Yesterday’s verification of the earlier breakdown below the neck line of the bearish formation encouraged the sellers to push the euro sharply lower against the greenback earlier today. What are the implications of their attack?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

In other, words, we decided to close our short positions in AUD/USD and take profits off the table as the exchange rate declined under our downside target.

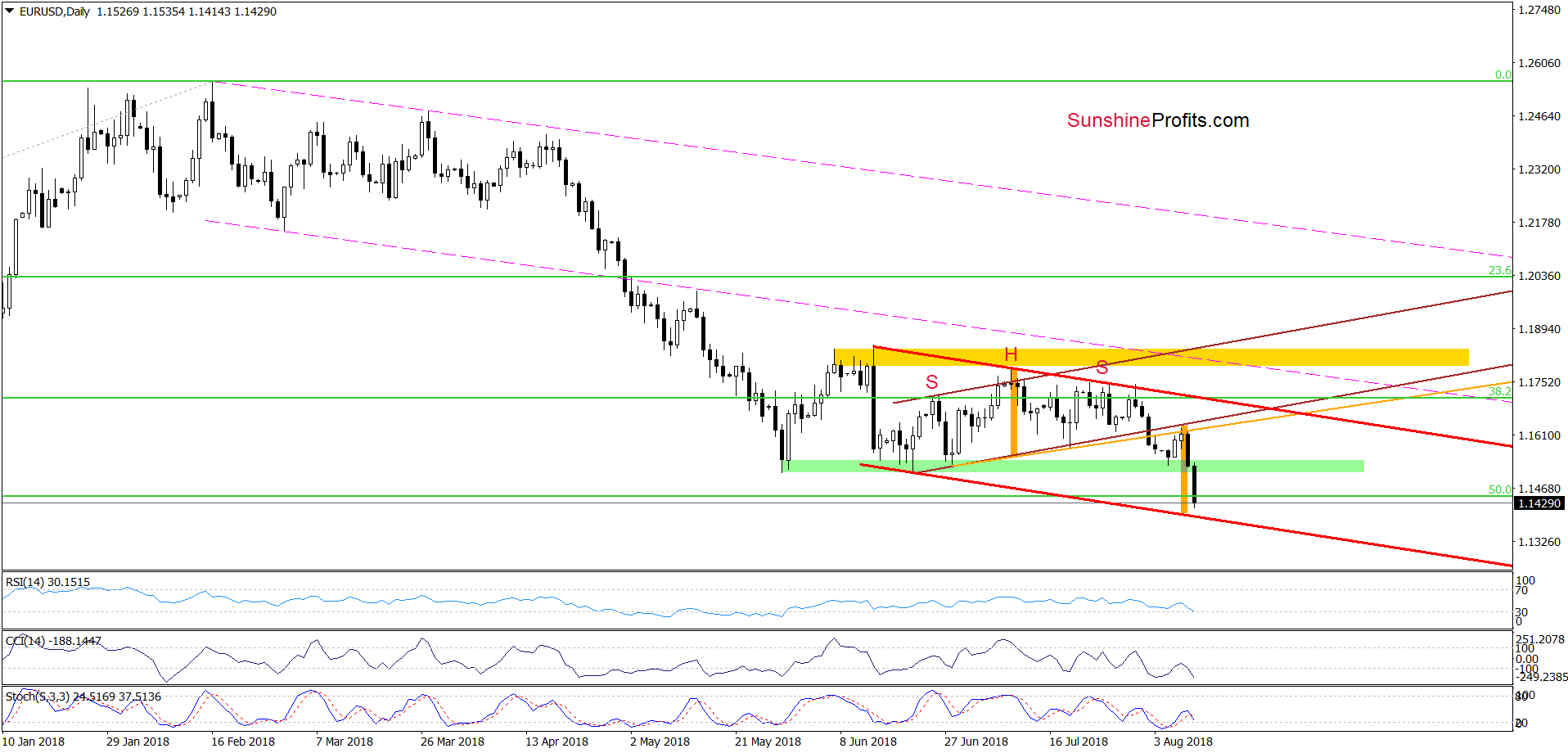

EUR/USD

Quoting our yesterday’s alert:

(…) the orange resistance line stopped the buyers triggering a pullback yesterday. Such price action looked like a verification of the earlier breakdown under this line and encouraged currency bars to act earlier today.

As a result, the pair moved quite sharply lower, which suggests that we’ll likely see a re-test of the strength of the green support zone and recent lows in the very near future.

From today’s point of view, we see that EUR/USD not only tested the above-mentioned downside target. But also slipped well below it, breaking even below the 50% Fibonacci retracement earlier today.

How low could the exchange rate go?

In our opinion, EUR/USD will extend losses and test the lower border of the red declining trend channel in the very near future (very likely that even later in the day). At this point it is worth noting that in this area the size of the downward move will also correspond to the height of the head and shoulders formation, which could reduce the selling pressure and trigger a rebound at the beginning of the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

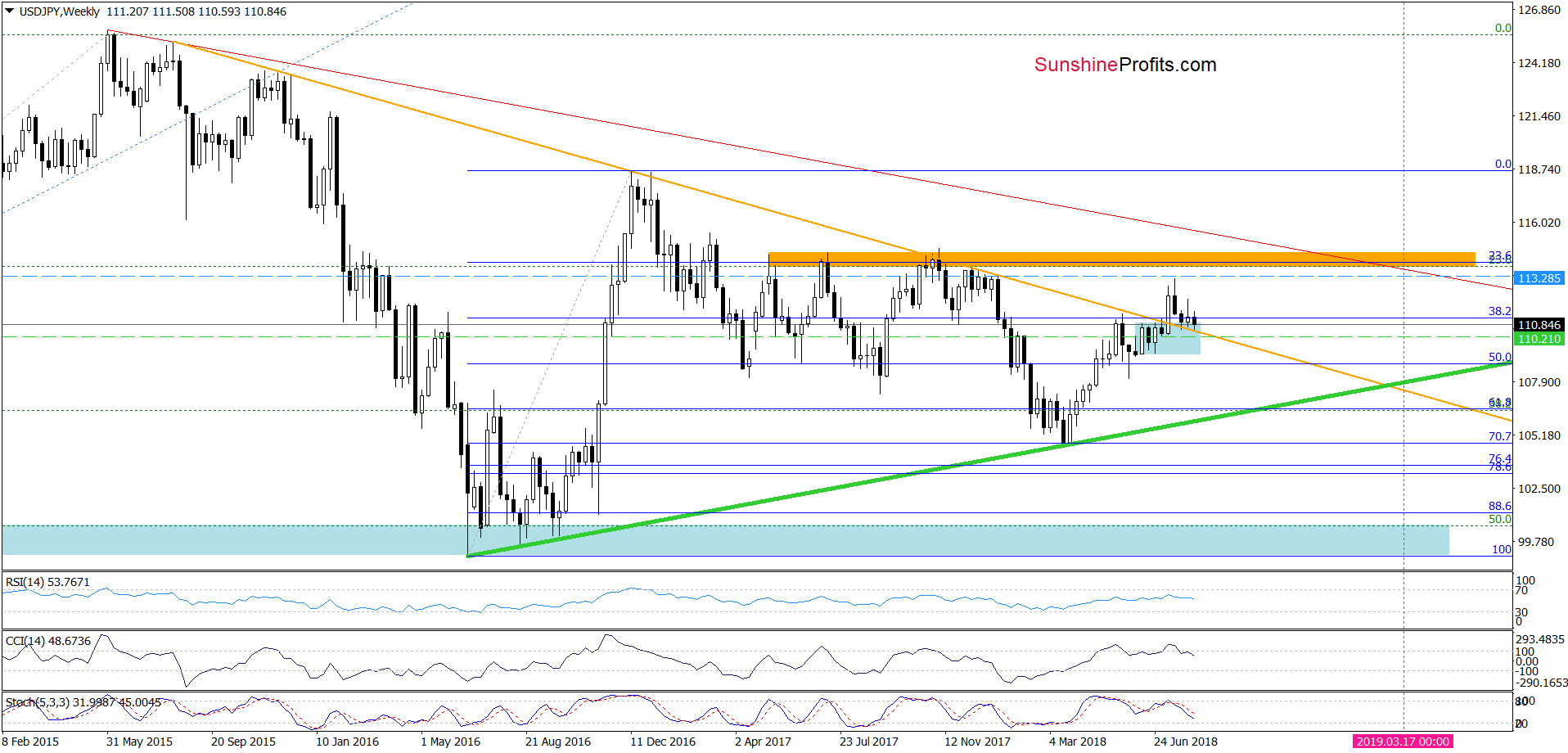

USD/JPY

Although USD/JPY pulled back once again this week, the exchange rate is still trading above the previously-broken long-term orange line, which serves as the nearest support at the moment of writing this alert.

What does it mean for USD/JPY?

In our opinion, this week’s price action looks like another verification of the earlier breakout, which means that as long as there is no weekly closure under this line lower values of the exchange are not likely to be seen and one more reversal from here should not surprise us in the coming week.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 110.21 and the initial upside target at 113.50 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

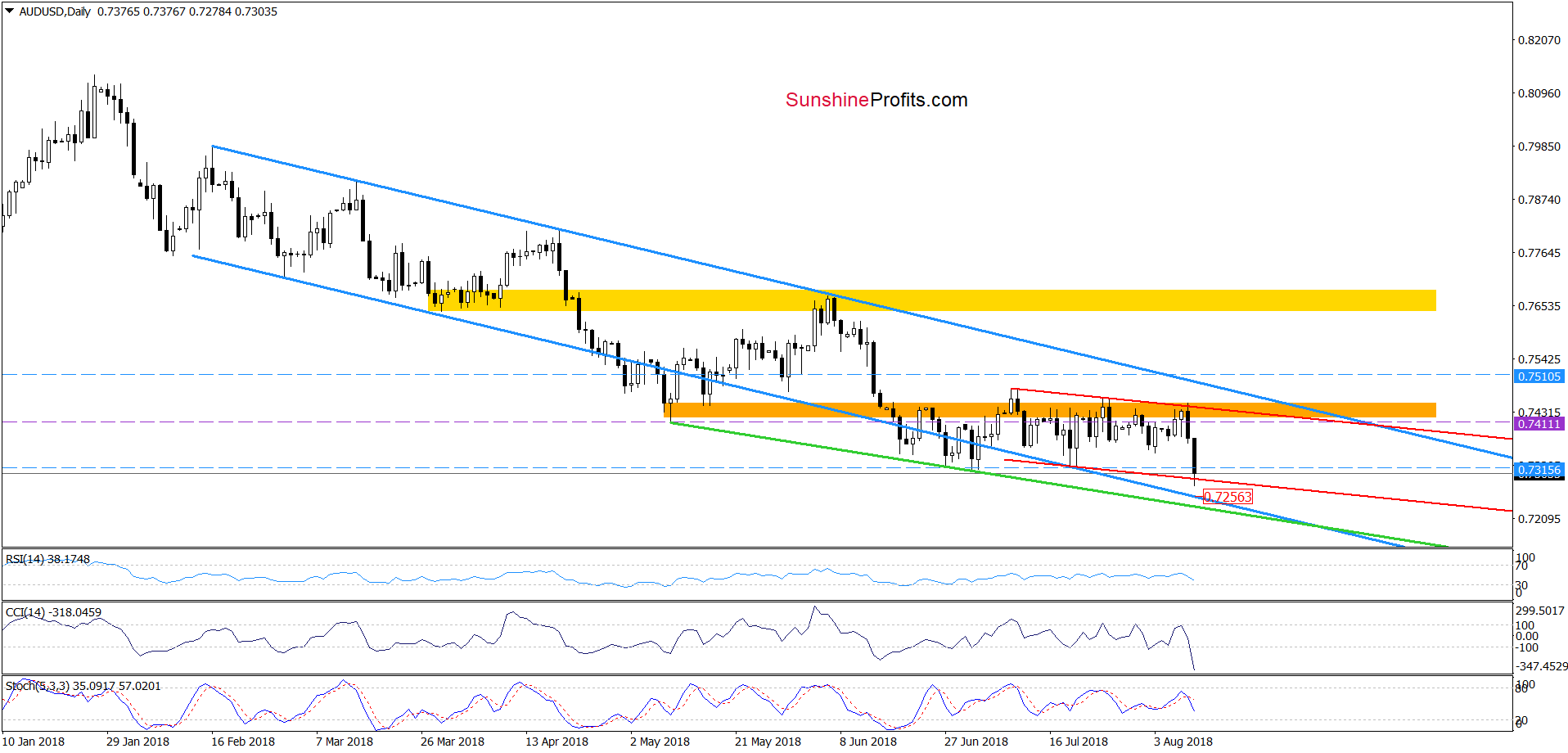

AUD/USD

In our last commentary on this currency pair, we wrote the following:

(…) AUD/USD is still trading under the orange resistance zone and slightly below the purple dashed horizontal line (AUD/USD was trading at around this level when we decided to open short positions).

Therefore, we believe that as long as the above-mentioned strong resistance zone continues to keep gains in check (for almost a month), higher values of AUD/USD are not likely to be seen and further deterioration is just around the corner.

How low could the pair go if currency bears extend losses in the coming week?

In our opinion, if AUD/USD moves lower once again, the exchange rate will (at least) decline to our downside target, which is currently slightly above July lows.

From today’s point of view, we see that AUD/USD extended declines as we had expected. Yesterday’s unsuccessful attempt to move higher (for the 12th time in a row) encouraged currency bears to show their claws once again. Thanks to Thursday’s attack, the exchange rate invalidated the earlier tiny breakout above the upper border of the red declining trend channel, which triggered another sharp move to the downside during today’s session.

As you see on the chart, the pair not only broke below recent lows and our downside target, but also reached the lower line of the red channel, which suggests that reversal may be just around the corner – especially when we factor in the proximity to the lower border of the medium-term blue declining trend channel.

At this point it is worth noting that the sell signals generated by the indicators continue to support the sellers and lower values of the exchange rate. Nevertheless, in our opinion, the likelihood of reversal in this area is too big to justify continuing to own short positions.

Therefore, in our opinion, closing short positions and taking profits off the table is justified from the risk/reward perspective (as a reminder, we opened them when AUD was trading at about 0.7411 (the purple horizontal line) and the pair is currently under our downside target, which made our positions even more profitable than we initially assumed).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts