Earlier today, the USD Index extended gains and came back above the level of 101. As a result, AUD/USD moved lower and broke below the support zone, but can we trust this breakdown?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0967; the initial downside target at 1.0521)

- GBP/USD: short (a stop-loss order at 1.2738; the downside target at 1.2157)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

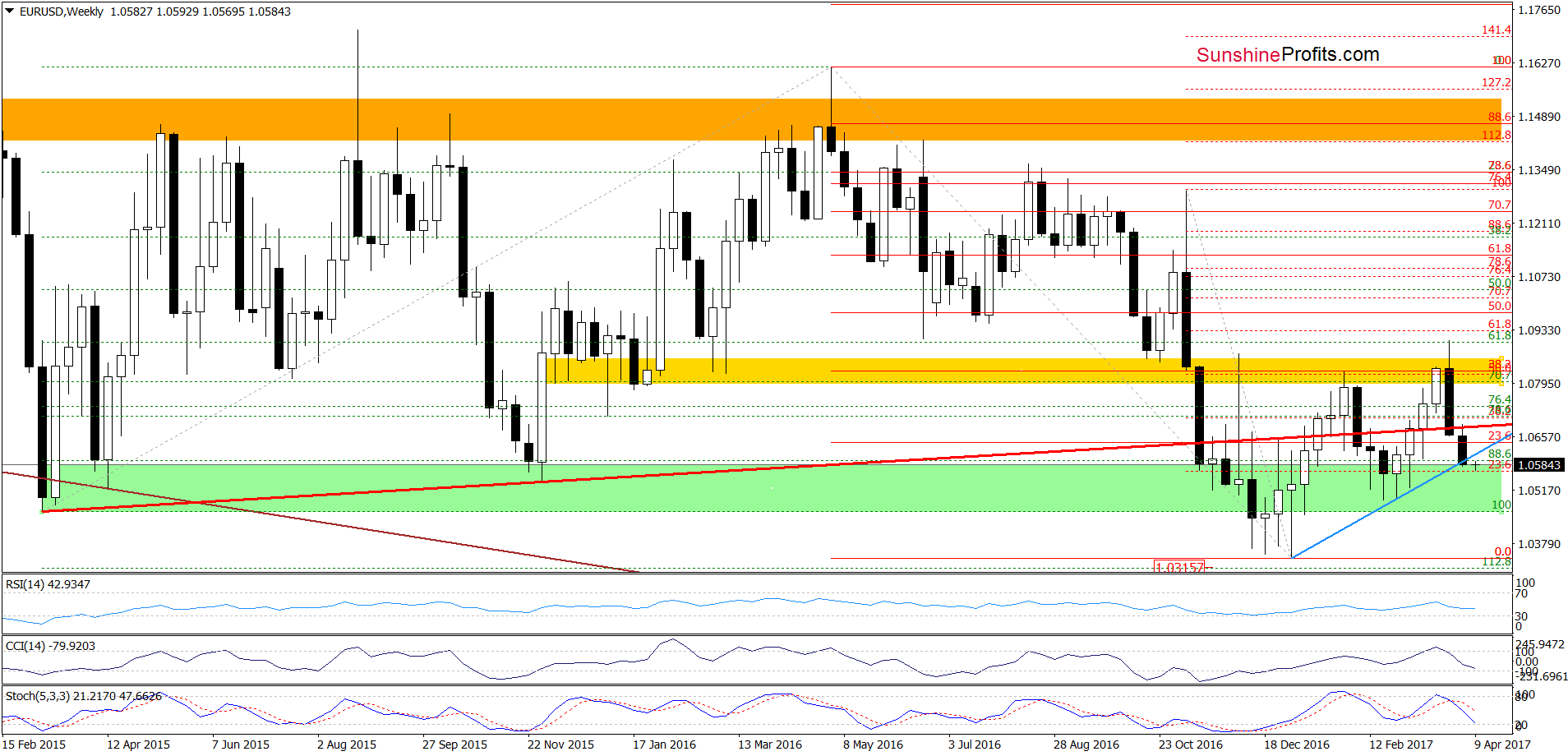

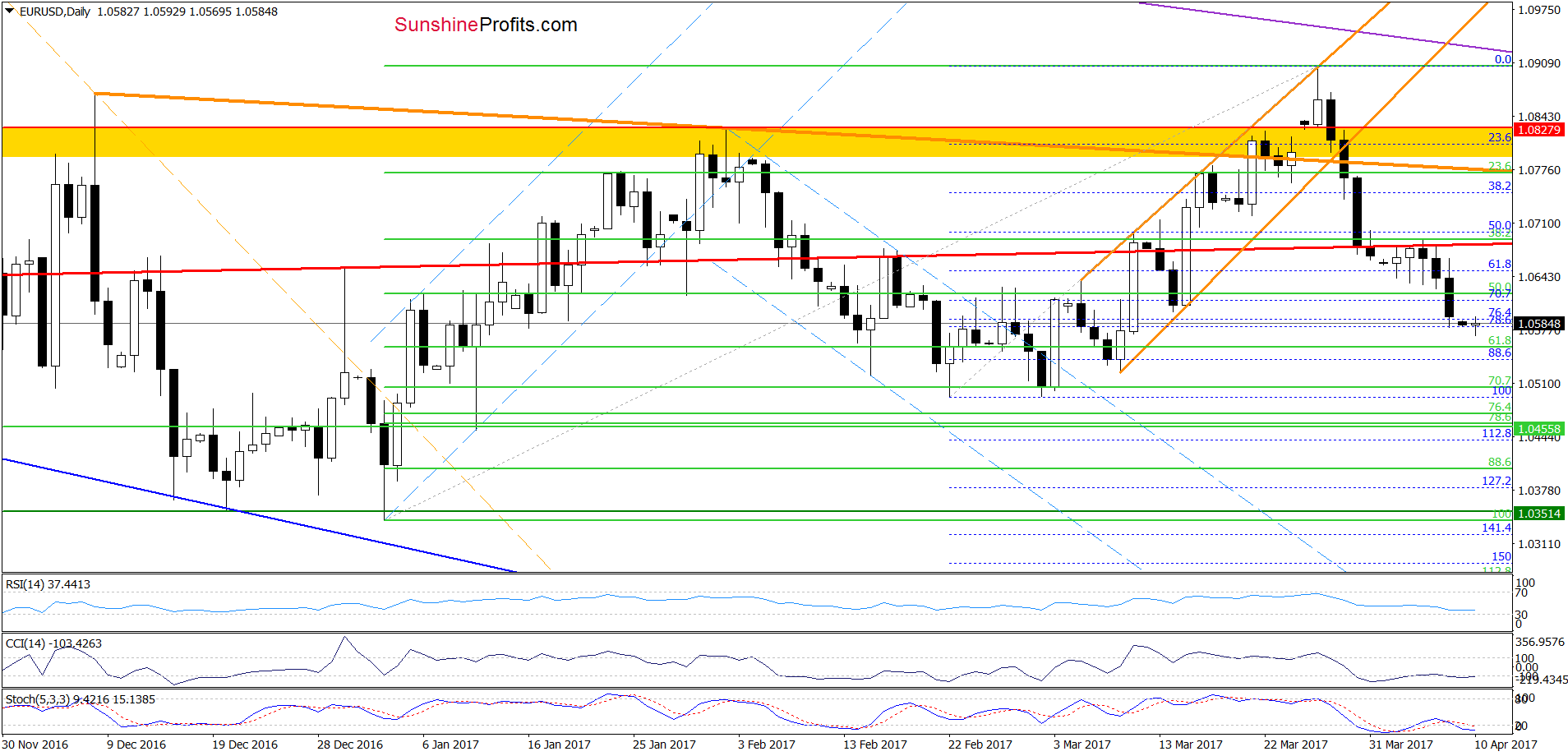

EUR/USD

Looking at the daily chart, we see that EUR/USD declined quite sharply on Friday, extending losses and hitting a fresh April low. Therefore, we believe that what we wrote a week ago remains up-to-date also today:

(…) we think that lower values of EUR/USD are more likely than not. Therefore, if the pair extends losses, (…) the initial downside target for currency bears will be around 1.0521 (slightly above the late February and March lows).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.0967 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

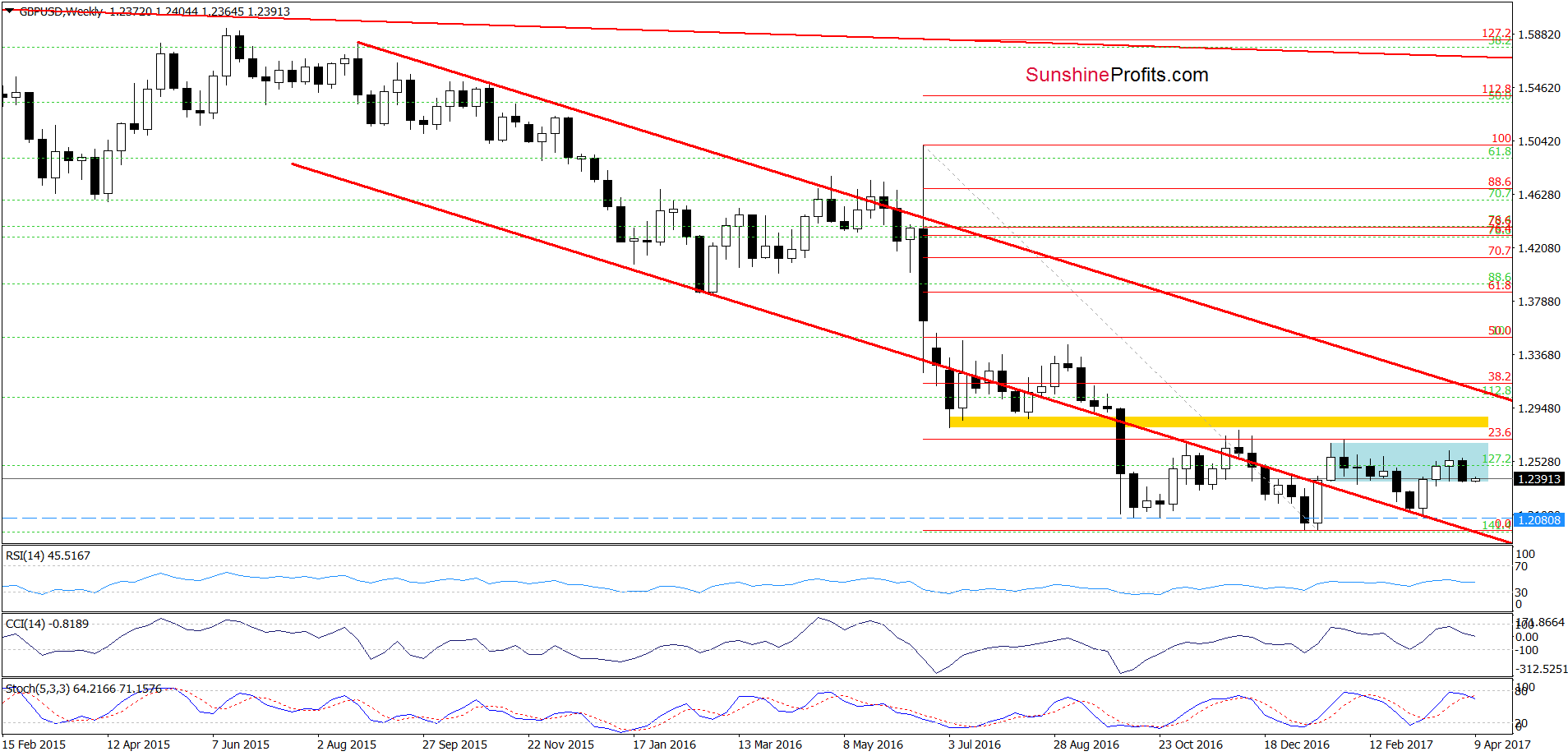

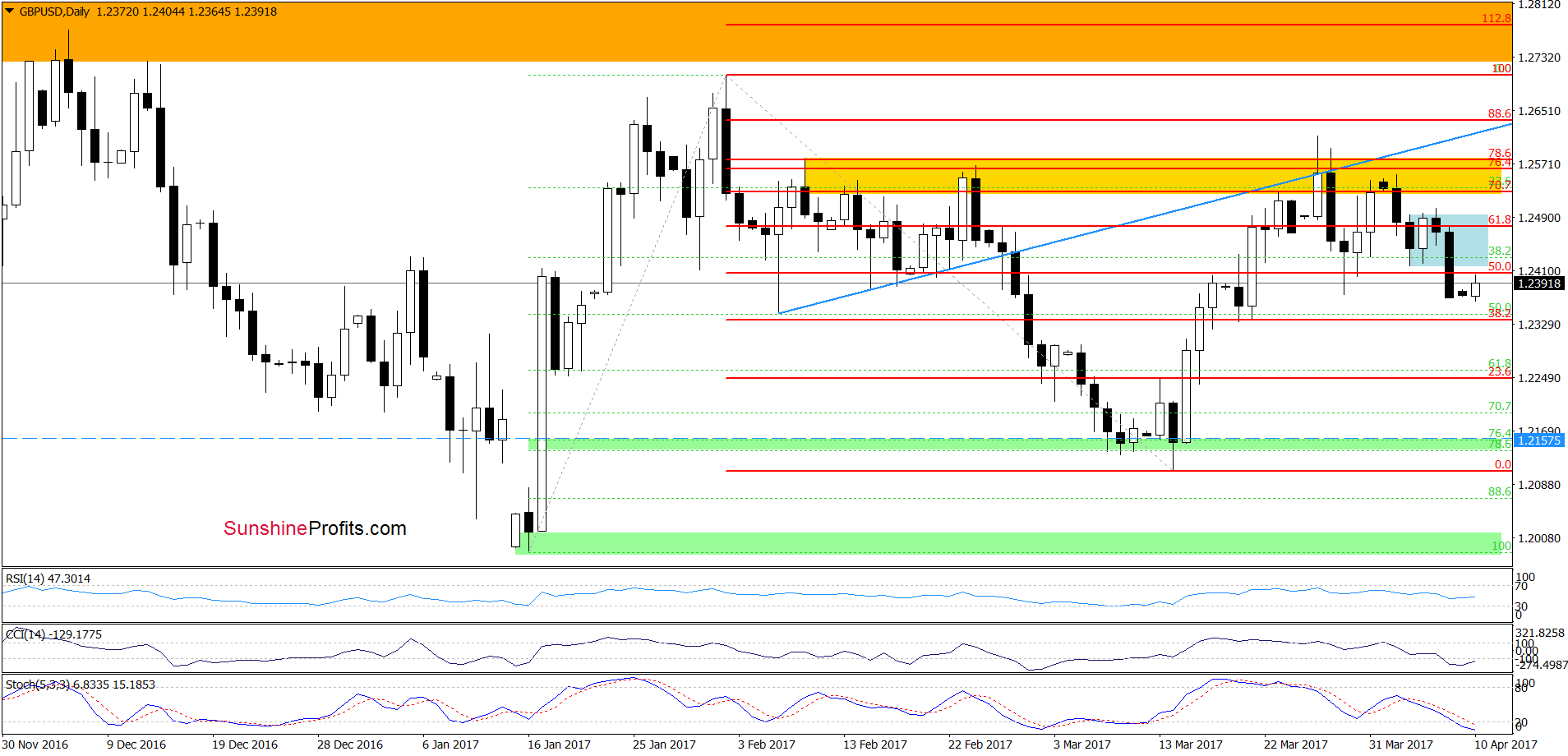

GBP/USD

On Thursday, we wrote the following:

(…) although GBP/USD rebounded slightly yesterday, the pair remains in the blue consolidation under the yellow resistance zone. Additionally, the sell signals generated by the indicators are still in play, which suggests another downswing (…)

From today’s point of view, we see that the situation developed in line with the above scenario and GBP/USD moved sharply lower on Friday. Thanks to this drop, the exchange rate declined below the lower border of the blue consolidation, which suggests further deterioration in the coming days. If this is the case, we’ll see a drop to (at least) around 1.2333-1.2338, where the March 20 and the March 21 lows are. If this support is broken, we’ll see a decline to the March lows and the green support zone in the following days. Nevertheless, taking into account today’s rebound, it seems that the pair will verify the breakdown under the lower line of the consolidation first (maybe even later in the day).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2738 and the downside target at 1.2157) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

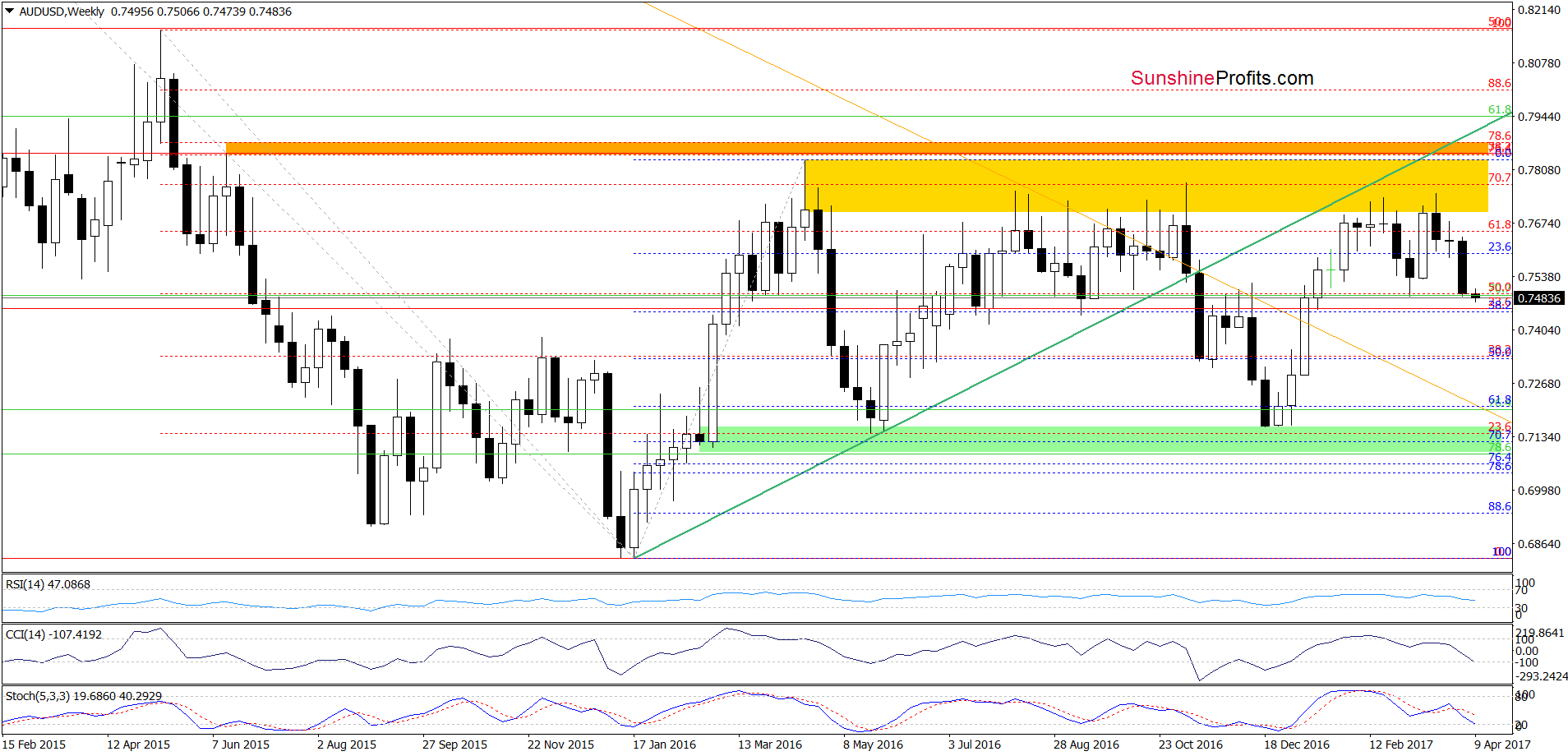

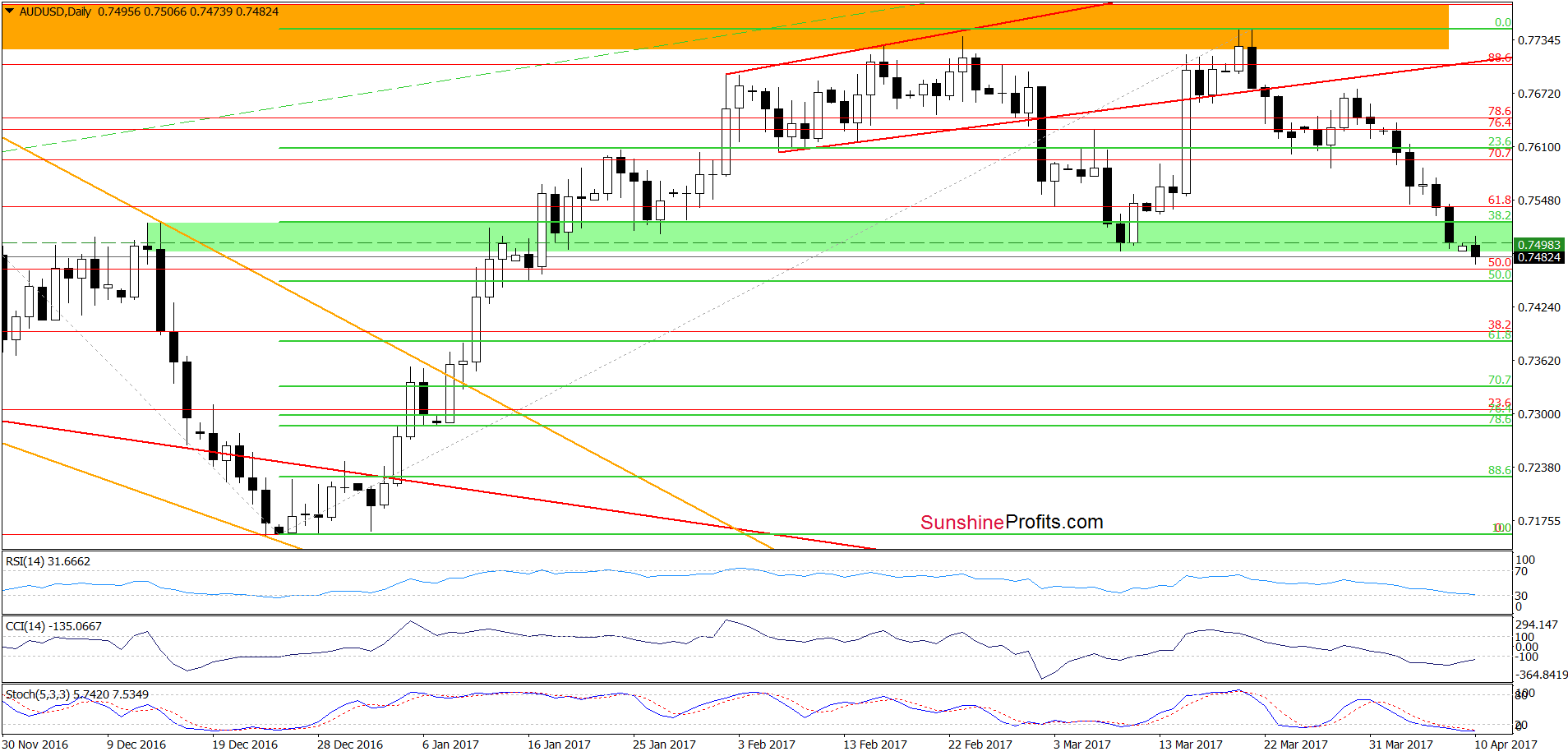

AUD/USD

On the daily chart, we see that AUD/USD moved lower and broke slightly below the green support zone earlier today. Although this is a negative development, which suggests further deterioration, we think it would be more bearish and reliable if the exchange rate closes today’s session below it. If we see such price action, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts