In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1180; downside target at 1.0568)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (a stop-loss order at 0.9664; upside target at 1.0237)

- AUD/USD: none

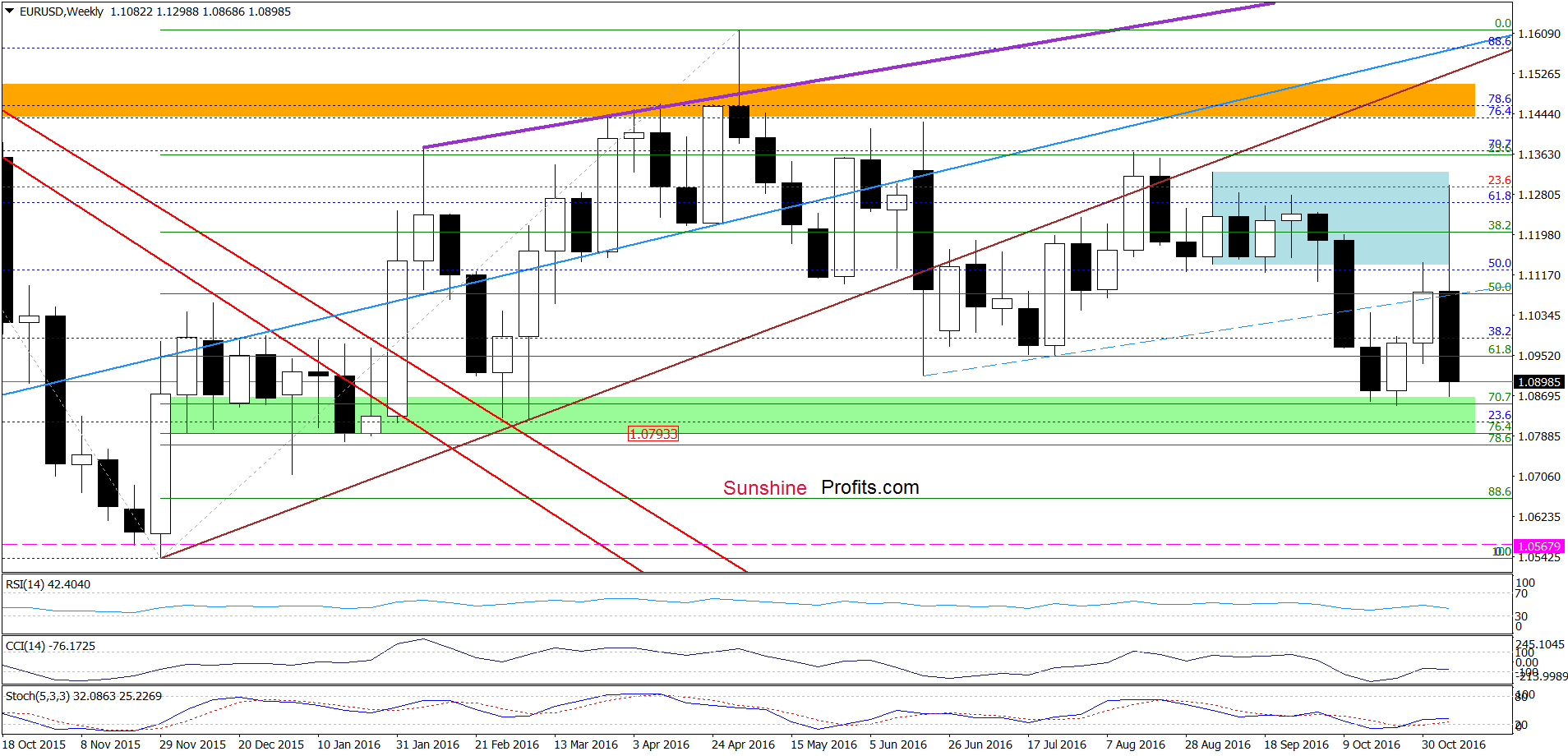

EUR/USD

Yesterday, we wrote:

(...) invalidation of earlier breakout above the blue dashed support/resistance line and its negative impact on the EUR/USD is still in effect and suggests further deterioration in the coming week.

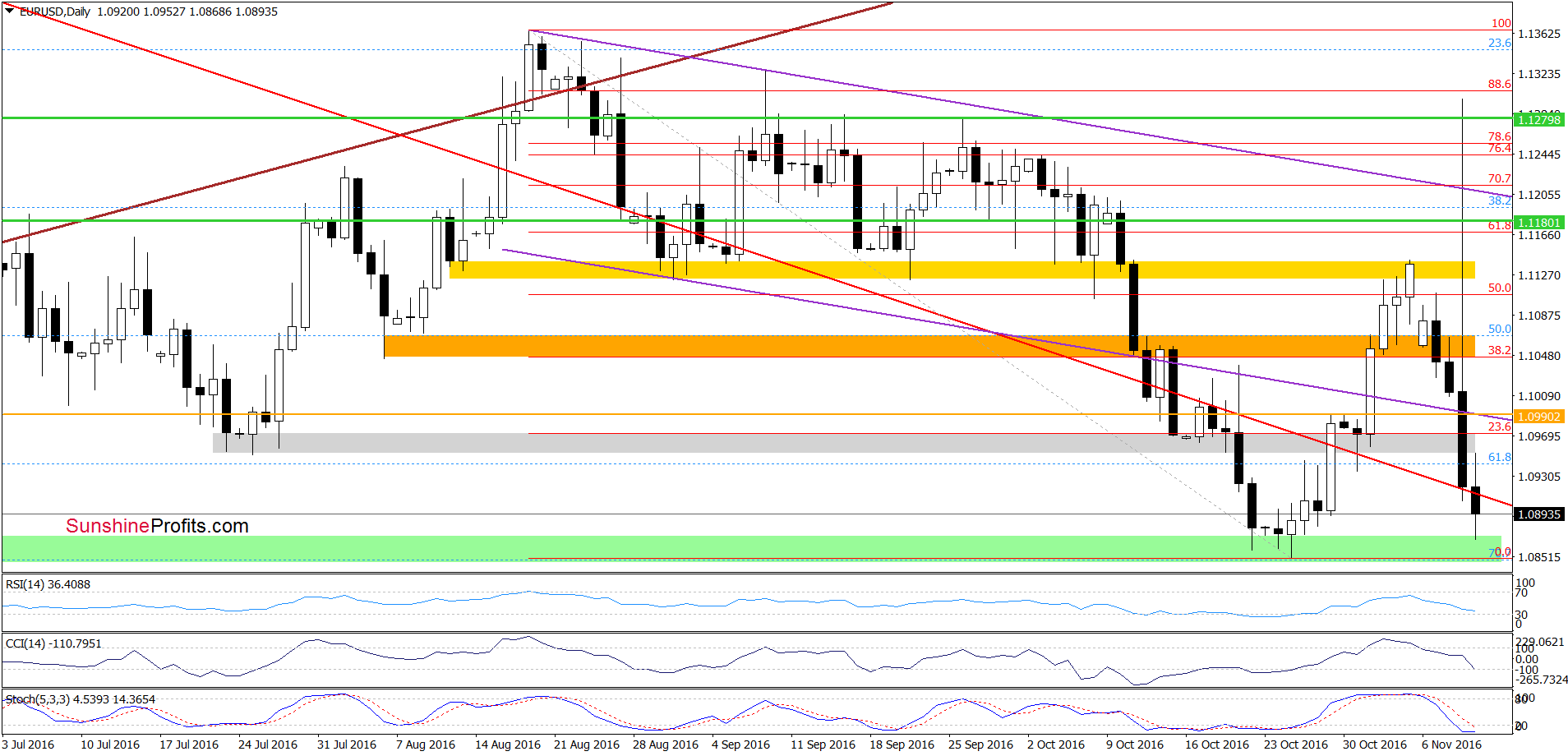

From today’s point of view, we see that the situation developed in line with the above scenario and EUR/USD extended losses. How did this drop affect the very short-term picture? Let’s check.

Looking at the daily chart, we see that currency bears pushed EUR/USD not only below the orange support zone, but also under the grey support zone and the red declining line, which resulted in a test of the green support zone based on the Oct lows. Although the exchange rate rebounded earlier today, sell signals generated by the indicators remain in place suggesting further deterioration. Therefore, if the pair moves lower from current levels, we’ll likely see a test of the lower border of the green support zone marked on the weekly chart (around 1.0793) in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1180 and downside target at 1.0568) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

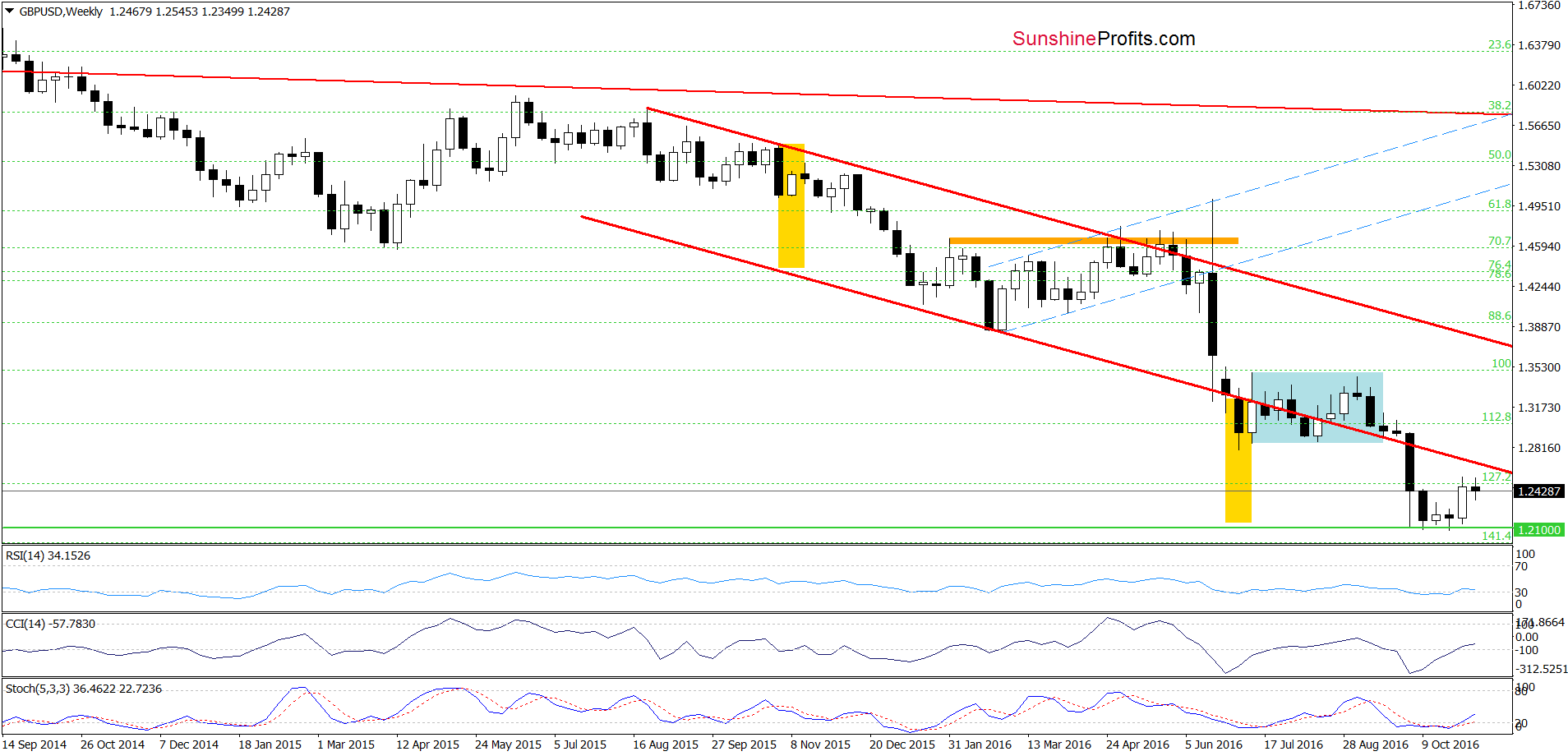

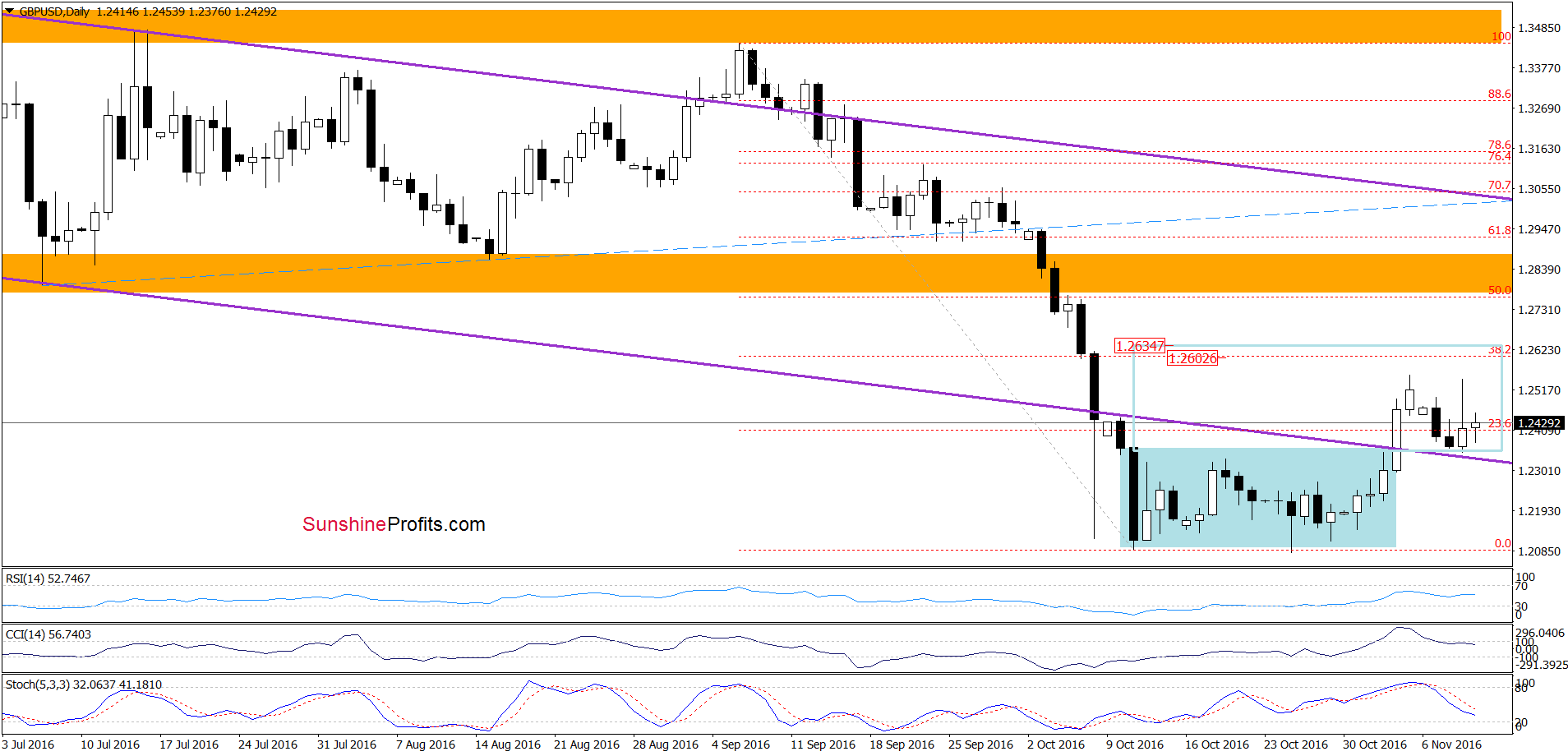

GBP/USD

Although GBP/USD moved lower yesterday, currency bulls stopped further deterioration, which resulted in a small rebound earlier today. Such price action looks like a verification of earlier breakout above the lower purple line, which suggests further improvement. If this is the case and the exchange rate increases from here, we’ll see a realization of the last Wednesday’s scenario:

(…) what could happen if currency bulls manage to push GBP/USD above the purple resistance line and the upper border of the blue consolidation? In our opinion, such positive event could trigger an upward move to around 1.2602, where the 38.2% Fibonacci retracement (based on the Sep-Oct downward move) is. Additionally, slightly above this level (around 1.2634) the size of the upswing would correspond to the height of the formation, which could encourage currency bears to act.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, unless there are very important developments in the market, there will be no alert tomorrow due to the Veteran's Day and the travel schedule of your Editor. The Monday's alert will be posted normally.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts