The euro increased to the highest level since November against the greenback after the results of the first round of voting in French presidential elections eased worries over the future of the euro zone. In this environment, EUR/USD increased above 1.0900, but will we see further improvement?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1052; the initial downside target at 1.0521)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 107.62; the initial upside target at 111.16)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

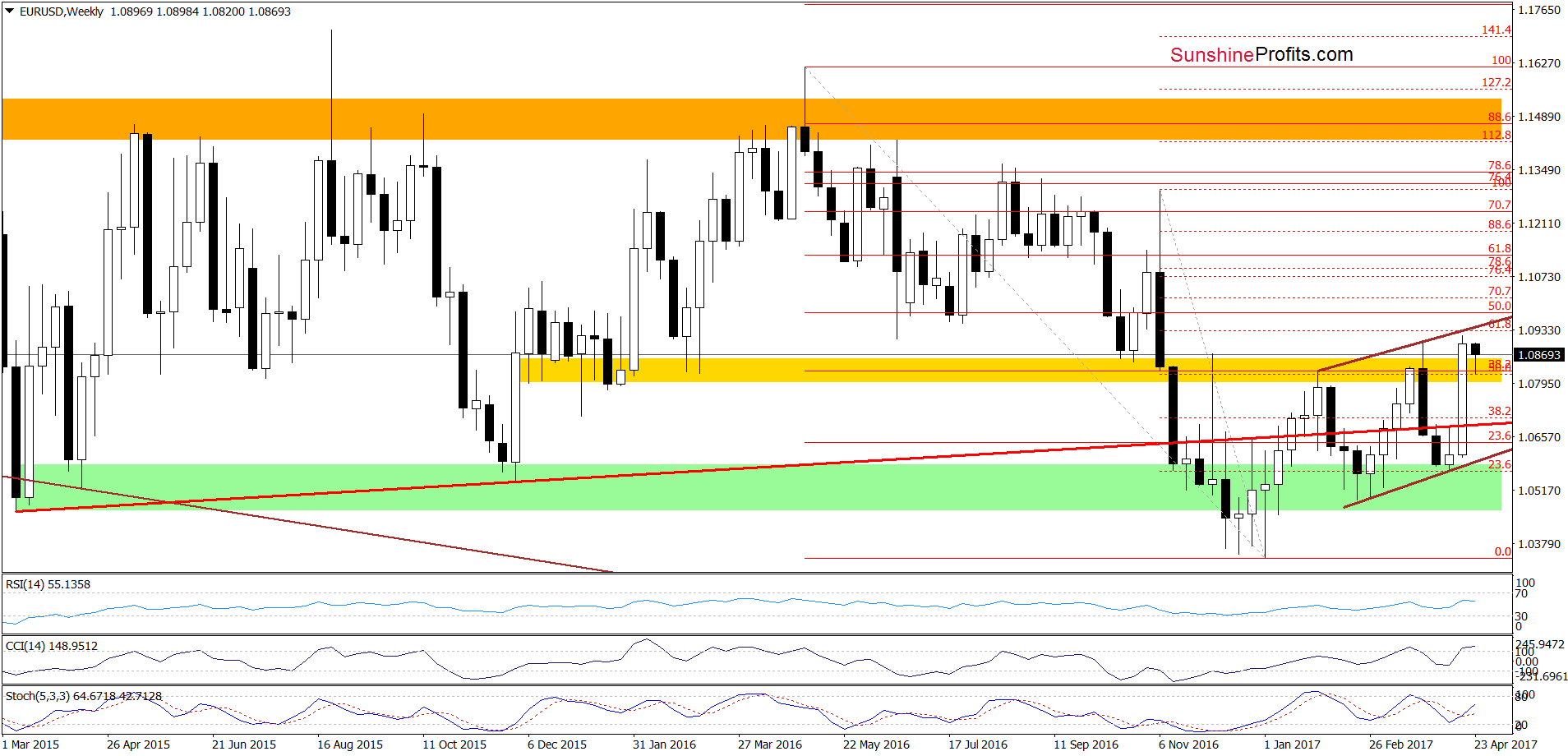

On the weekly chart, we see that EUR/USD moved sharply higher and broke slightly above the March high. Despite this improvement, the proximity to the upper border of the brown rising trend channel and the 61.8% Fibonacci retracement encouraged currency bears to act. As a result, the exchange rate pulled back, invalidating the earlier breakout above the March peak.

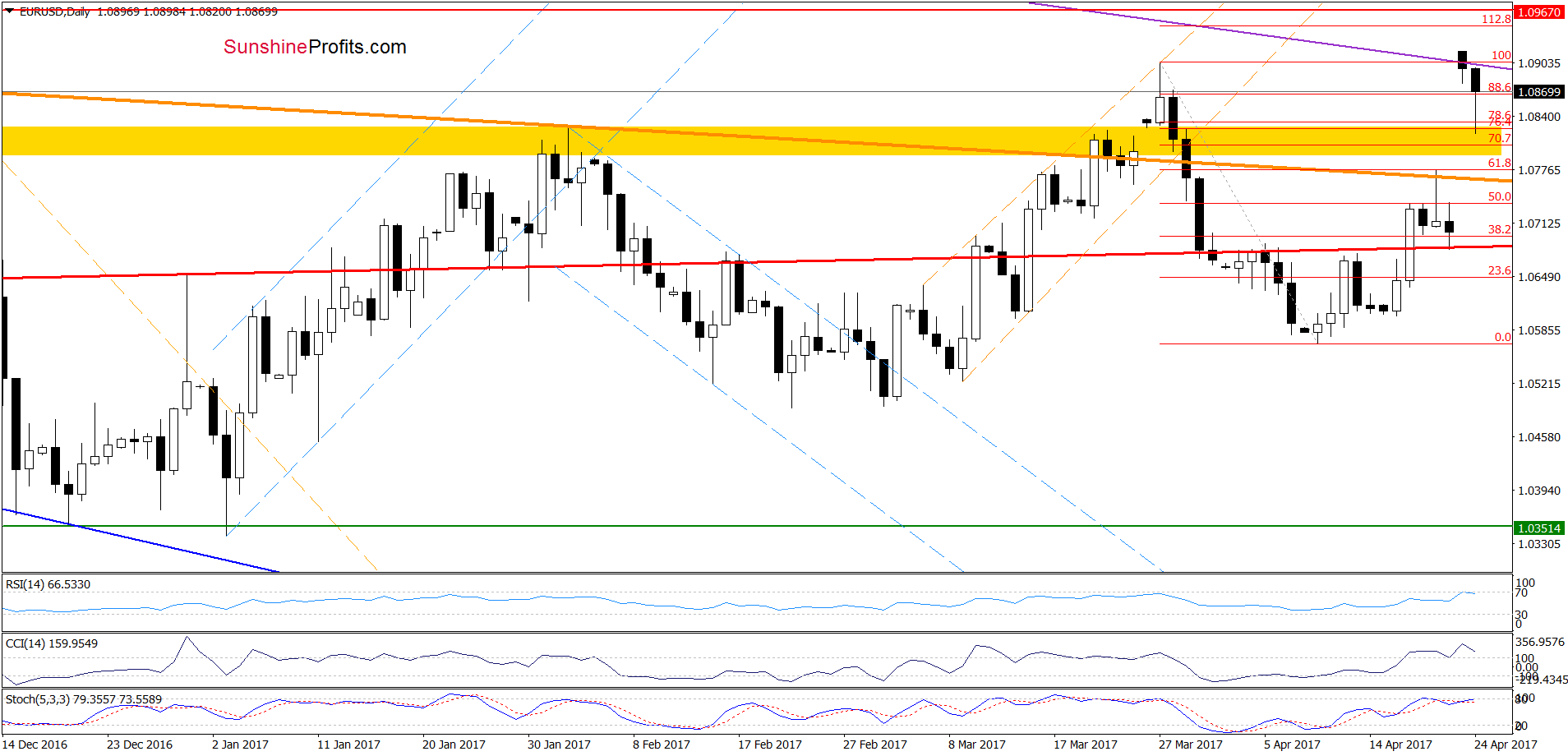

Additionally, the daily RSI (seen on the chart below) generated the sell signal, while the CCI and the Stochastic Oscillator climbed to their overbought areas, suggesting that reversal and lower values of the exchange rate are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

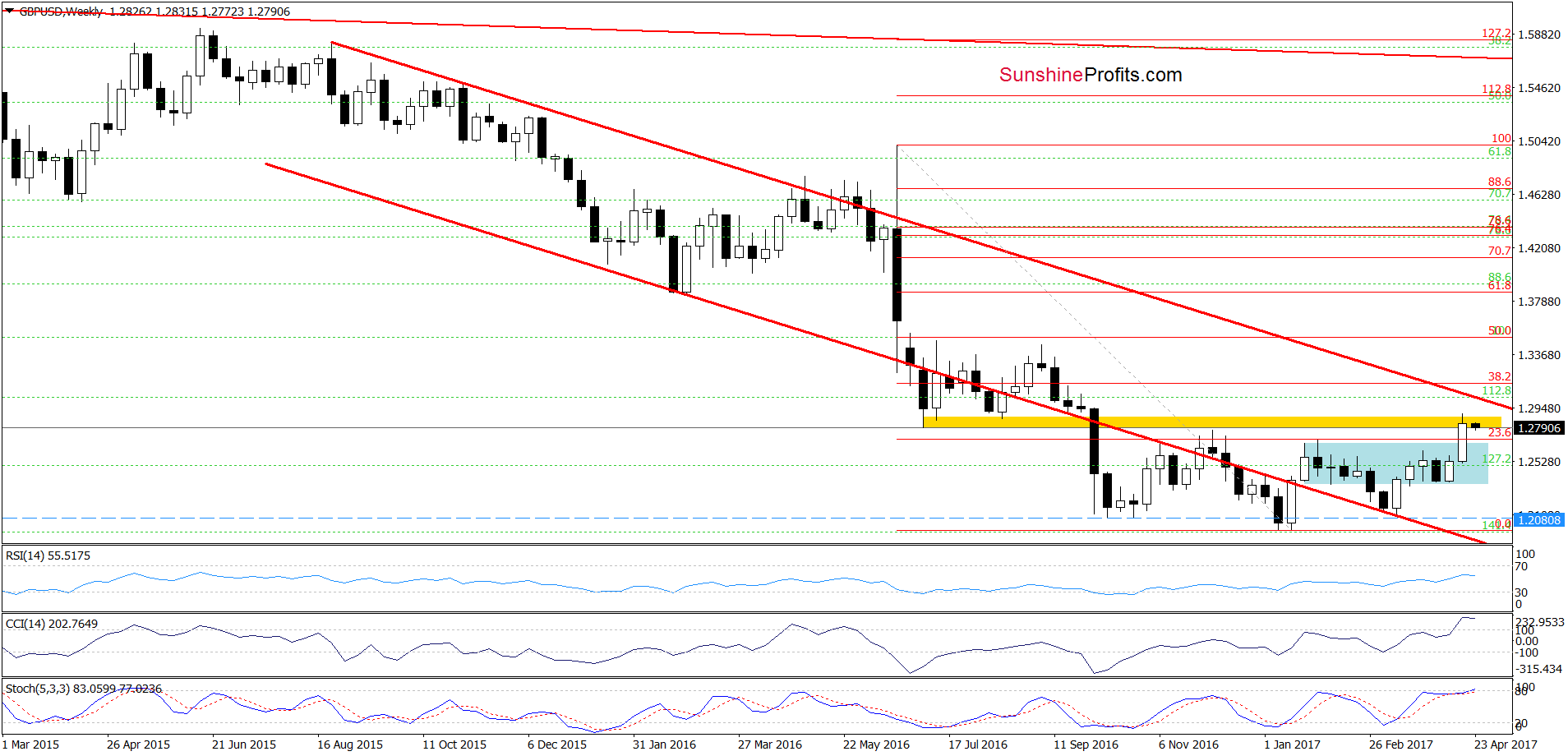

From today’s point of view, we see that the overall situation hasn’t changed much as GBP/USD remains in the blue consolidation in the yellow resistance zone (marked on the weekly chart). Therefore, our last commentary on this currency pair is up-to-date:

(…) the yellow resistance zone (…) was strong enough to stop currency bulls at the beginning of Ddecember, which together with the current position of the weekly indicators suggest that we may see a reversal in the coming week.

How did this ncrease affect the very short-term chart?

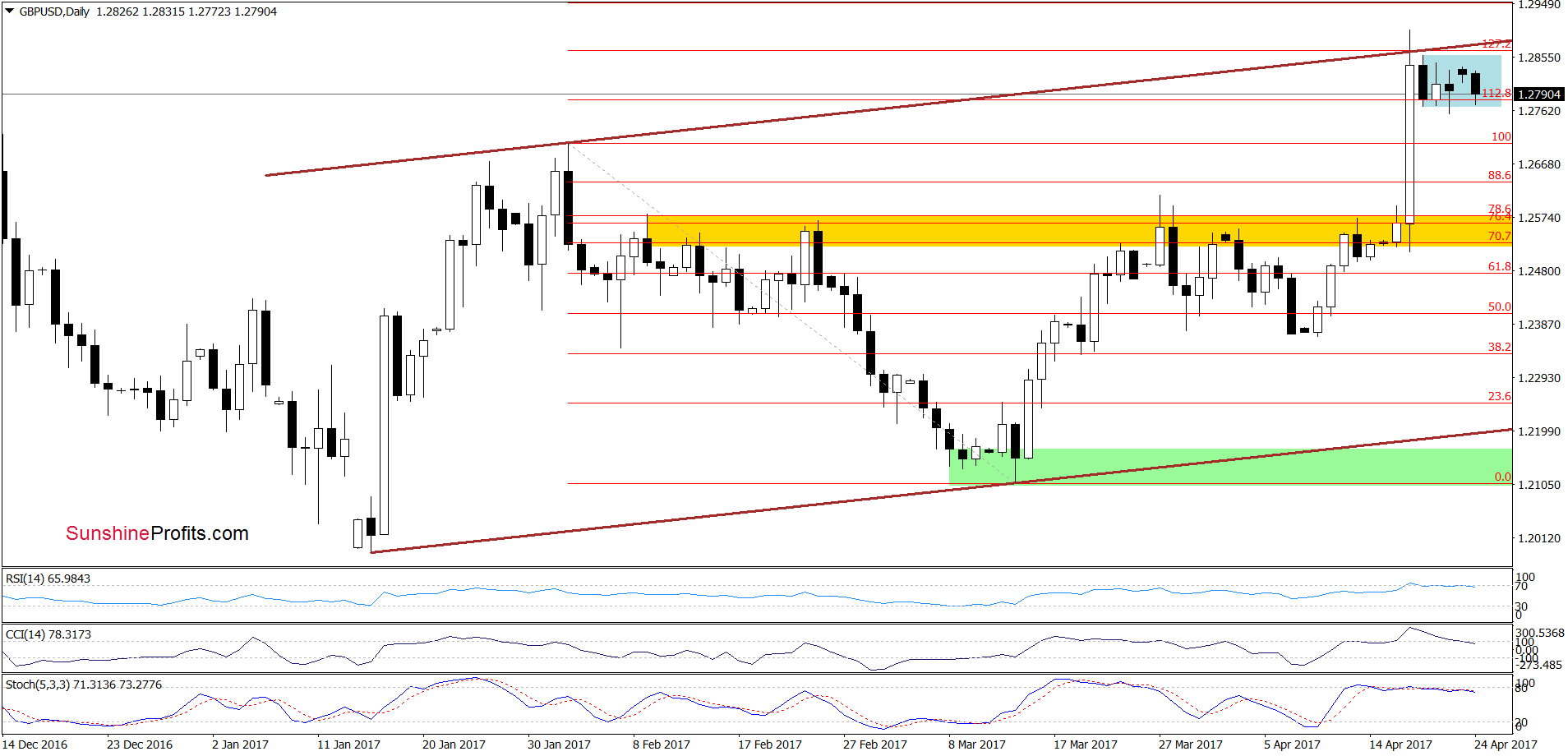

(…) GBP/USD broke above the yellow resistance zone and January high, which resulted in a climb to the upper border of the brown rising trend channel and the 1.272% Fibonacci extension. The combination of these resistances triggered a pullback in the previous days, which suggests that further deterioration may be just around the corner – especially when we factor in the medium-term picture and the current position of the daily indictors (the RSI and the Stochastic Oscillator generated sell signals, while the CCI is very close to doing the same). However, as long as there is no invalidation of the breakout above the January high, short-lived moves in both directions are likely.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

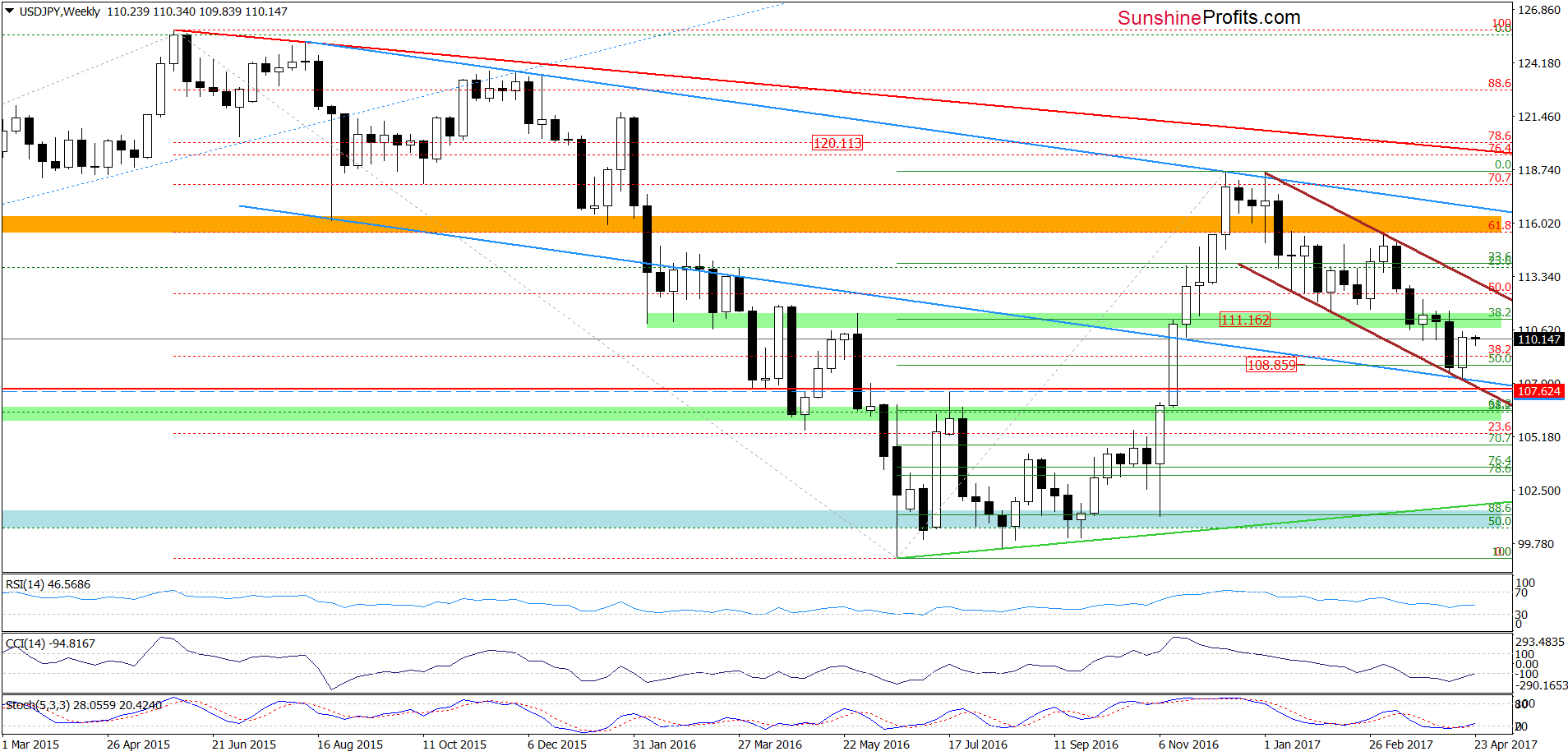

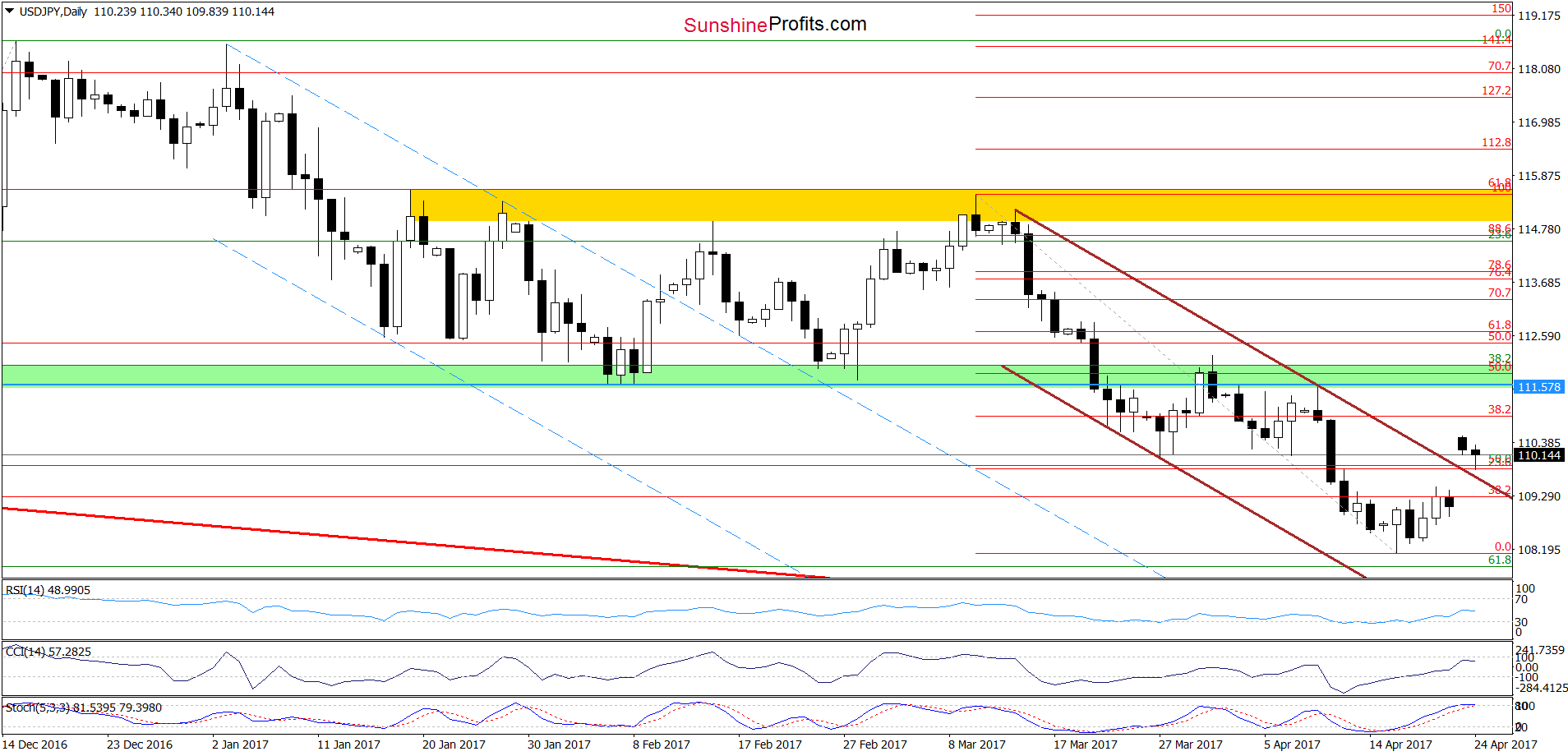

Looking at the charts, we see that the combination of the lower border of the brown declining trend channel and the lower line of the blue trend channel (both marked on the weekly chart) triggered a rebound, which took the exchange rate above the upper line of the brown declining trend channel seen on the daily chart. Earlier today, the pair moved a bit lower, which looks like a verification of the earlier breakout. If this is the case, we’ll see further improvement and a test of the green zone (marked on the daily chart in the coming days.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 107.62 and the initial upside target at 111.16) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts