Earlier today, currency bulls took EUR/USD above the last week’s high, which looks quite encouraging – especially when we factor in the lack of the sell signals generated by the daily indicators. Nevertheless, it is worth considering where their opponents may try to take control, right?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

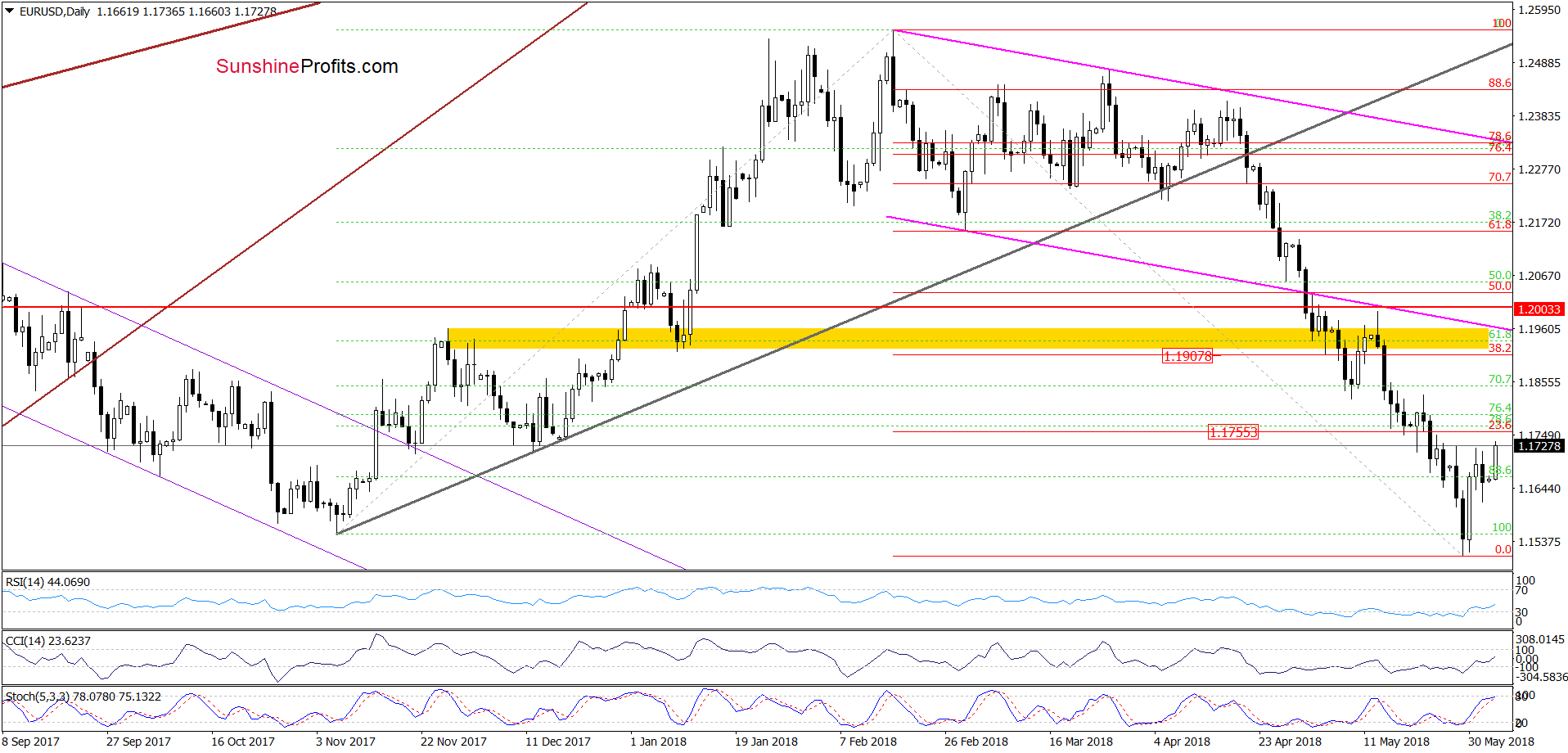

From today’s point of view, we see that the situation in the very short term improved a bit as EUR/USD limbed above the last week’s high. Additionally, there are no sell signals generated by the indicators, which means that what we wrote on Thursday remains up-to-date also today:

(…) higher values of the exchange rate are ahead of us – especially when we factor in the buy signals generated by the indicators.

How high could the pair go in the coming days?

In our opinion, the first upside target will be around 1.1755, where the 23.6% Fibonacci retracement based on the entire 2018 decline is. If it is broken, we may see a move even to the yellow resistance zone, which is currently reinforced by the next retracement (around 1.1907).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

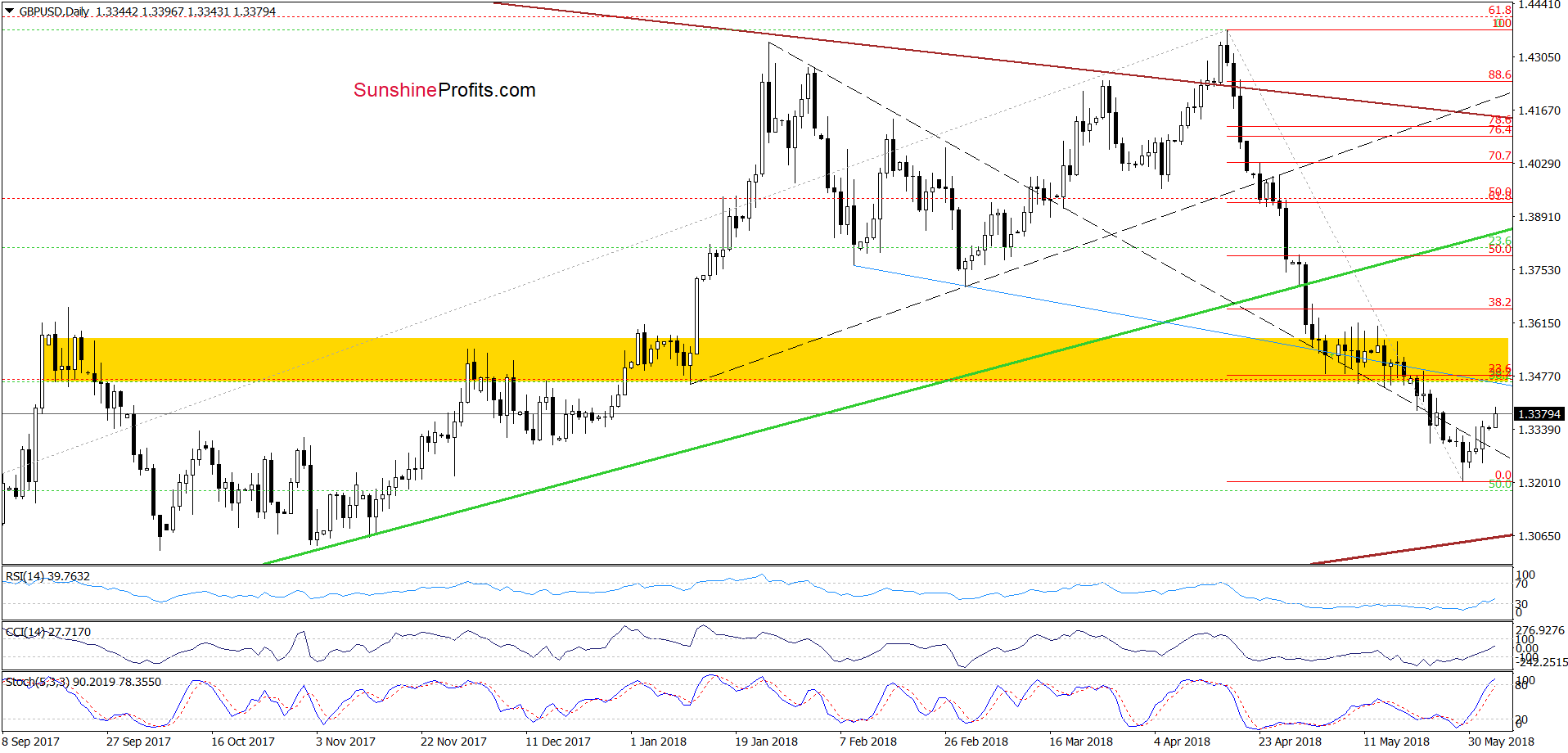

On Friday, GBP/USD broke above the previously-broken upper border of the black triangle (marked with dashed lines) and closed the day above this line, invalidating the breakdown. This positive event encouraged currency bulls to act earlier today, which resulted in further improvement.

Taking the above into account, and combining with the lack of the sell signals generated by the daily indicators, we believe that our last commentary on this currency pair is still valid:

(…) the situation developed in line with our assumptions, which just like in the case of EUR/USD, suggests higher values of the exchange rate in the very near future.

If this is the case and the pair extends gains, we’ll likely see a test of the previously-broken yellow resistance zone, which is currently reinforced by the 23.6% Fibonacci retracement based on the entire downward move, which started in mid-April.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

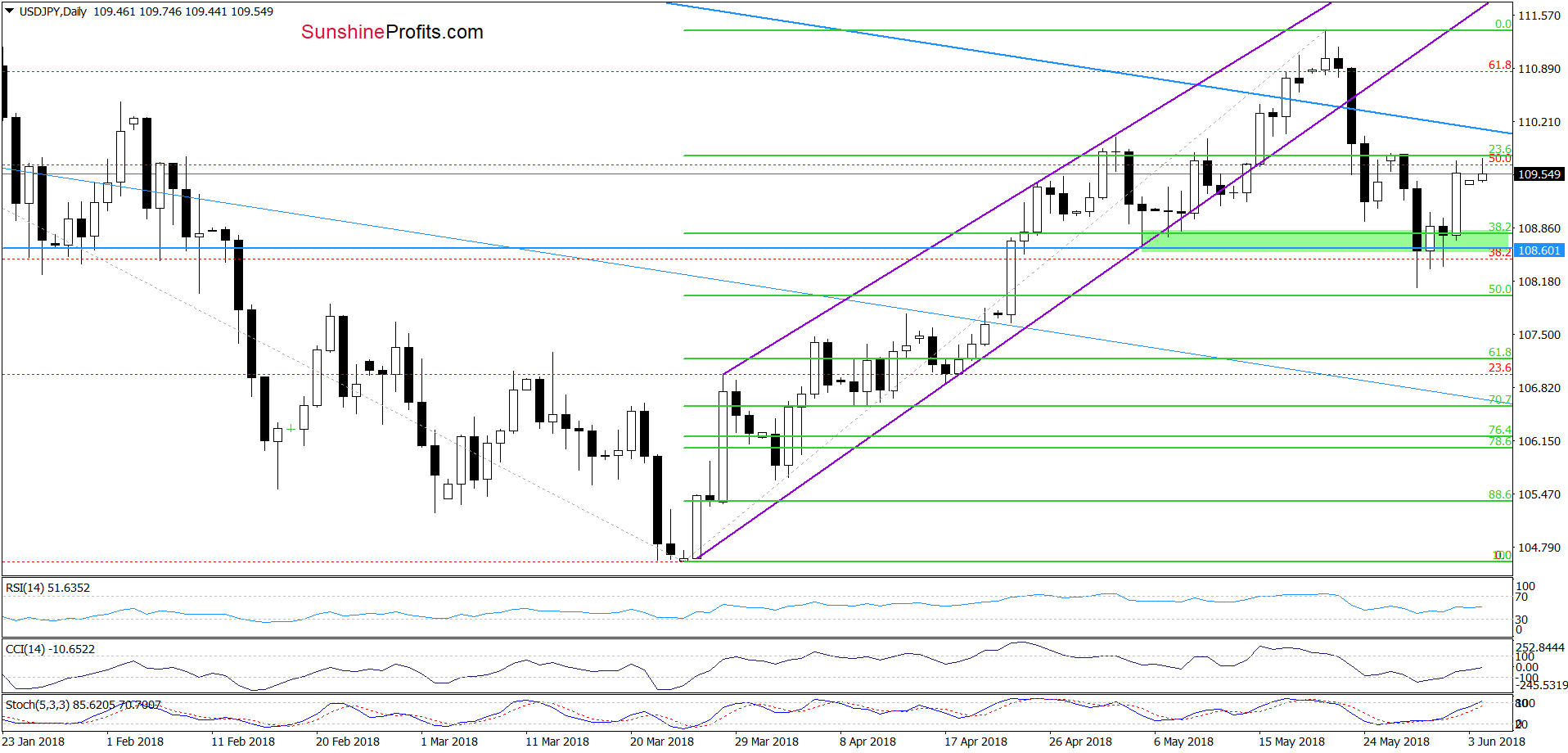

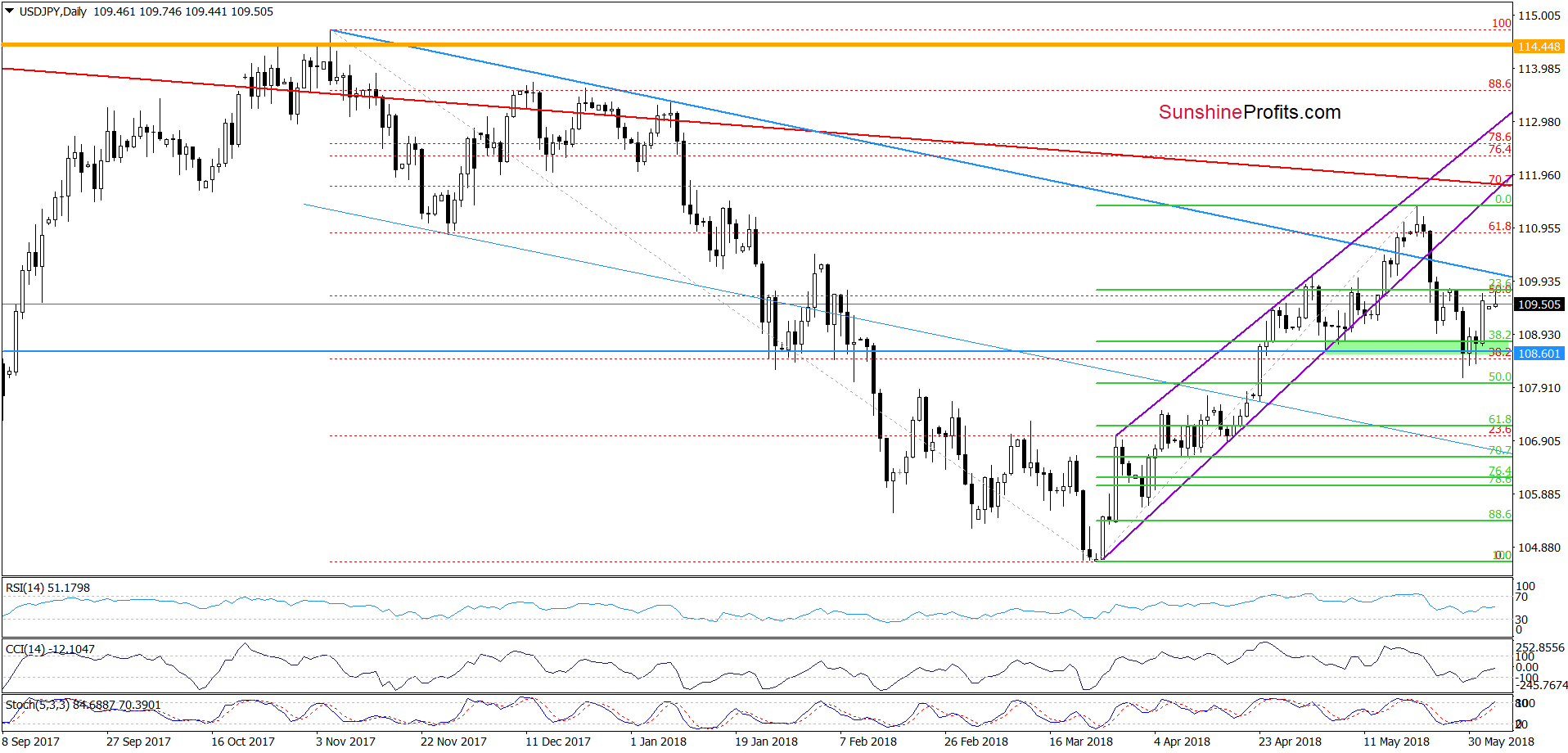

Last Tuesday, we wrote the following:

(…) currency bears took the pair lower (as we had expected), which resulted in a test of our downside target and the early May lows. Earlier today, the pair rebounded, invalidating the earlier breakdowns, which suggests further improvement and a comeback to (at least) yesterday’s high.

On the following day, we added:

(…) USD/JPY (…) currently is testing the 38.2% Fibonacci retracement, while the CCI and the Stochastic Oscillator are preparing to generate buy signals.

As you see on the above chart, the situation developed in line with the last week’s assumptions and USD/JPY approached our first upside target. Nevertheless, similarly to what we wrote about the current position of the daily indicators in the case of EUR/USD and GBP/USD, there are no sell signals, which suggests that one more move to the upside can’t be ruled out.

What could this mean for USD/ JPY? In our opinion, a test of the blue declining resistance line based on the November 2017 and January 2018 peaks (currently around 110.08) in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts