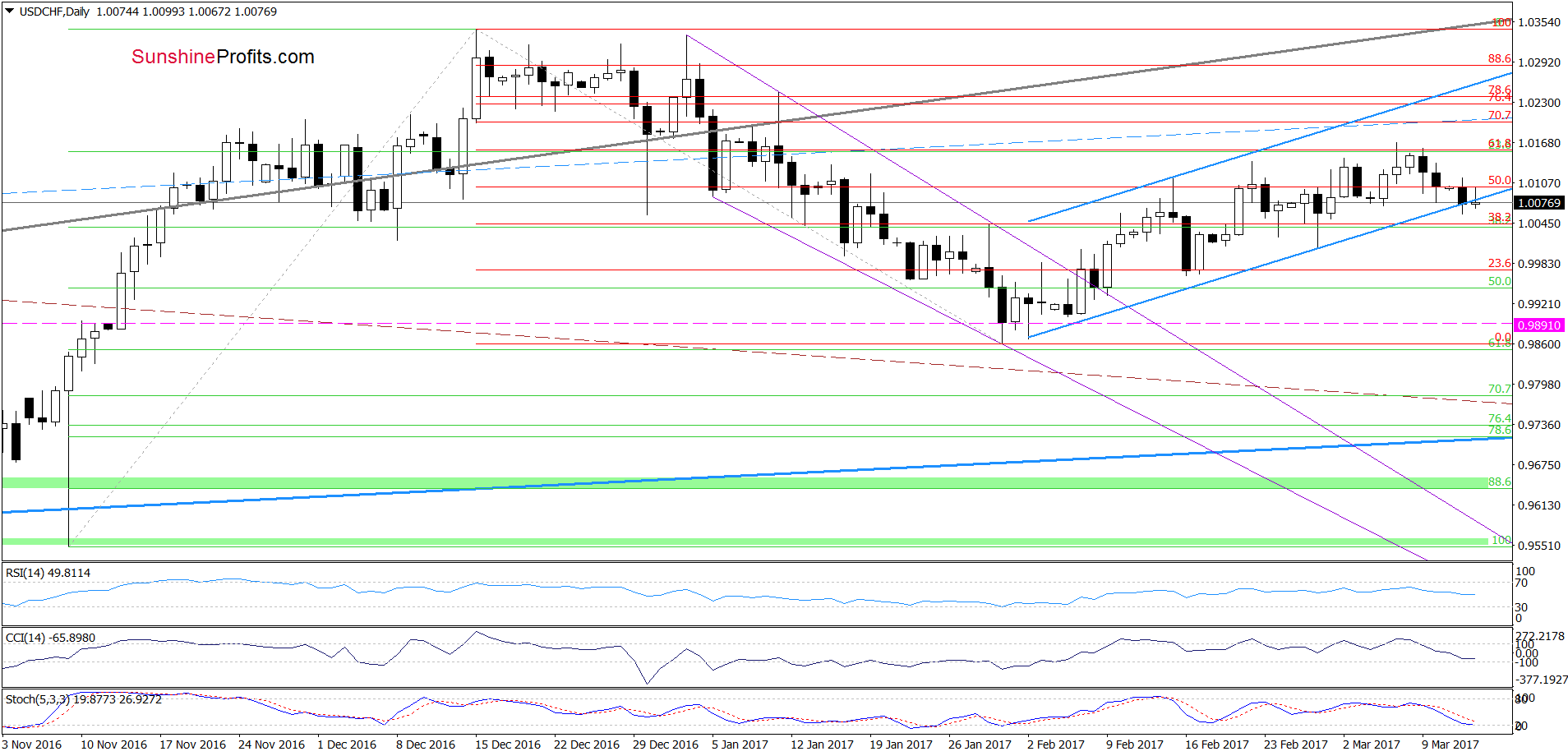

Yesterday, the U.S. dollar moved lower against the Swiss franc, which pushed USD/CHF under the lower border of the rising trend channel. Will currency bulls be strong enough to push the pair higher in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.0810; the initial downside target at 1.0388)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (a stop-loss order at 0.9891; the initial upside target at 1.0180)

- AUD/USD: none

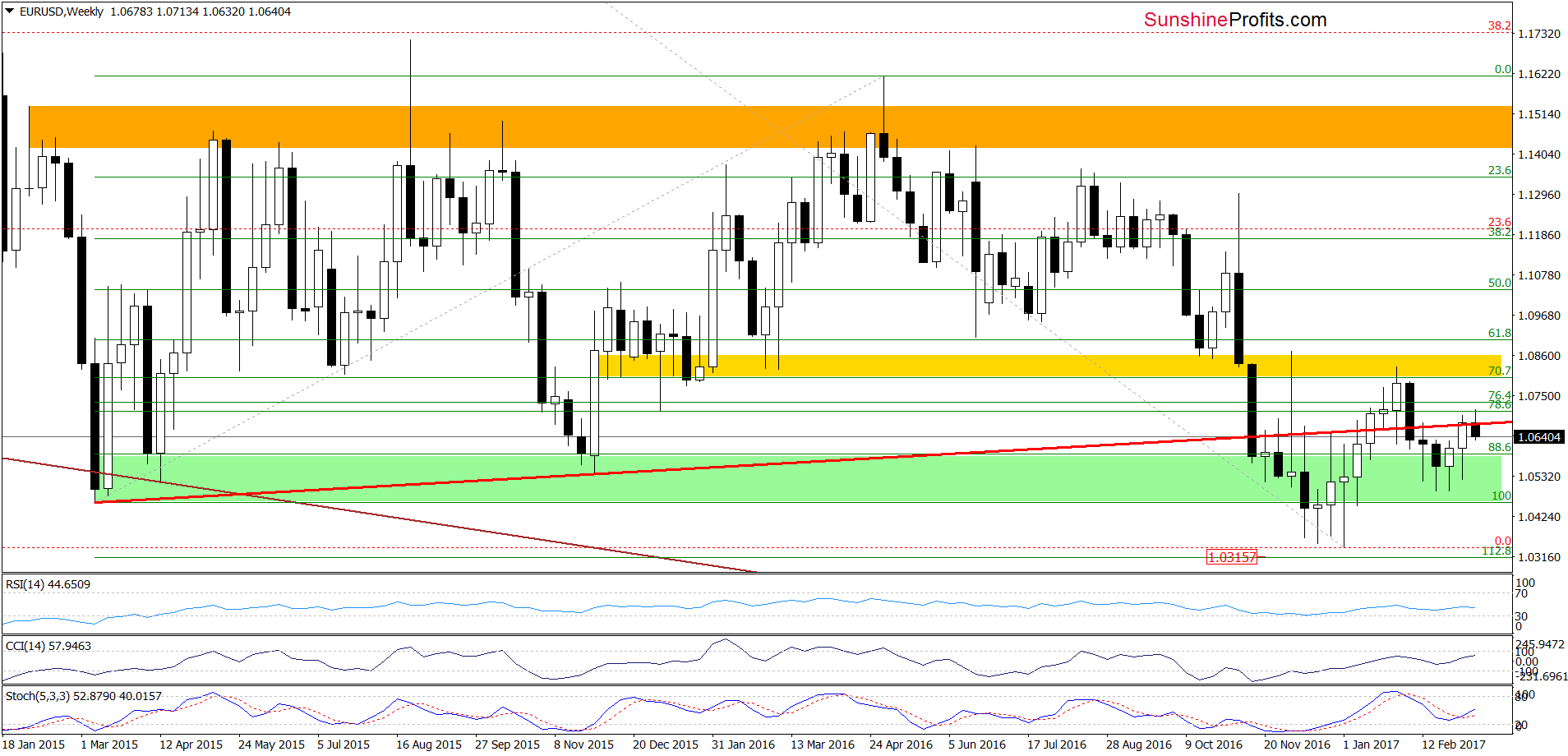

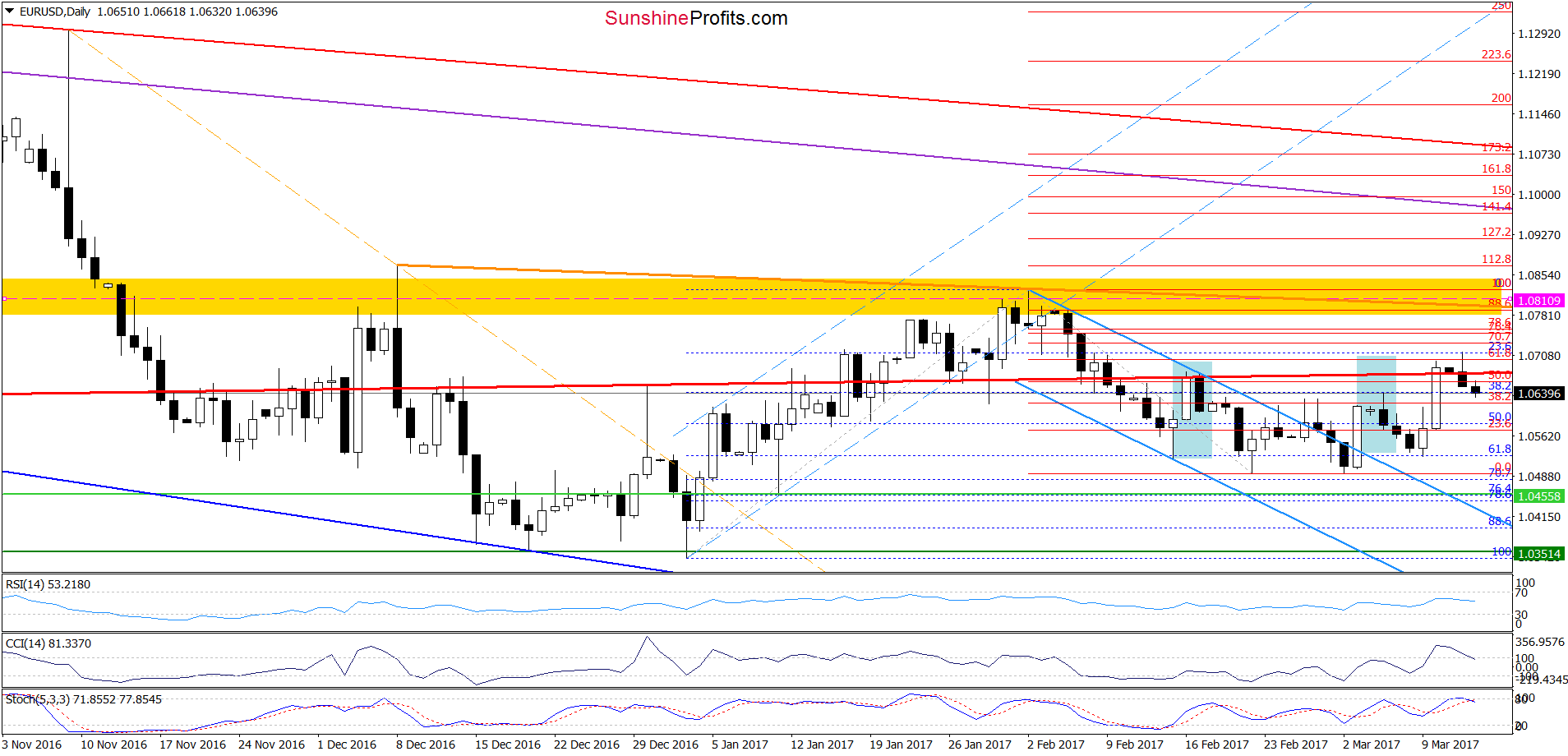

EUR/USD

Quoting our previous alert:

(....) the exchange rate also climbed to the 61.8% Fibonacci retracement, which paused the rally. In this area, the size of the rebound corresponded to the height of the blue declining trend channel, which alsoreduced the buying pressure. What’s next? Taking all the above into account and the fact that EUR/USD invalidated today’s tiny breakout above the 61.8% Fibonacci retracement, we think that currency bears will push the pair lower in the coing day(s). If this is the case, and the exchange rate invalidates the breakout above the red resistance line (closing the day below it), we’ll see further deterioration (....)

From today’s oint of vie, we see that the situation developed in line with the above scenario and EUR/USD closed yesterday’s session under the red resistance line, invalidating the earlier breakout. Additionally, the CCI and the Stochastic Oscillator generated the sell signals, which suggests (at least) a test of the recent lows in the following days.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.0810 and the initial downside target at 1.0388 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

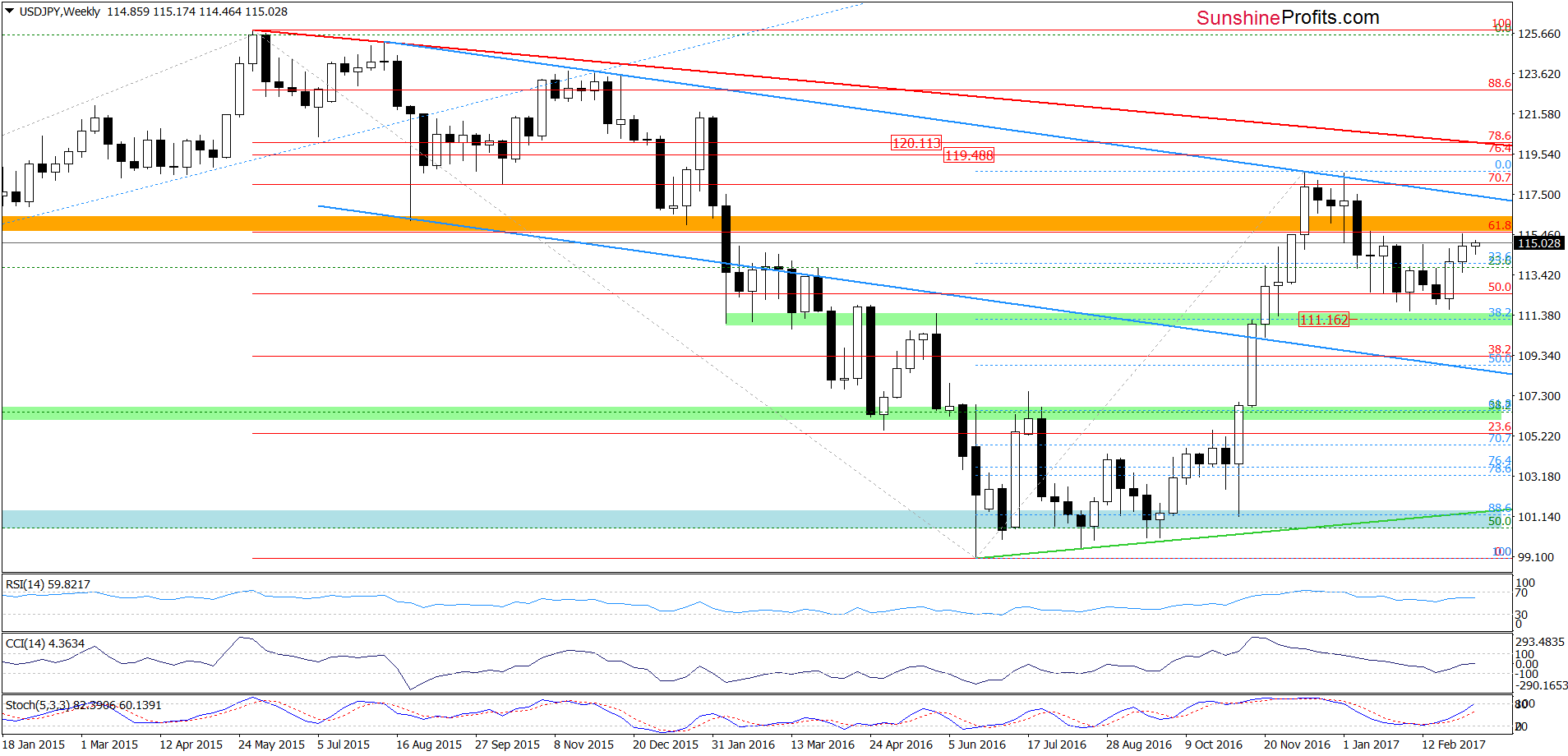

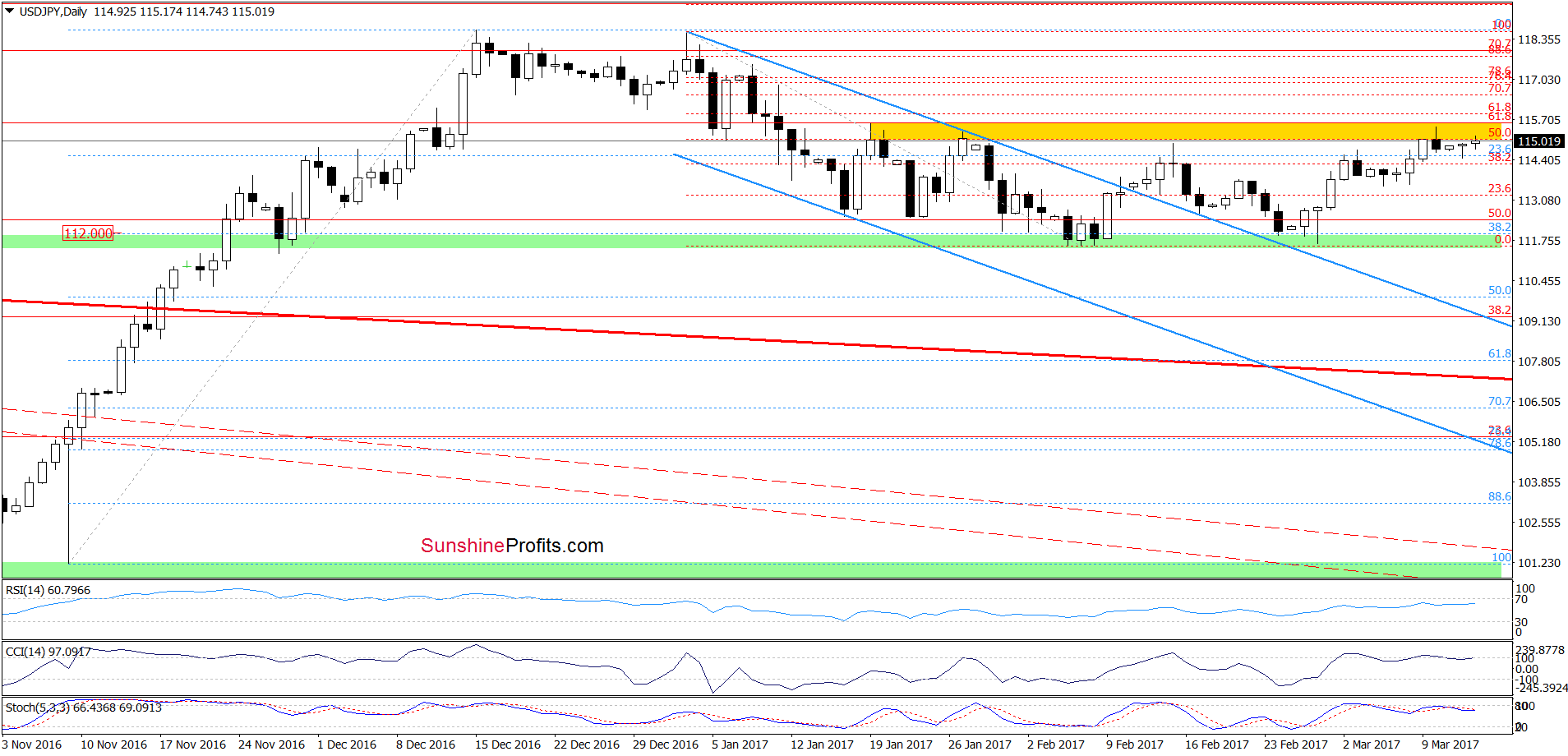

USD/JPY

On March 1, we wrote the following:

(…) USD/JPY moved lower, which looks like another re-test of the strength of the green support zone (…) which together with the position of the indicators suggest that (…) reversal is just around the corner. If (…) the pair rebounds in the following days, the initial upside target will be the yellow resistance zone.

On the daily char, we see that currency bulls pushed USD/JPY higher (as we had expected), which resulted in an increase to our upside target. Where will the exchange rate head next? Taking into account the current position of the indicators it seems that another attempt to move lower is just around the corner – especially when we factor in the proximity to the yellow resistance zone. As you see, this area was strong enough to stop currency bulls several times in the previous weeks, which increases the probability of reversal. If his is the case and USD/JPY declines from here, the initial downside target will be around 113.54-113.58, where the recent lows are.

When can we expect further rally? In our opinion, another bigger move to the upside will be more likely and reliable only if we see a breakout above the yellow resistance zone.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

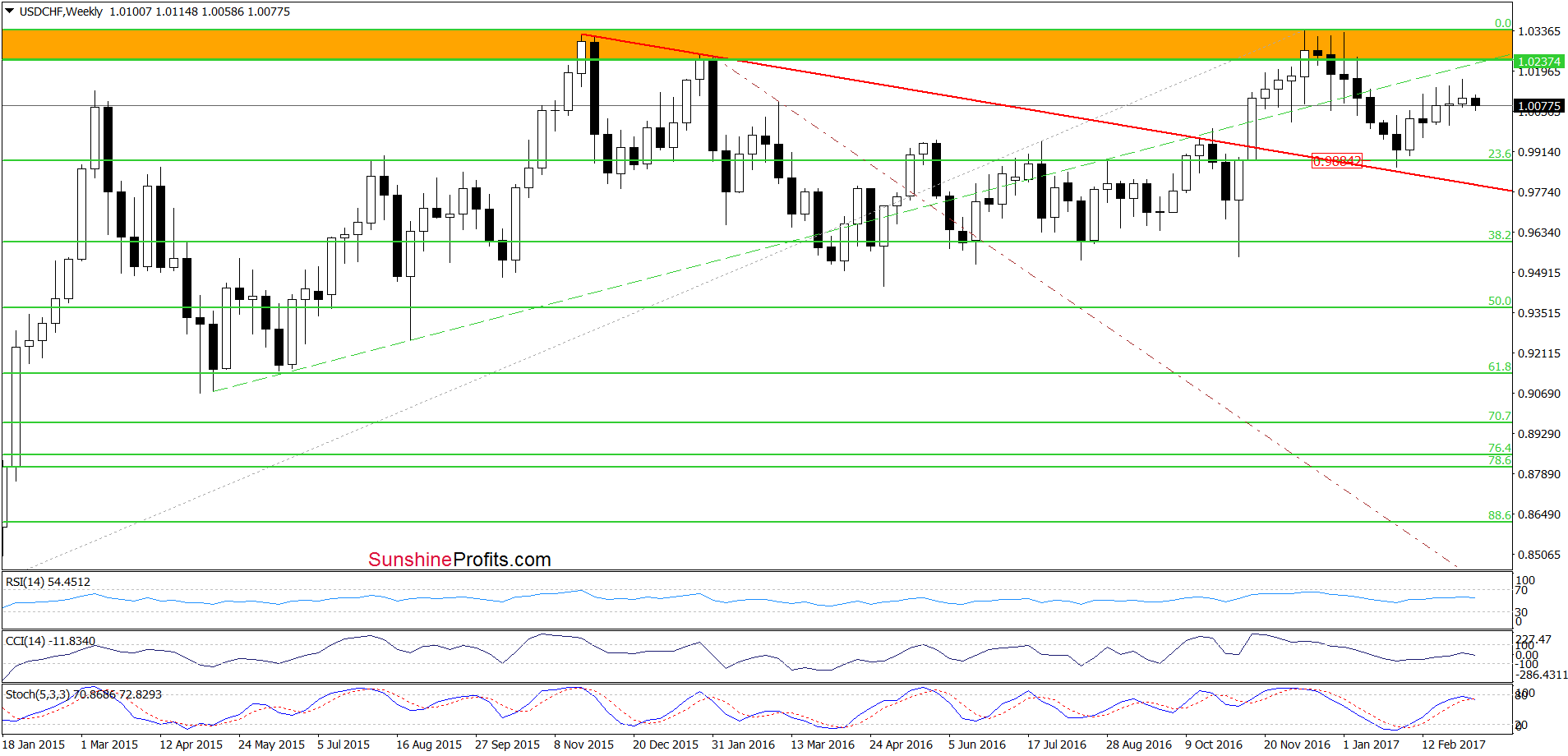

USD/CHF

On the daily chart, we see that although USD/CHF slipped under the lower border of the blue rising trend channel yesterday (and earlier today), this deterioration was temporary and currency bulls tried to push the pair higher. This suggests that as long as there is no daily closure under this line another attempt to move higher is likely – especially when we factor in the fact that the CCI and the Stochastic Oscillator are very close to generating buy signals. If this is the case and the pair closes today’s session above the lower blue line, invalidating this tiny breakdown it will be a bullish development, which will likely encourage currency bulls to act and result in an upward move to the upper border of the formation in the following days.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.9891 and the initial upside target at 1.0180 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts