on the above charts is yesterday’s sharp drop, which took USD/CAD not only below the previously-broken upper border of the red declining trend channel, but also under the medium-term green support line (seen more clearly on the first chart).

In this way, the exchange rate invalidated the earlier breakouts, which doesn’t bode well for higher values of USD/CAD in the coming day(s) – especially when w factor in the fact that although currency bulls tried to go higher earlier today, they failed, which suggests that today’s price action could be a verification of yesterday’s breakdowns.

Additionally, all daily indicators still have some space to go, which increases the probability that the pair will go even lower.

Taking all the above into account, we believe that closing long positions (to protect our capital and avoid further losses) is justified from the risk/reward perspective as the exchange rate could even test the green support zone in the following days.

Nevertheless, we will continue to monitor the forex market to find for you the best (and as safe as possible) opportunities for subsequent transactions

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts