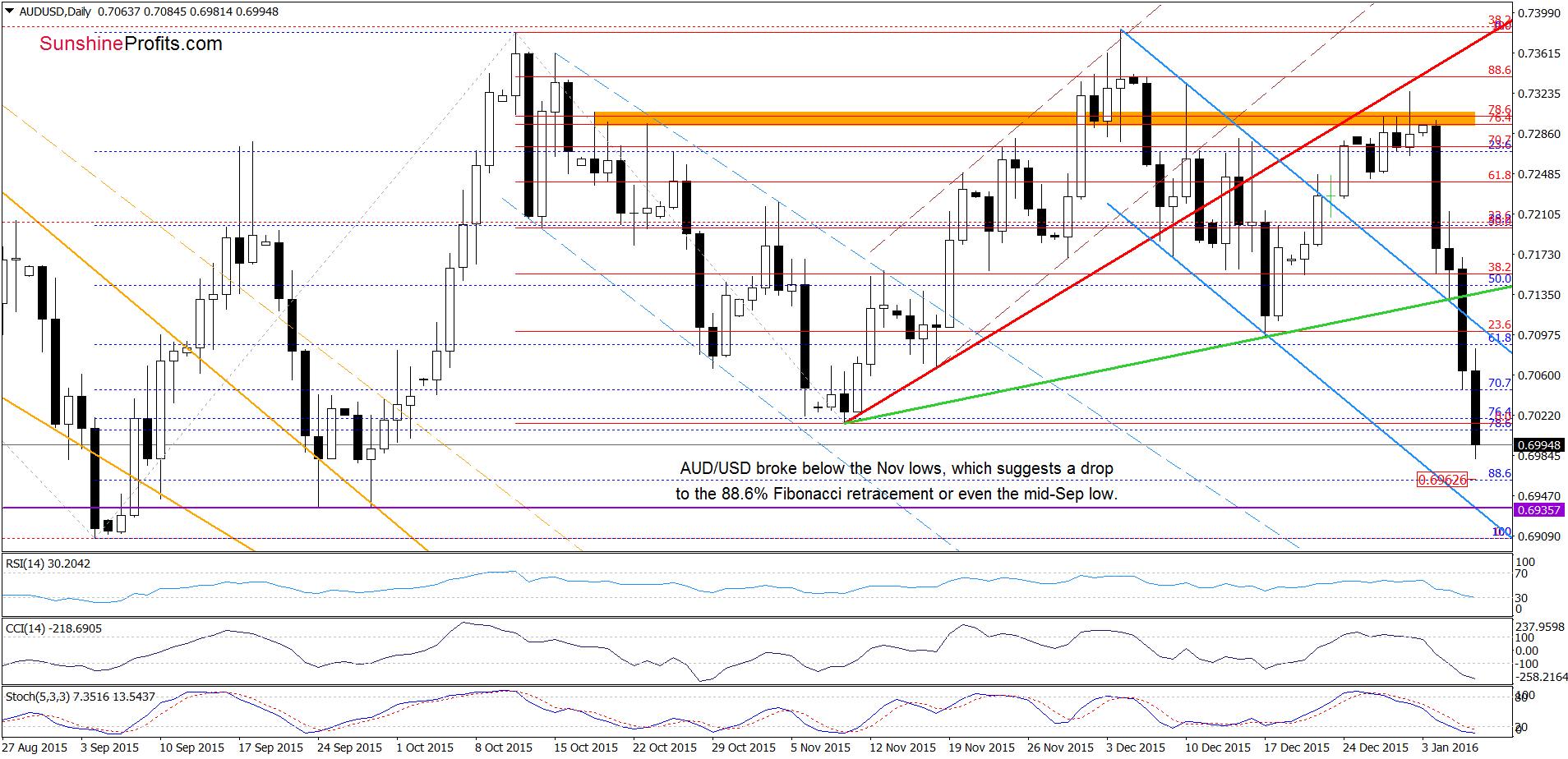

Earlier today, the Australian Bureau of Statistics showed that building approvals dropped by 12.7% in November, missing expectations for a 3.0% fall. Hanks to these disappointing numbers, AUD/USD dropped under the Nov low and reached the long-term key support line. Will it withstand the selling pressure?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1363; initial downside target at 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

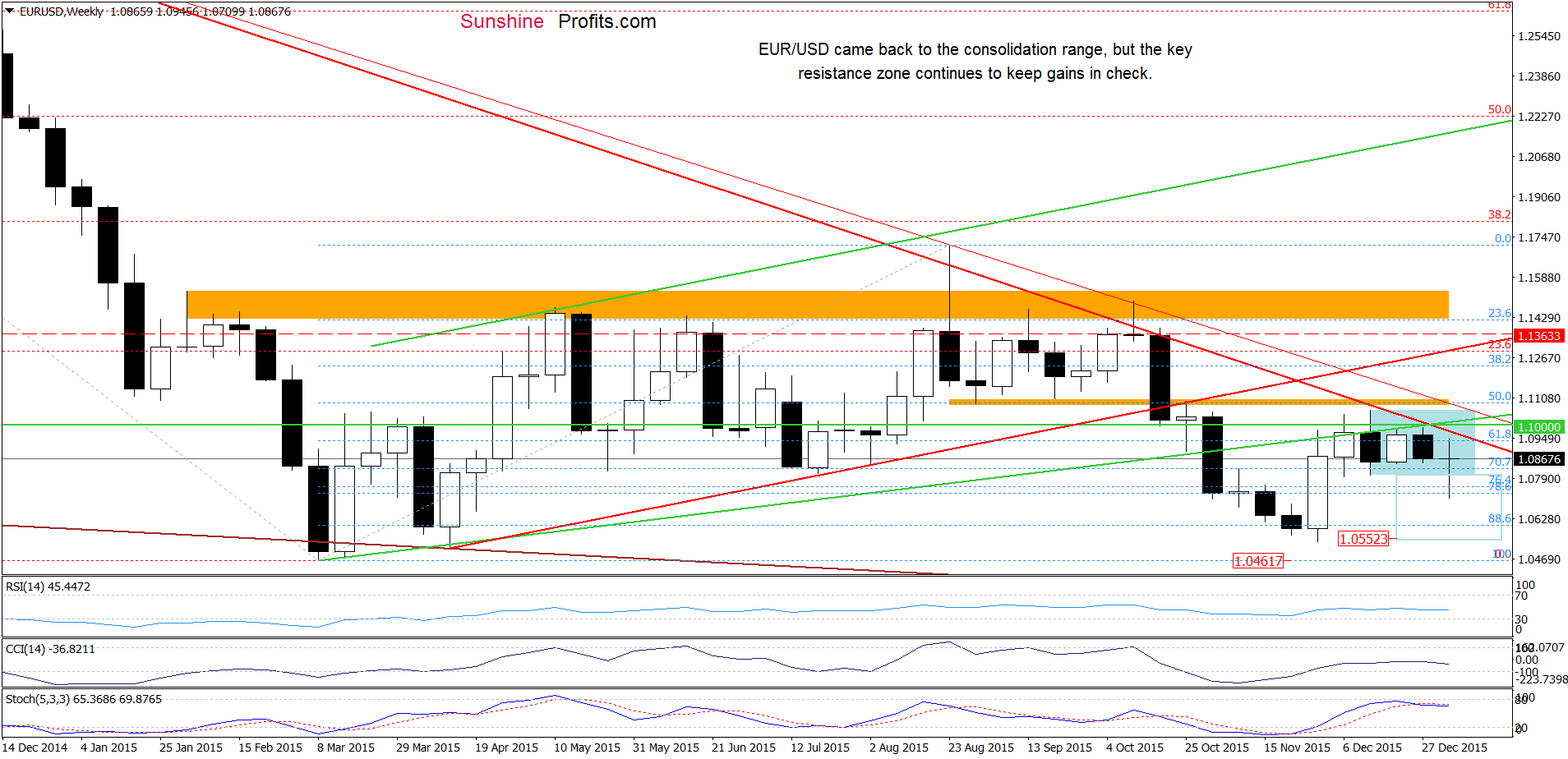

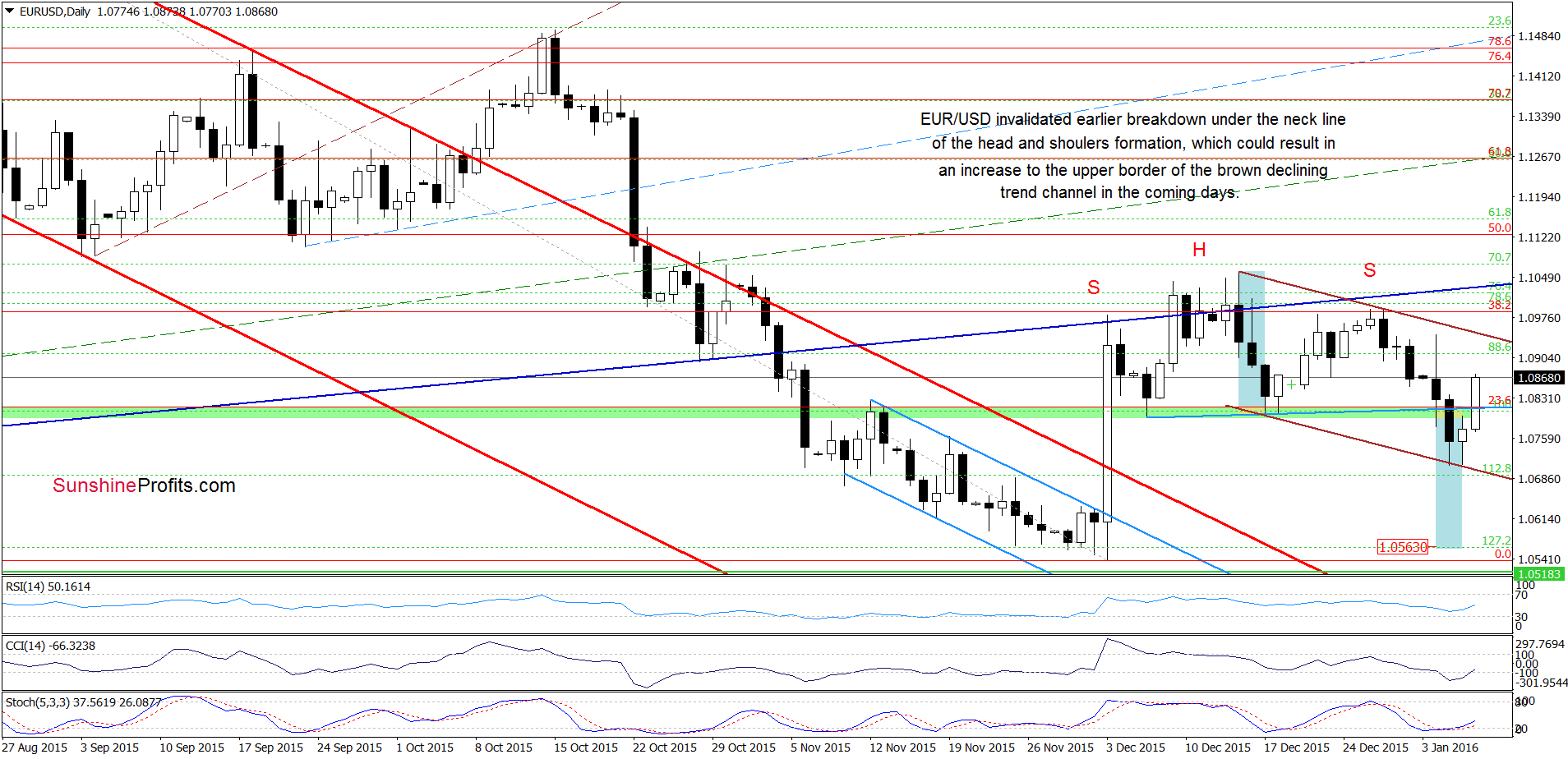

EUR/USD

Looking at the daily chart, we see that EUR/USD bounced off the lower border of the brown declining trend channel and climbed above the neck line of the head and shoulders formation, invalidating earlier breakdown. Although this is a positive signal, which suggests further improvement, we think that the space for gains is quite limited. Why? Firstly, even if the exchange rate moves lower from here, the upper border of the trend channel in combination with this week’s high will likely stop currency bulls. Secondly, and even more importantly, the pair remains under the solid resistance zone (marked on the weekly chart) created by the previously-broken green resistance line, the barrier of 1.1000, the orange resistance zone and the long-term red declining resistance lines, which successfully stopped further rally in recent weeks. Therefore, we believe that as long as there won’t be a breakout above this area, another attempt to move lower is more likely than not.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1363 and the initial downside target at 1.0462) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

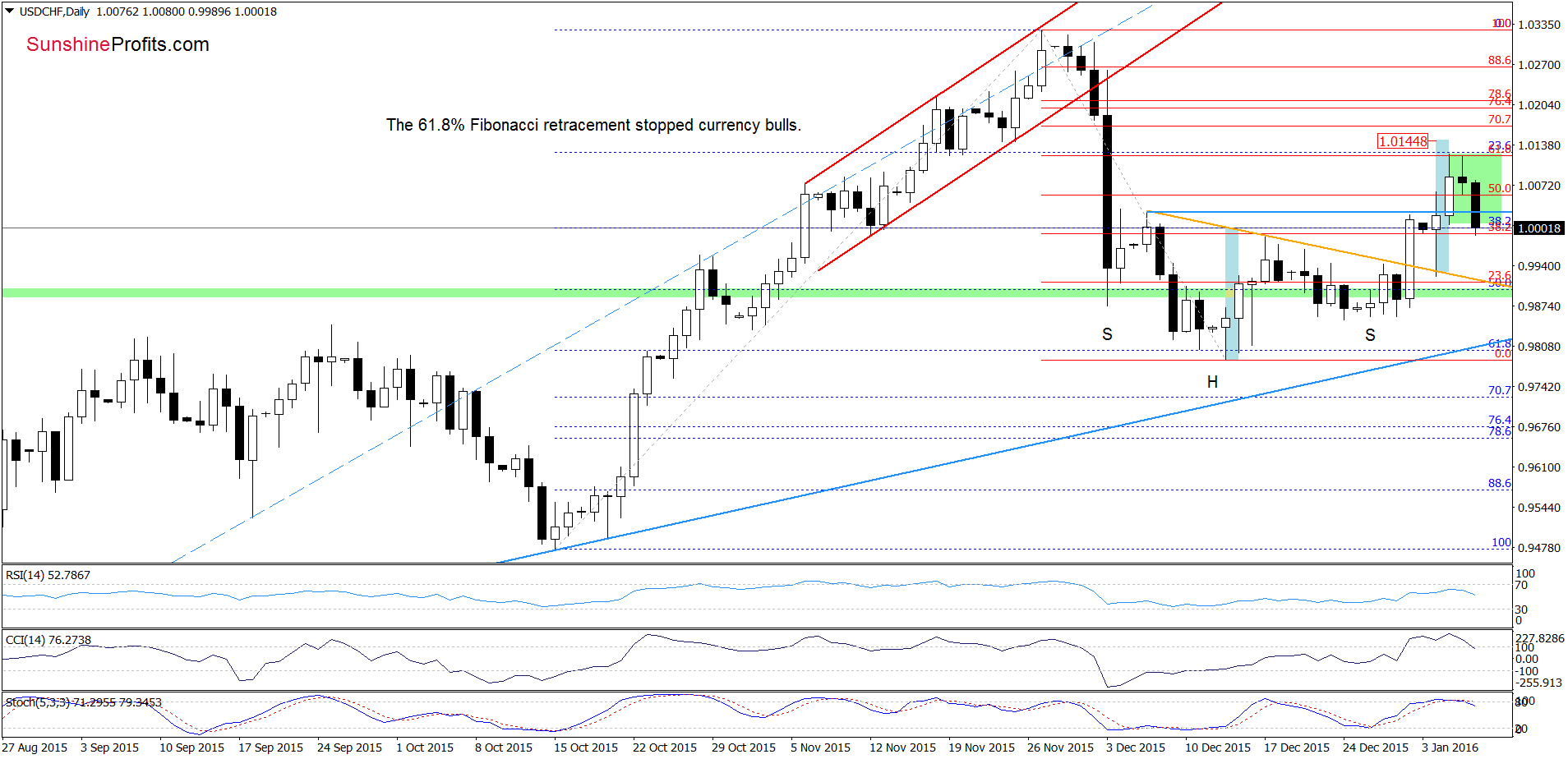

USD/CHF

The situation in the medium term hasn’t change much as USD/CHF remains above the previously-broken upper border of the consolidation. Today, we’ll focus on the very short-term changes.

From today’s point of view, we see that although USD/CHF broke above Dec 7 high, the 61.8% Fibonacci retracement (based on the Nov-Dec declines) stopped further improvement, triggering a pullback. With this downswing, the pair invalidated earlier breakout, which suggests a test of the orange support line and the green support zone in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

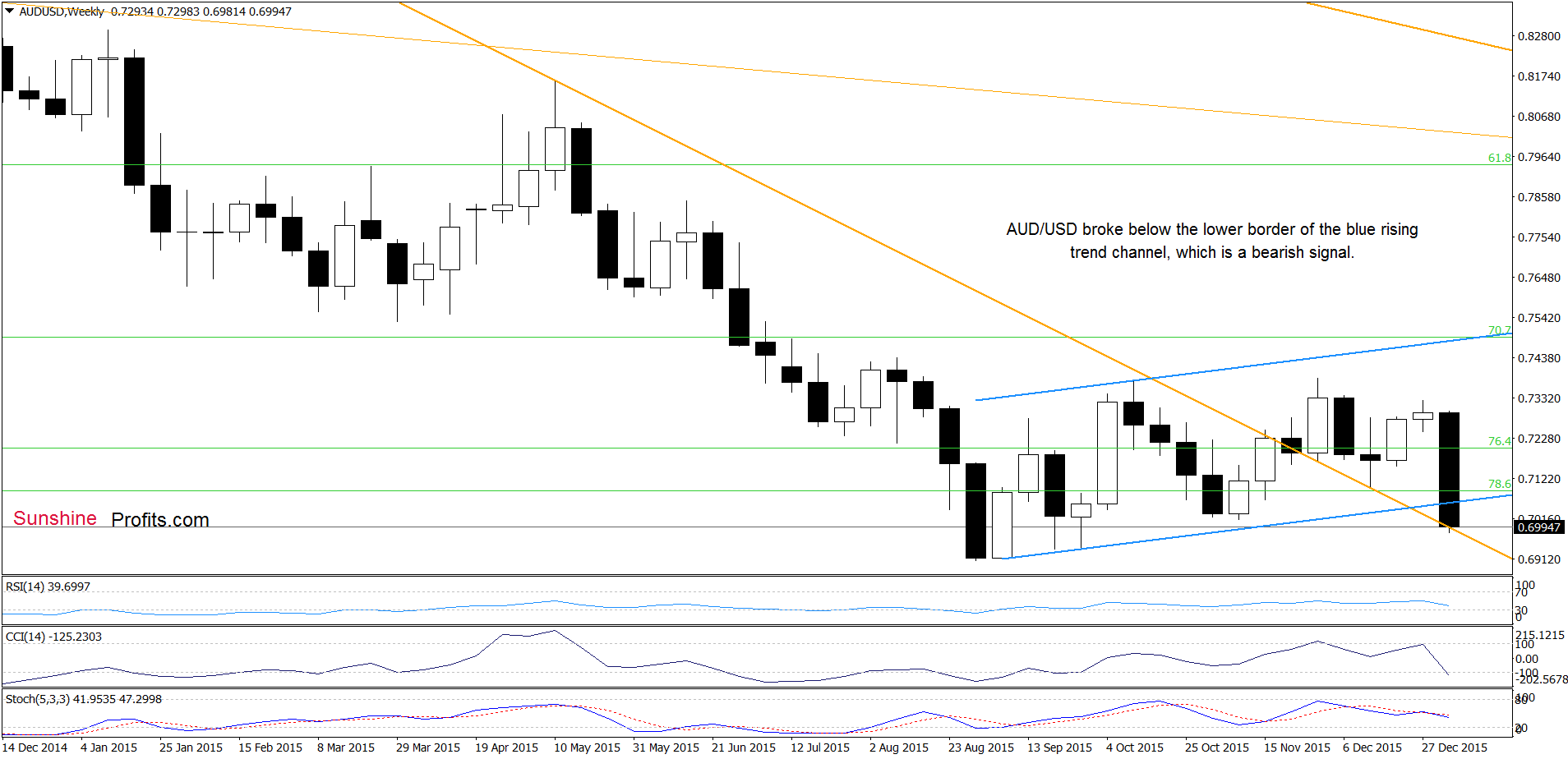

AUD/USD

Quoting our Forex Trading Alert posted on Dec 30:

If (…) AUD/USD declines from here, we’ll see a test of the previously-broken upper line of the blue declining trend channel in the coming days.

Looking at the daily chart, we see that currency bulls not only broke below the above-mentioned blue line, but also managed to push AUD/USD under the Nov lows. This is a bearish signal, which suggests a drop to the 88.6% Fibonacci retracement or even a test of the purple horizontal support line based on the mid-Sep low.

Are there any technical factors that could hinder the realization of the above scenario? Let’s examine the weekly chart and find out.

From this perspective, we see that the recent downward move took the pair to the previously-broken long-term orange support line, which could pause further deterioration – similarly to what we saw in mid-Dec. Nevertheless, if AUD/USD breaks under this key support, we’ll see a test of the mid-Sep (or even Aug) lows.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts