The start of the week surprised currency bulls as GBP/USD dived below 1.3100 earlier today. Although they managed to erase almost entire decline, there are some bearish factor on the horizon that can stop them in the very near future.

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3377; the initial downside target at 1.2923)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

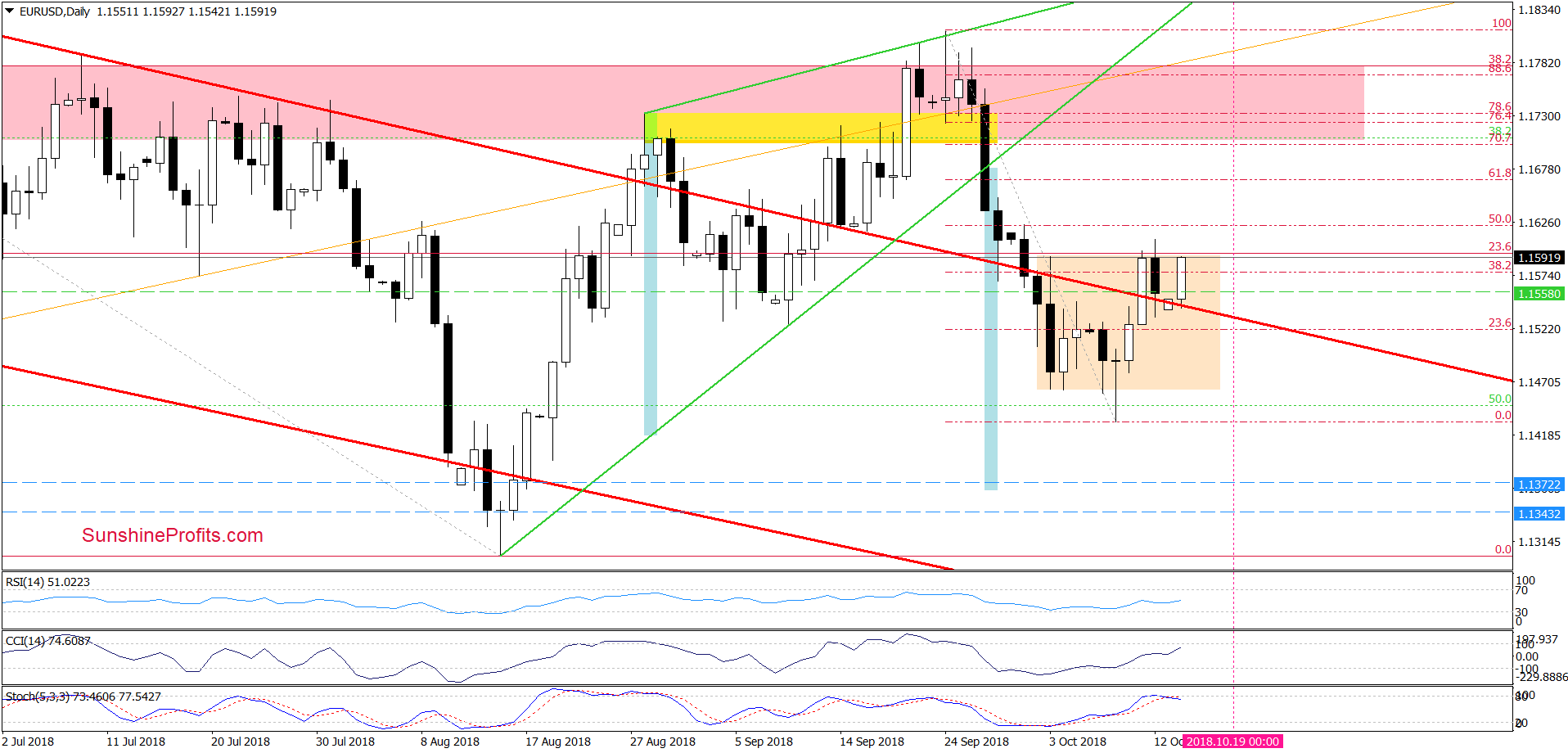

EUR/USD

On Friday, EUR/USD invalidated the earlier tiny breakout above the upper line of the consolidation, which triggered a sharp pullback that took the exchange rate to the previously-broken upper border of the red declining trend channel.

Nevertheless, earlier today, currency bulls regained control and came back to the north border of the consolidation, approaching the 23.6% Fibonacci retracement once again. Although this is a positive event, we should keep in mind that the two previous attempts to go higher failed. Additionally, the Stochastic Oscillator generated a sell signal, suggesting that the space for gains may be limited and another reversal from this area should not surprise us in the very near future.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1878 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

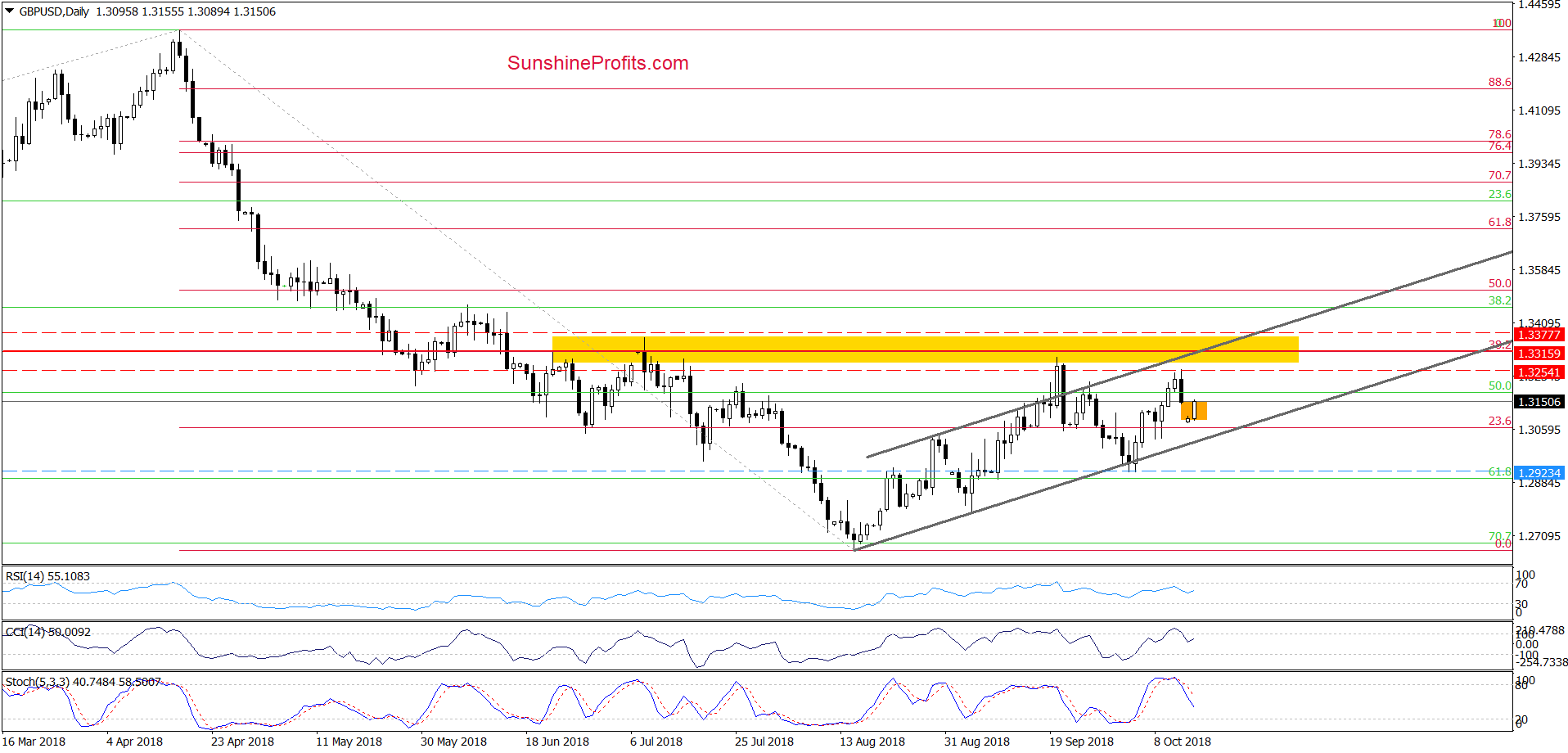

GBP/USD

From today’s point of view, we see that although GBP/USD bounced off today’s low, the orange gap remains open (at least at the moment of writing this alert), which means that as long as currency bulls do not manage to close it, the gap serves as the nearest resistance, blocking the way to the north.

At this point, it is also worth noting that the sell signals generated by the CCI and the Stochastic Oscillator remain in the cards, supporting the sellers and lower values of GBP/USD in the coming week.

How low can the pair go? We think that the best answer to this question will be the quote from our last commentary on this currency pair:

(…) If (…) GBP/USD moves lower from current levels, we’ll see (at least) a test of the lower border of the grey rising trend channel in the following days.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3377 and the initial downside target at 1.2923 are justified from the risk/reward perspective.

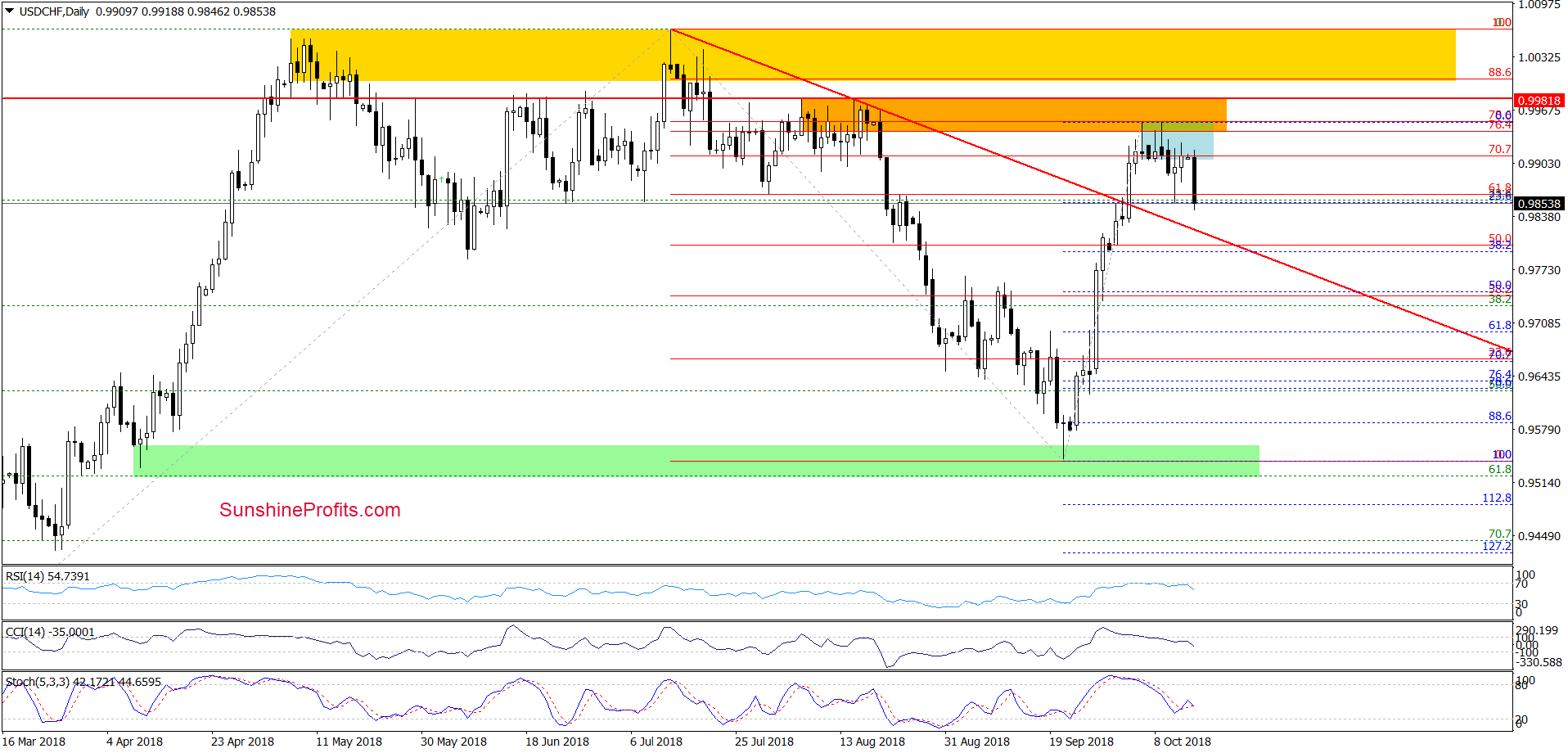

USD/CHF

Looking at the daily char, we see that although USD/CHF bounced off Thursday’s low and climbed slightly above the lower border of the blue consolidation on the following day, the sell signals generated by the CCI and the Stochastic Oscillator encouraged the sellers to act earlier today.

Thanks to their determination, the exchange rate dropped below the consolidation once again, which resulted in a sharp pullback and a drop below the last week’s low.

Taking this bearish development into account and combining it with the current position of the indicators (they still have space for declines), we think that the pair will test the previously-broken red declining line (it serves as the nearest support) in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts