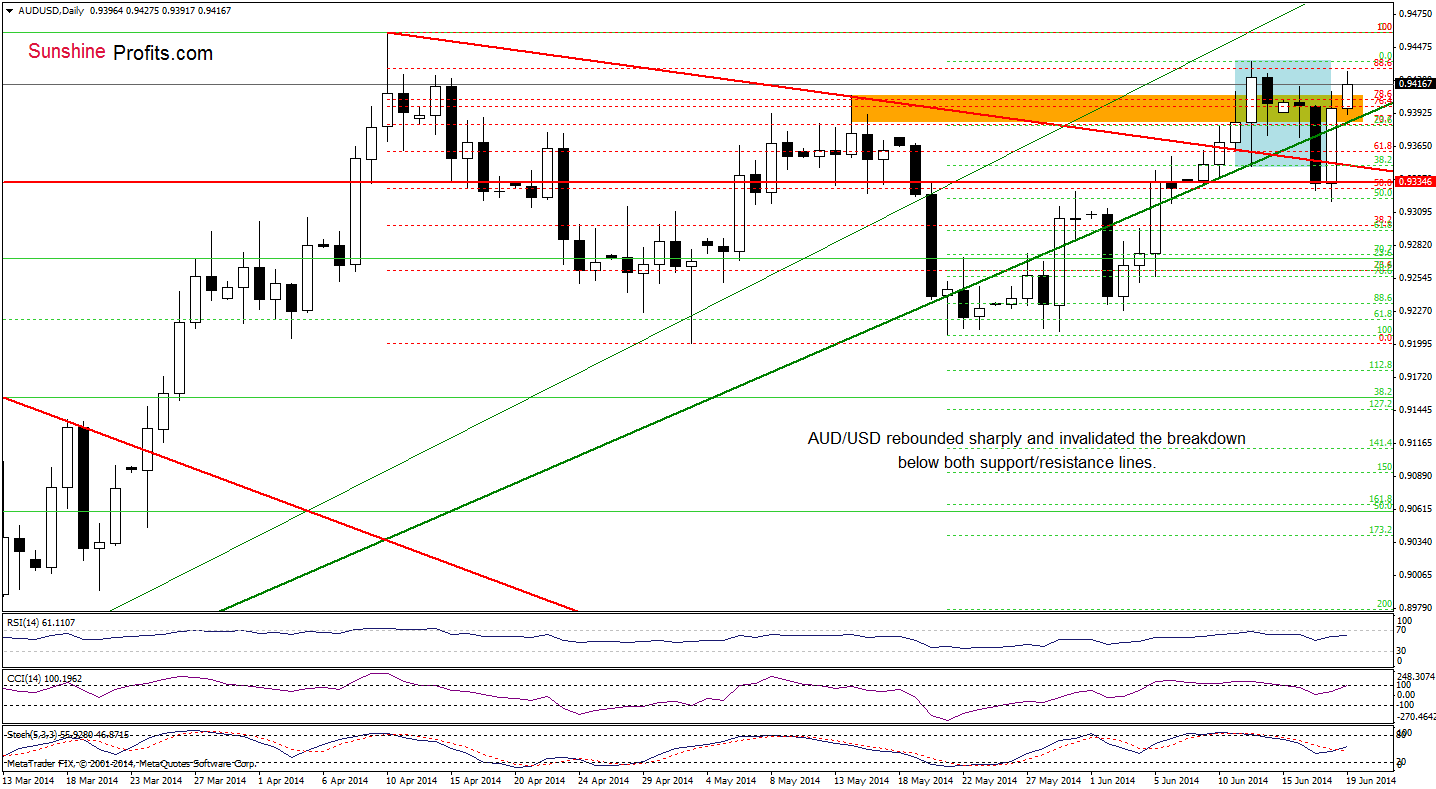

Yesterday, the Australian dollar moved higher against its U.S. counterpart after the Federal Reserve indicated that interest rates will remain low for a considerable time after the bank’s asset purchase program ends. Thanks to this news AUD/USD rebounded sharply, invalidating earlier breakdown and breaking above the resistance zone. Will we see further improvement in the near future?

In our opinion the following forex trading positions are justified - summary:

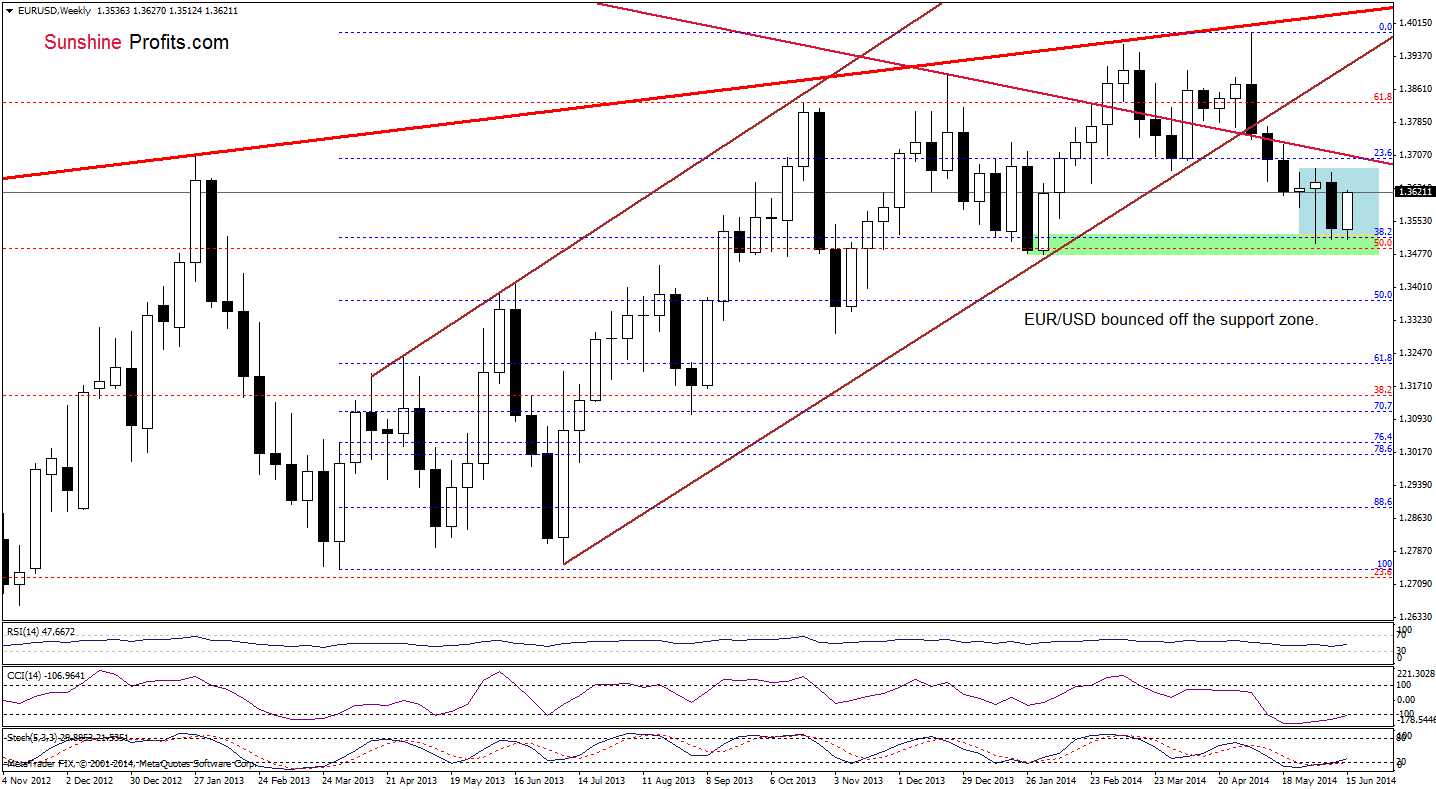

EUR/USD

The overall situation in the medium term has improved as EUR/USD bounced off the support zone created by the 38.2% Fibonacci retracement and last week’s low. Taking this fact into account and combining it with the current position of the indicators, it seems to us that we’ll see further improvement and the upside target will be last week’s high of 1.3668.

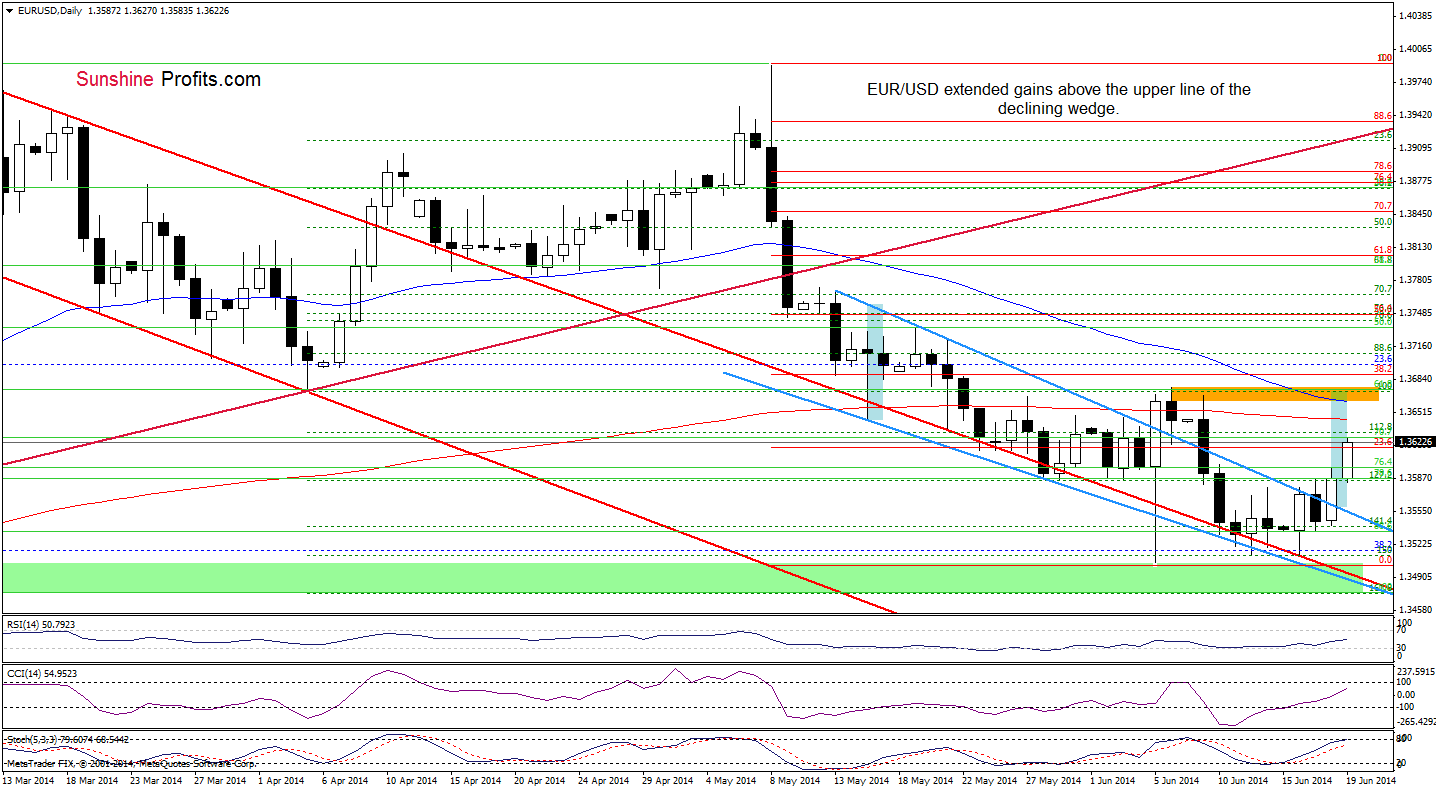

Having say that, let’s focus on the very short-term changes.

Looking at the above chart, we see that the exchange rate extended gains above the upper line of the declining wedge, which suggests that what we wrote yesterday is up-to-date:

(…) if the exchange rate confirms the breakout, we’ll see further improvement and an increase to around 1.3670, where the size of an upswing will correspond to the height of the declining wedge (marked with blue). At this point, it’s worth noting that in this area is a strong resistance zone created by the June 6 and June 9 highs. On top of that, slightly above these levels is also the 38.2% Fibonacci retracement (based on the entire recent decline), which serves as an additional resistance.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

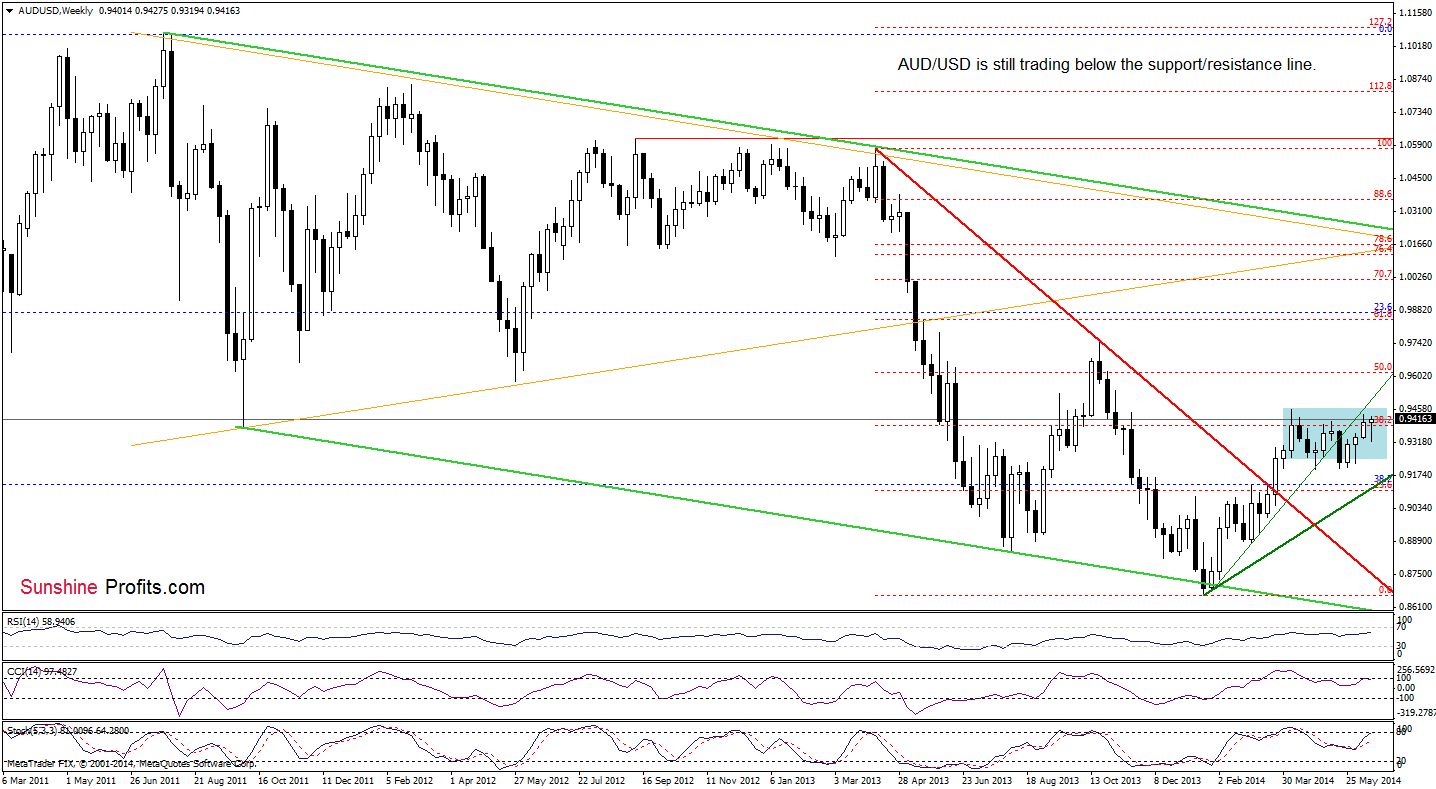

AUD/USD

Looking at the above charts, we see that the situation in the medium term hasn’t changed much, but the very short-term outlook improved significantly as AUD/USD rebounded sharply, invalidating earlier breakdown below both resistance lines. With this upswing, the exchange rate also broke above the resistance zone created by the 76.4% and 78.6% Fibonacci retracements, approaching the last week’s high. If the 88.6% and the last Thursday high hold, we’ll see a pullback from here and the initial downside target will be the medium-term green line. However, if this resistance area is broken, we’ll see another attempt to reach the 2014 high of 0.9459.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts