Earlier today, the greenback moved higher against the euro, the yen and the Swiss franc. Nevertheless, the U.S. currency declined against the British pound, Canadian dollar and its Australian counterpart. Did these moves change the outlook for major currency pairs? We invite you to read our today's Forex Trading Alert.

Forex Trading Positions - Summary:

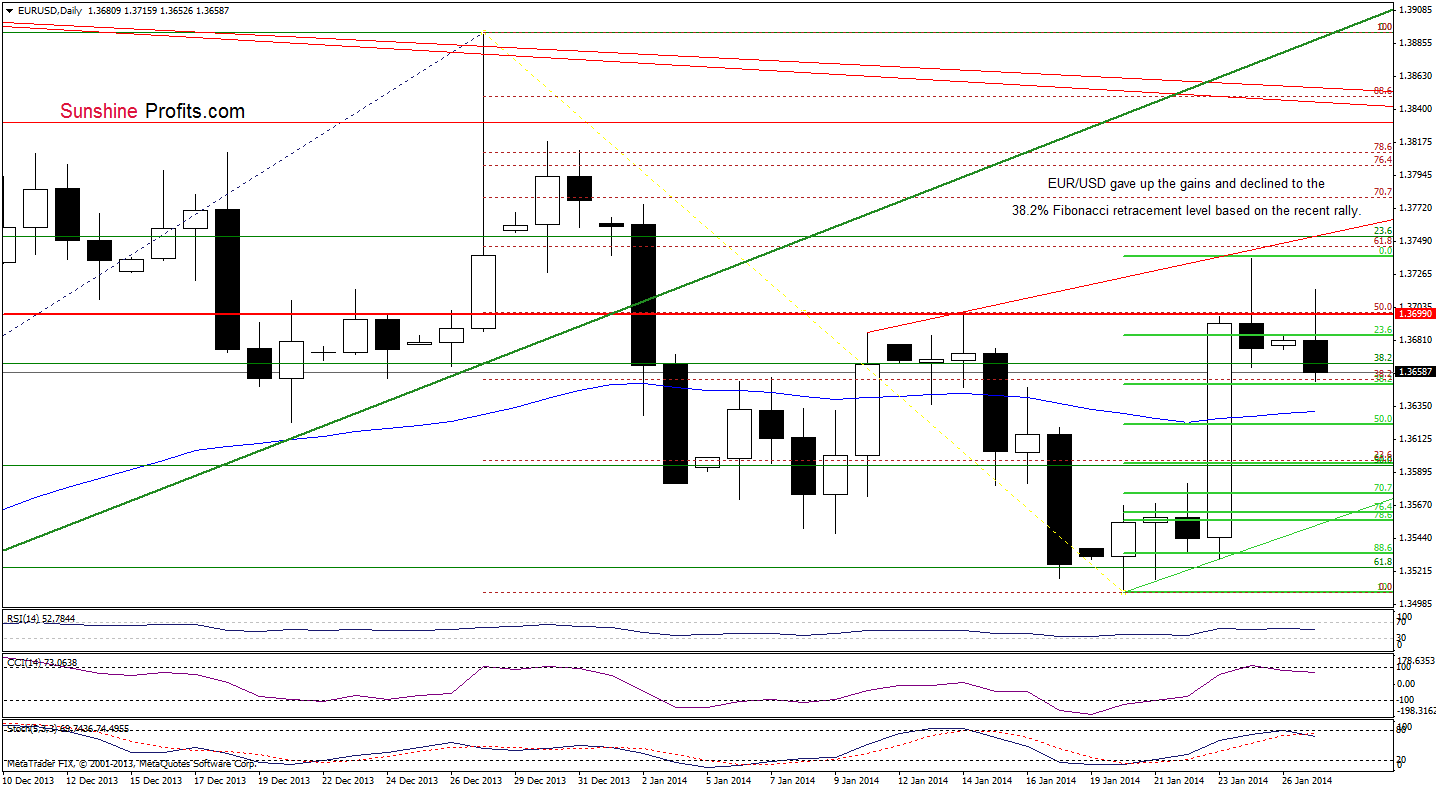

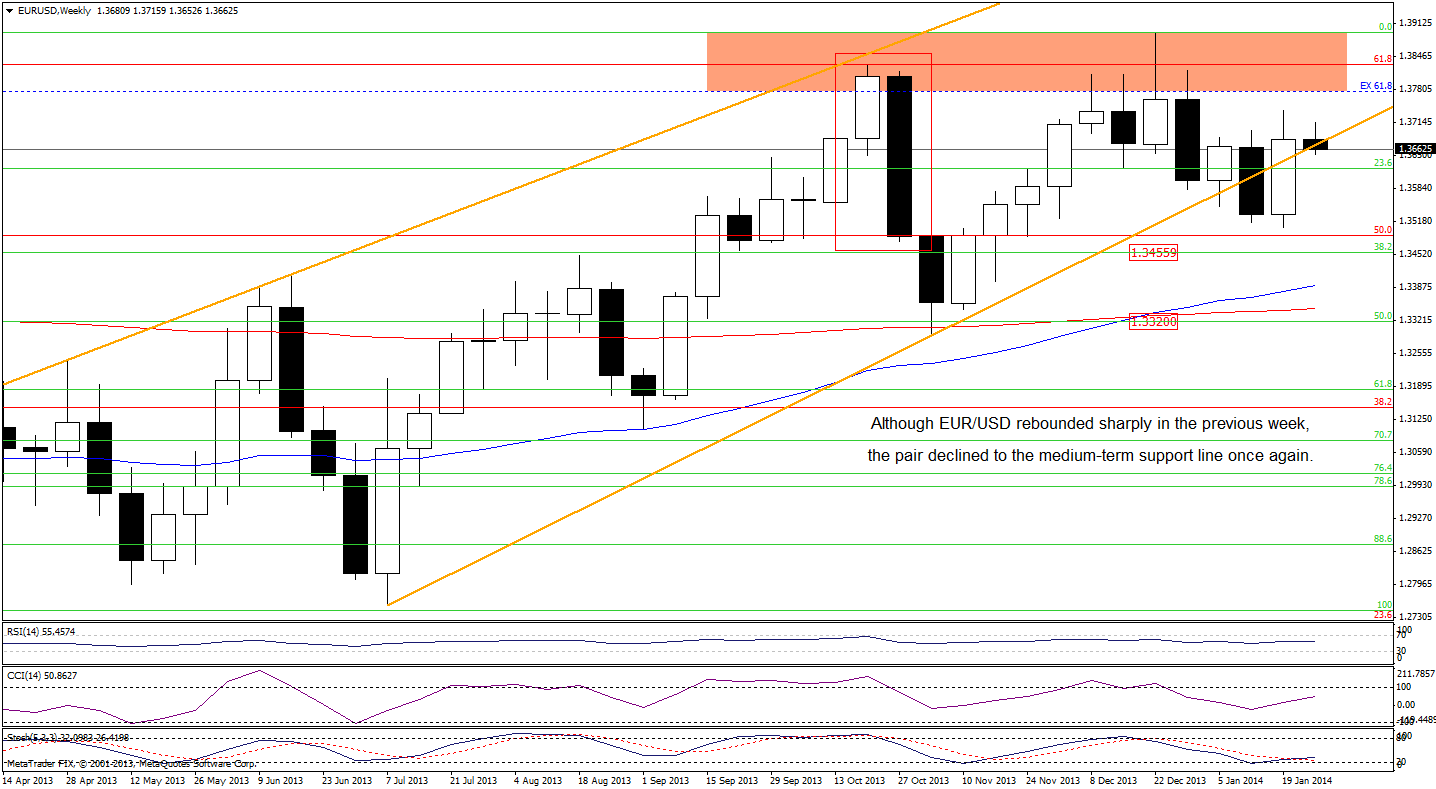

EUR/USD

On the above chart, we see that EUR/USD gave up the gains and extended its decline earlier today. With this downswing, the pair reached the 38.2% Fibonacci retracement level based on the recent rally and the medium-term rising support line (seen more clearly on the chart below). From this perspective, the current correction is still shallow and if the strong support encourages buyers to act, we will likely see another upswing in the near future. Nevertheless, we should keep in mind that the CCI and Stochastic Oscillator generated sell signals, which prescribe caution.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): we do not suggest opening any trading positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

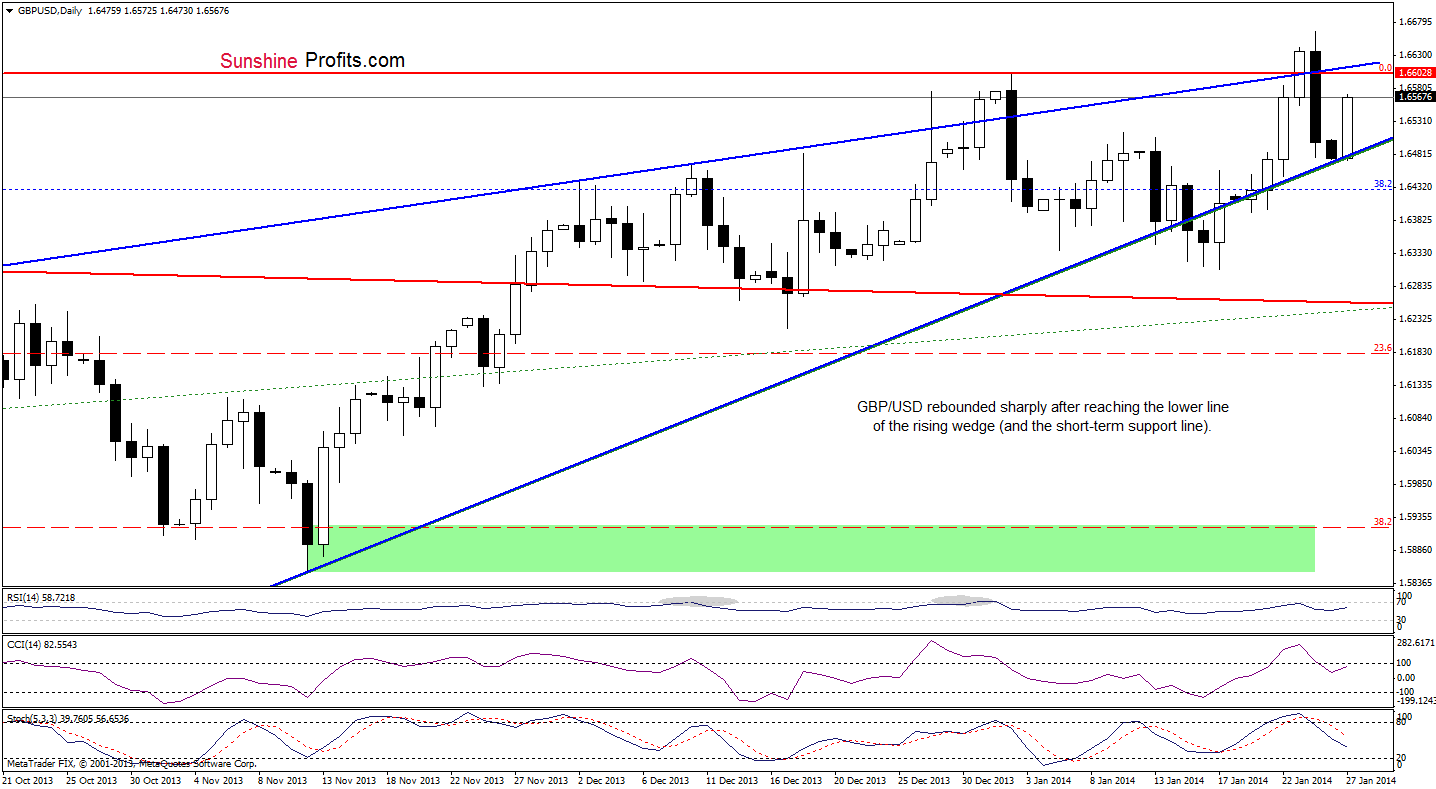

GBP/USD

Looking at the above chart, we see that the pair reached the lower border of the rising wedge (and the short-term rising support line) and rebounded sharply earlier today. With this upswing, GBP/USD approached the upper border of the rising wedge once again. At this point, it’s worth noting that we had already seen similar price action in the previous week. Back then, after a small breakout above this resistance line, the pair gave up the gains and reversed. If history repeats itself once again, we will likely see similar price action in the coming day (or days).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): we do not suggest opening any trading positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

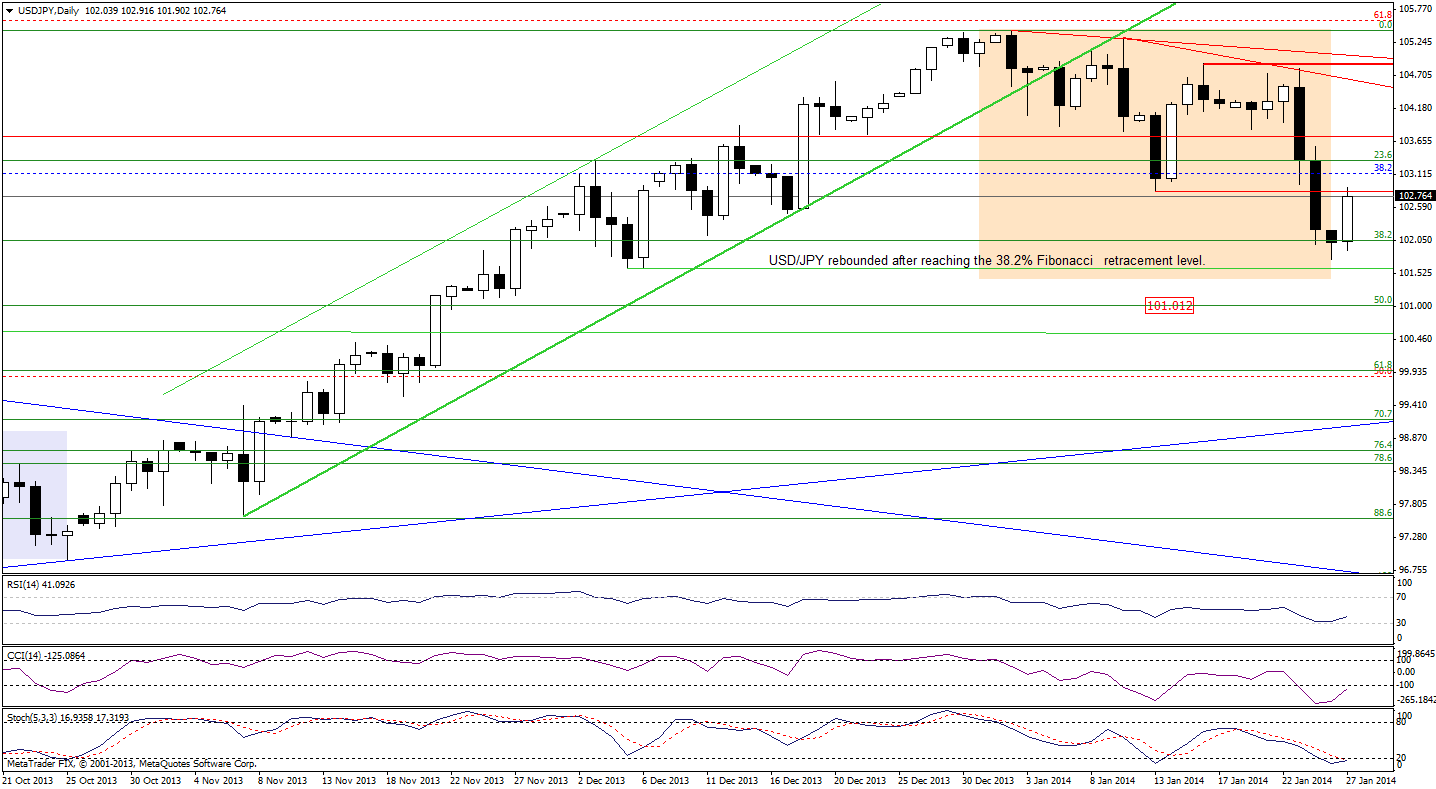

USD/JPY

In our last Forex Trading Alert, we wrote:

(…) the pair reached the 38.2% Fibonacci retracement level based on the Oct. - Jan. rally. If this strong support encourages buyers to push the order button, we will likely see an upward corrective move.

On the above chart, we see that USD/JPY rebounded sharply and climbed to the previous lows. If the pair extends its upswing, we will likely see further improvement and the first upside target will be Friday’s high. On the other hand, this upward move can be nothing more than a verification of the breakdown. If this is the case, we will likely see further deterioration and the first downside target will be the Dec. 5 low at 101.61 and the next the 50% Fibonacci retracement level.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): we do not suggest opening any trading positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

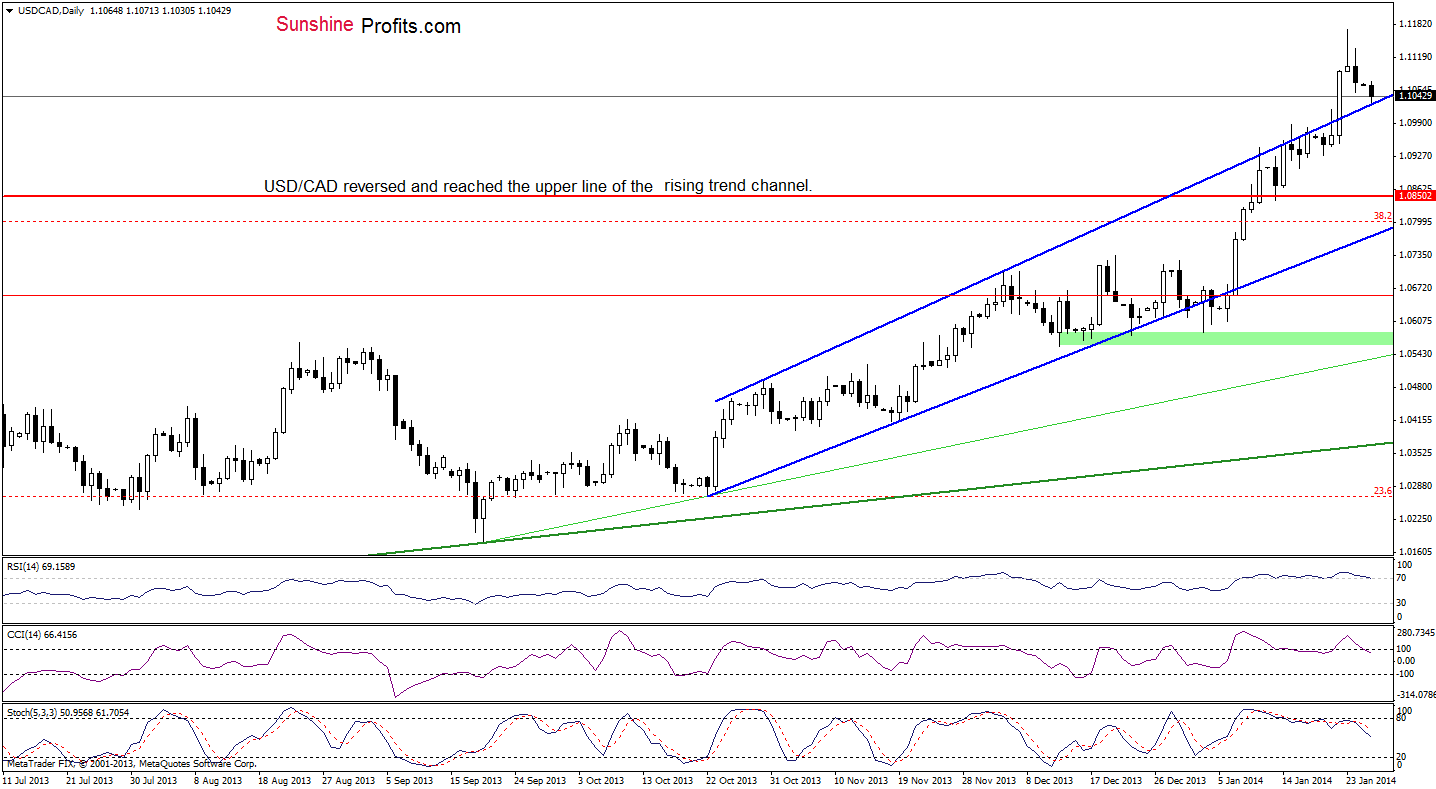

USD/CAD

On the above chart, we see that USD/CAD extended its decline and reached the upper line of the rising trend channel earlier today. Despite this drop, the current correction is still shallow and the pair remains above this strong support line which keeps further declines in check.

Nevertheless, we should keep in mind that the CCI and Stochastic Oscillator generated sell signals and the RSI is still overbought, which supports the bearish case. If the pair invalidates the breakout above the upper line of the rising trend channel, we will consider opening short positions.

Very short-term outlook: mixed

Short-term outlook: bullish

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): we do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

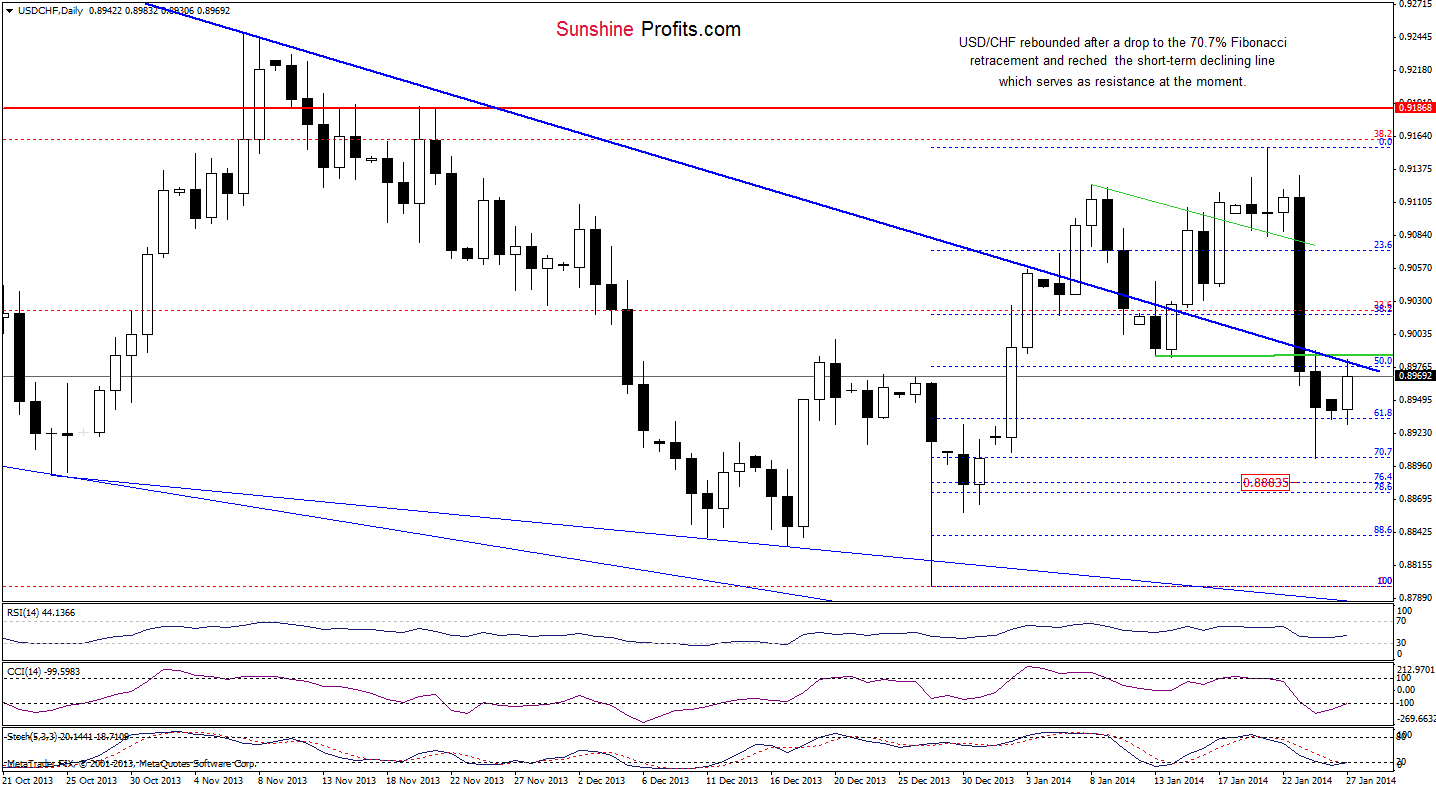

USD/CHF

On the above chart, we see that the situation has improved slightly as USD/CHF rebounded earlier today. Despite this upswing, the pair still remains below previous lows and the short-term declining support/resistance line (at least at the moment when these words are written). From this perspective, it seems that as long as this strong resistance remains in play, we won’t see a bigger upside correction. As a reminder, if the buyers fail, we will likely see further deterioration and the next downside target will be around 0.8883 where the next Fibonacci retracement is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): we do not suggest opening any trading positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

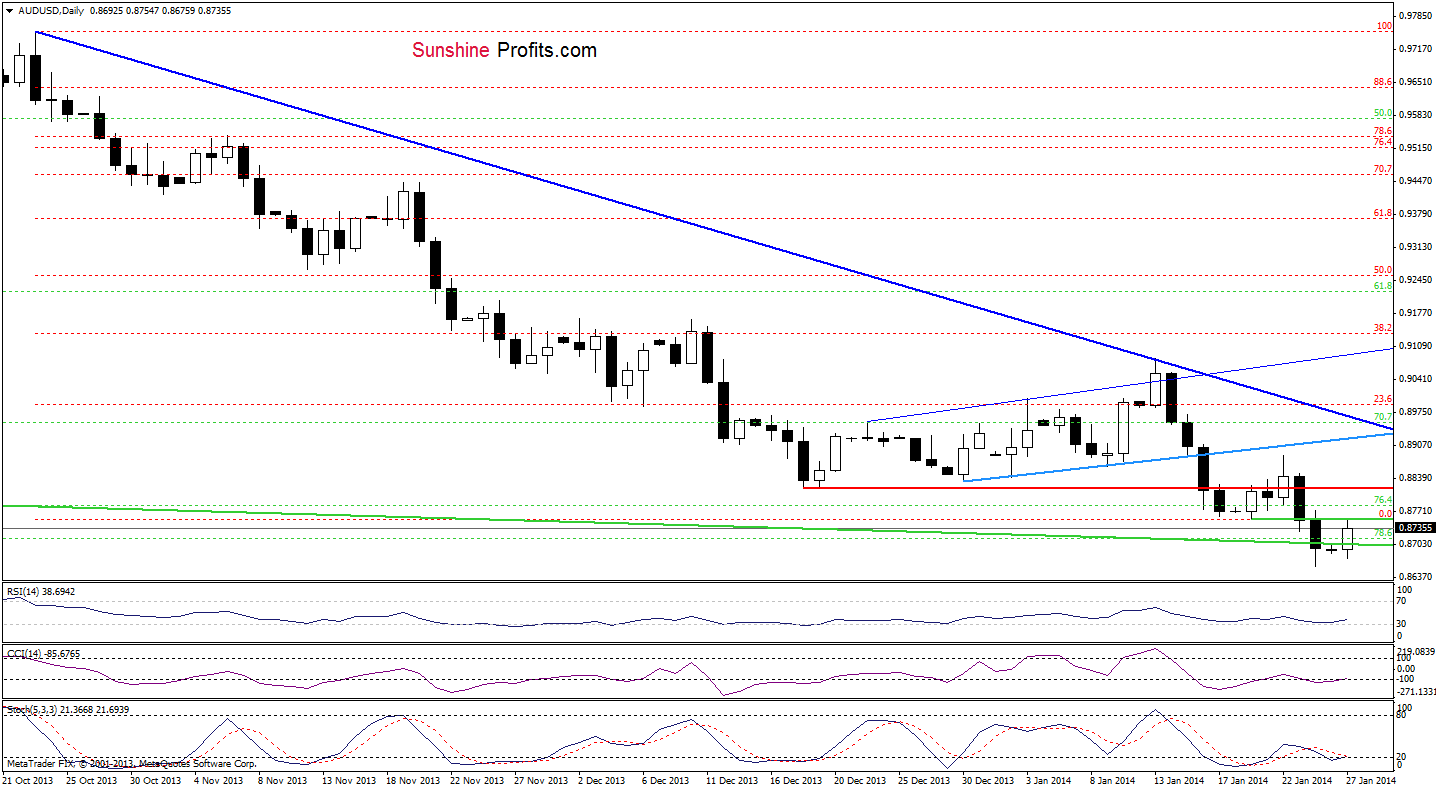

AUD/USD

Looking at the above chart, we see that the situation hasn’t changed much. Although the pair rebounded earlier today, it still remains below the previous lows. At this point, it’s worth noting that recent days have formed a consolidation. According to theory, if AUD/USD climbs above Friday’s high, we will likely see further improvement. Additionally, the CCI and Stochastic Oscillator generated buy signals, which is a bullish signal. Nevertheless, even if we see such price action, a strong resistance zone created by December lows and Wednesday high will likely stop further growth. Please note that it is still too early to say that the worst is behind the holders of the Australian currency as the pair remains below this resistance zone and another downswing can’t be rule out.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): we do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts