Earlier today, the ADP report showed that U.S. non-farm private employment increased more-than-expected, which pushed the greenback higher against other currencies. How did this increase affect the euro, the Swiss franc and the Australian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0967; the initial downside target at 1.0521)

- GBP/USD: short (a stop-loss order at 1.2738; the downside target at 1.2157)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (a stop-loss order at 0.9708; the upside target at 1.0145)

- AUD/USD: short (a stop-loss order at 0.7873; the initial downside target at 0.7498)

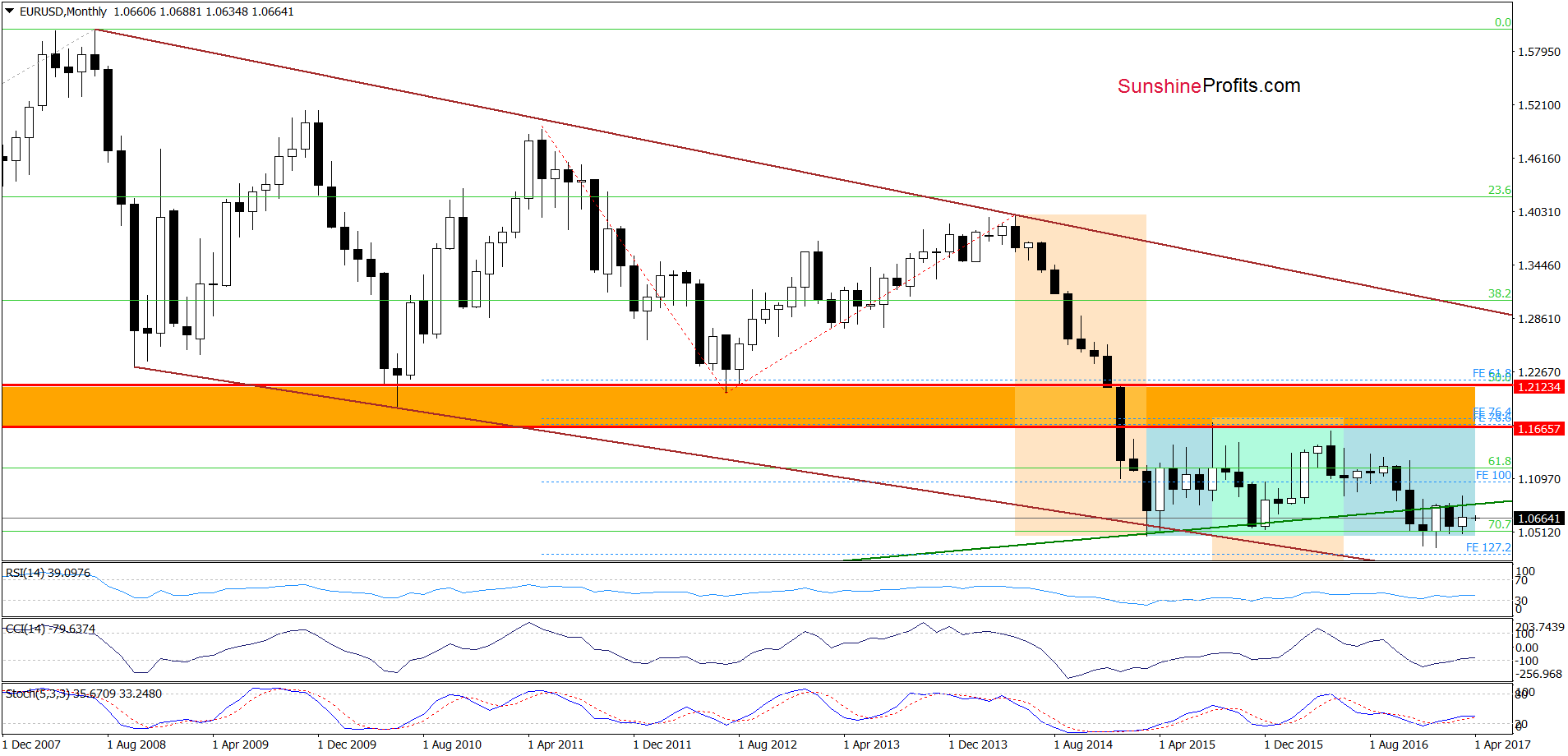

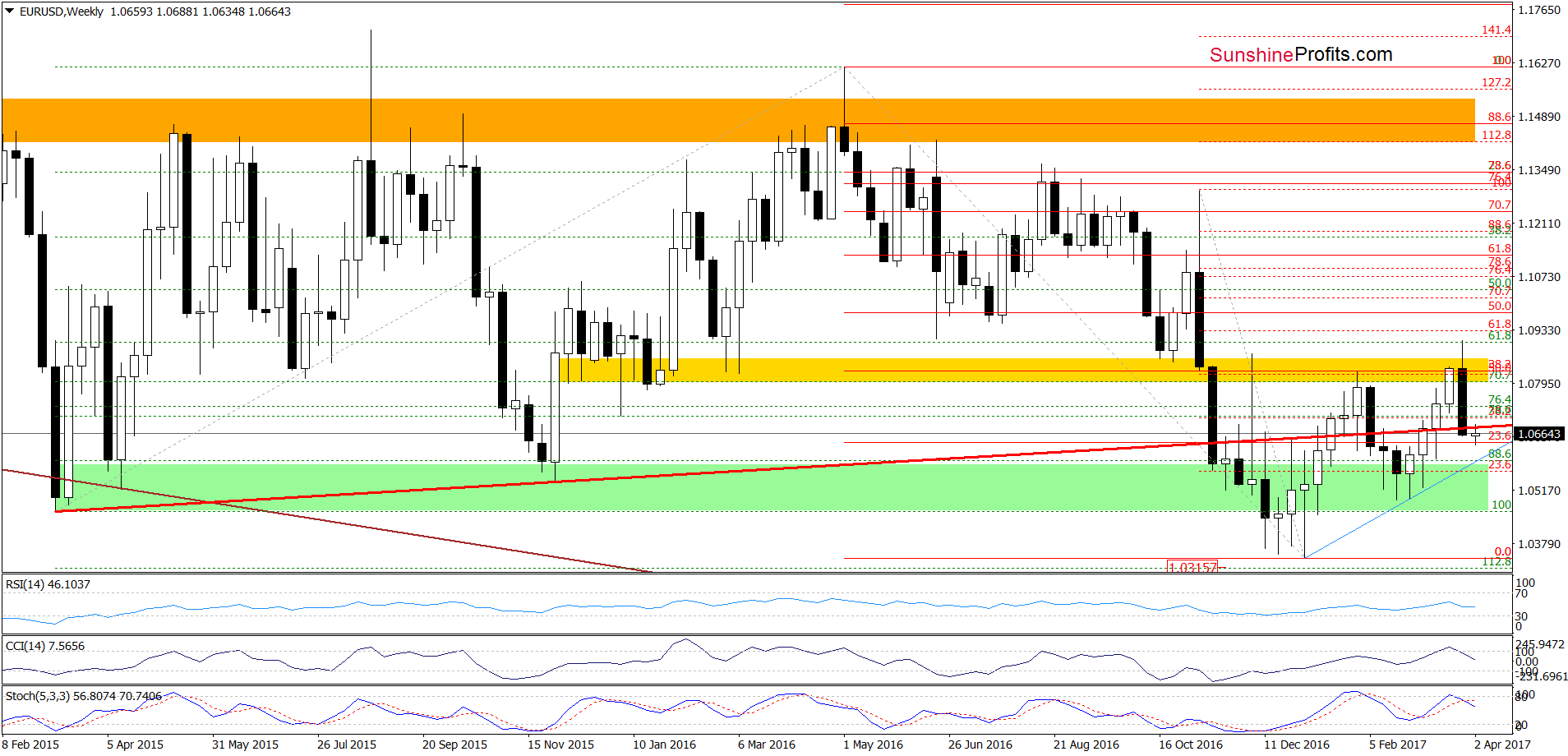

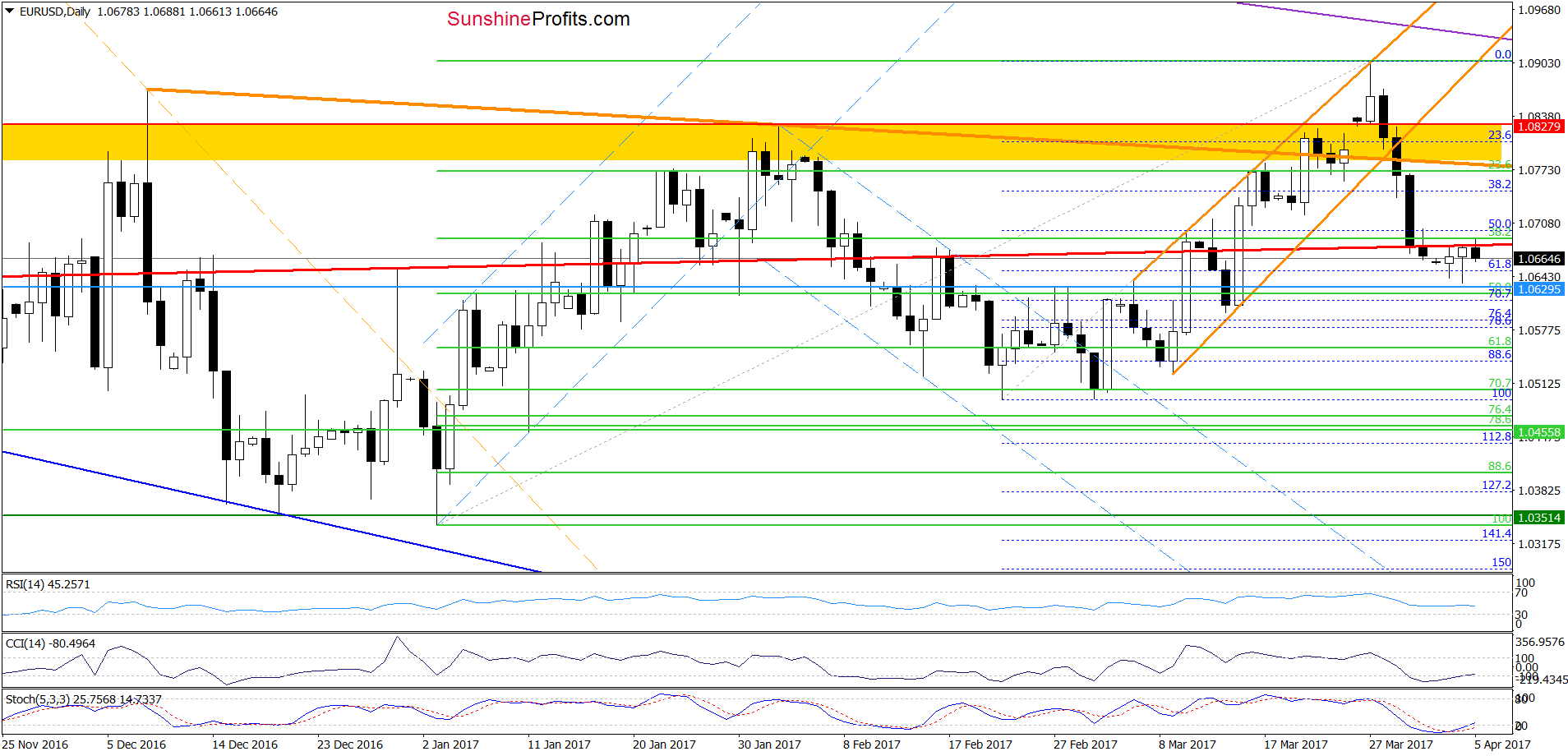

EUR/USD

From today’s point of view, we see that EUR/USD moved a bit higher earlier today, which looks like another verification of the earlier breakdown under the long-term red support/resistance line. This means that what we wrote on Monday is up-to-date also today:

The first thing that catches the eye on the weekly chart is an invalidation of the earlier breakout above the long-term red support/resistance line based on the March 2015 and November 2015 lows, which is a bearish development. Additionally, the CCI and the Stochastic Oscillator generated the sell signals, increasing the probability of further declines.

How did this drop affect the very short-term picture?

(…) EUR/USD closed Friday’s session under the red support/resistance line. Earlier today, the exchange rate moved a bit higher but then reversed and declined, which looks like a verification of the Friday’s breakdown.

Taking this fact and the long- and medium-term pictures into account, we think that lower values of EUR/USD are more likely than not. Therefore, if the pair extends losses, (…) the initial downside target for currency bears will be around 1.0521 (slightly above the late February and March lows).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.0967 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

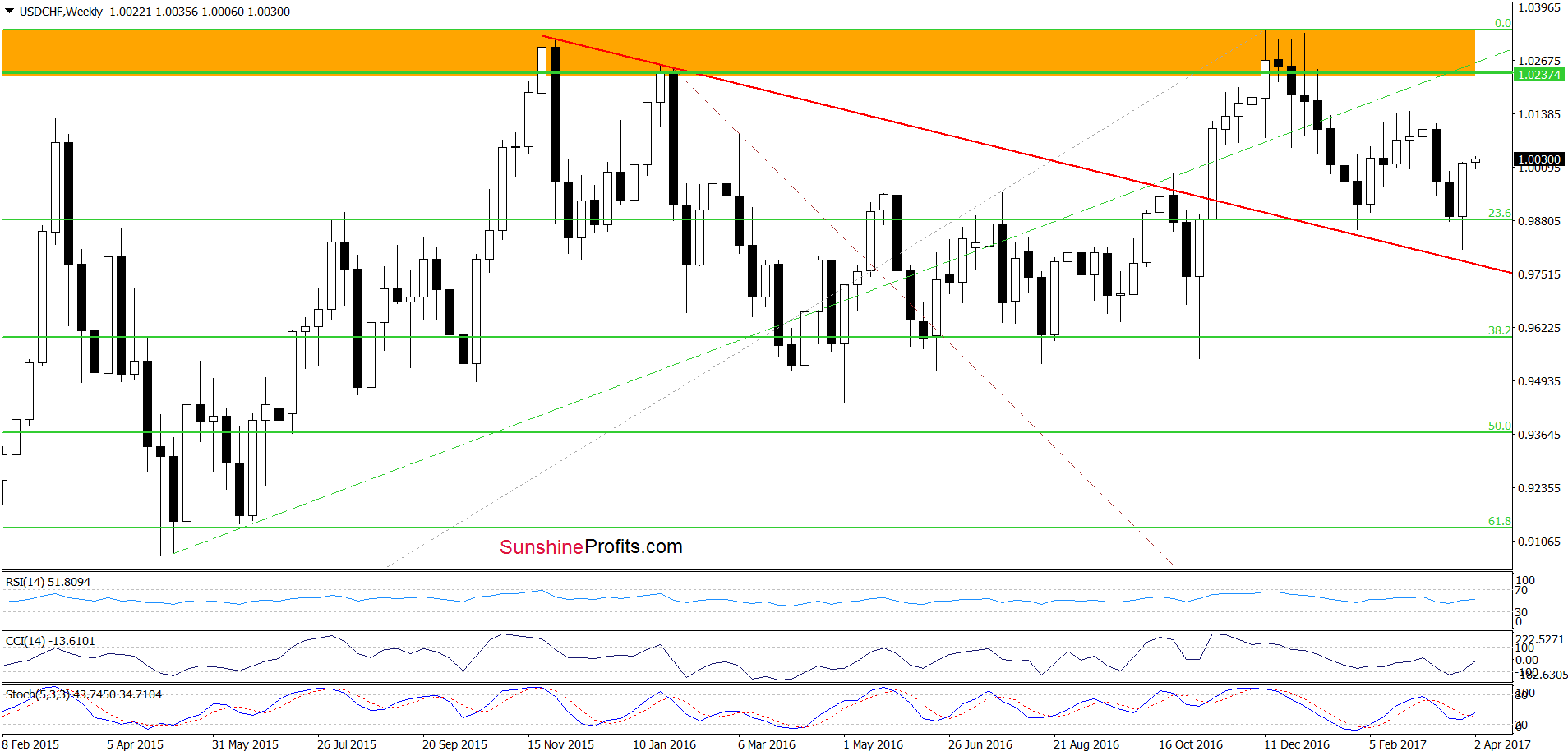

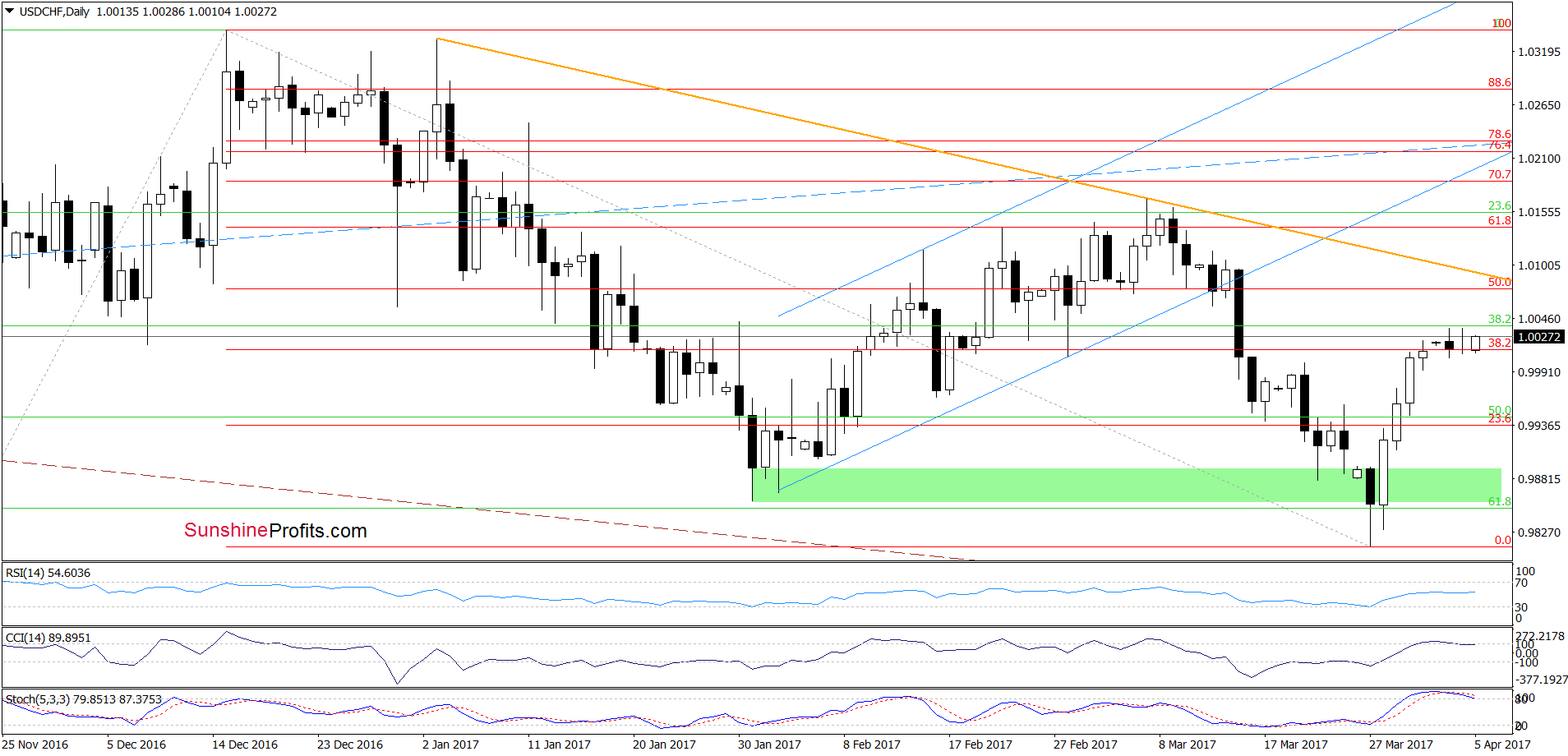

USD/CHF

On the daily chart, we see that USD/CHF broke above the 38.2% Fibonacci retracement based on the entire December – March downward move, which suggests a climb above Monday’s peak. If we see such price action, the next upside target will be the 50% retracement or even the orange declining resistance line based on the January and March highs in the coming days (currently around 1.000). Nevertheless, the current position of the indicators suggests that reversal in the coming days is likely. Therefore, if we see any bearish developments, we’ll likely close our profitable long positions. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 0.9708 and the upside target at 1.0145) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

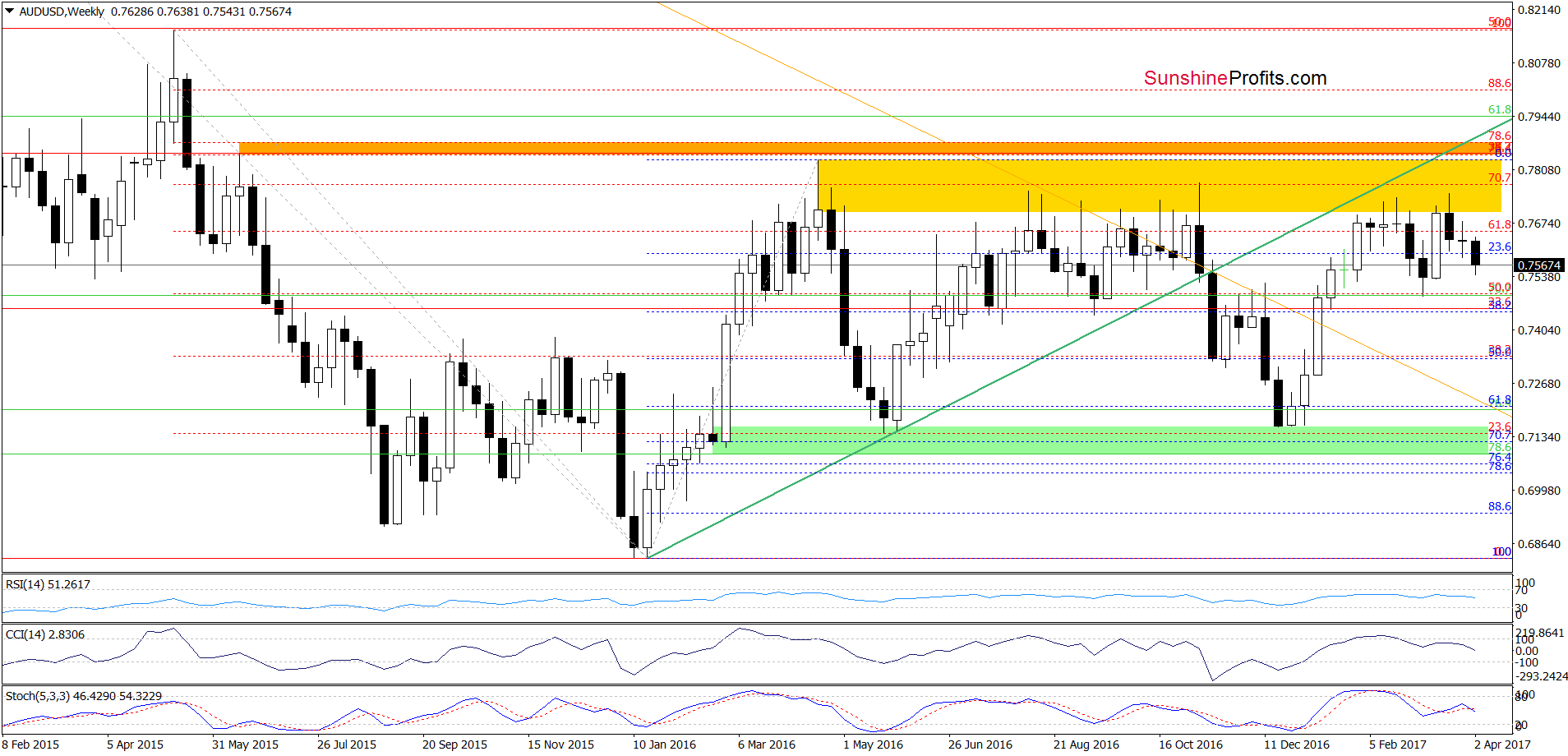

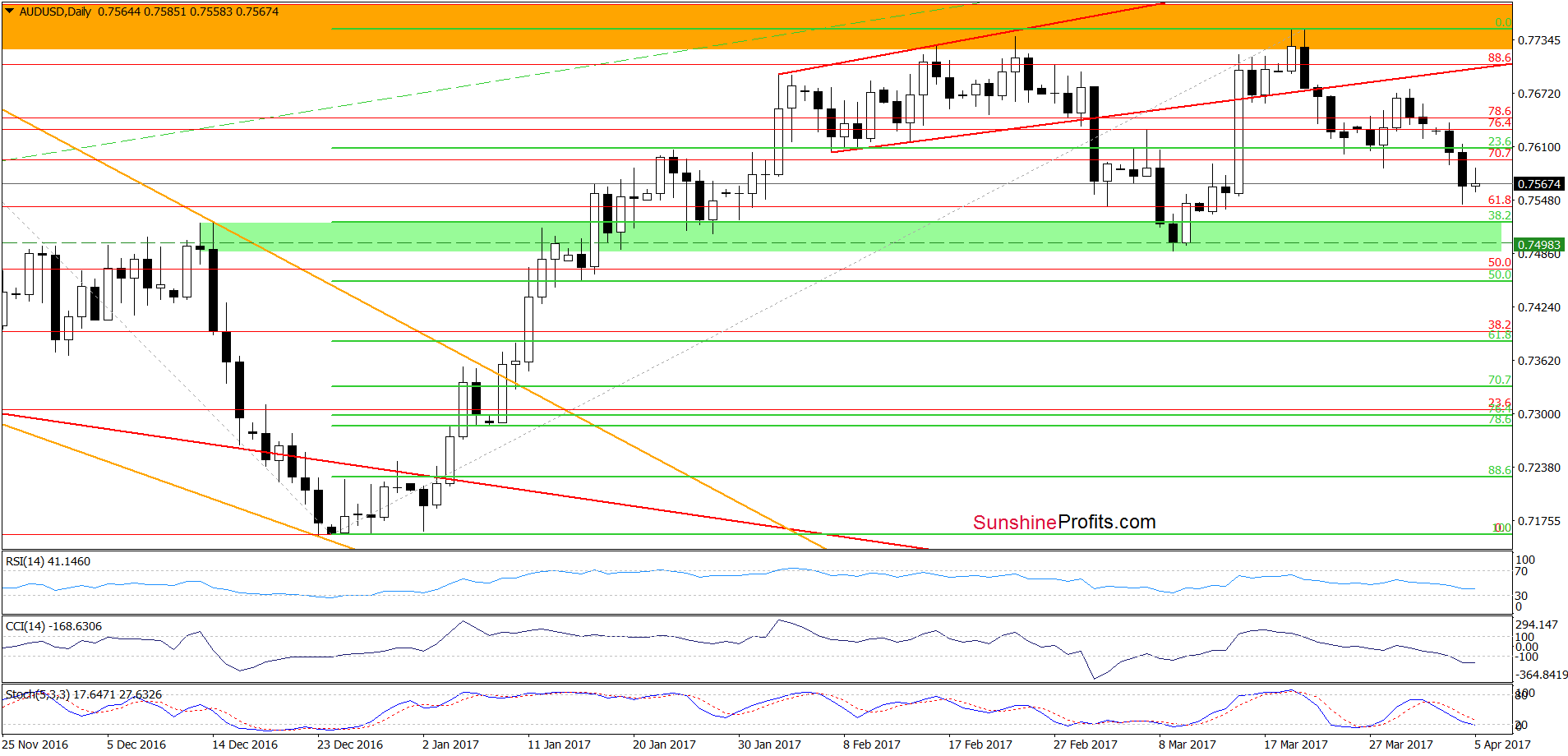

AUD/USD

Yesterday, AUD/USD extended declines and approached the green support zone, which triggered a small rebound earlier today. Despite this move, the sell signals generated by the indicators remain in place, which suggests that (a least) one more downswing is still ahead us. If this is the case, and the exchange rate moves lower, we’ll see a test the 38.2% Fibonacci retracement in the following days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.7873 and the initial downside target at 0.7498) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts