Earlier today, the USD Index slipped under the level of 96 as uncertainty over the timing of the next U.S. interest rates hike weighed on investors’ sentiment. How did this move affect the euro, yen and Australian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: long (stop-loss order at 0.9542; initial upside target at 0.9985)

- AUD/USD: none

EUR/USD

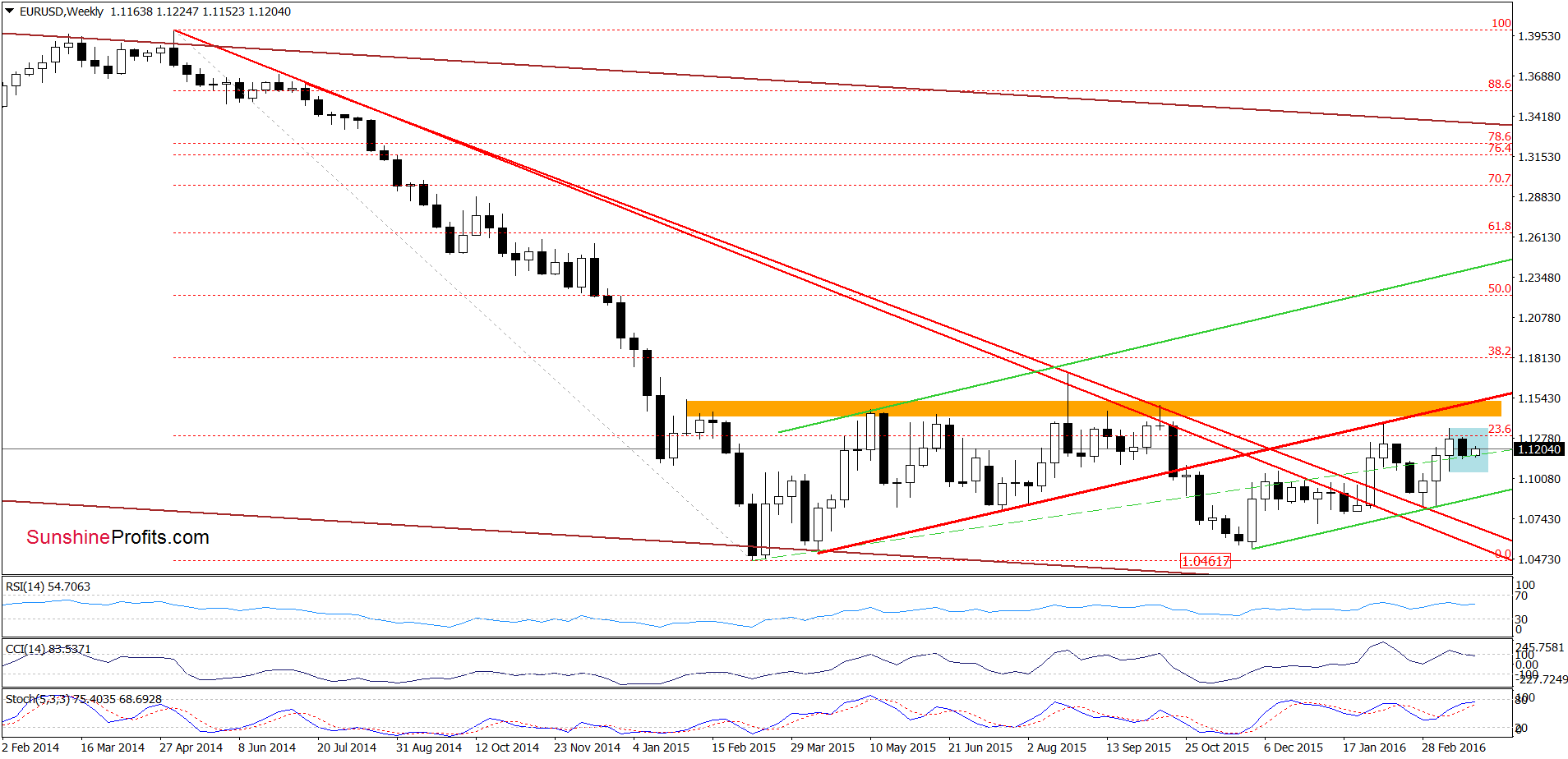

On the weekly chart, we see that EUR/USD is trading in the blue consolidation, which suggests that a breakdown under the lower line of the formation (or a breakout above the upper border) will trigger another bigger move.

Will the daily chart give us more clues about future moves? Let’s check.

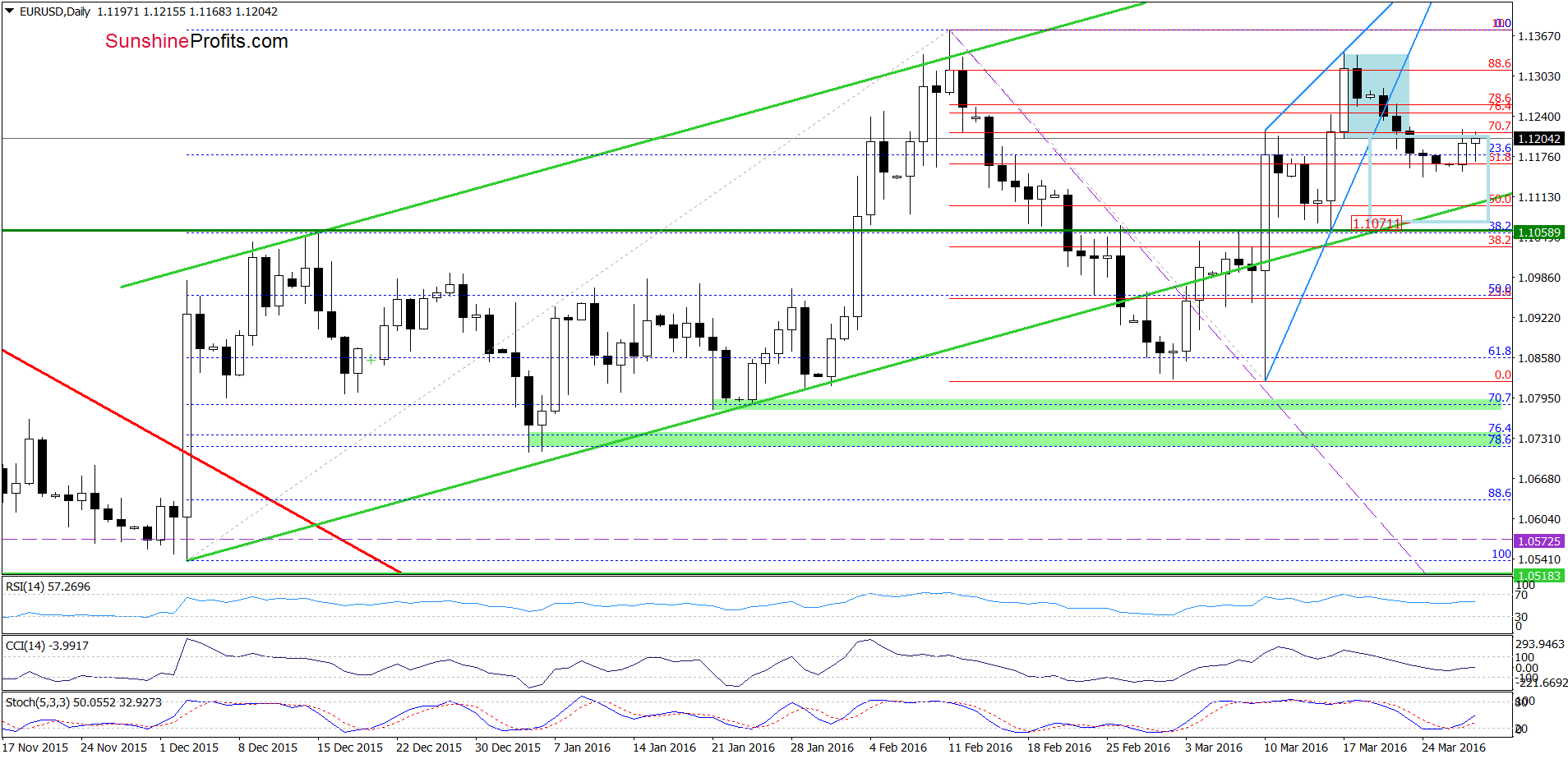

Looking at the daily chart, we see that EUR/USD remains under the lower border of the blue consolidation, which suggests that our last commentary is up-to-date:

(…) EUR/USD declined not only under the lower border of the blue rising wedge, but also below the lower line of the blue consolidation, which suggests further deterioration and a drop to around 1.1071, where the size of the move will correspond to the height of the formation.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

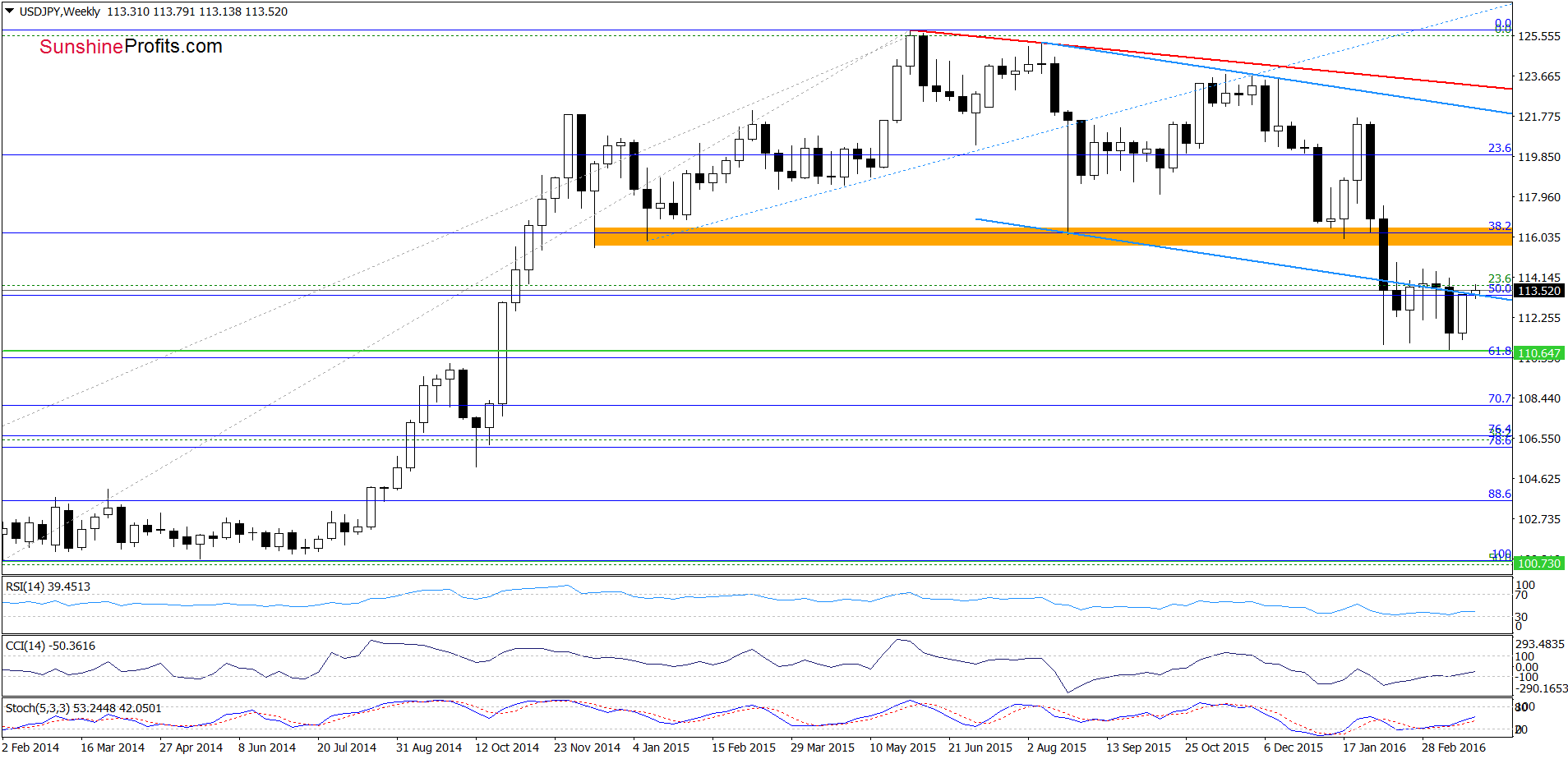

From the medium-term perspective, we see that USD/JPY rebounded and climbed above the lower border of the blue declining trend channel. Although this is a positive signal, which suggests further improvement, w think that it would be more reliable if the exchange rate closes the week above this blue line.

Will we see further improvement? Let’s examine the very short-term picture and find out.

Quoting our previous commentary on this currency pair:

(…) Taking into account buy signals generated by the indicators, we think that the exchange rate will climb to at least the green and red resistance lines (around 113.33-114.05 at the moment) in the coming days.

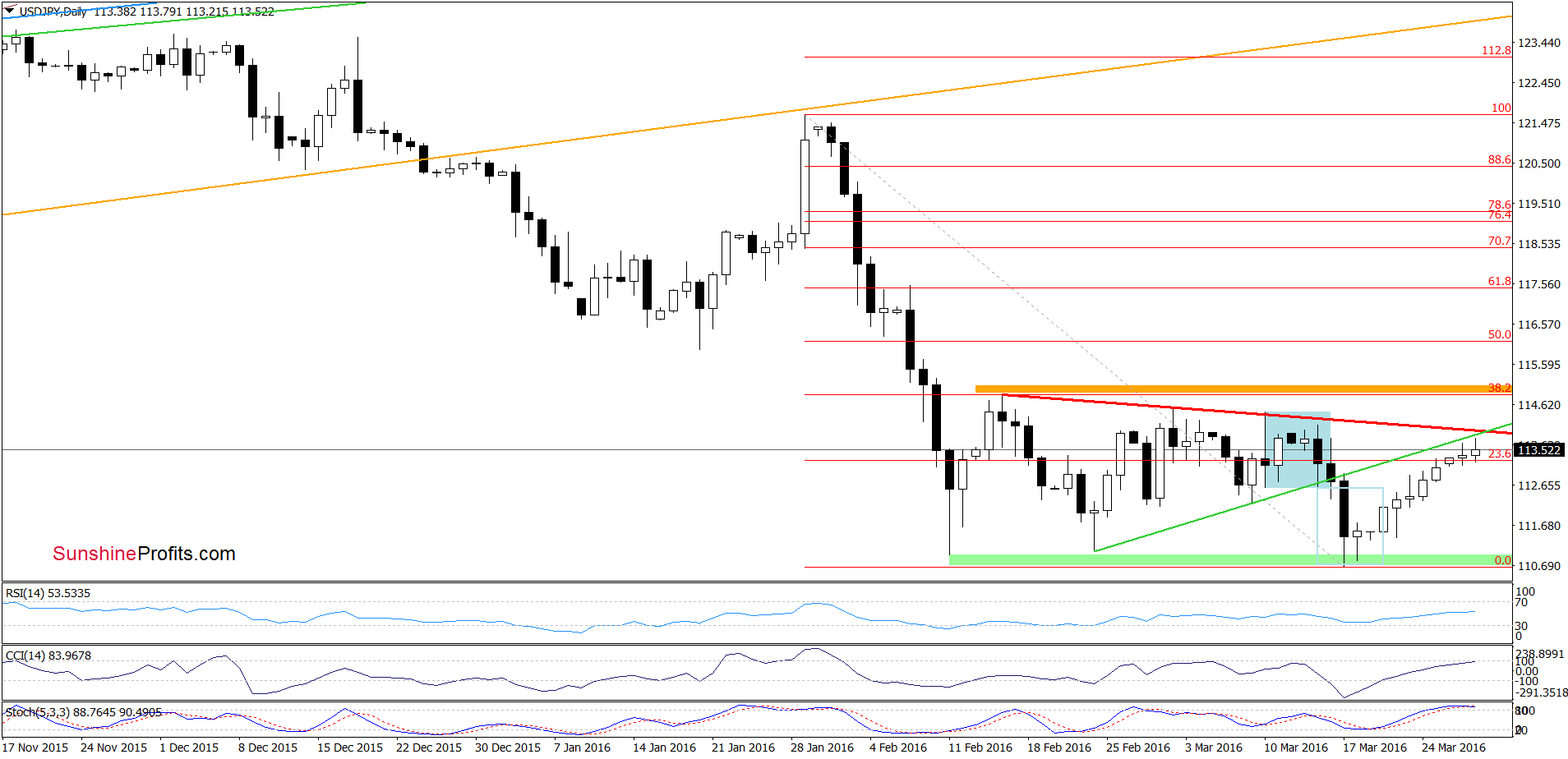

Looking at the daily chart, we see that the situation developed in line with the above scenario and USD/JPY reached our upside target. With this move, the pair also climbed to the red resistance line based on the previous highs, which suggests that we may see reversal in the coming days. This scenario is also reinforced by the current position of the Stochastic Oscillator, which is overbought and very close to generating a sell signal. If this is the case and USD/JPY declines from here, the initial downside target would be around 122.60, where the 38.2% Fibonacci retracement (based on the recent upward move) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

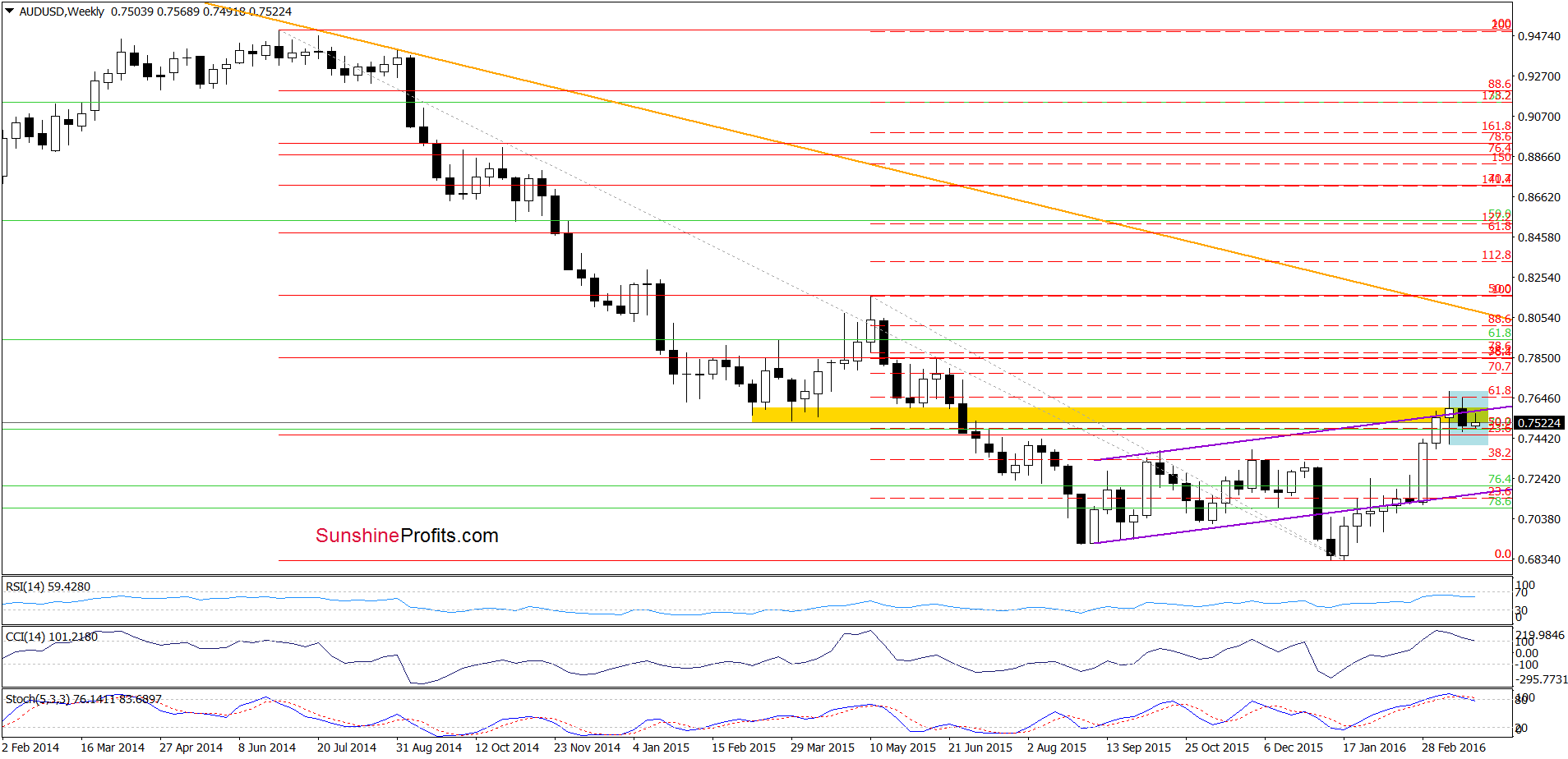

Today, we’ll focus on the medium-term chart as the very short-term picture hasn’t changed much because AUD/USD is trading around 23.6% Fibonacci retracement based on the recent upward move.

The first thing that catches the eye on the weekly chart is drop under the upper border of the purple rising trend channel. With this move the pair invalidated earlier breakout above this line, which is a bearish signal that suggests further deterioration. Additionally, the Stochastic Oscillator generated a sell signal, while the CCI is very close to doing the same, supporting currency bears. Nevertheless, in our opinion, such price action would be more reliable if AUD/USD declines under the lower border of the blue consolidation.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts