Yesterday’s session took GBP/USD under important long-term support line. Earlier today, the situation worsened even more when currency bears pushed the exchange rate to a fresh 2018 low. What’s next with the relationship between the British pound and the greenback?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 111.15; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

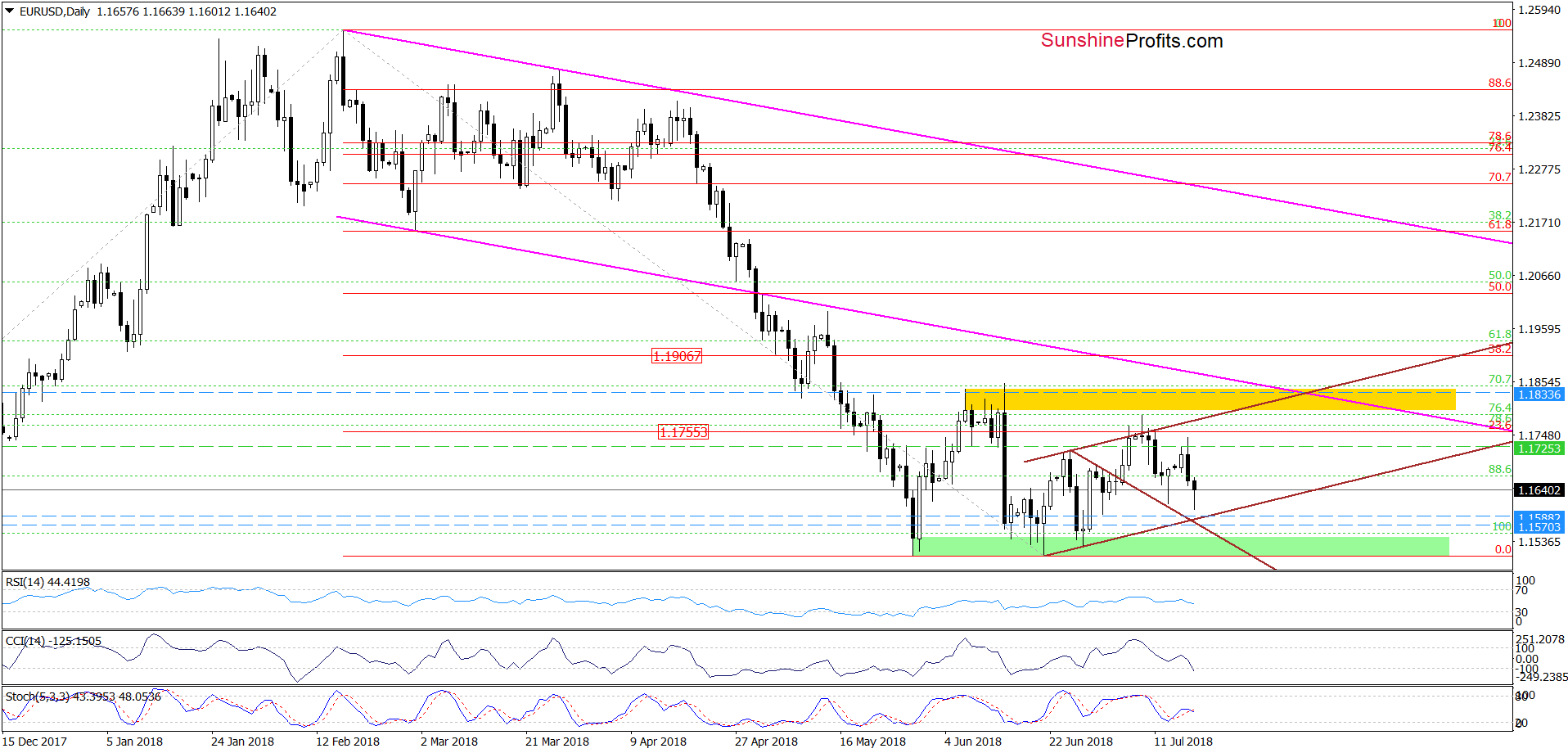

EUR/USD

Yesterday, we wrote:

(…) EUR/USD is still trading inside the brown rising trend channel, which suggests that as long as there is no breakout above the upper line of the formation higher values of EUR/USD are not likely to be seen and another attempt to move lower should not surprise us (…)

If this is the case, and currency bears show their claws once again, the first downside target will be the lower border of the brown rising trend channel (currently around 1.1588).

On the daily chart, we see that currency bears attacked earlier today, while the Stochastic Oscillator re-generated the sell signal, suggesting that we’ll see a realization of the above scenario in the very near future.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

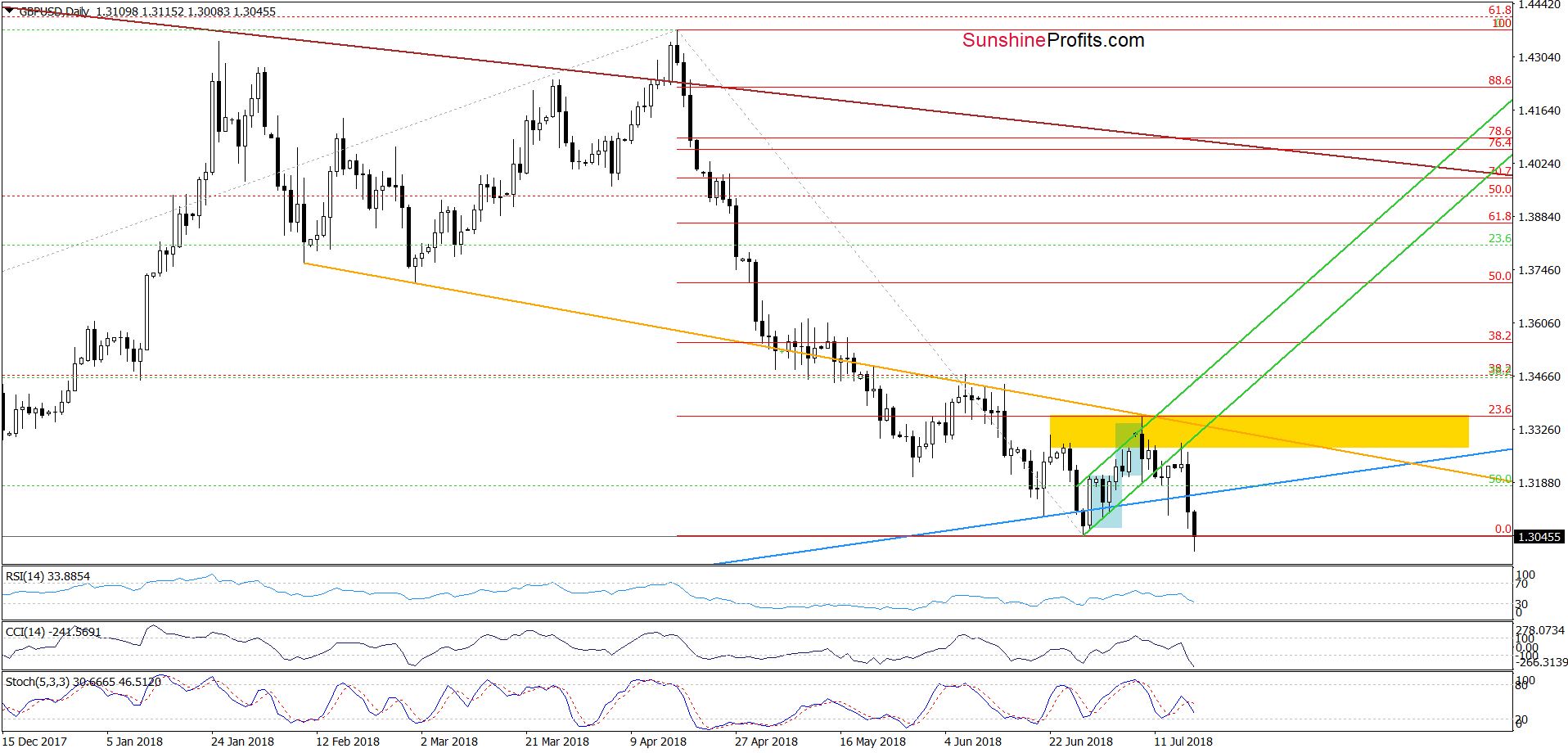

GBP/USD

On Monday we wrote the following:

(…) a comeback to the previously-broken lower border of the very short-term green rising trend channel (…) looks like a verification of the earlier breakdown.

Additionally, this area is reinforced by the yellow resistance zone and the orange declining resistance line, which together managed to stop increases in the previous week.

Taking all the above into account, we believe that (…) lower values of GBP/USD are more likely than further improvement. Therefore, if the exchange rate reverses and declines from here, we’ll see a re-test of the blue support line in the very near future.

From today’s point of view, we see that currency bears not only took GBP/USD to our downside target, but also managed to push the exchange rate below it earlier today. Additionally, the Stochastic Oscillator re-generated the sell signal, suggesting further declines in the very near future.

Therefore, if the pair closes today’s session under the June low, we’ll consider opening short positions with an initial downside target around 1.2896, where the 61.8% Fibonacci retracement (based on the entire January 2017 – March 2018 upward move) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, if the pair closes today’s session under the June low, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

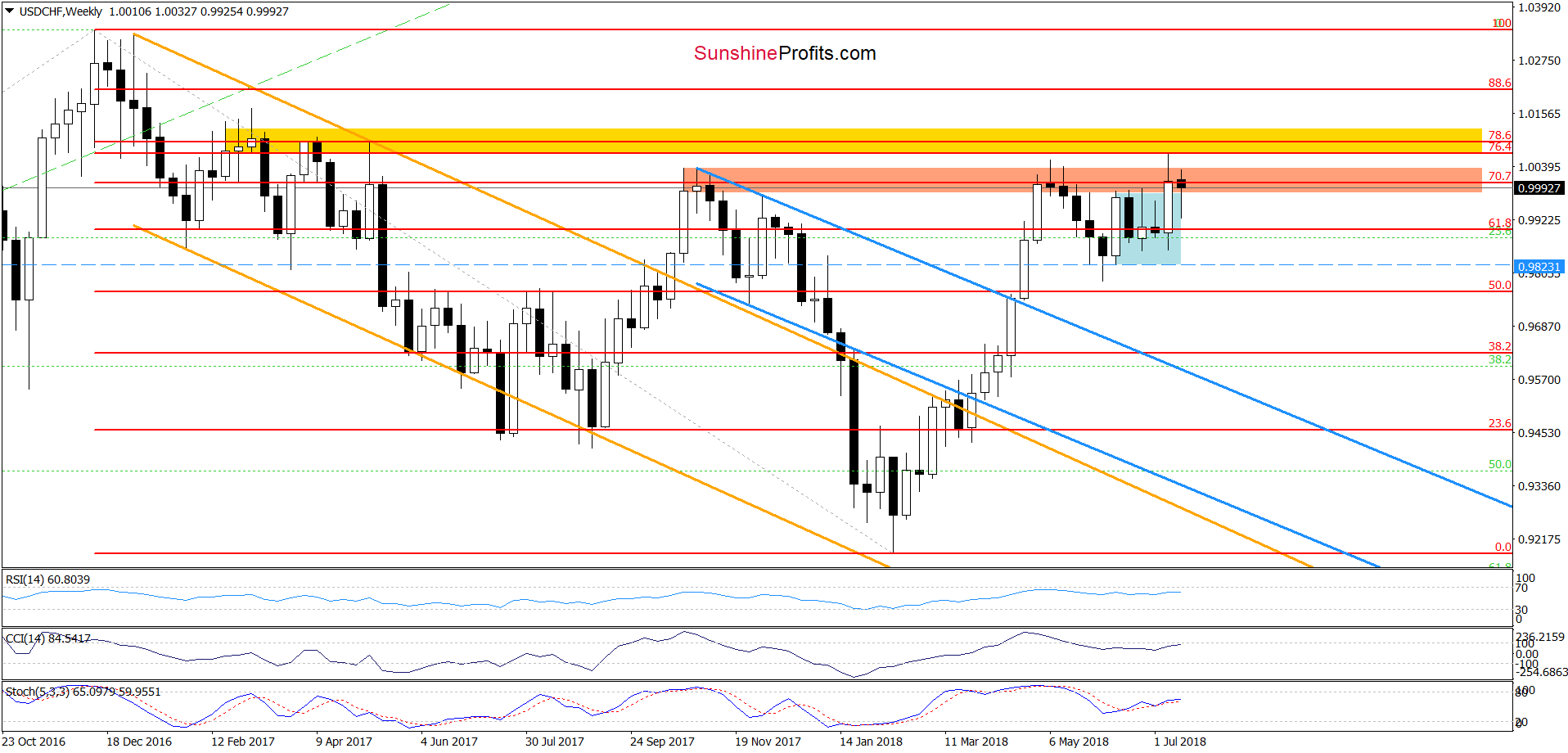

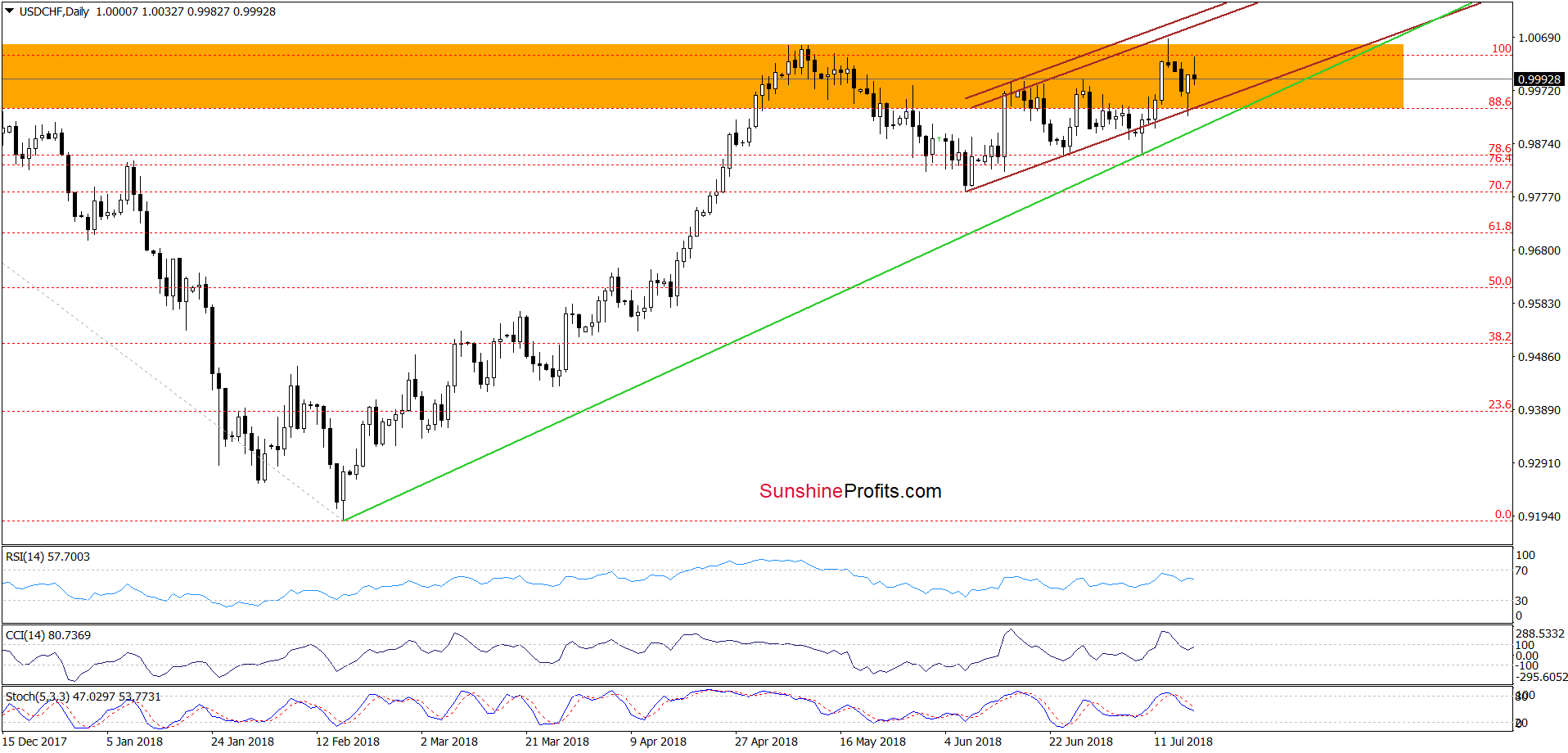

USD/CHF

Quoting our last commentary on this currency pair:

(….) the yellow resistance zone (seen on the weekly chart) in combination with the upper border of the brown rising trend channel (marked on the daily chart) stopped them, triggering a pullback on Friday.

As a result, the pair came back to the orange resistance zone, invalidating the earlier breakout above May high. This show of weakness was enough to attract the sellers. Thanks to their comeback, USD/CHF extended losses earlier today, which suggests a test of the lower border of the brown rising trend channel (…)

Looking at the above charts, we see that the situation developed in tune with the above scenario and USD/CHF slipped to our downside target during yesterday’s session. As you see, this support triggered a quick rebound, but the upper border of the orange resistance zone stopped the buyers, triggering a downswing earlier today.

Nevertheless, as long as there is no successful breakdown under the nearest support lines (the lower border of the brown rising trend channel and the green support line), a bigger move to the downside is not likely to be seen.

Therefore, we think that waiting at the sidelines for a profitable opportunity is justified from the risk/reward perspective. However, if the situation develops in line with the above scenario (the breakdown), we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts