Earlier today, the USD Index extended yesterday’s losses and approached the level of 98. As a result, USD/CHF reversed and approached its important short-term support zone. Will we see another rebound from here?

In our opinion the following forex trading positions are justified - summary:

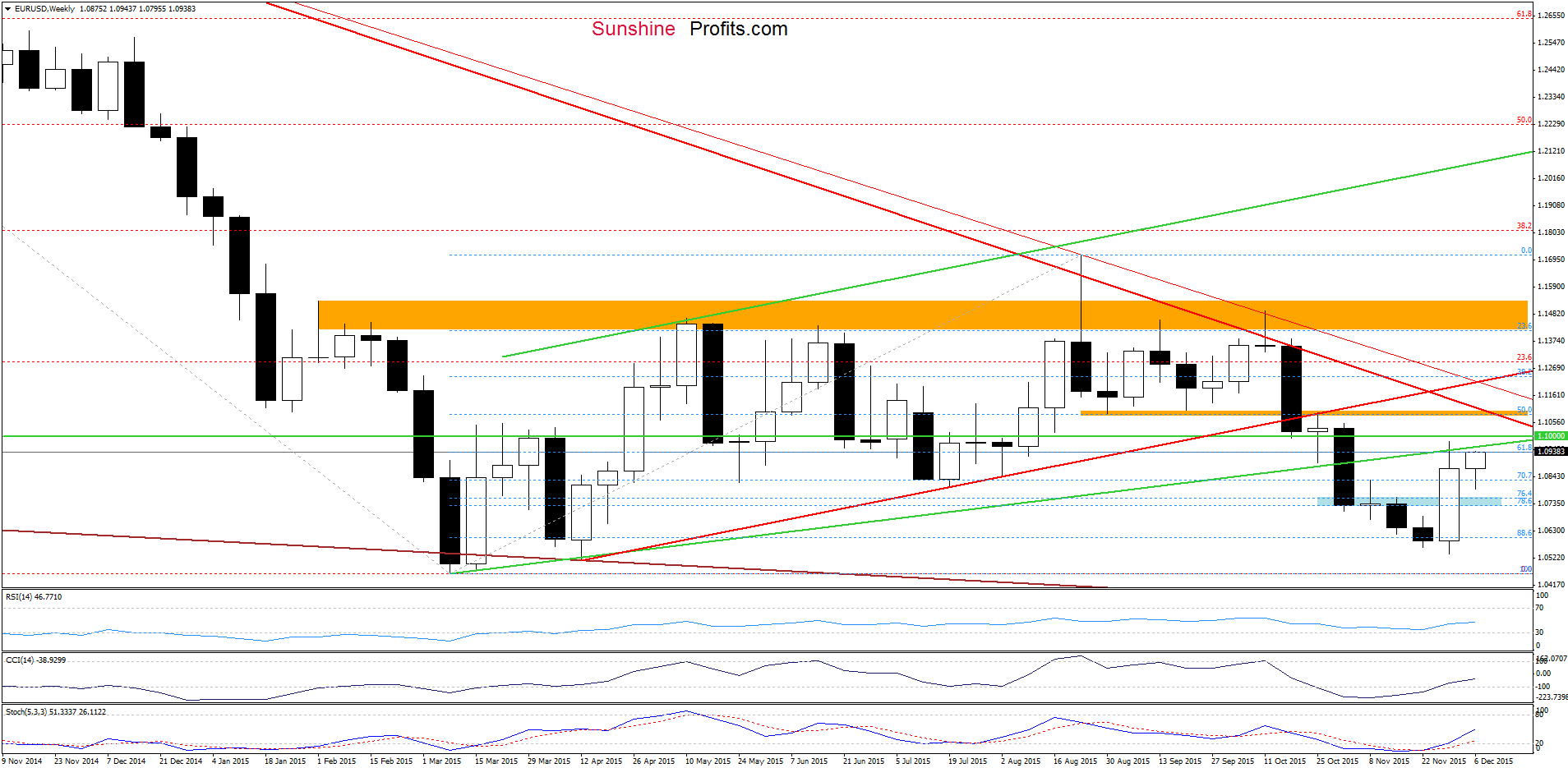

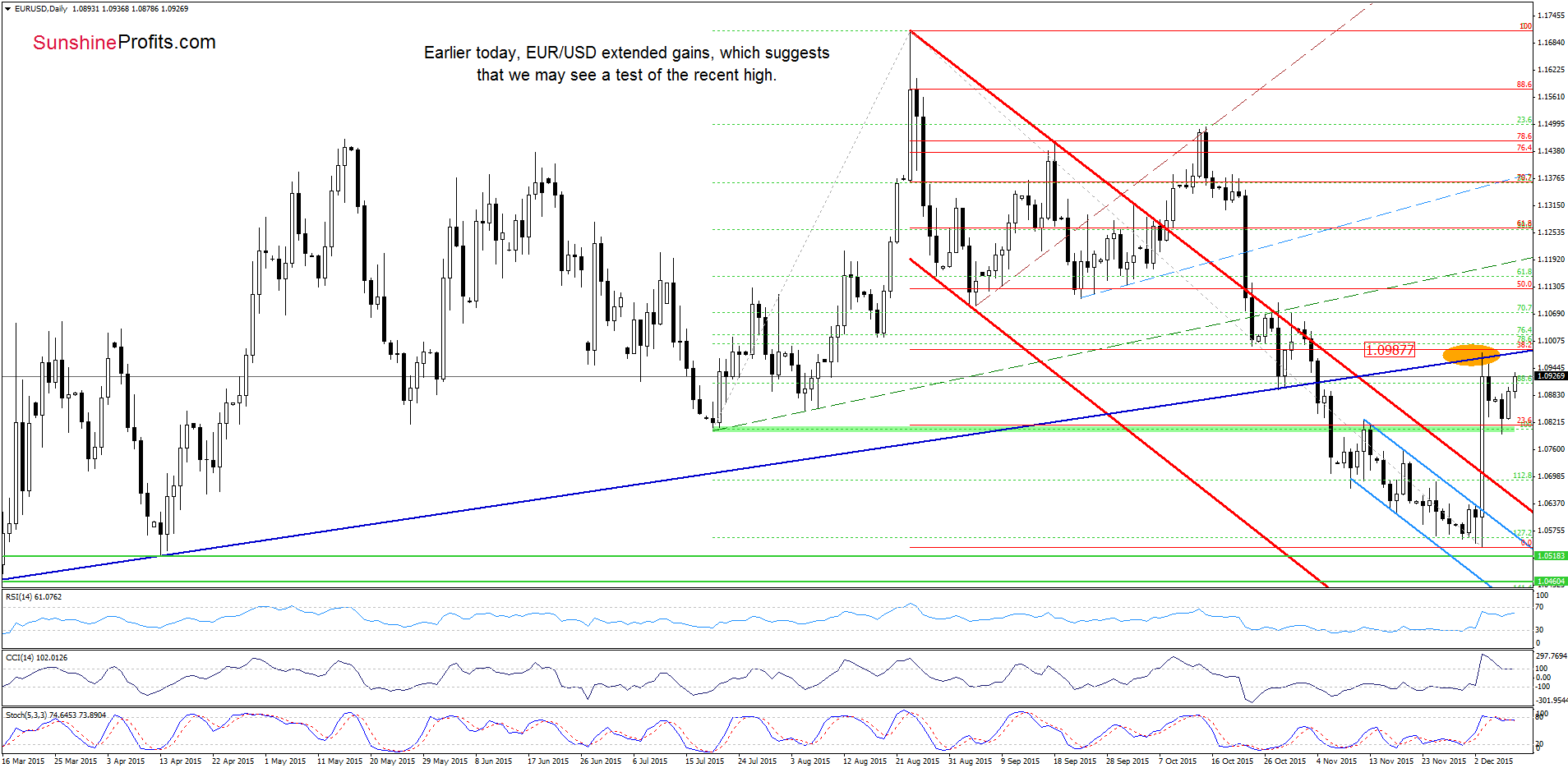

EUR/USD

Quoting our previous commentary:

(…) currency bulls (…) managed to push the pair higher, which suggests further improvement and an increase to around 1.0936-1.0940, where the resistance area created by the 76.4% and 78.6% Fibonacci retracement is.

Earlier today, the exchange rate extended gains, which resulted in a climb to our yesterday’s upside target. If the pair moves higher from here, we’ll see a test of the strength of the previously-broken green resistance line (based on the Mar and Apr lows and marked on the weekly chart) in the coming day(s). If it is broken, currency bulls will likely push EUR/USD to the last week’s high.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

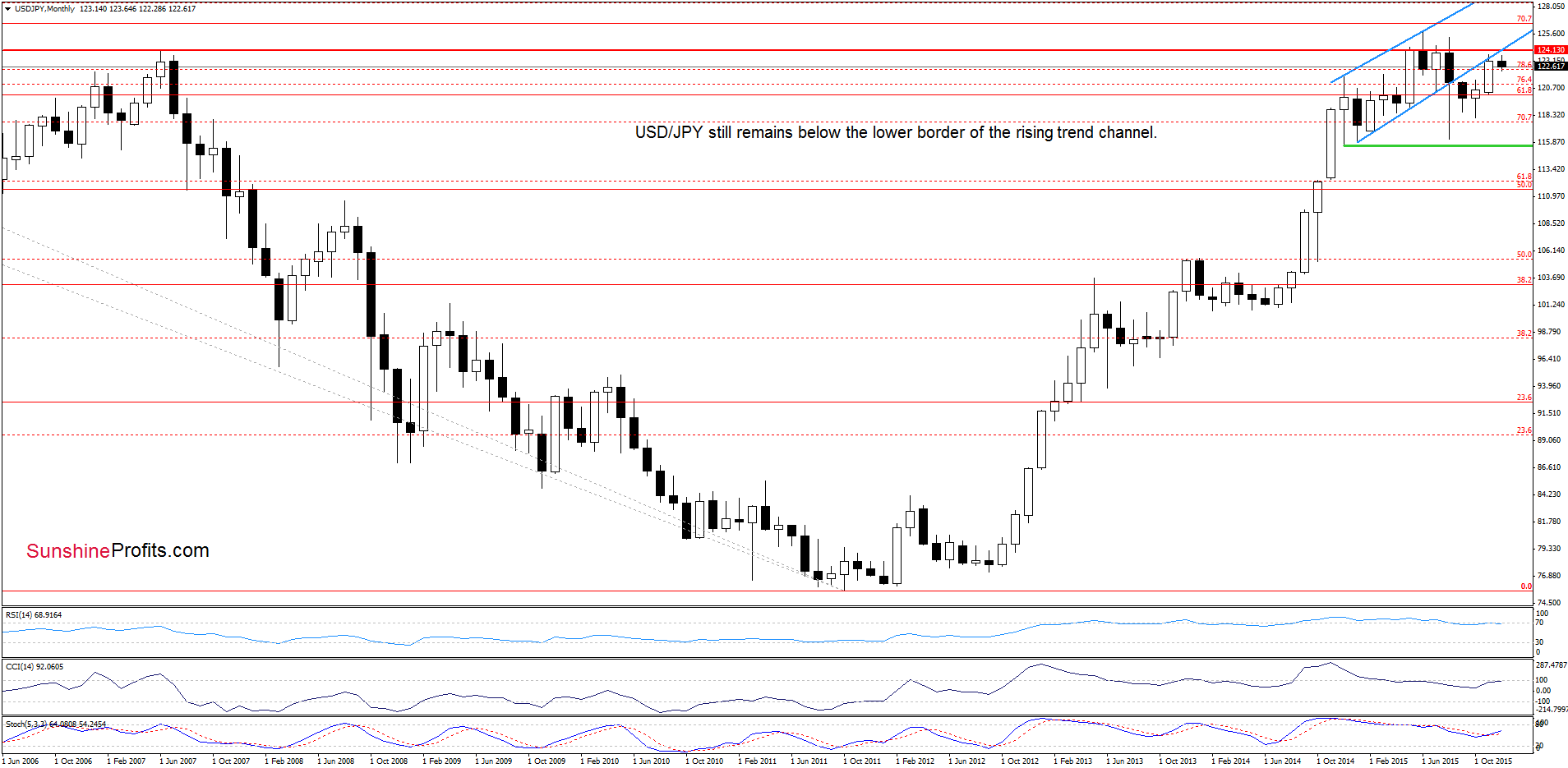

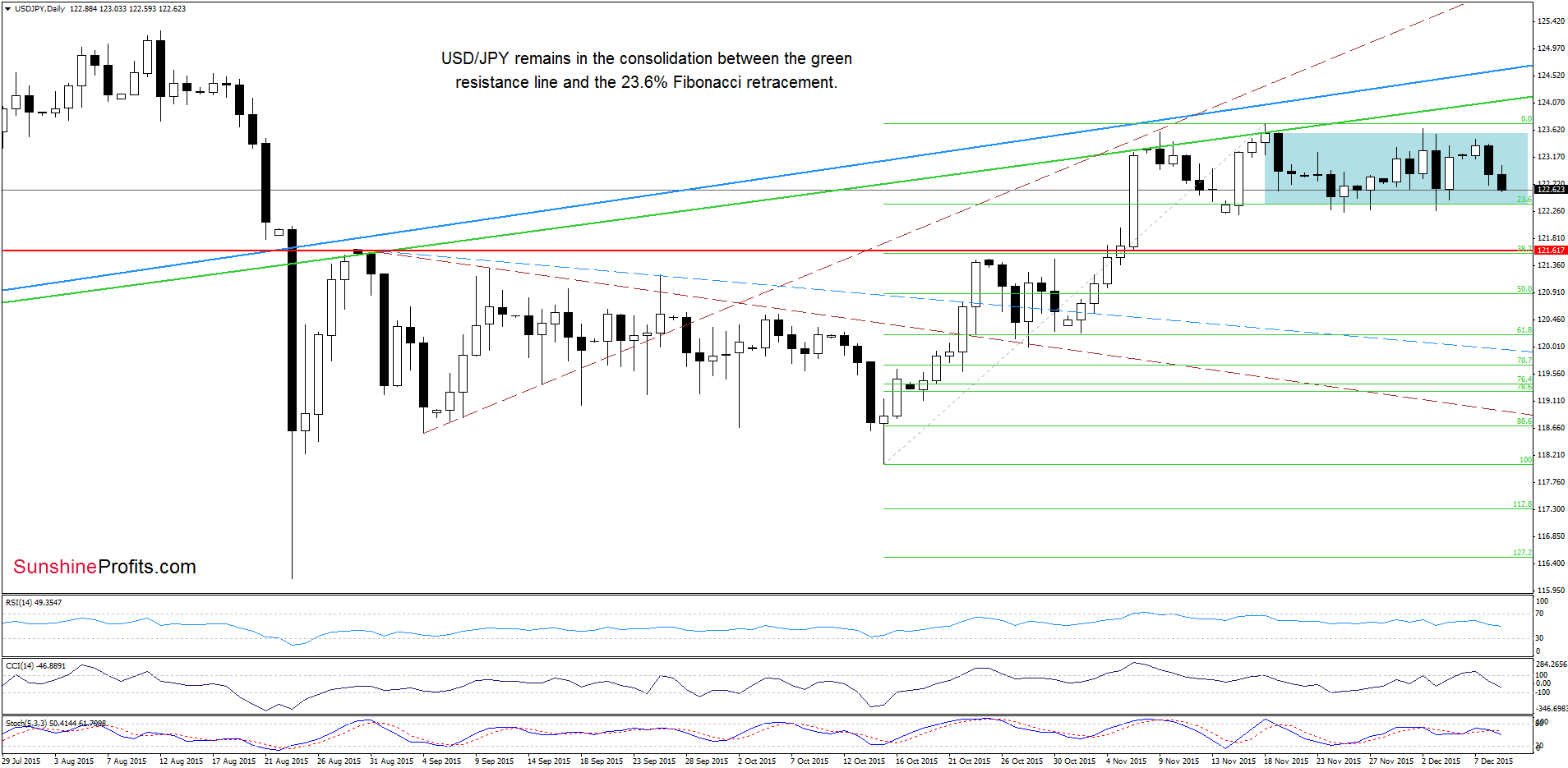

USD/JPY

On the above chart, we see that USD/JPY is still trading under the lower border of the blue rising trend channel, which means that as long as there is no comeback above this key resistance line a sizable upward move is not likely to be seen.

Having said that, let’s examine the very short-term chart.

From this perspective we see that the upper border of the consolidation triggered a decline, which suggests a test of the lower line of the formation. Nevertheless, in our opinion, as long as there is no breakdown under the 23.6% Fibonacci retracement another sizable move is not likely to be seen (especially when we factor in the fact that there was similar price action in the previous week, which triggered a rebound). Finishing today’s commentary on this currency pair, please note that sell signals generated by the indicators suggests further deterioration. If this is the case, and USD/JPY closes the day under recent lows, we may see a decline to the red horizontal support line in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

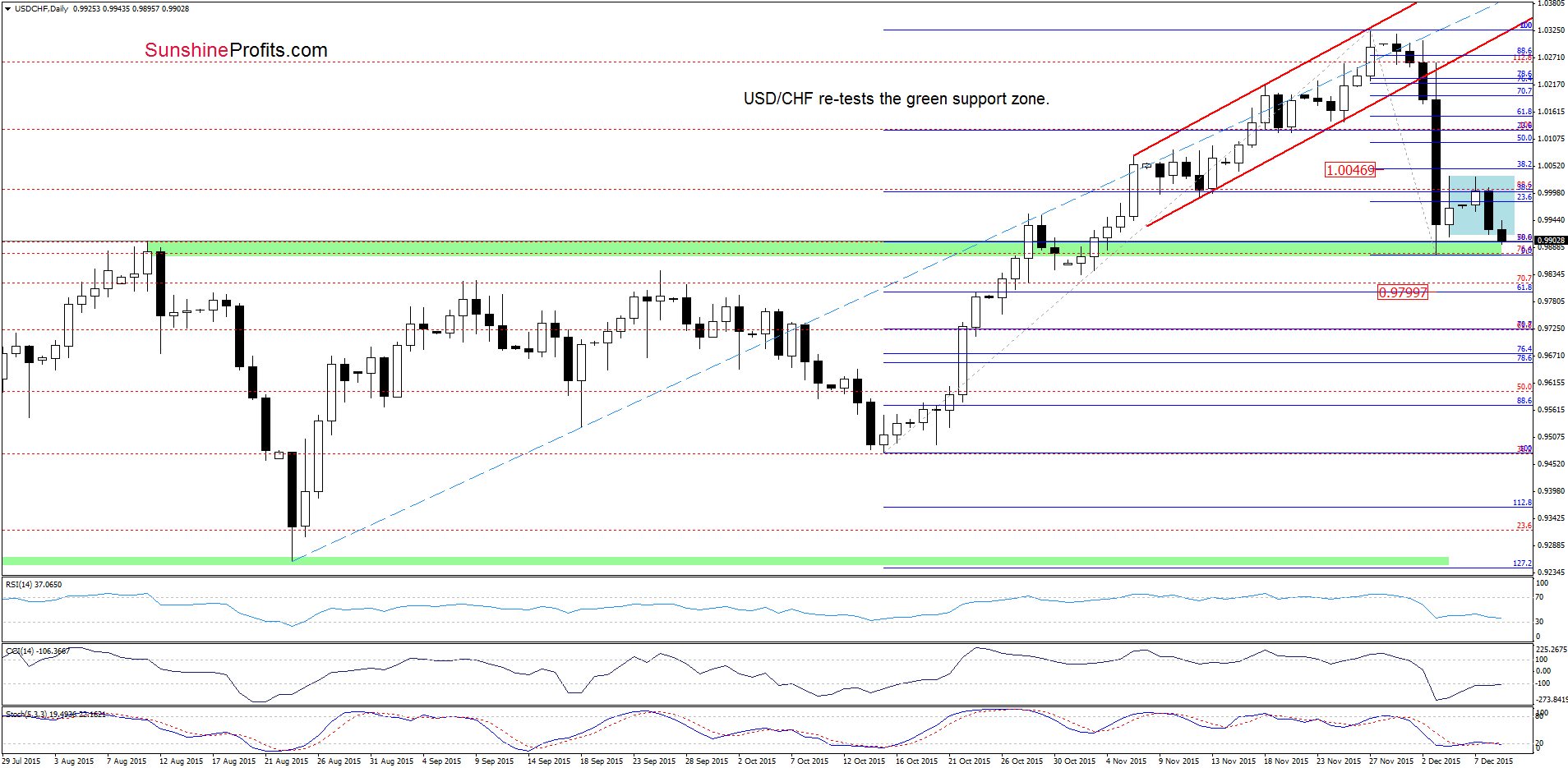

USD/CHF

As you see on the daily chart, the proximity to the 38.2% Fibonacci retracement (based on the recent decline) encouraged currency bears to act, which resulted in another downswing and a drop to the green support zone. If this important support area withstands the selling pressure, we’ll likely see a rebound from here to around the 38.2% Fibonacci retracement. However, as long as there are no buy signals, further deterioration can’t be ruled out (especially when we factor in a breakdown under the lower border of the blue consolidation marked on the above chart). Therefore, if USD/CHF extends declines, the next downside target would be around 0.9800, where the 61.8% Fibonacci retracement (based on the mid-Oct-Nov upward move) is.

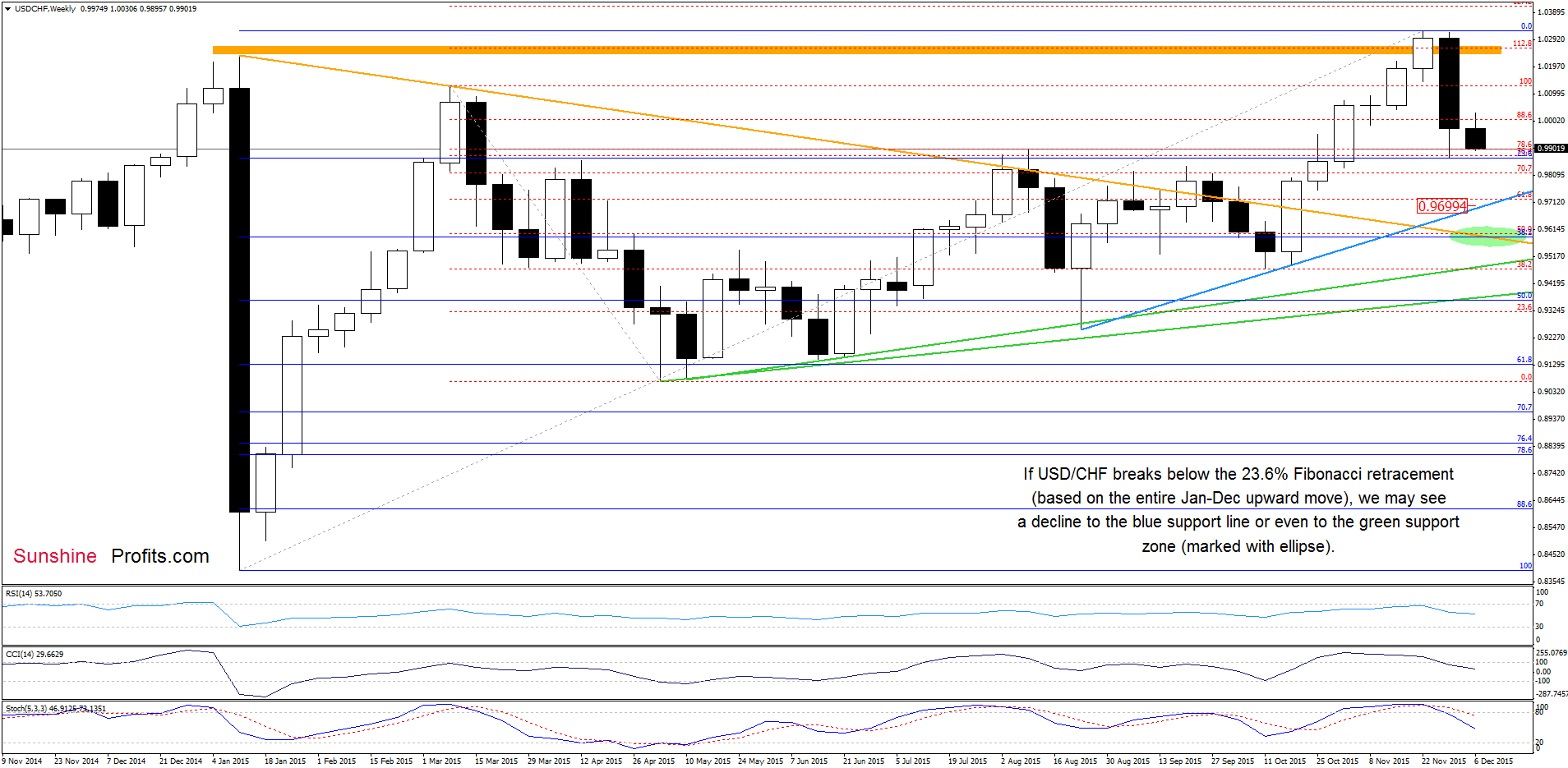

What could happen if this support is broken? Let’s examine the weekly chart and find out.

From this perspective, we see that further deterioration and a breakdown under the 23.6% retracement could result in a decline to the blue support line (based on the Aug and Oct lows) or even to the green support area (created by the 38.2% Fibonacci retracement based on the Jan-Nov upward move and the orange support line).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts