Wednesday’s session showed that currency bears are quite strong after they managed to invalidate the earlier breakout above the upper line of the declining trend channel. Will they take EUR/USD below 1.1450 in the following days?

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3377; the initial downside target at 1.2923)

- USD/JPY: long (a stop-loss order at 111.11; the initial upside target at 113.40)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (with a stop-loss order at 0.7208; the initial downside target at 0.7051)

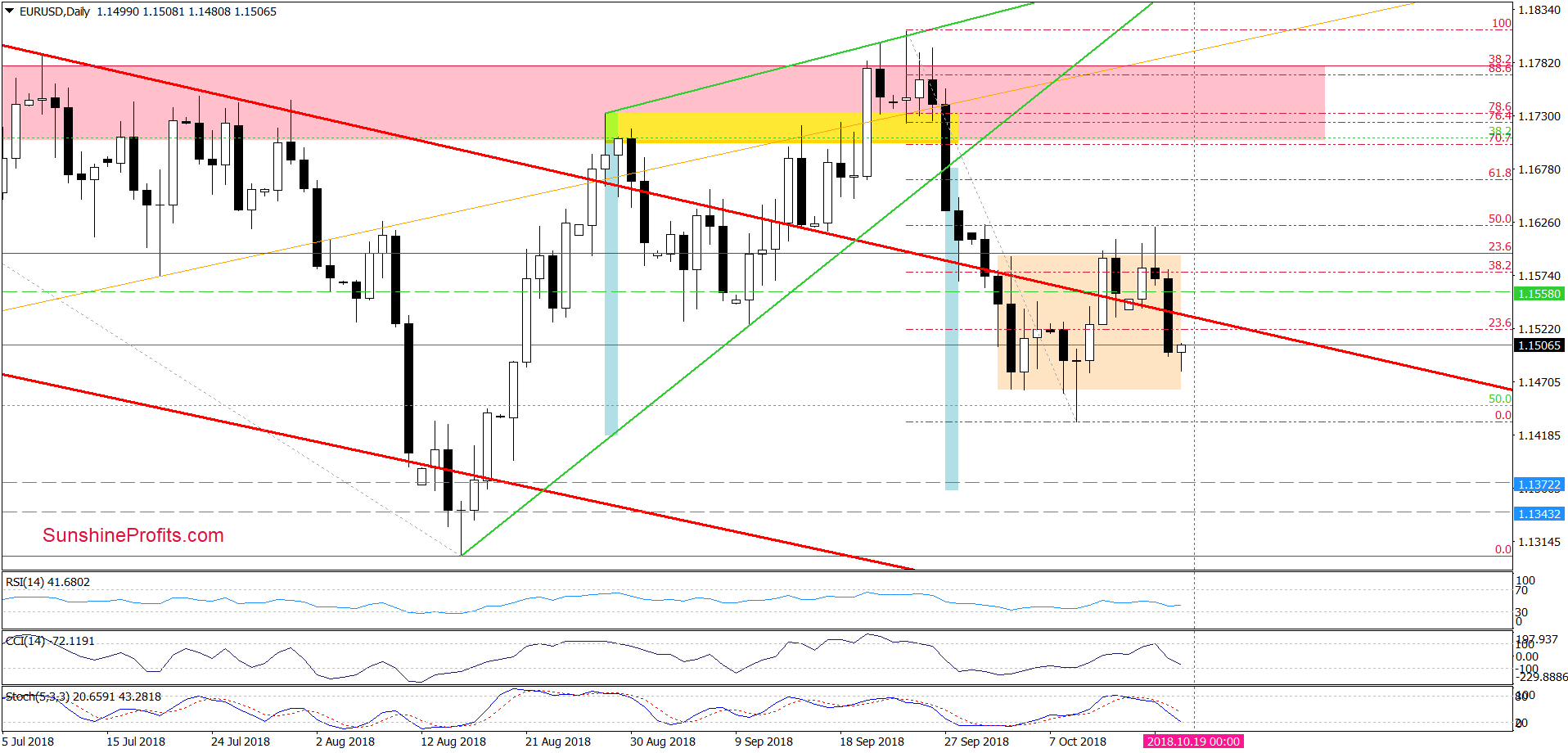

EUR/USD

Quoting our last alert:

(…) the exchange rate slipped to the previously-broken upper border of the red declining trend channel, which in combination with the sell signals generated by the indicators (the CCI joined the Stochastic Oscillator and also generated a sell signal) suggests that we’ll see an invalidation of the earlier breakout above this line later in the day.

From today’s point of view, we see that the situation developed in line with the above assumption and EUR/USD closed yesterday’s session well below the red line. Earlier today, we noticed a small rebound, which looks like a nothing more than a verification of yesterday’s breakdown.

Additionally, the sell signals generated by the indicators remain in the cards, supporting another move to the downside in the very near future. Therefore, if the pair declines from this area, we’ll see a test of the lower border of the consolidation or even the last week’s low in the following days.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1878 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

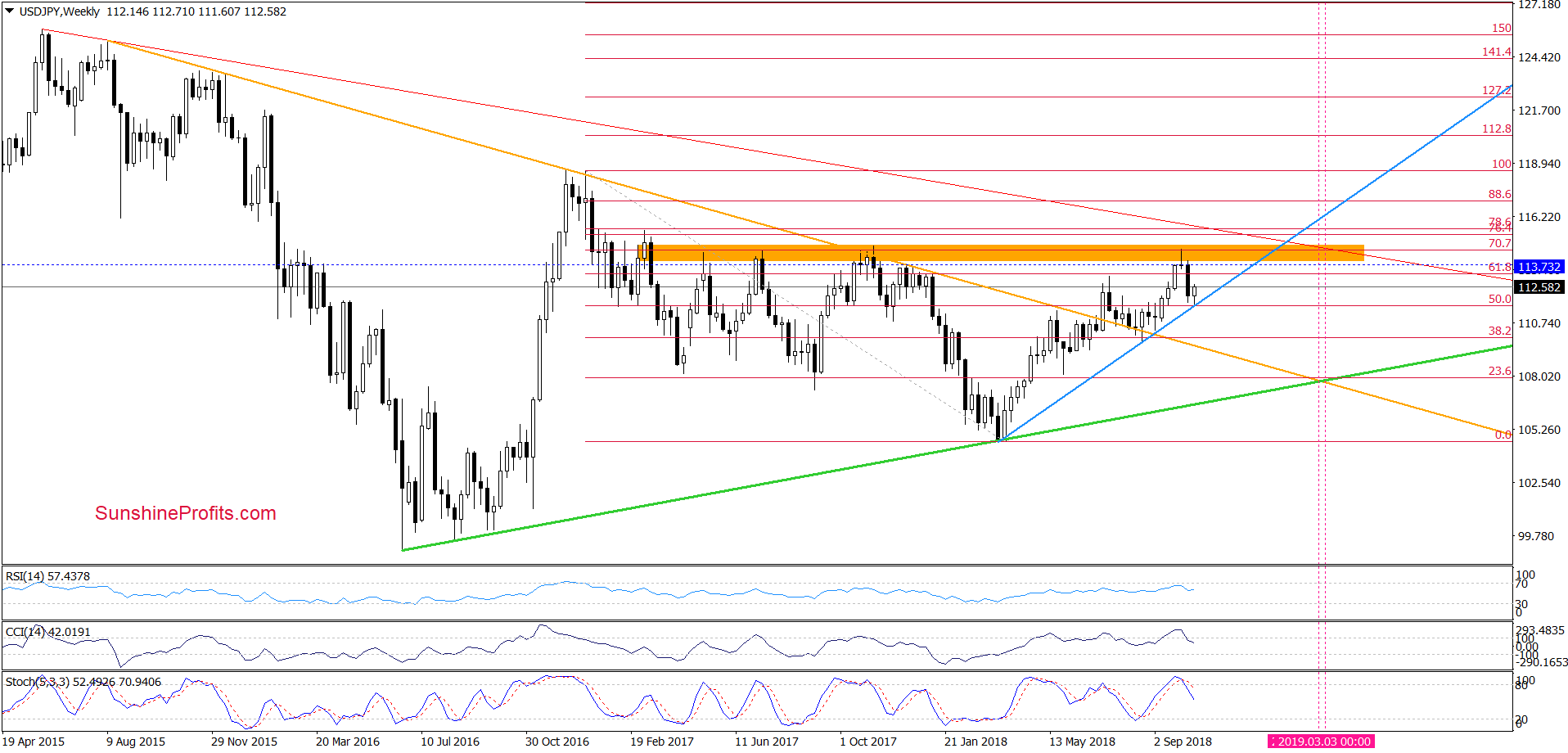

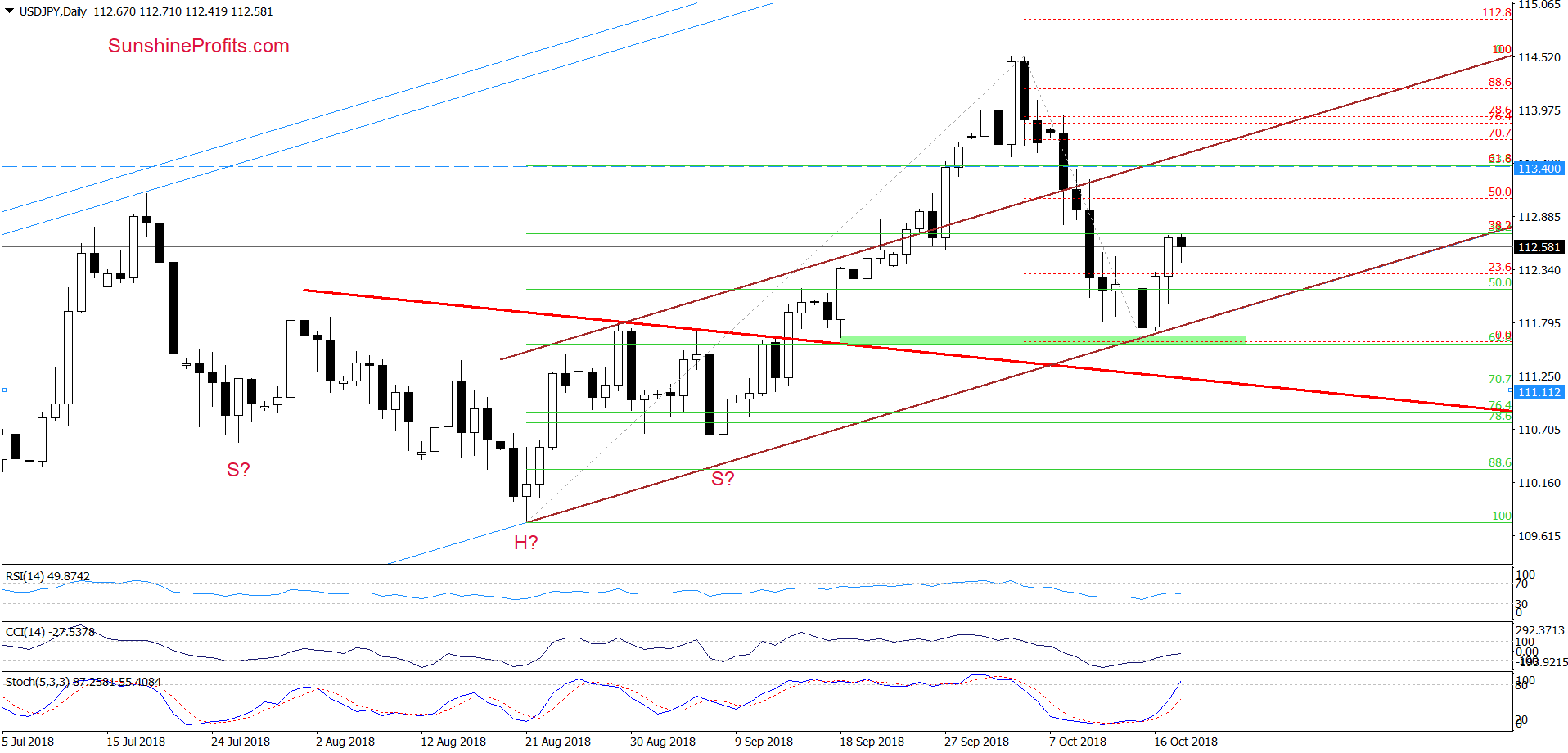

USD/JPY

Quoting our last commentary on this currency pair:

(…) currency bears (…) pushed USD/JPY below the 50% Fibonacci retracement, which resulted in further deterioration and a test of the lower border of the brown rising trend channel and the 61.8% Fibonacci retracement.

(…) thanks to yesterday’s downswing, the exchange rate tested the durability of (…) the medium-term blue support line based on the March and August lows, which suggests that as long as it servs as a support another bigger move to the downside is not likely to be seen.

Additionally, the CCI and the Stochastic Oscillator generated buy signals, increasing the probability of (at least) the very short-term improvement in the following days.

Looking at the daily chart, we see that USD/JPY extended gains and climbed to the 38.2% Fibonacci retracement based on the recent downward move. Although this resistance triggered a small pullback earlier today, the buy signals continue to support the buyers and higher values of the exchange rate in the very near future.

This suggests that if the pair reverses and climbs once again, we’ll likely see a test of the previously-broken upper line of the brown rising trend channel (or even the orange resistance zone marked on the weekly chart) in the very near future.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 111.11 and the initial upside target at 113.40 are justified from the risk/reward perspective.

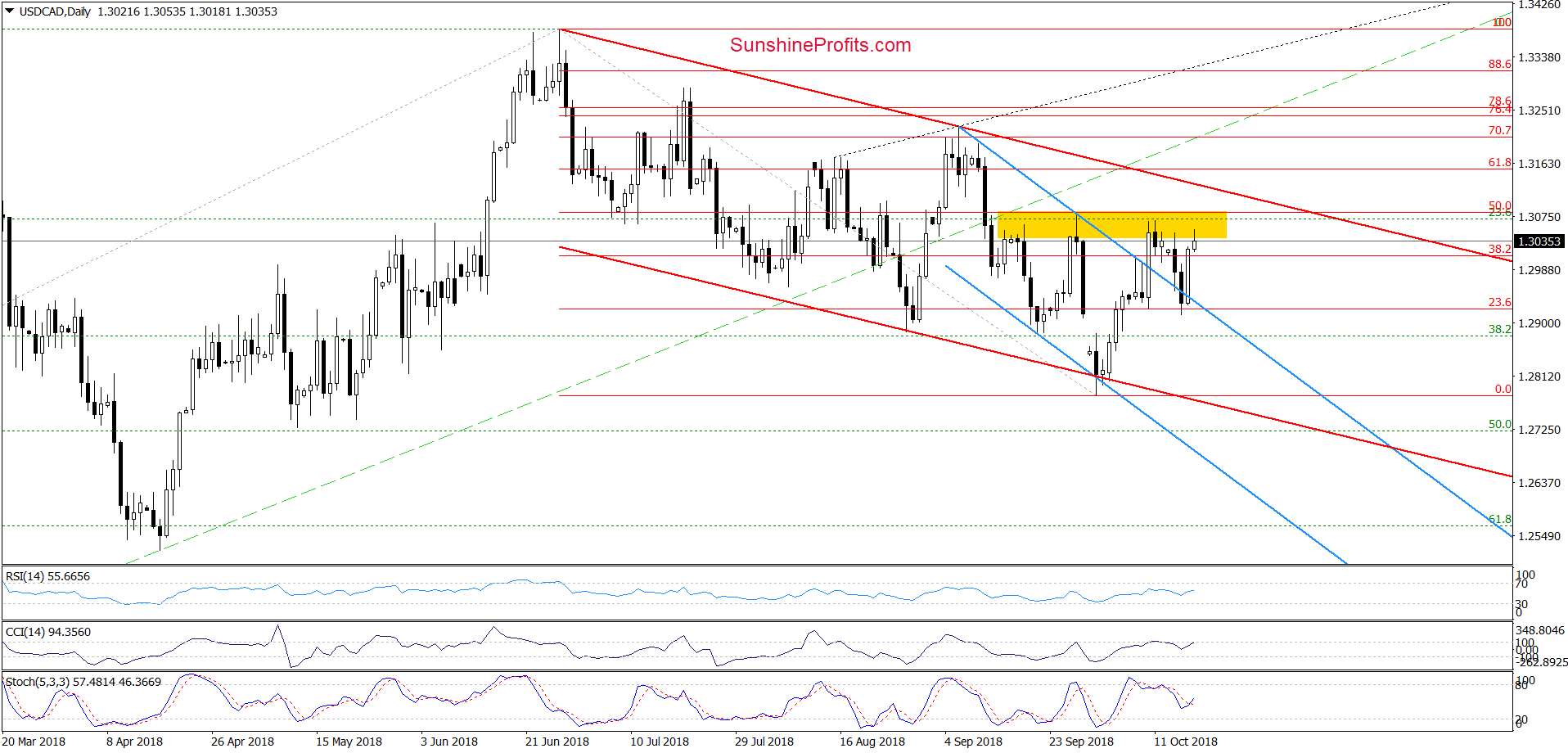

USD/CAD

On Tuesday, we wrote:

(…) we believe that another test of the strength of the above-mentioned blue line is very likely later in the day. (…)

On the daily chart, we see that currency bears pushed the pair lower as we had expected. Nevertheless, despite a daily closure under this line, their opponents triggered a rebound in the following days, which resulted in a comeback to the yellow resistance zone created y the previous highs and the 50% Fibonacci retracement.

What’s next? The buy signal generated by the Stochastic Oscillator suggests that the buyers will try to push the pair higher (maybe even to the upper border of the red declining trend channel). However, we think that as long as there is not successful breakout above the yellow area higher values of USD/CAD are questionable.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts