The most important event of this year will be today’s Federal Reserve's decision. Most investors expect that the U.S. central bank will raise interest rates for the first time since June 2006, however, before we know the decision and its impact on the currency market let’s take a closer look at EUR/USD, USD/JPY and USD/CHF.

In our opinion the following forex trading positions are justified - summary:

EUR/USD

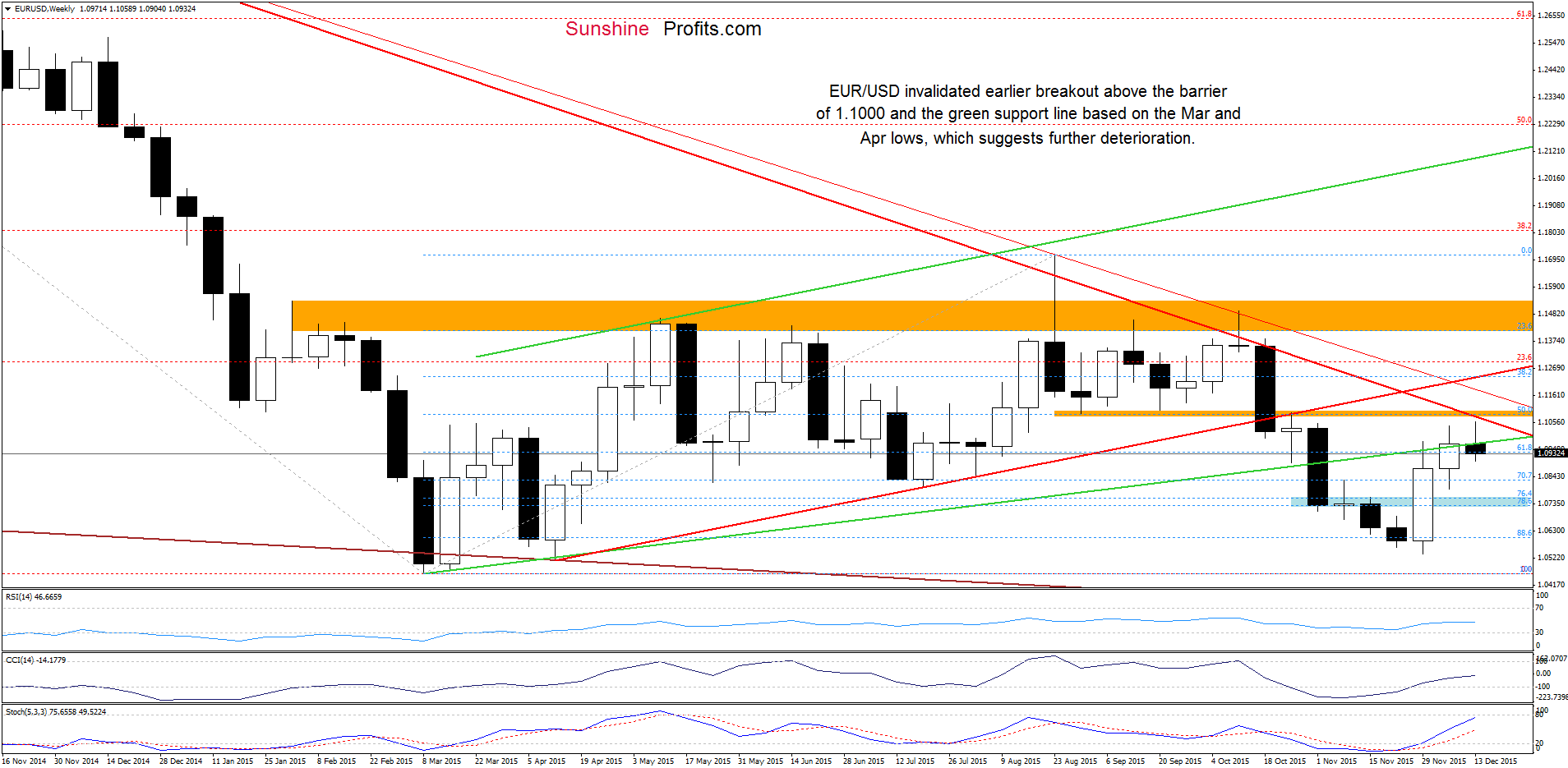

Looking at the weekly chart, we see that EUR/USD reversed and invalidated earlier breakout above the barrier of 1.1000 and the green line based on the Mar and Apr lows, which is a negative signal. Taking this fact into account, and combining it with the proximity to the orange resistance zone and the long-term red declining resistance line we think that further deterioration is just around the corner.

Will the very short-term picture give us more clues about future moves? Let’s check.

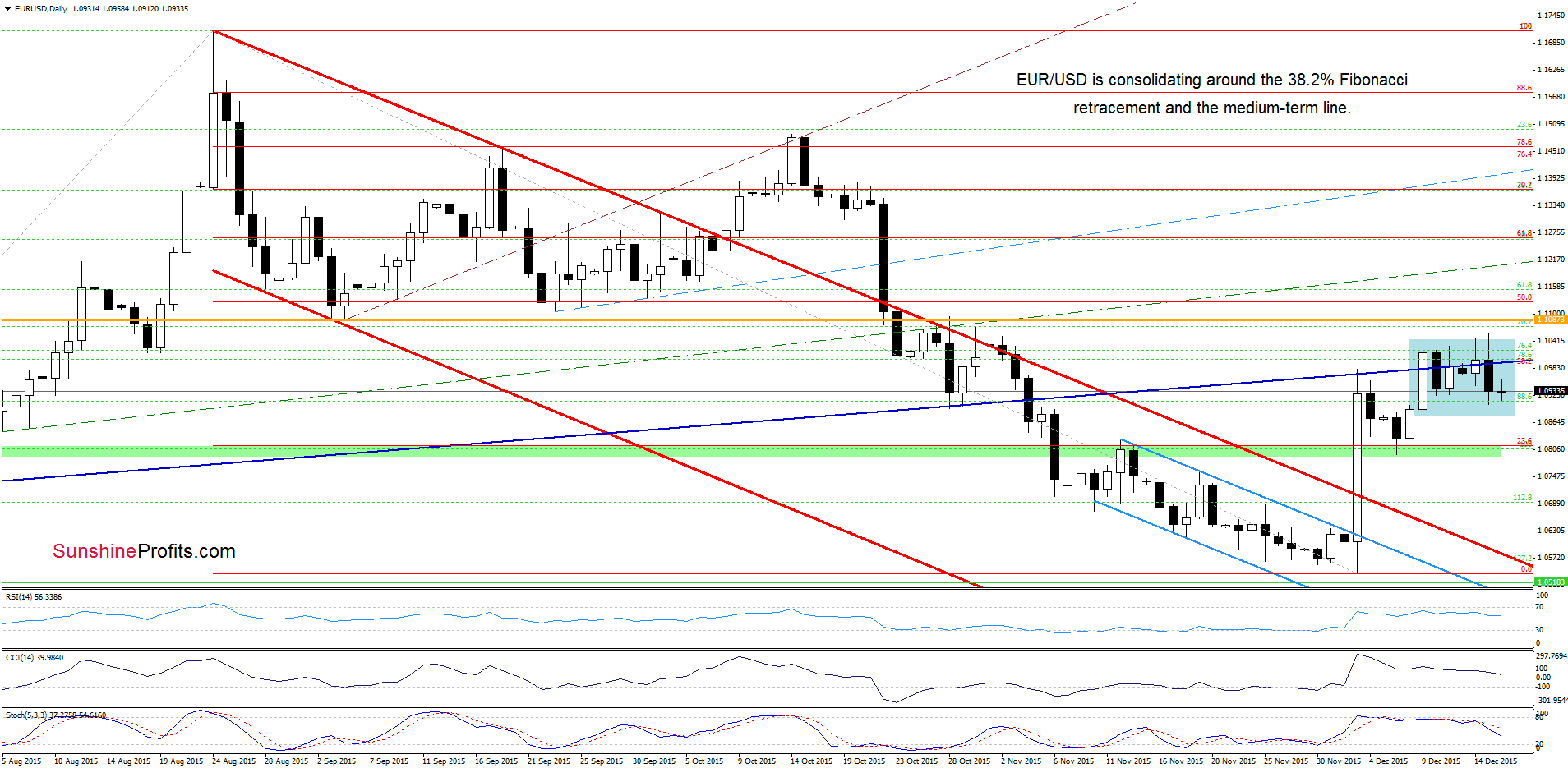

From this perspective, we see that the situation in the very short term hasn’t changed much as EUR/USD is still consolidating around the 38.2% Fibonacci retracement and the navy blue support/resistance line. Yesterday, the pair invalidated earlier breakout, which is a bearish signal that suggests lower values of the exchange rate in the coming days. Nevertheless, in our opinion, we’ll see an acceleration of declines if EUR/USD drops below the lower border of the consolidation.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Quoting our last commentary on this currency pair:

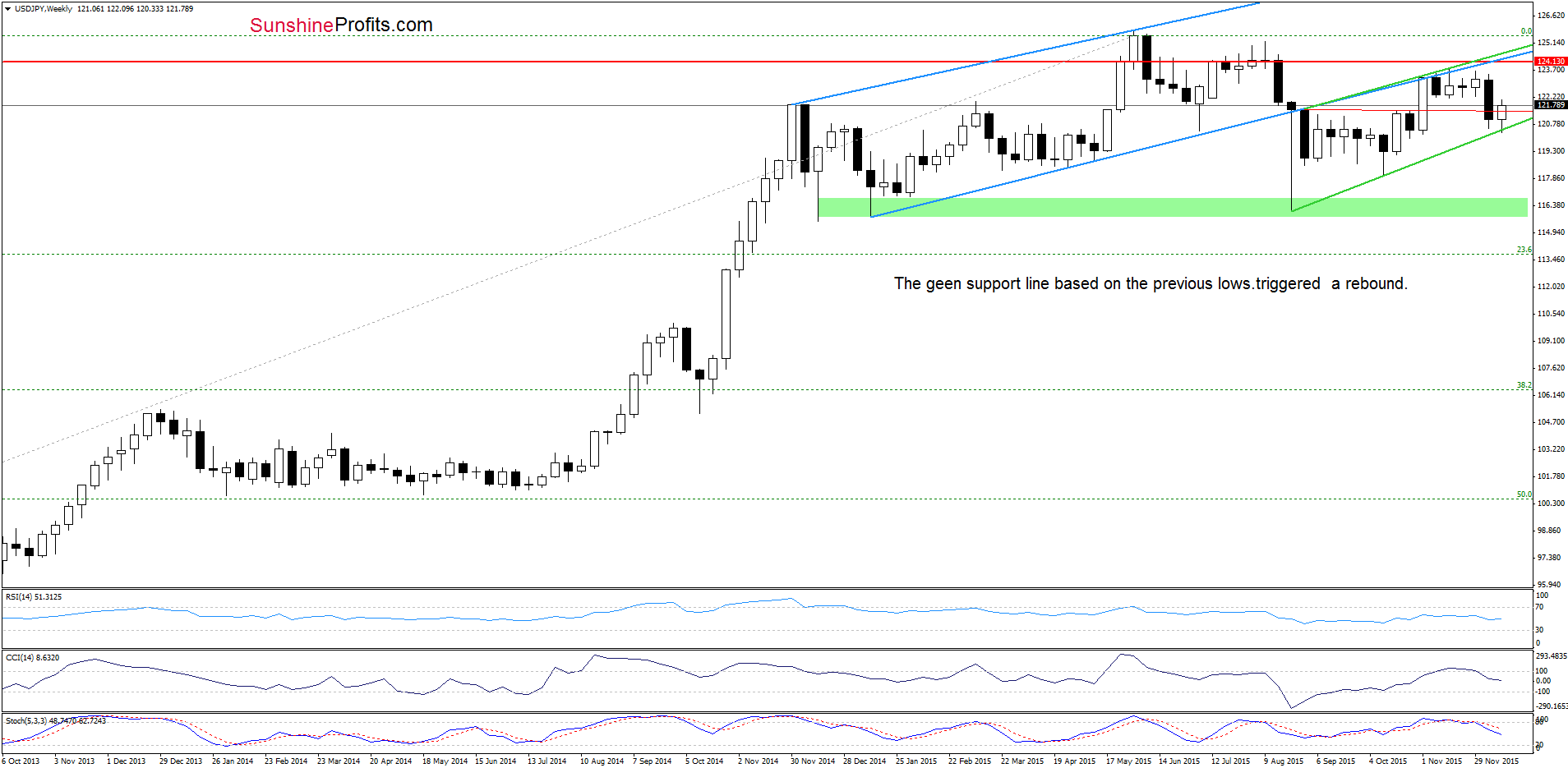

(…) USD/JPY approached the green support line (based on the previous lows), which suggests that the space for declines might be limited.

Looking at the medium-term chart, we see that the above-mentioned support line encouraged currency bulls to act, which resulted in a rebound.

How did this move affect the very short-term picture? Let’s check.

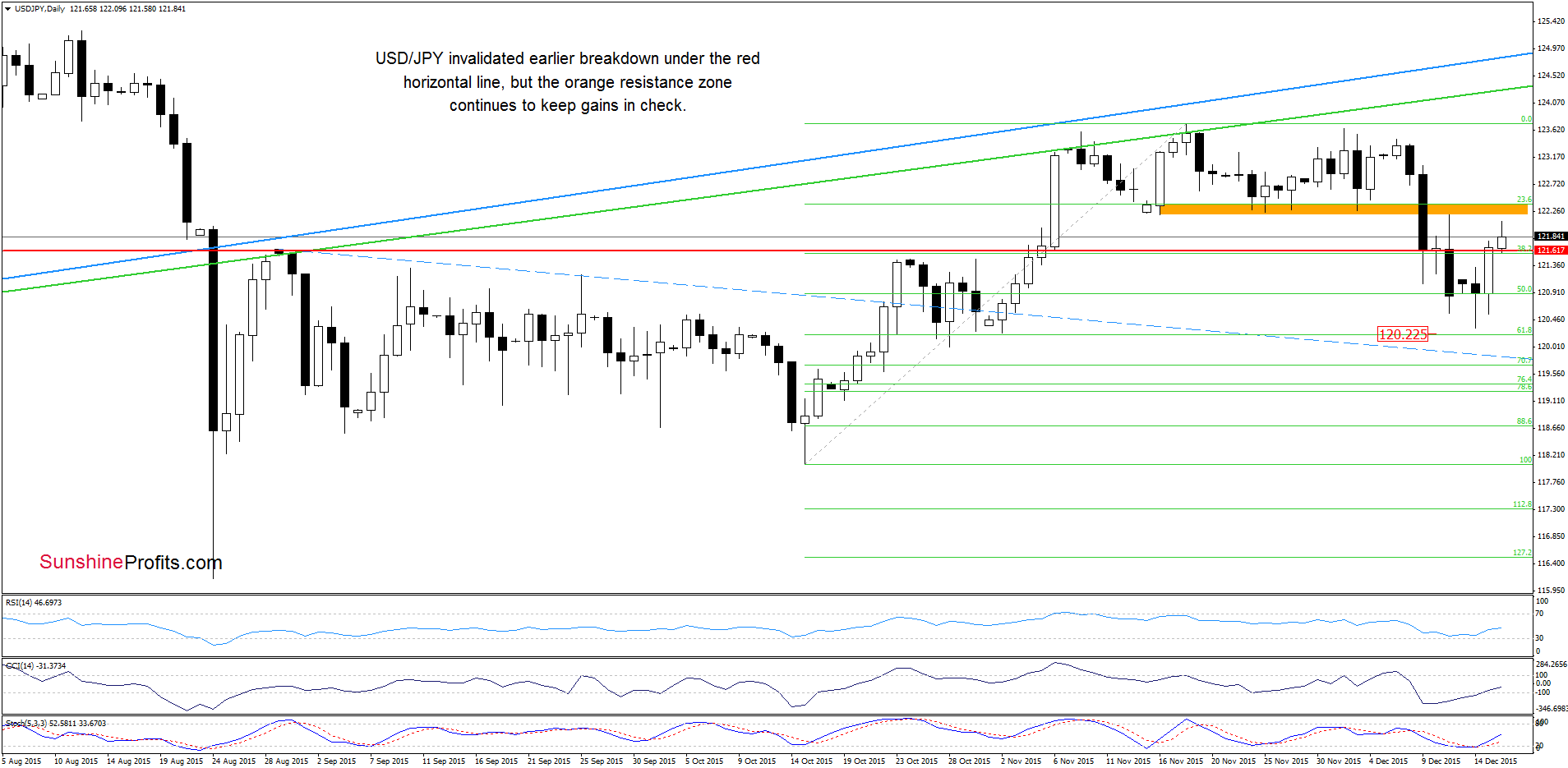

On the daily chart, we see that USD/JPY reversed and rebounded, invalidating earlier breakdown under the red horizontal support line. Taking this positive signal into account, and combining it with buy signals generated by the indicators, we think that currency bulls will try to push the pair higher. Nevertheless, further rally will be more likely and reliable if the pair climbs above the orange resistance zone.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

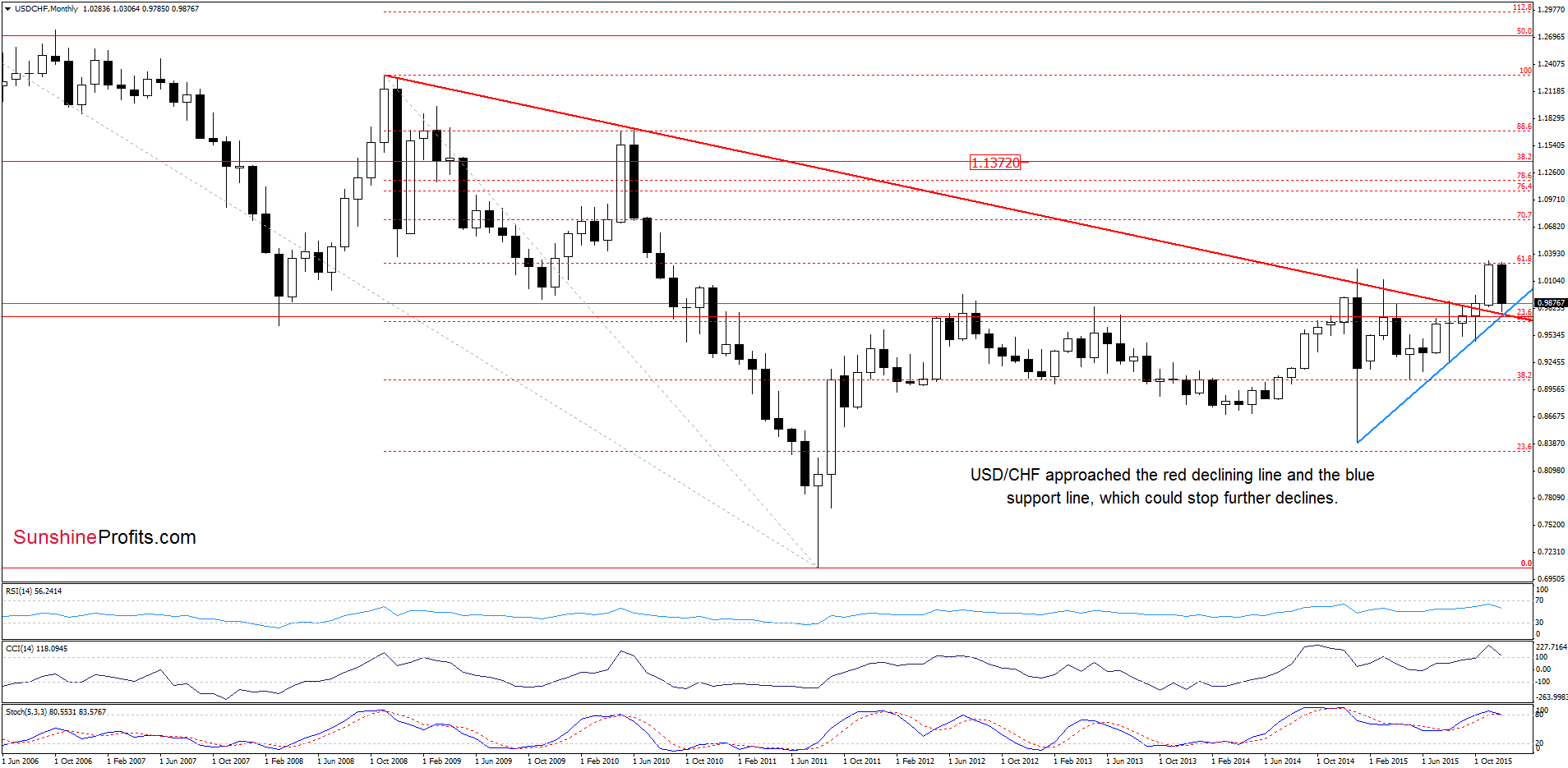

USD/CHF

On Monday, we wrote:

(…) USD/CHF approached the previously-broken long-term red declining line and the blue support line based on the previous lows, which together could trigger a rebound in the near future.

Looking at the above chart, we see that the pair rebounded slightly as we had expected.

What impact did it have on the daily chart? Let’s check.

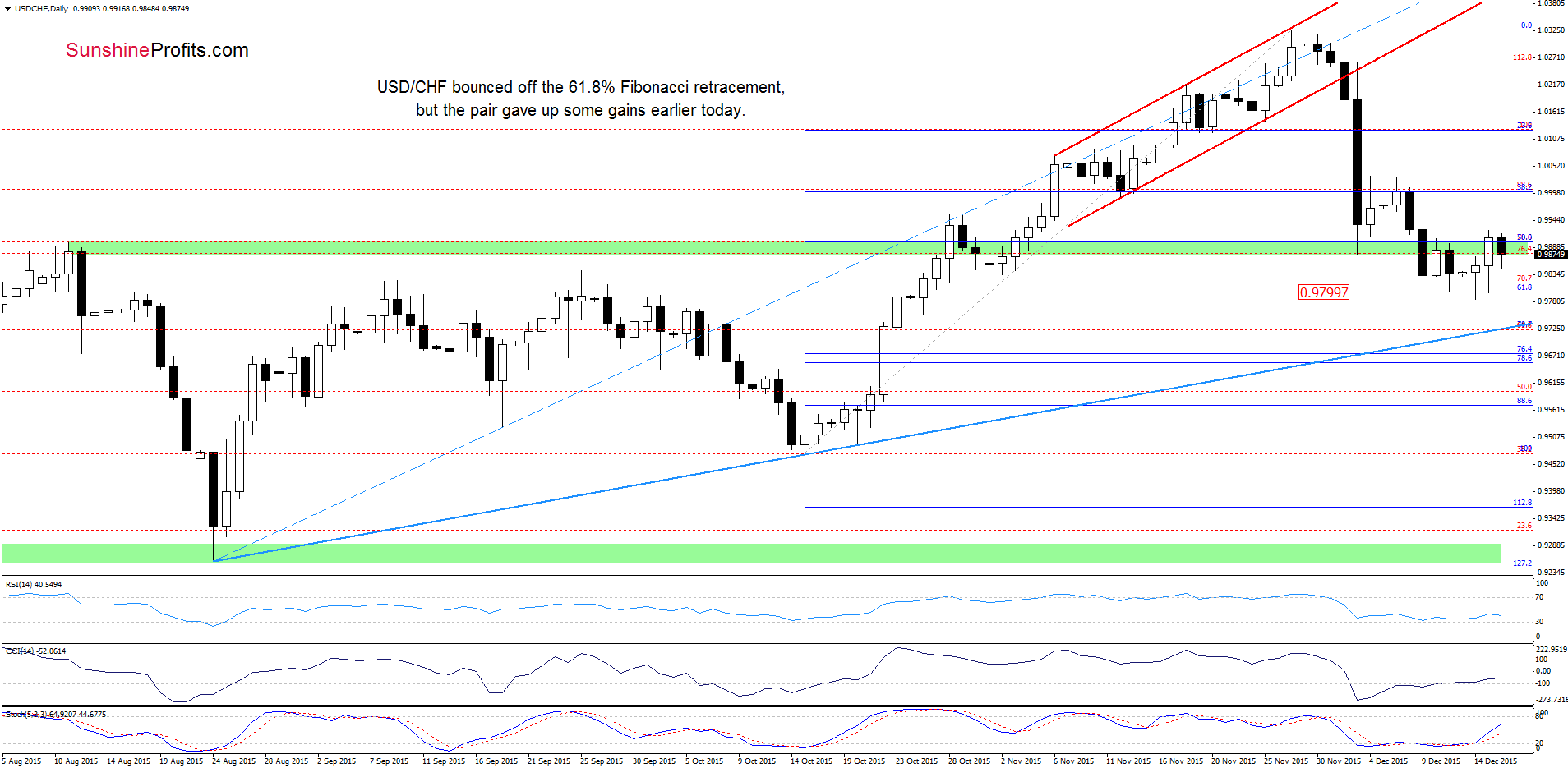

Quoting our last commentary on this currency pair:

(…) there are positive divergences between the CCI and the exchange rate, which in combination with the support level (the 61.8% Fibonacci retracement) could encourage currency bulls to act – especially when we factor in the long-term picture.

From today’s point of view, we see that USD/CHF moved little higher in recent days as we had expected. Despite this increase, the pair gave up some gains and pulled back earlier today. Although this is a negative sign, buy signals generated by the indicators remain in place, supporting another attempt to move higher.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts