Earlier today the euro extended gains against the greenback, but will we see further rally in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 111.16)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Yesterday, we wrote:

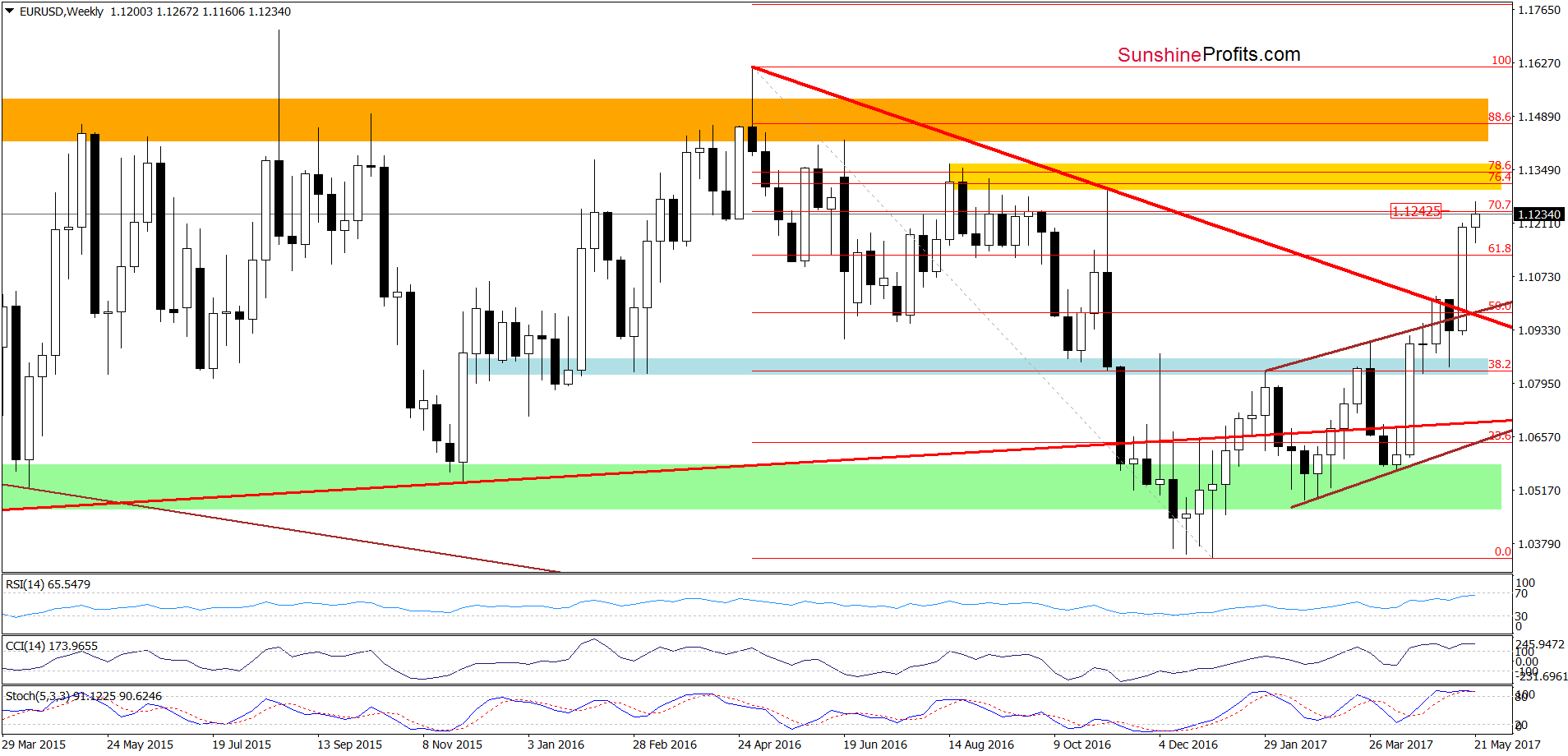

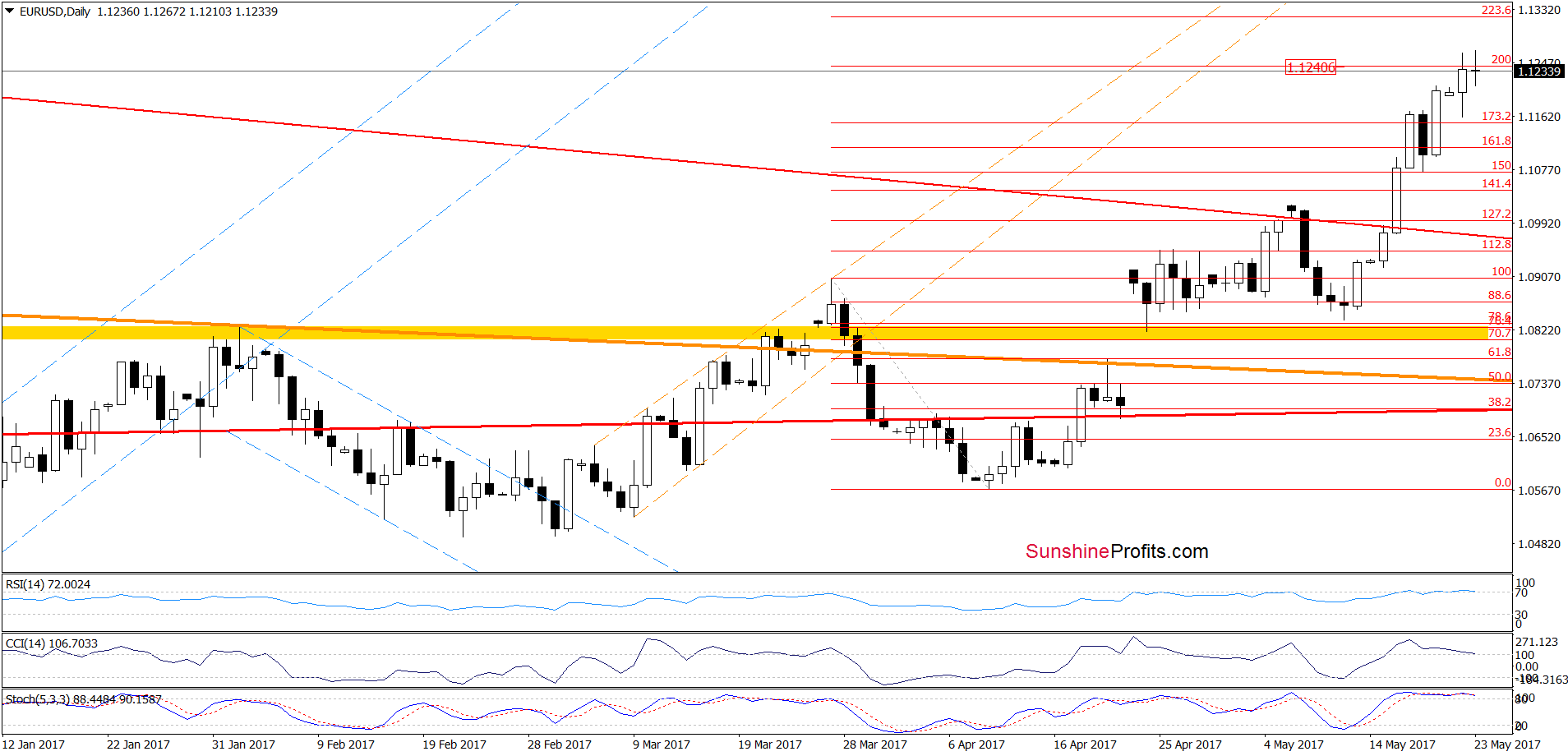

(…) the exchange rate (…) remains above the earlier highs (Wednesday’s and Thursday’s peaks) and the 173.2% Fibonacci extension. Additionally, there are no sell signals generated by the daily indicators at the moment of writing these words, which suggests that another upswing and a test of the 200% Fibonacci extension and the 70.7% Fibonacci retracement based on the entire May-January downward move (around 1.1242)

From today’s point of view, we see that the situation developed in line with the above scenario and the EUR/USD reached upside targets as we had expected. Although this is a bullish development, we should keep in mind that daily and weekly indicators are overbought and very close to generating sell signal, which increases the probability of reversal and lower values of EUR/USD in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

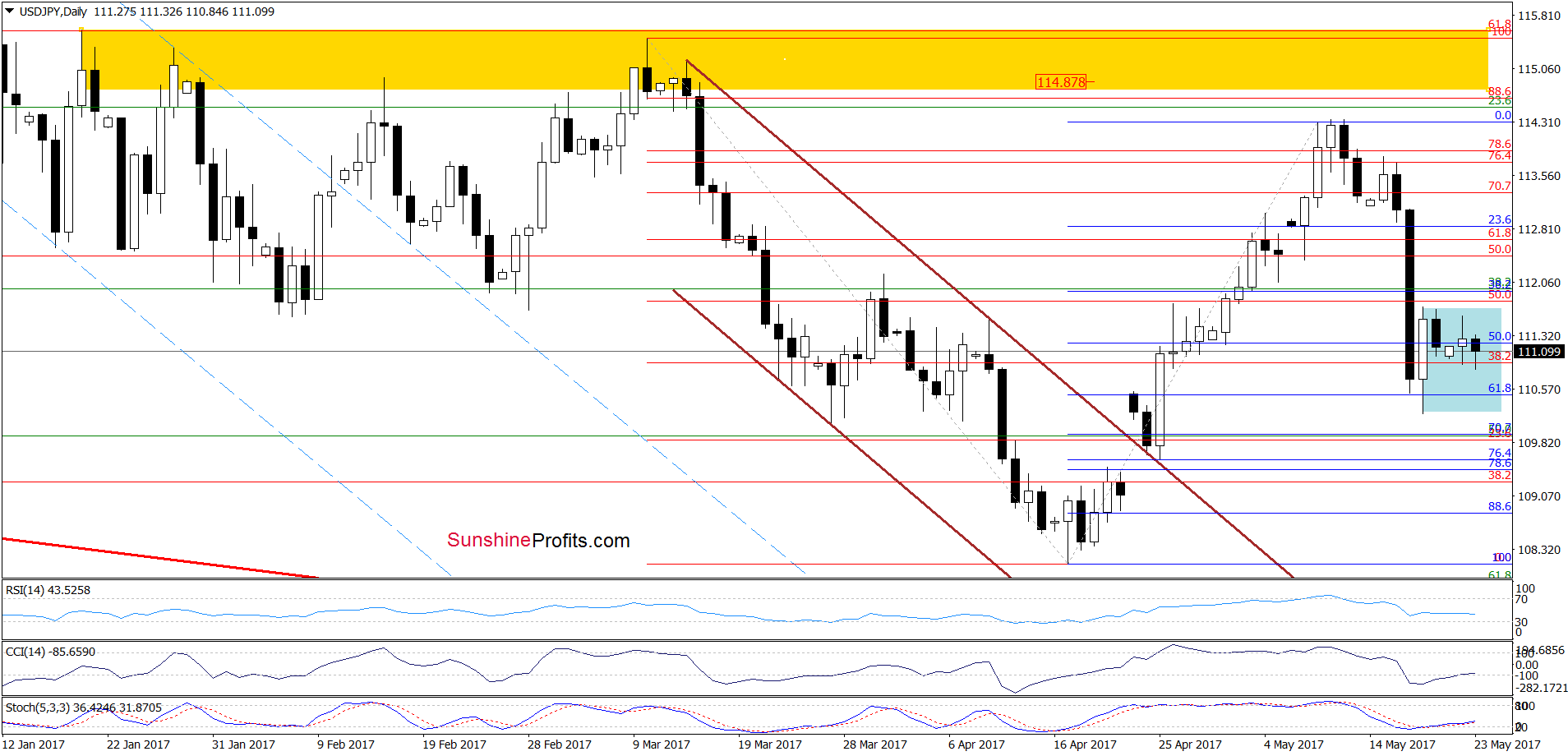

Looking at the daily chart, we see that the overall situation in the very short term hasn’t changed much as USD/JPY is still trading in the blue consolidation. Therefore, what we wrote in our previous commentary on this currency pair is up-to-date:

(…) USD/JPY declined slightly below the 61.8% Fibonacci retracement, but currency bulls managed to push the pair higher, which resulted in an invalidation of the breakdown. As a result, the exchange rate came back above 111, which together with the current position of the indicators (the CCI and the Stochastic Oscillator are overbought and very close to generating sell buy signals) suggests further improvement in the coming week. If this is the case and the pair extends rebound, we’ll likely see a test of the yellow resistance zone in the coming week.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 107.62 and the initial upside target at 111.16) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts