Earlier today, the euro moved higher against the U.S. dollar, but the combination of resistances stopped currency bulls once again. Does it mean that the euro’s rally is over?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss order at 1.3232; the initial downside target at 1.2375)

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 113.08)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

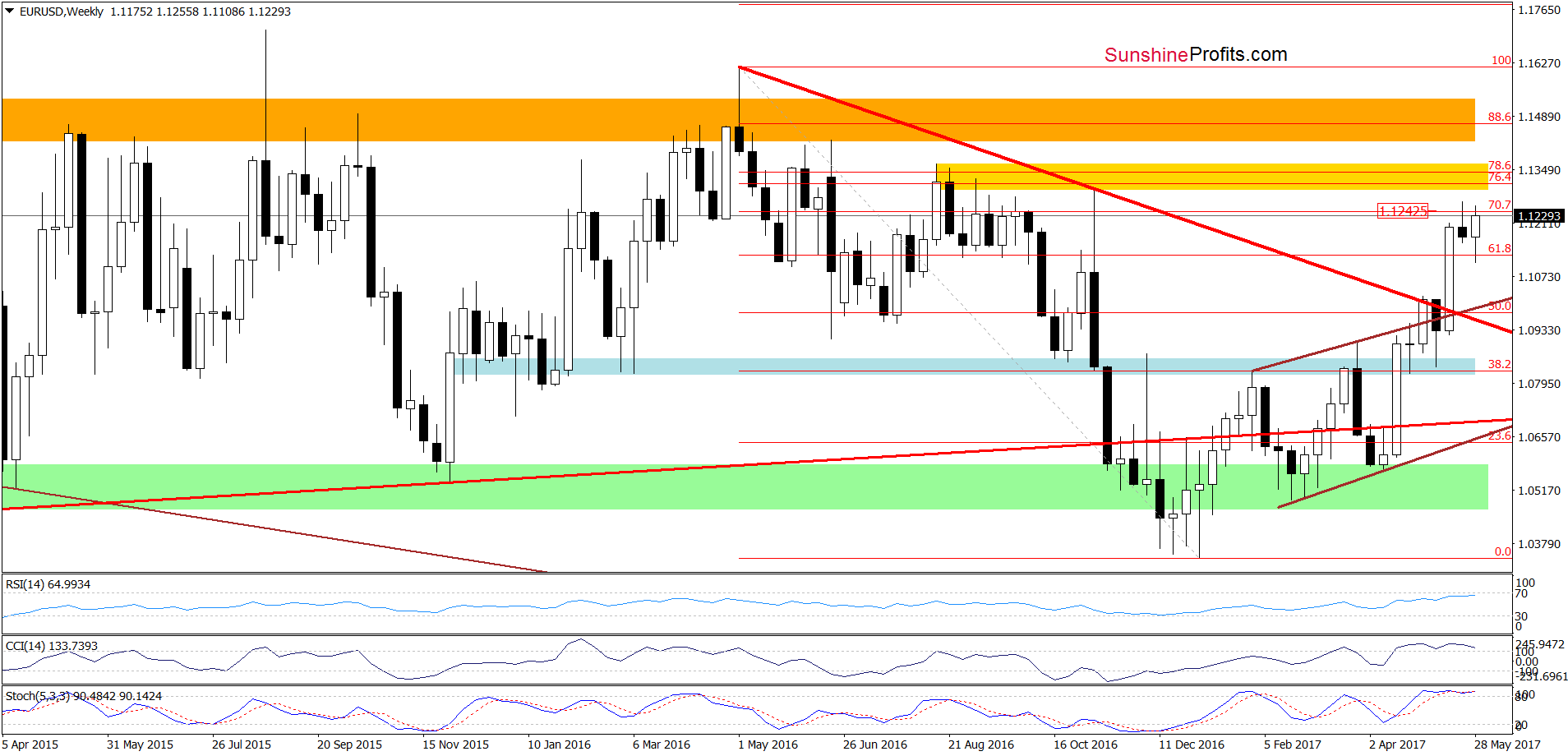

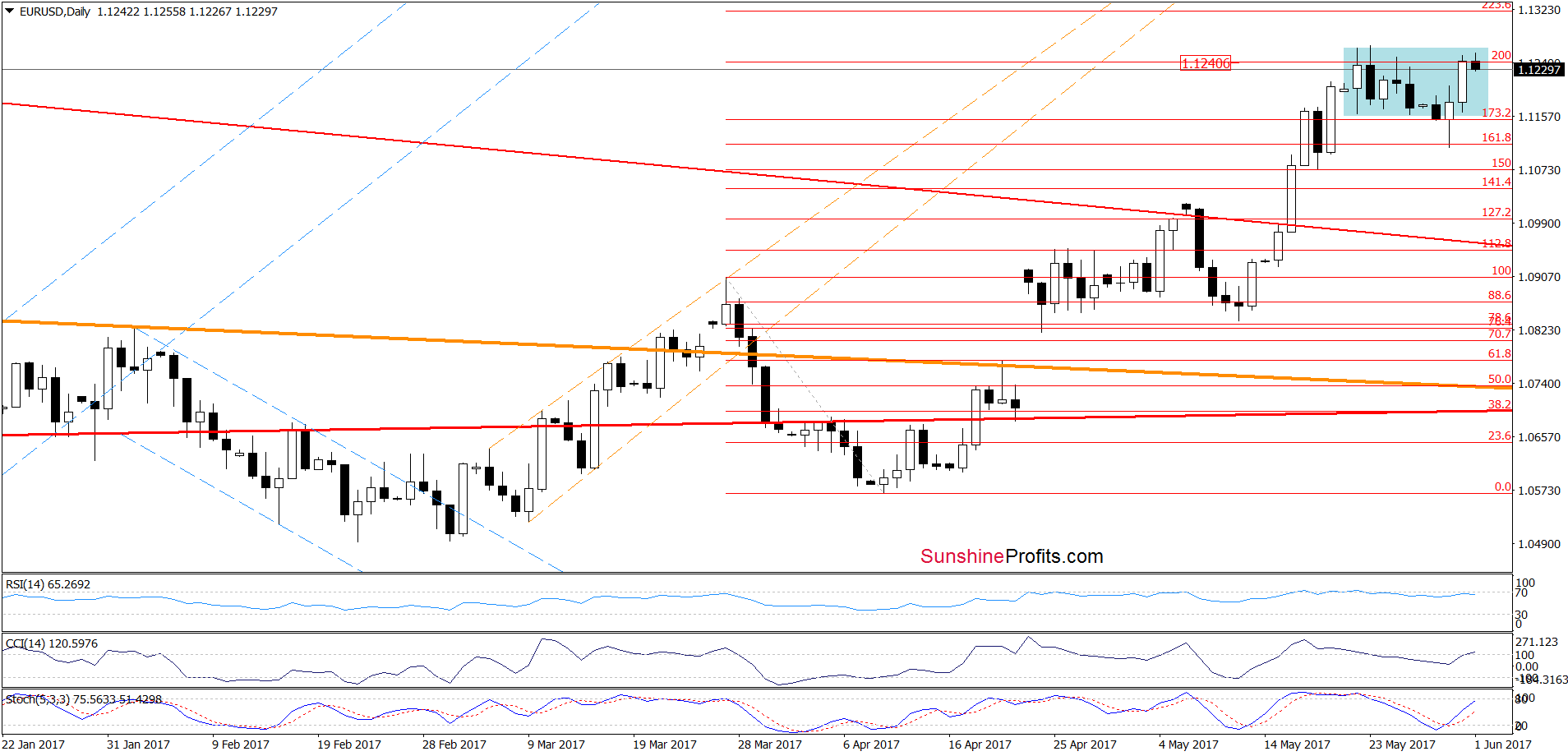

EUR/USD

On Tuesday, we wrote the following:

(…) the current position of the Stochastic Oscillator suggests that we may see a rebound and a test of the recent highs before a bigger move to the downside.

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD came back to the 200% Fibonacci extension, the 70.7% Fibonacci retracement (seen on the weekly chart) and the recent highs. As you see, this resistance area stopped currency bulls once again, which suggests that we’ll see a test of the lower border of the consolidation in the coming day(s). If we see a drop under Tuesday’s low, we’ll consider opening short positions.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

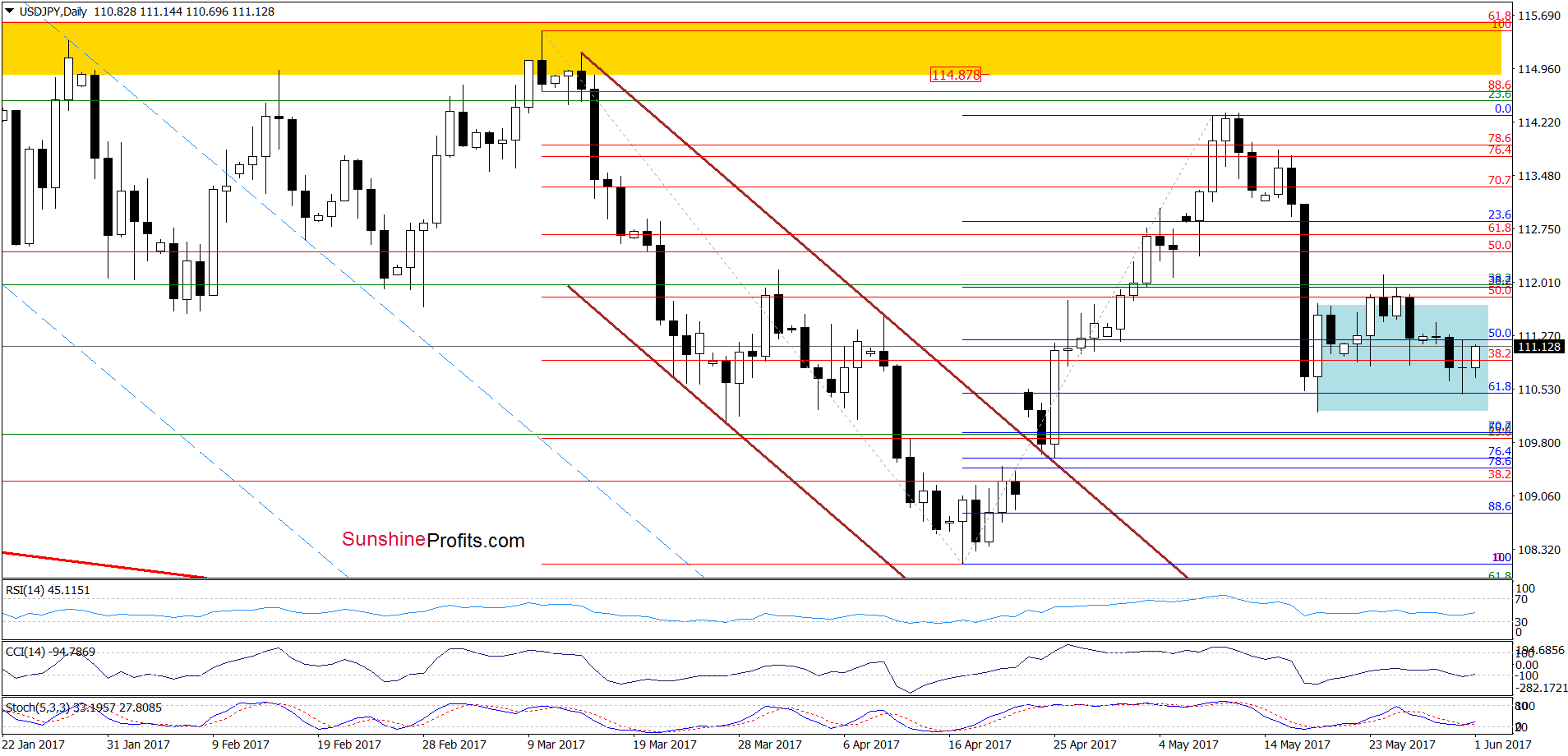

USD/JPY

Looking at the daily chart, we see that although currency bears pushed USD/JPY lower in the previous days, the exchange rate still remains in the blue consolidation. Yesterday, the pair re-tested the strength of the 61.8% Fibonacci retracement, which triggered a rebound earlier today. Additionally, the CCI and the Stochastic Oscillator generated the buy signals, which increase the probability of further improvement in the coming days. If this is the case, we’ll see a climb to the upper border of the consolidation and the last week’s highs. If this resistance area is broken, the next upside target will be around 113.08, where the May 17 high is.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 107.62 and the initial upside target at 113.08) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

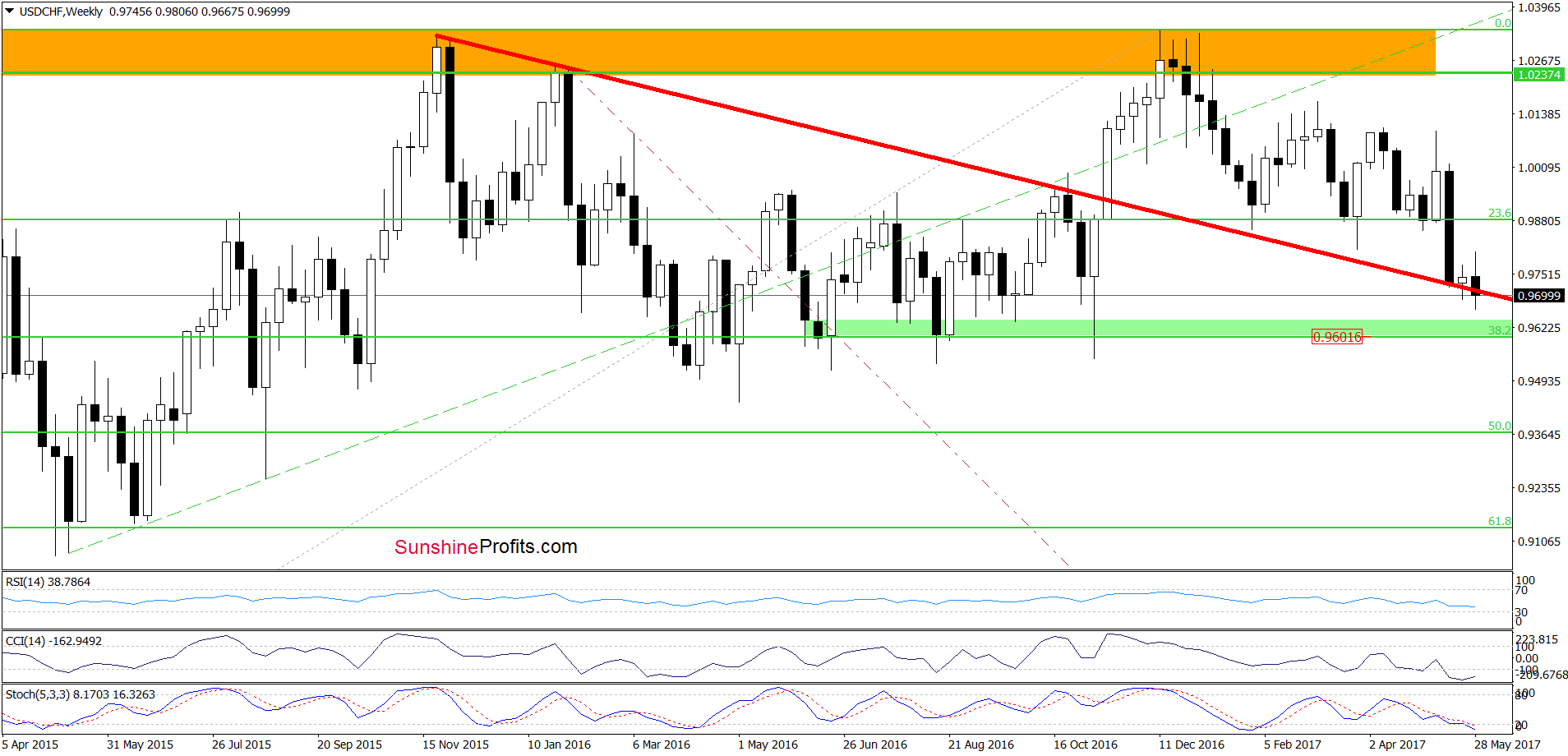

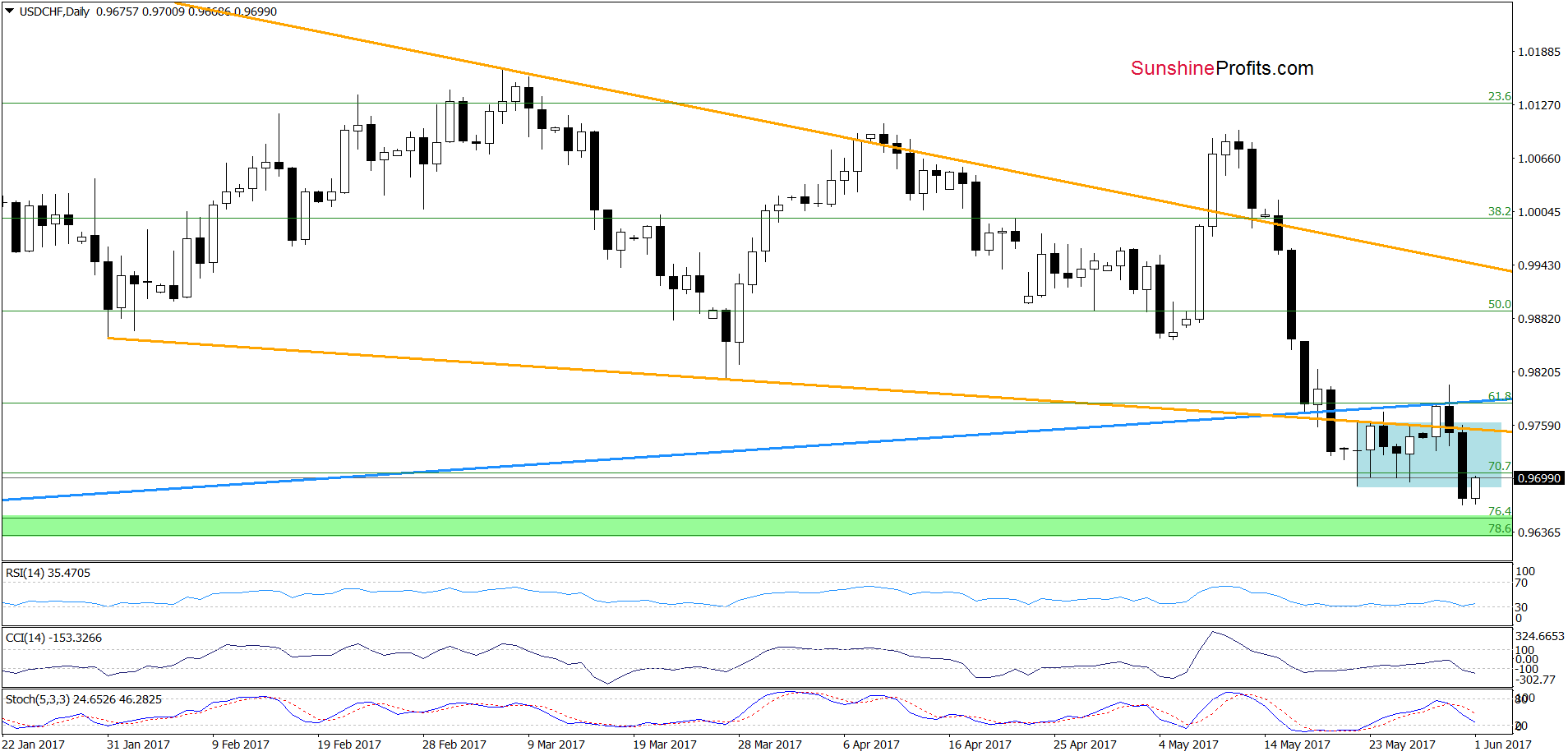

USD/CHF

Quoting our last commentary on this currency pair:

(…) USD/CHF broke above the upper border of the blue consolidation, which resulted in a climb to the previously-broken 61.8% Fibonacci retracement and the blue resistance line. (…) this area stopped further improvement, which means that as long as there is no invalidation of the breakdown under these levels and a daily closure above them another move to the upside is not likely to be seen and a re-test of the recent lows and the red long-term support line (seen on the weekly chart) can’t be ruled out.

On the weekly chart, we see that the situation developed in tune with the above scenario as currency bears pushed USD/CHF lower, which resulted in a drop under the long-term red declining support line. This negative event (which will turn into bearish if the pair closes the week below it) triggered a decline under the lower border of the blue consolidation (marked on the daily chart) and the 70.7% Fibonacci retracement, which increases the probability of a test of the green support zone created by the 76.4% and 78.6% Fibonacci retracements in the coming day(s). This scenario is also reinforced by the current position of the daily indicators (the sell signals remain in cards), which suggests that today’s upswing may be just a verification of yesterday’s breakdown.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts