Earlier today, the common currency rebounded slightly after reports that Ukraine had reached an agreement on a ceasefire with Russia. Nevertheless, the most important event, which would drive the EUR/USD pair higher or lower will be tomorrow European Central Bank monthly meeting. Before we know whether the ECB will announce quantitative easing measures or not, let’s check the technical picture of the exchange rate.

In our opinion the following forex trading positions are justified - summary:

EUR/USD

The medium-term picture hasn’t changed much since yesterday and EUR/USD is still trading around the 70.7% Fibonacci retracement level. Today, we’ll focus only on the very short-term changes.

From this perspective, we see that although EUR/USD rebounded slightly earlier today, the size of the upswing is too small to say that the very short-term (not to mention the short-term) outlook improved. As you see on the daily chart, the exchange rate is still trading in a narrow range between the 70.7% Fibonacci retracement (which serves as the nearest support) and the previously-broken 112.8% Fibonacci price projection (the nearest resistance). Therefore, we think that as long as the pair remains below the orange gap, another attempt to move lower can’t be ruled out. If this is the case, we believe that our downside targets from yesterday’s Forex Trading Alert will be in play:

(…) based on our experience, we noticed that the 127.2% Fibonacci price projection and the support zone created by the 76.4% and 78.6% Fibonacci retracement levels are much stronger than the current Fibonacci retracement and more often stopped the decline in the past. Therefore (…) we believe that the next downside target will be at 1.3075 or even around 1.3016-1.3047, where the above-mentioned levels are.

Before we move on to the next currency pair, please note that we will have a decision or at least more information regarding the European QE tomorrow - perhaps this will be the day when currencies reverse their direction for some time. We will keep our eyes open and report to you accordingly.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

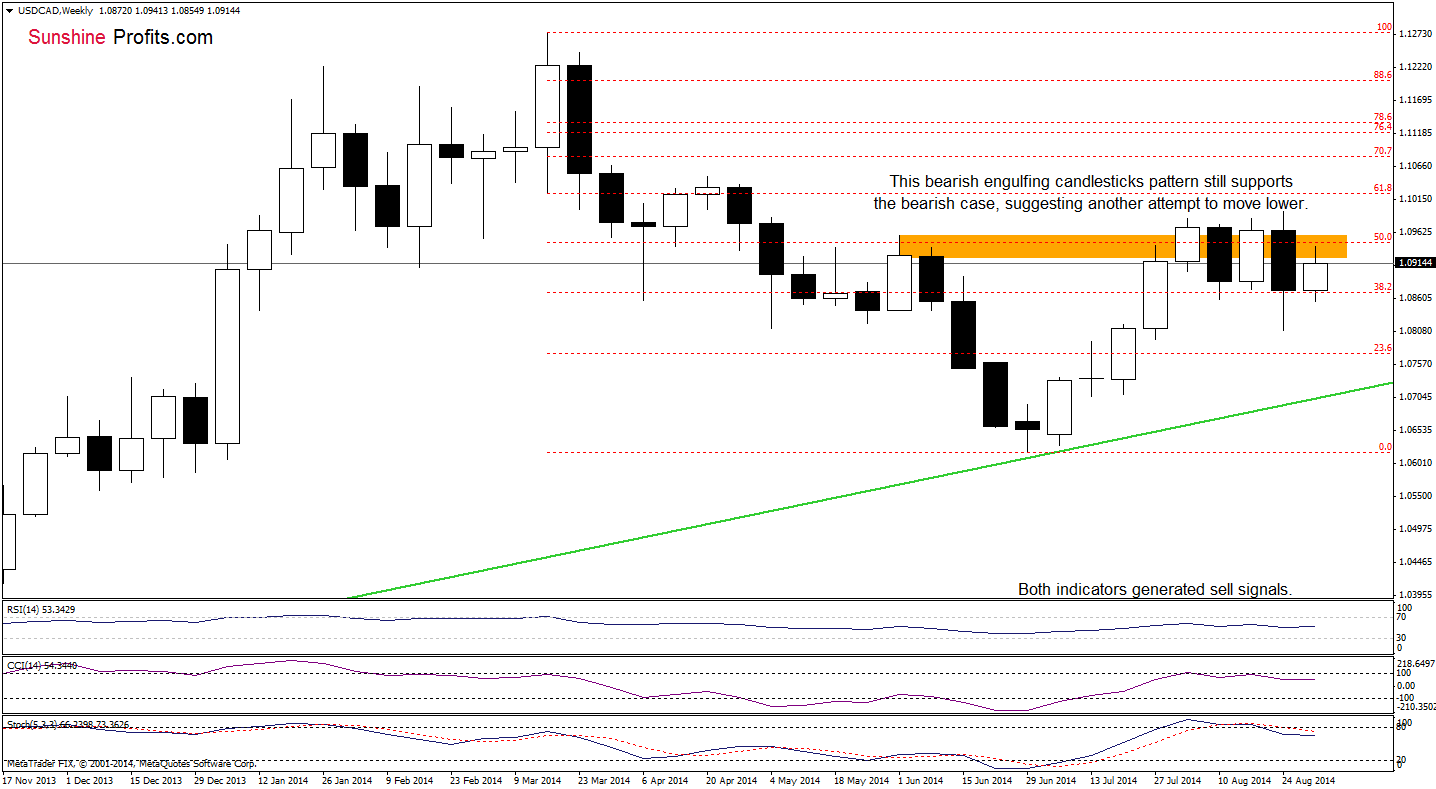

USD/CAD

Although the medium-term outlook has improved slightly as USD/CAD rebounded, the pair still remains below the recent highs. Additionally, the bearish engulfing candlesticks pattern in combination with sell signals generated by the indicators still supports currency bears, suggesting another attempt to move lower.

Having say that, let’s examine the daily chart.

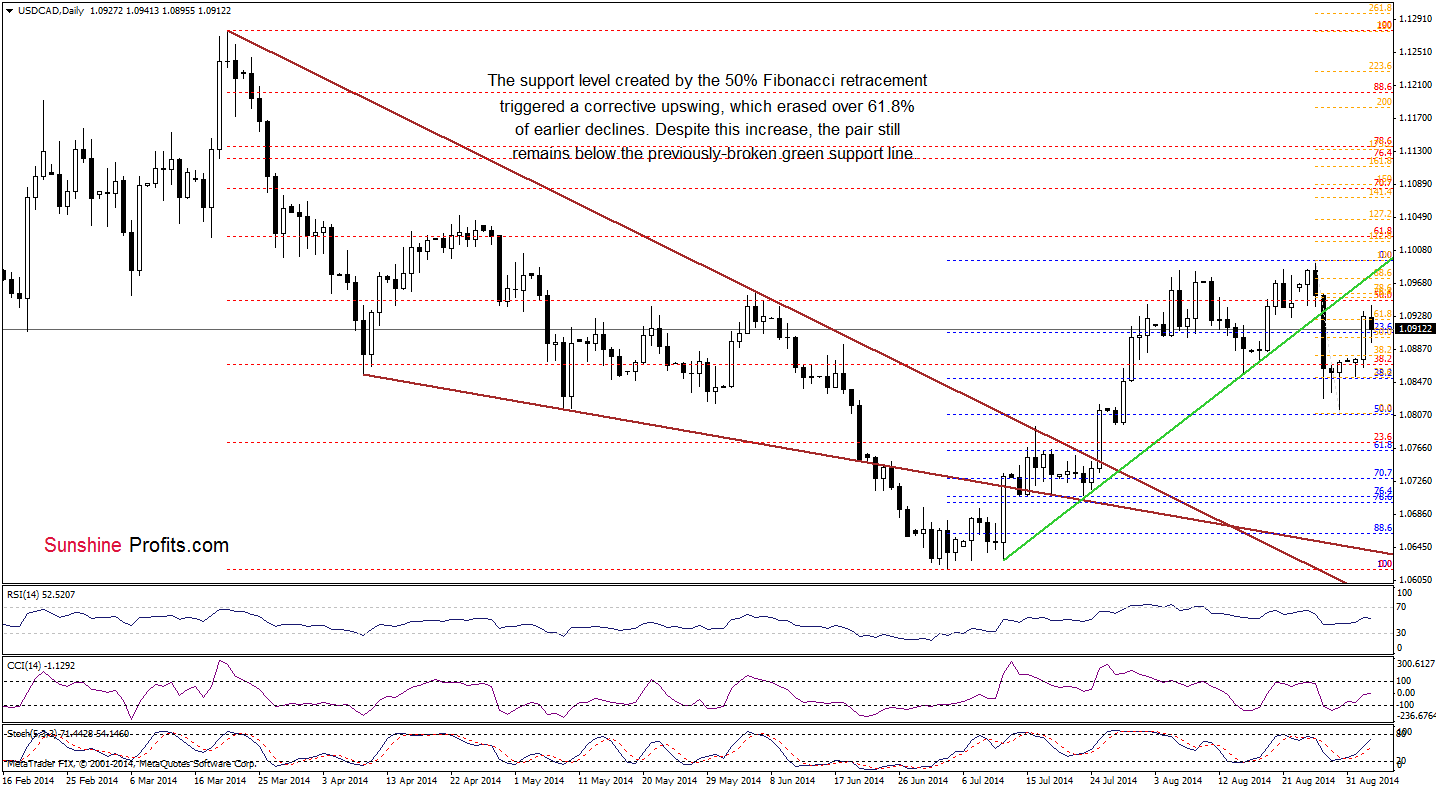

Looking at the above chart, we see that the support level created by the 50% Fibonacci retracement triggered a corrective upswing, which erased 61.8% of earlier decline. Although this is a positive signal, USD/CAD invalidated a breakout above this resistance level, which is a bearish sign that suggests further deterioration (especially when we factor in the fact that the exchange rate still remains below the previously-broken the green resistance line based on the Jul 7, Jul 23 and Aug 15 lows). If this is the case, we’ll see a drop to the nearest support around 1.0855, where the bottom of the recent pullback is. If this level is broken, the pair will test the strength of the 50% Fibonacci retracement once again.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

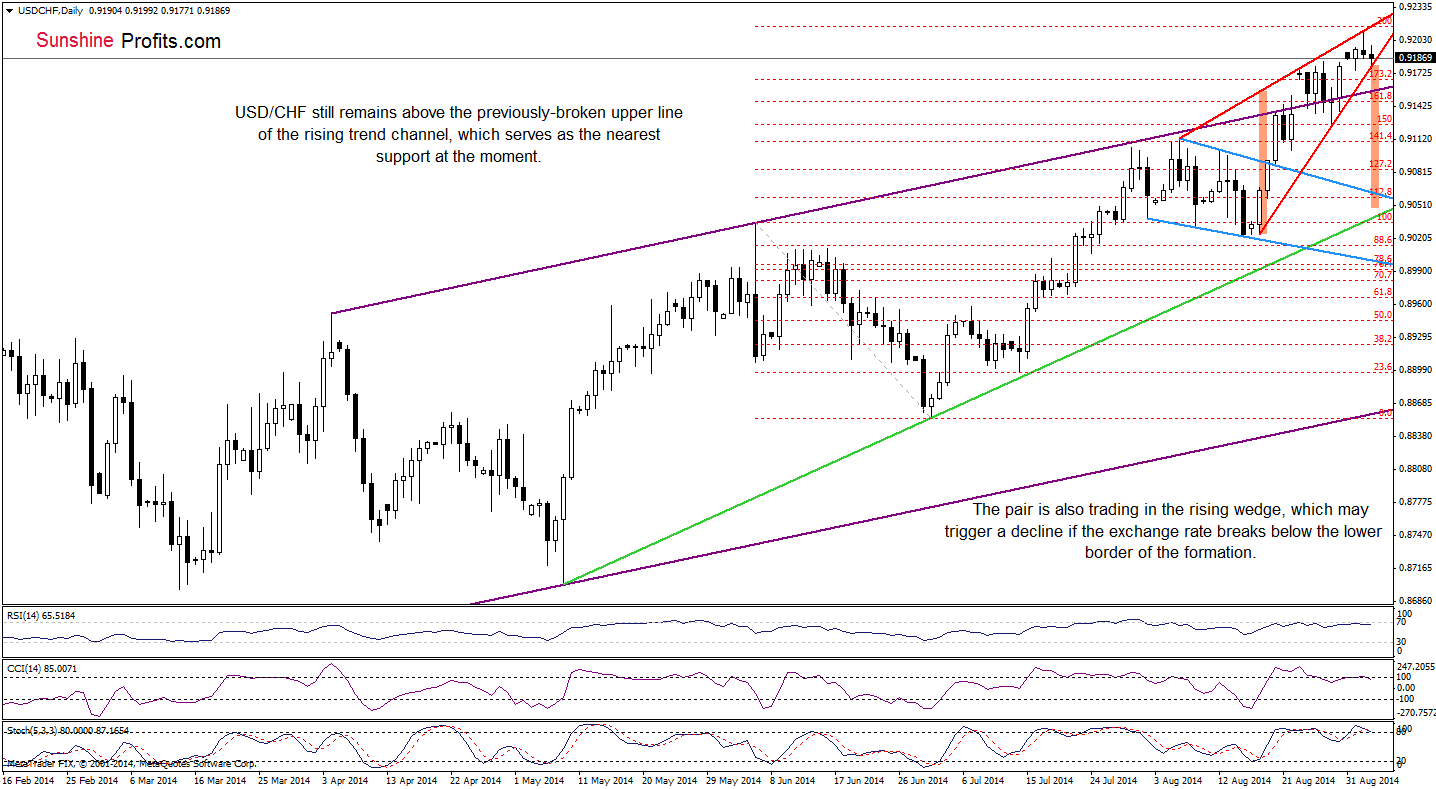

The medium-term outlook has improved as USD/CHF climbed above the last week’s high. This is a bullish signal, which suggests further improvement. Nevertheless, when we take a closer look at the above chart, we can notice that the recent upward move is very similar to the previous one (the pair moved slightly above the 100% Fibonacci price projection), which suggests that we may see a correction in the coming week – especially if currency bulls do not manage to break above the orange resistance zone and the indicators will generate sell signals.

Can we infer something more from the daily chart?

The first thing that catches the eye on the above chart is a rising wedge (marked with red). As you see on the daily chart, the upper line of the formation stopped the rally yesterday, while the lower border still keeps the decline in check. Taking into account the fact that this is a bearish formation, which usually precedes corrections (we saw similar situation on the weekly chart of the GBP/USD in the recent weeks), we think that the next short-term move will be to the downside. If the exchange rate moves below its nearest support line, we may see a drop even to the previously-broken upper line of the declining trend channel (marked with blue). Nevertheless, before currency bears will realize this scenario, they will have to push the pair below the medium-term purple support line (the upper line of the rising trend channel), which serves as the key support (around 0.9153) at the moment. Please note that all three indicators are very close to generate sell signals, which supports the bearish case and suggests a correction in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bullish bias

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts