Earlier today, the Conference Board showed that its consumer confidence index rose to 104.1, beating analysts’ expectations. Thanks to this increase, the USD Index extended gains and climbed above the level of 95.50. How did this move affect the euro, British pound and Australian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1114; initial upside target at 1.1327)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3346; initial downside target at 1.2876)

- USD/CHF: none

- AUD/USD: none

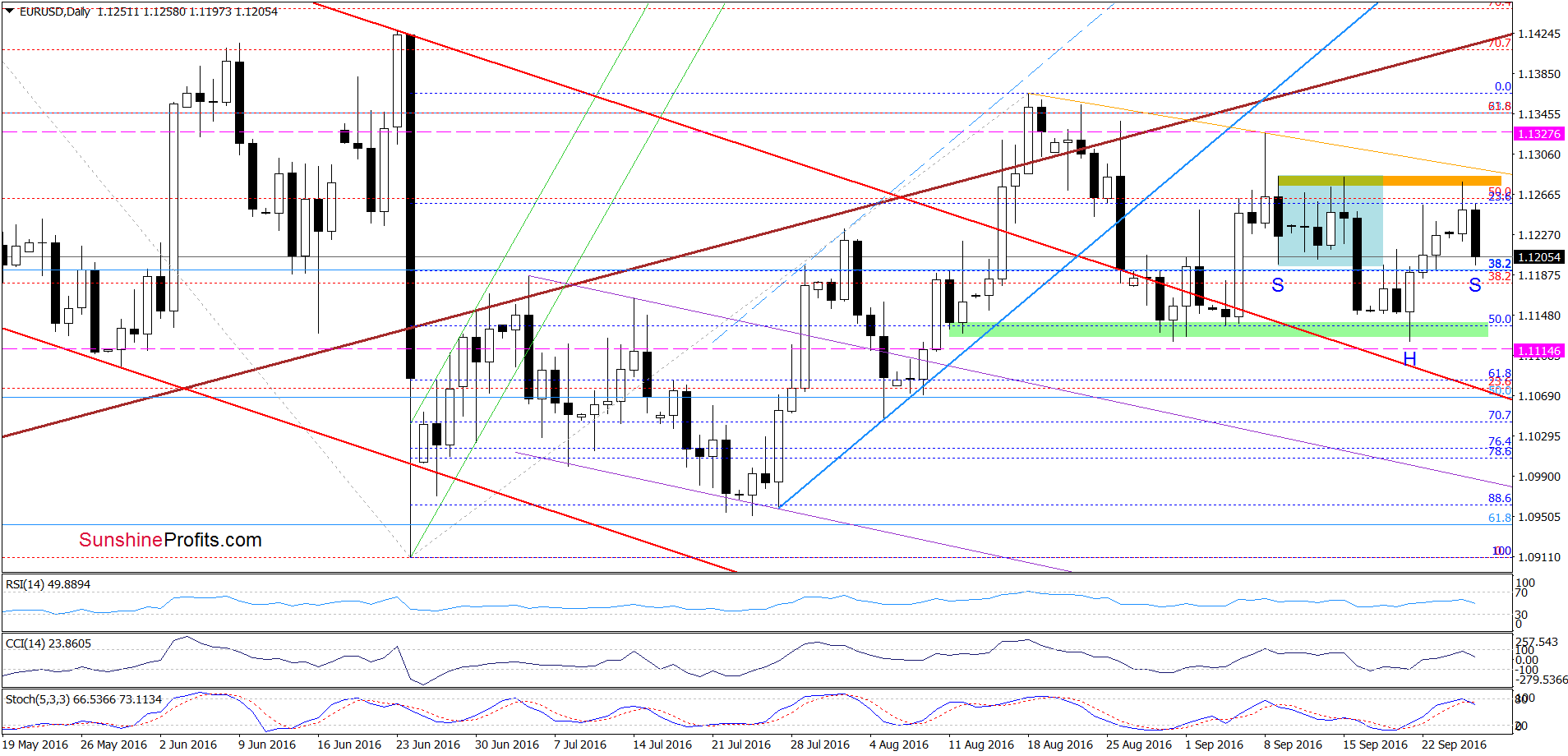

EUR/USD

From the daily perspective, we see that EUR/USD reached the orange resistance zone (based on the upper border of the blue consolidation), which triggered a decline earlier today. Additionally, the CCI and Stochastic Oscillator generated sell signals, suggesting further deterioration in the coming days. Nevertheless, when we take a closer look at the daily chart we can notice a potential reverse head and shoulders formation. If this is the case, the right shoulder is currently underway and we should see a reversal in the coming day(s). Nevertheless, if the exchange rate drops under 1.1174 we’ll likely close long positions. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions (with a stop-loss order at 1.1114 and initial upside target at 1.1327) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

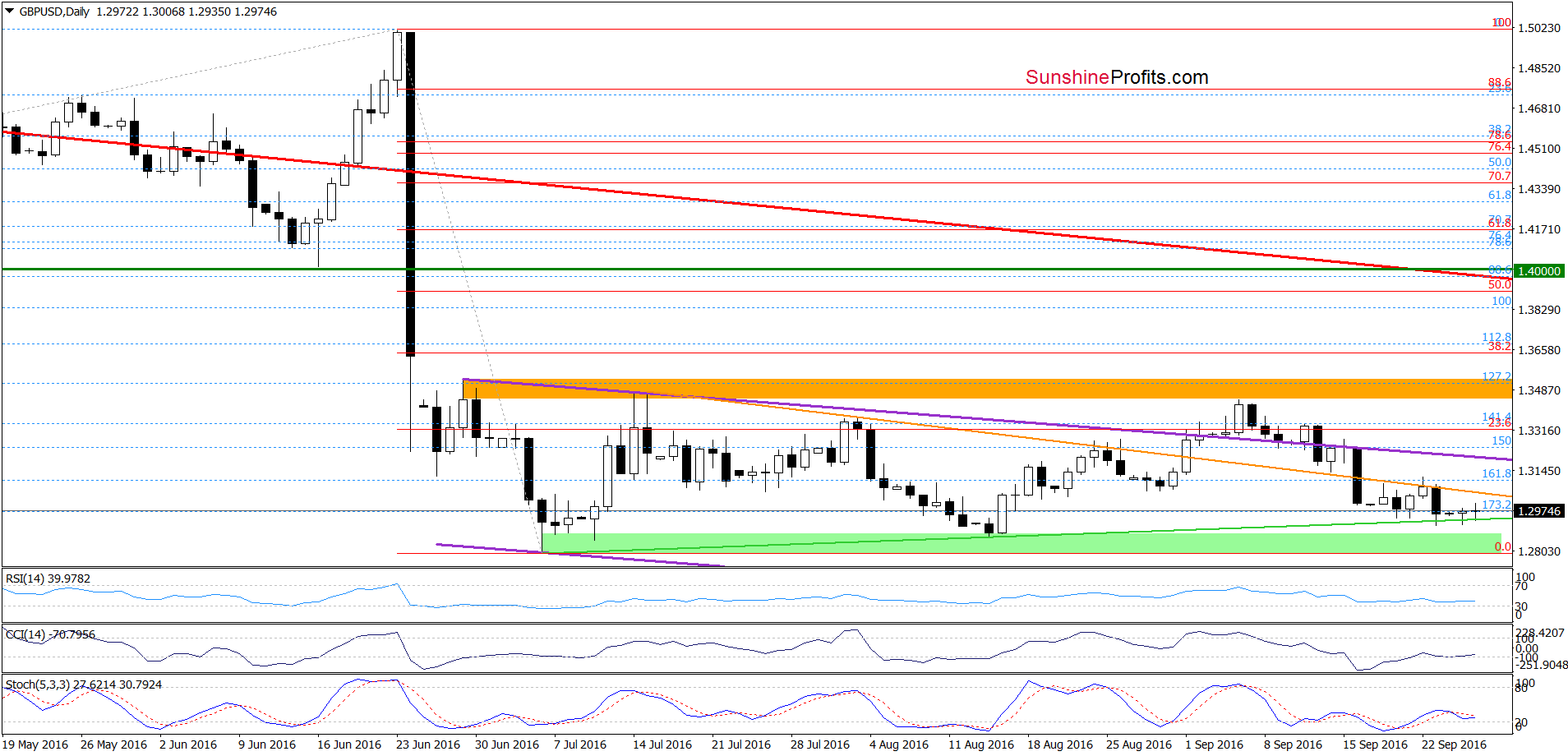

GBP/USD

Looking at the charts from today’s point of view, we see that GBP/USD slipped to the green support line based on the previous lows (marked on the daily chart) and the lower border of the red declining trend channel. Additionally, daily CCI and Stochastic Oscillator generated buy signals, which could encourage currency bulls to act in the coming days. Nevertheless, in our opinion, as long as there won’t be invalidation of the breakdown under the orange resistance line another bigger move to the upside is not likely to be seen.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

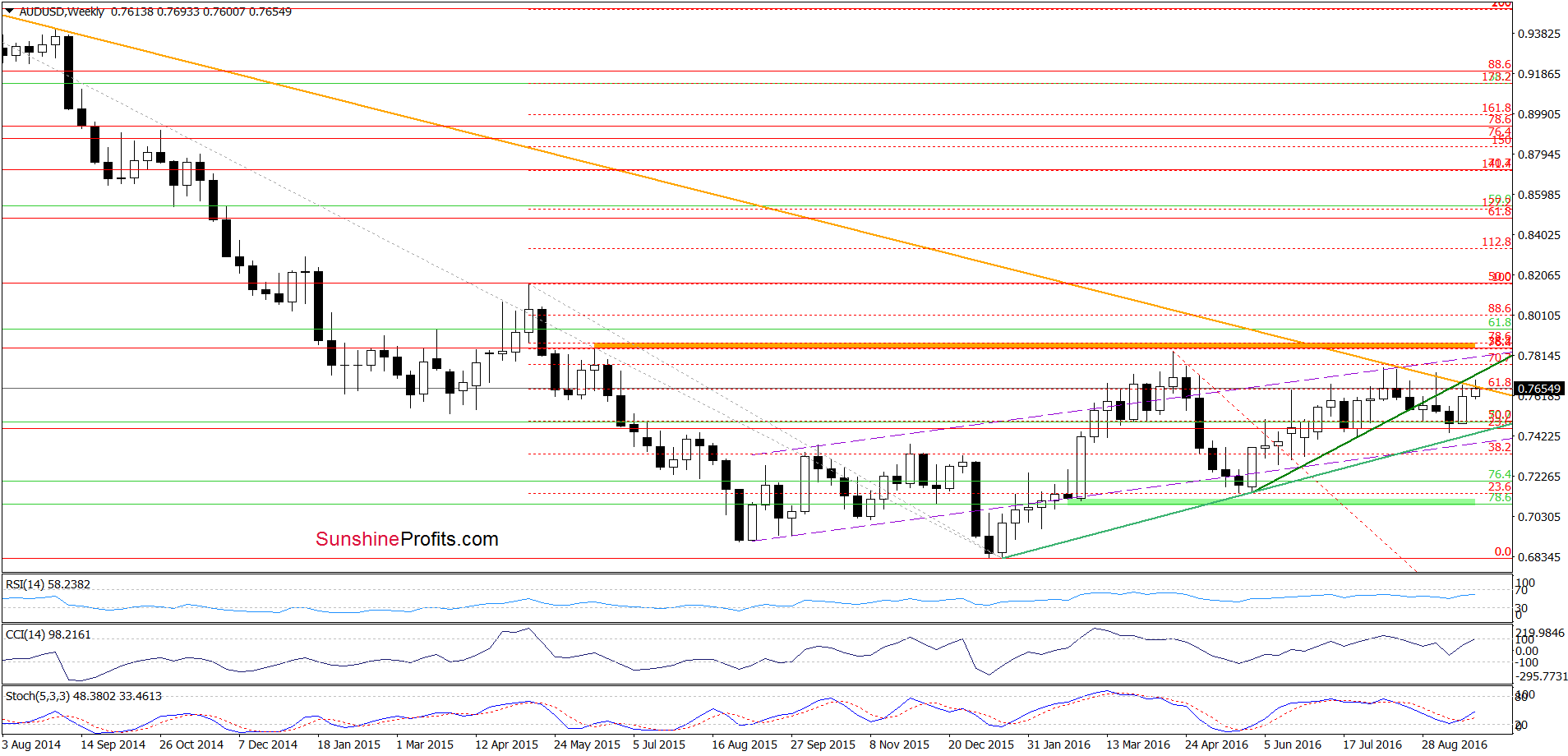

AUD/USD

On the weekly chart, we see that AUD/USD extended last week’s gains and reached the strong resistance area created by the medium-term green rising line and the long-term declining orange resistance line. Taking this combination into account, we think that the probability of reversal in the coming week is very high.

Will the very short-term chart confirm this scenario? Let’s check.

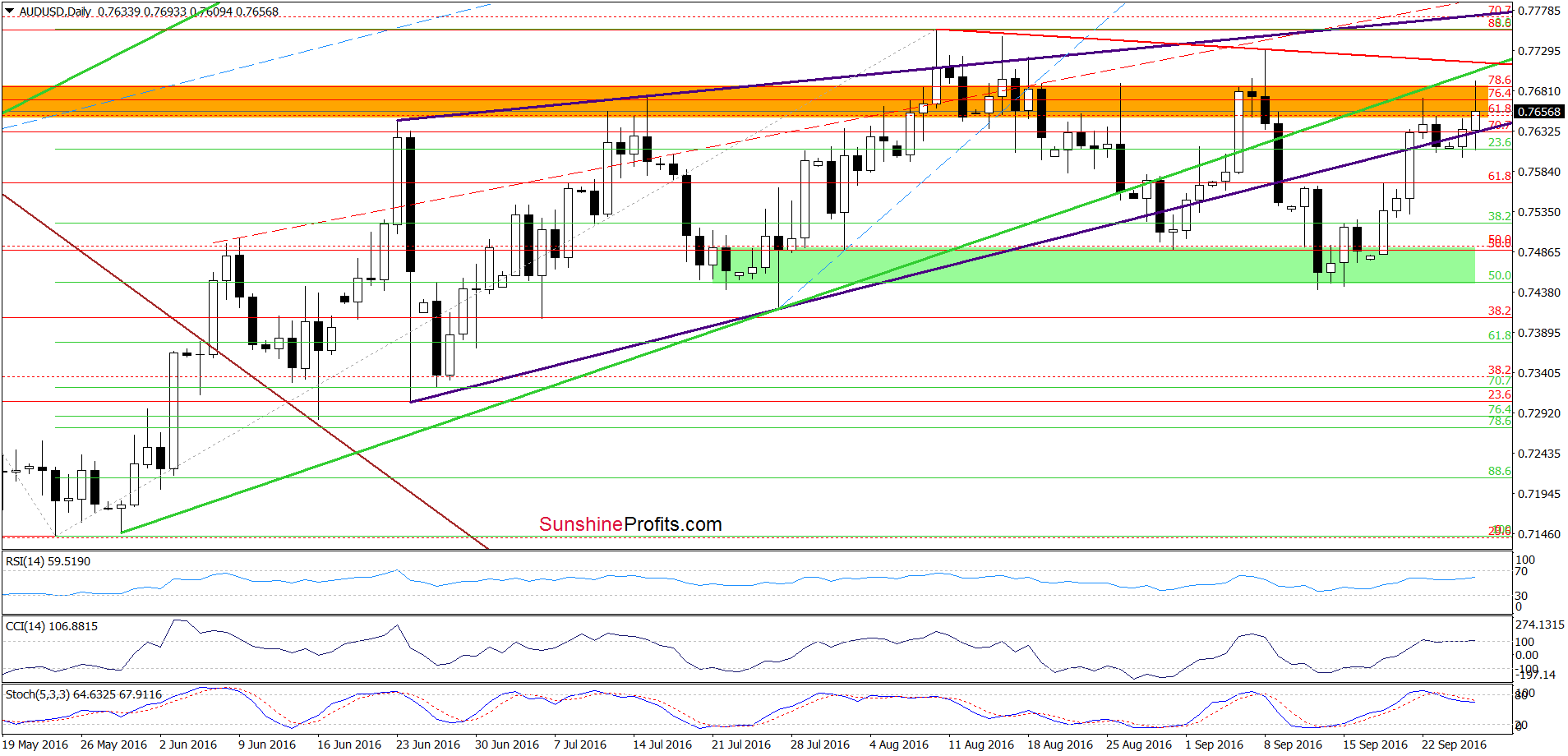

From today’s point of view, we see that although AUD/USD slipped under the lower border of the purple rising wedge, this deterioration was temporary and the pair invalidated breakdown quite quickly. This event triggered a rebound earlier today, however, the orange resistance zone continues to keep gains in check. Additionally, the CCI and Stochastic Oscillator generated sell signals, which suggests that another attempt to move lower is just around the corner. Therefore, in our opinion, if the exchange rate closes one of the following days under the purple support line, we’ll consider opening short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts