The recent dynamic growth of the US dollar pushed USD/CAD to the fresh 2018 peaks. However, analyzing the charts it seems that the good streak of currency bulls has probably come to an end. Where such bleak assumptions come from? We have found 6 solid arguments, which do not bode too well for this currency pair at the beginning of next month. Do you want to know them too?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3503; the initial downside target at 1.3003)

- USD/CHF: none

- AUD/USD: none

In other words, closing all existing positions on EUR/USD and USD/JPY is justified from the risk/reward perspective at the moment of writing this alert.

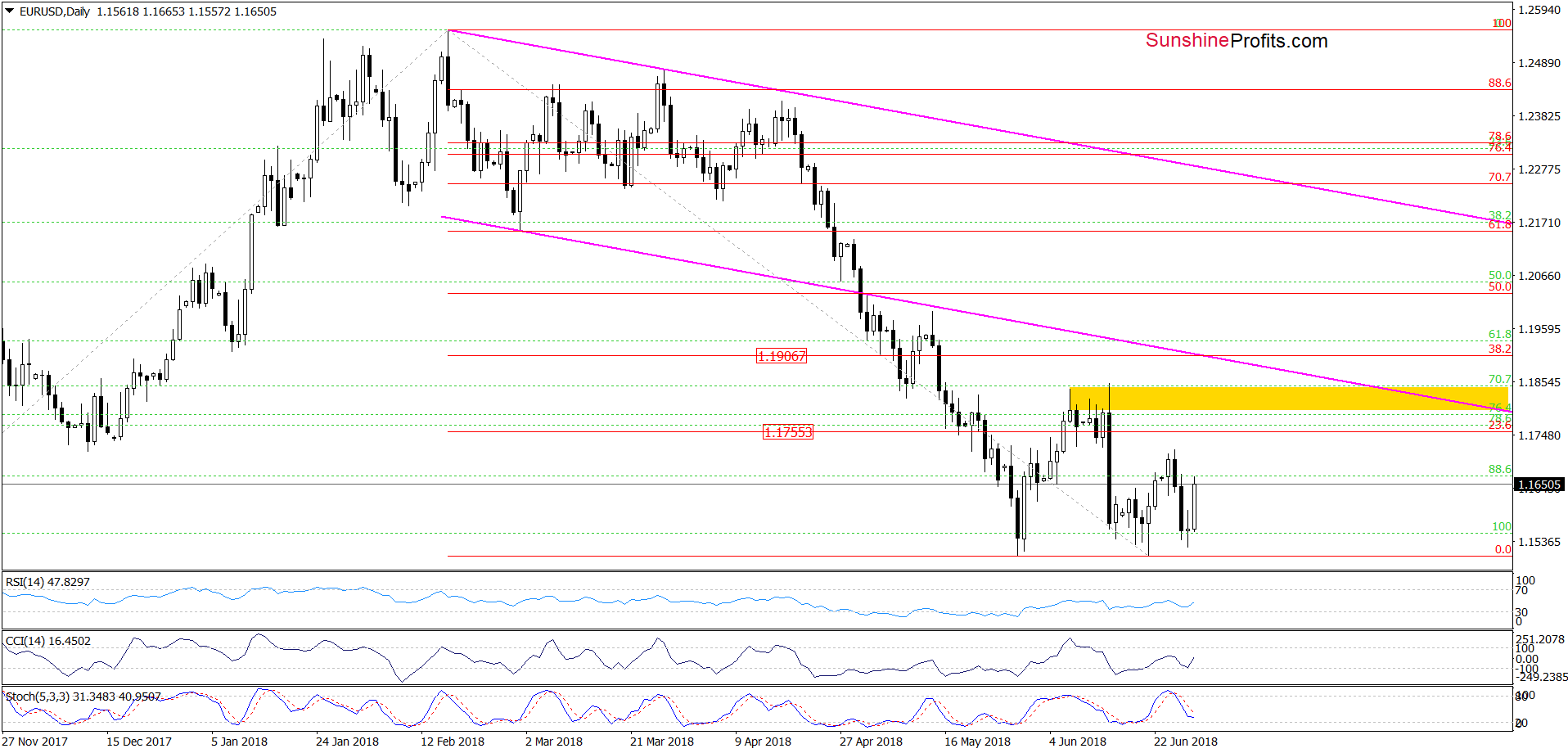

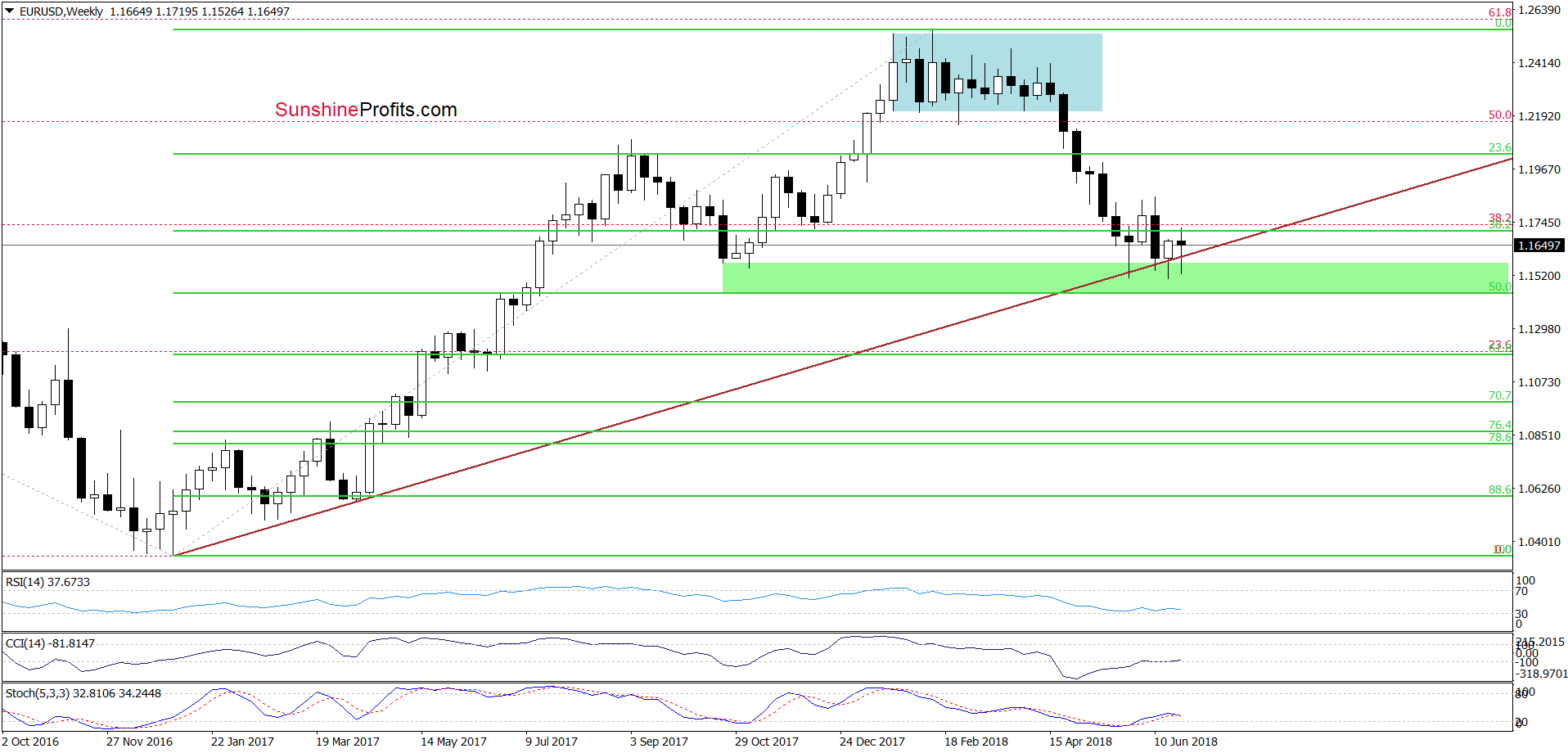

EUR/USD

Considering only the daily chart, we see that the sell signals generated by the indicators remain in the cards, supporting currency bears. Can we trust them? We think that it is not the best idea. Why? Because the buyers extended yesterday’s gains, erasing a significant part of the recent downward move earlier today.

Nevertheless, this was not the most important factor that prompted the closing of short positions. So, what was it? Take a look at the chart below.

Looking at the medium-term chart, we see that currency bulls managed to invalidate the breakdown under the long-term brown rising line similarly to what we already saw in the past.

In all previous cases, such price action triggered further improvement, which suggests that our stop-loss order could be minted, and short positions would bring losses in the coming days. Therefore, with a view to protecting your capital, we decided to close short positions (at the moment of writing this alert there are a bit profitable) and not to take unnecessary risks.

Is it the right time to open opposite (long) positions? In our opinion, not yet, because in such situations it is worth to wait for the closure of the week to make sure that the invalidation of the breakdown actually took place.

At this point it is also worth noting that an additional argument, which could support currency bulls in the fight for higher values of EUR/USD would be a pro-growth candlestick formation - the morning star, which is already pre-drawn on the daily chart. Nevertheless, before it becomes an ally of the buyers, we must wait for its physical appearance and the closure of today's session.

Fishing todays alert, please keep in mind that when we see reliable conditions to open new positions, we will let you know as soon as it possible.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

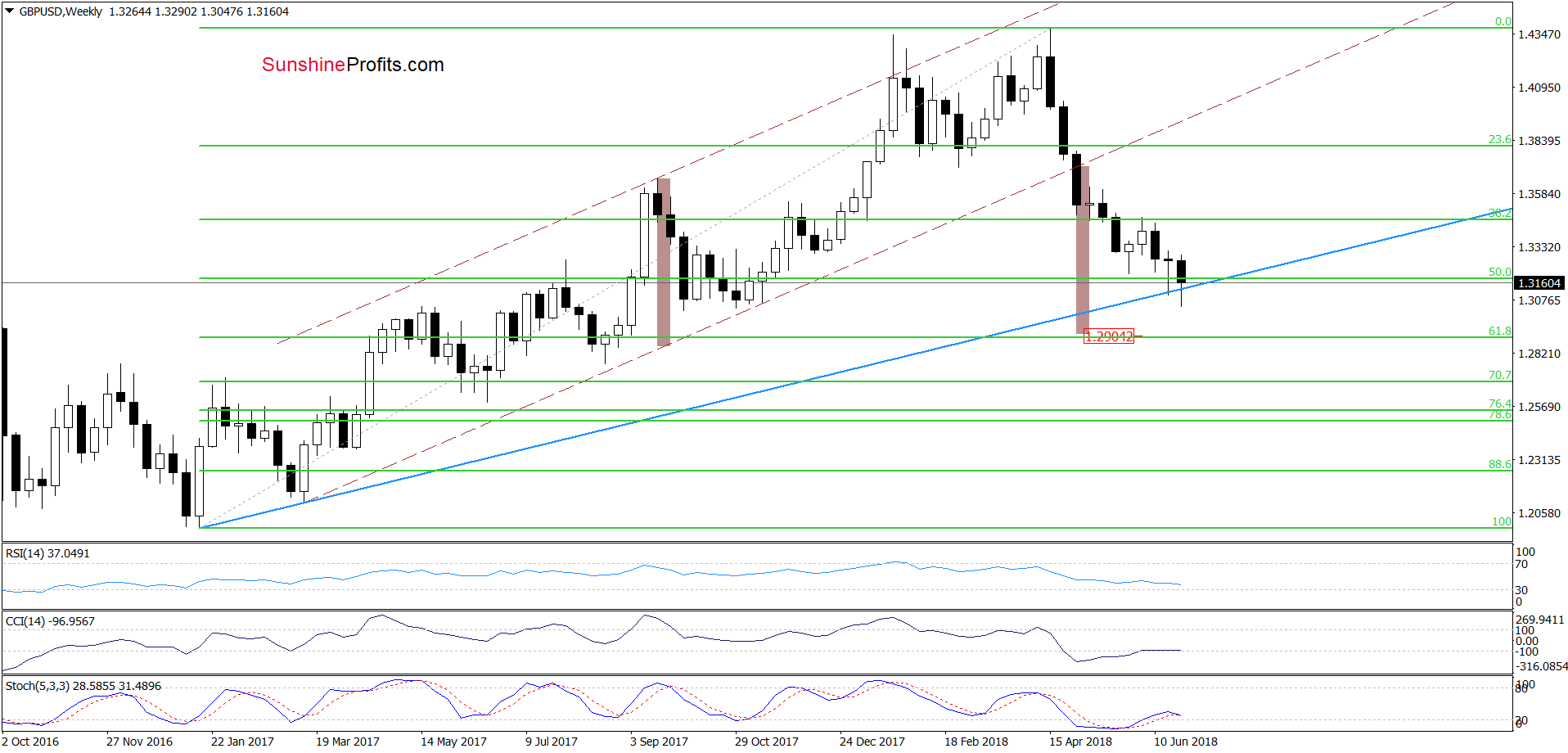

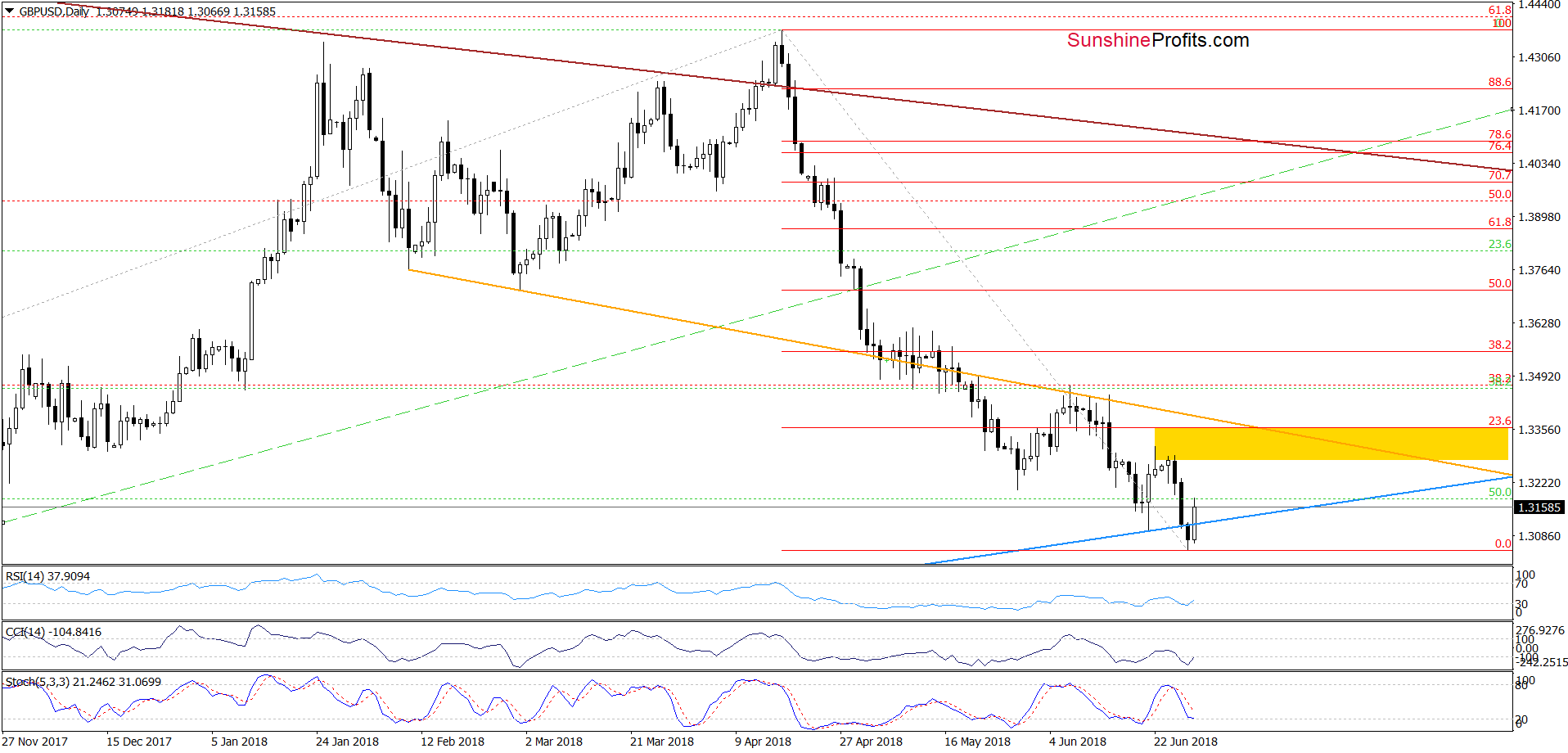

GBP/USD

A similar situation to the one described above we also observed on the charts of GBP/USD. As you see, the exchange rate rebounded quite sharply, invalidating the earlier breakdown under the long-term blue support line.

On the medium-term chart, we see that the pair tested this important support in the previous week, but currency bears didn’t manage to go lower. As it turned out, we can observe how the history repeats itself once again this week.

What does it mean for GBP/USD?

In our opinion, if the pair closes today’s session (and the whole week) above this important support line, we’ll likely see further improvement and a test of the yellow resistance zone marked on the daily chart.

This scenario will be even more reliable if the CCI and the Stochastic Oscillator join the RSI, which has already generated a buy signal. Connecting the dots, if we really see an invalidation of the breakdown under the long-term blue line, we will think about opening long positions (probably for a short time to realize potential profits around the above-mentioned yellow resistance zone). As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Looking at the medium-term chart, we see that USD/CAD climbed to the 50% Fibonacci retracement in the previous week, which resulted in a pullback. This week currency bulls tried to go higher once again, but they failed for the second time in a row, which does not look very good - especially if we take into account the current levels of the CCI and the Stochastic Oscillator.

On top of that, the RSI climbed to its highest level since May 2017. Did something important happen then? Yes. Such high reading of this indicator preceded a significant move to the downside in the following weeks.

Taking this fact into account and two unsuccessful attempts to go above the 50% Fibonacci retracement, it seems to us that further deterioration is just around the corner.

What’s interesting, additional bearish signals, we can also notice on the daily chart.

From this perspective, we see that USD/CAD invalidated the earlier breakout above the upper border of the brown rising trend channel during yesterday’s session after we saw two unsuccessful attempts to climb above the resistance zone created by the 76.4% and 78.6% Fibonacci retracements.

Earlier today, the pair extended losses and moved below the upper border of the long-term pink rising trend channel, invalidating also this breakout, which is an additional very negative sign. Taking all the above into account, we think that opening short positions is currently justified from the risk/reward perspective.

How low could the exchange rate go?

In our opinion, the initial downside target will be around 1.2983, where the lower border of the brown rising trend channel (marked on the daily chart) is.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.3503 and the initial downside target at 1.3003) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts