Is the above title applicable only to EUR/USD really? Breakout is something we can trust not to be a short-term phenomenon. Fakeouts provide a picture of false strength only to vanish into thin air. Let’s not get confused here and take a look at the odds favoring next moves in our closely watched pairs such as the euro or the Australian dollar objectively.

- EUR/USD: short (a stop-loss order at 1.1410; the initial downside target at 1.1258)

- GBP/USD: short (a stop-loss order at 1.3236; the initial downside target at 1.2820)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss at 0.7228; the exit target at 0.7042)

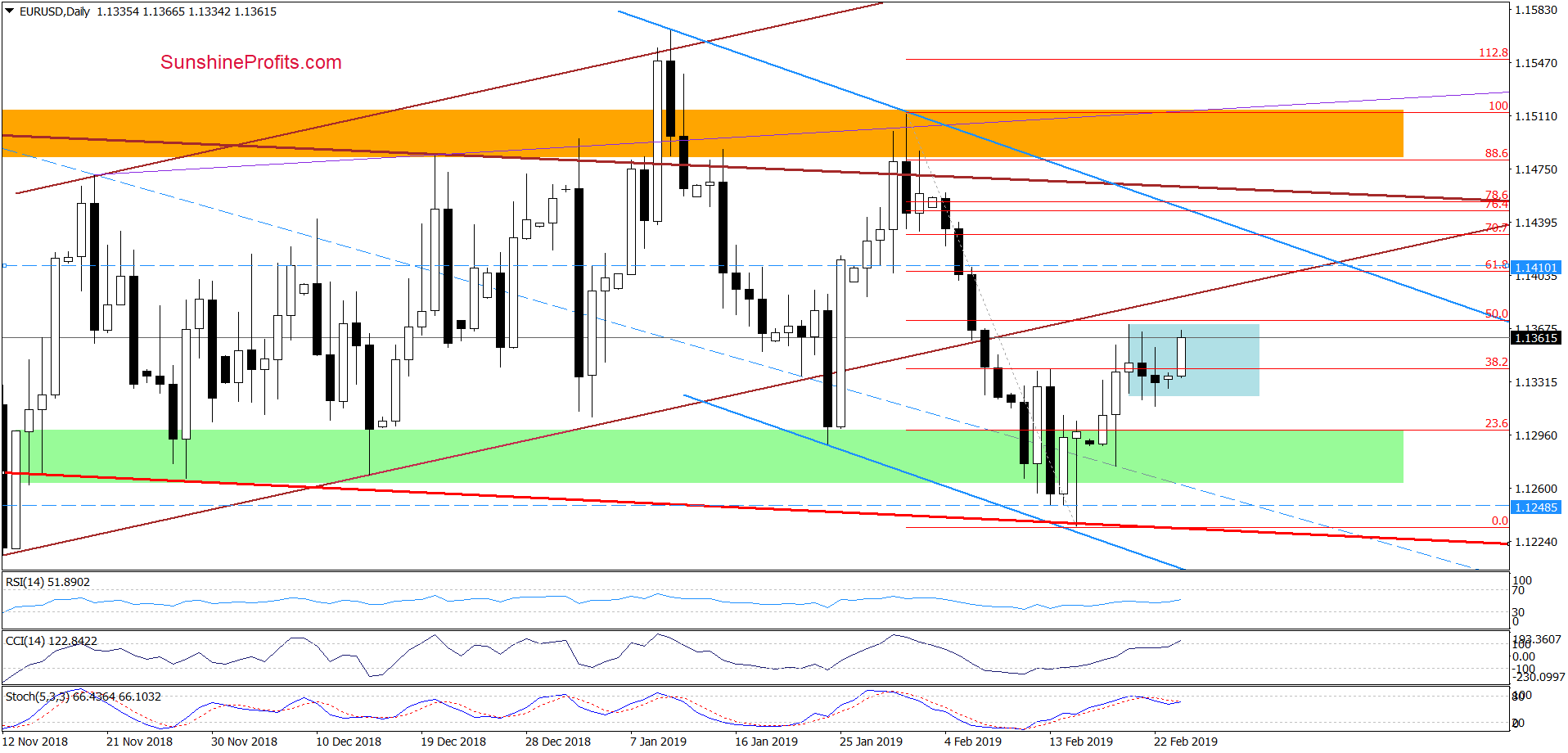

EUR/USD

Although EUR/USD closed Friday’s session below the 38.2% Fibonacci retracement for the second time in a row, currency bulls triggered an upswing earlier today. The exchange rate reverted back above the retracement as a result.

This is a positive development at first sight as it can translate into invalidation of the last week’s breakdown. Nevertheless, we should keep in mind that as long as there is no daily close above the retracement, another reversal can’t be ruled out. Especially when we factor in the fact that the pair remains inside the blue consolidation, which suggests that the upper line of the formation can encourage the sellers to act in the very near future.

Additionally, there are two resistances nearby: the 50% Fibonacci retracement and the lower border of the brown rising trend channel. Together with the current position of the daily indicators, these suggest that the space for gains may be limited.

If that’s the case, we’ll likely see another move to the downside and a retest of the major supports (the lower border of the red declining trend channel and the long-term red support line based on the October 2017 and August 2018 lows) and recent lows around 1.1250 in the following days.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1410 and the initial downside target at 1.1258 are justified from the risk/reward perspective.

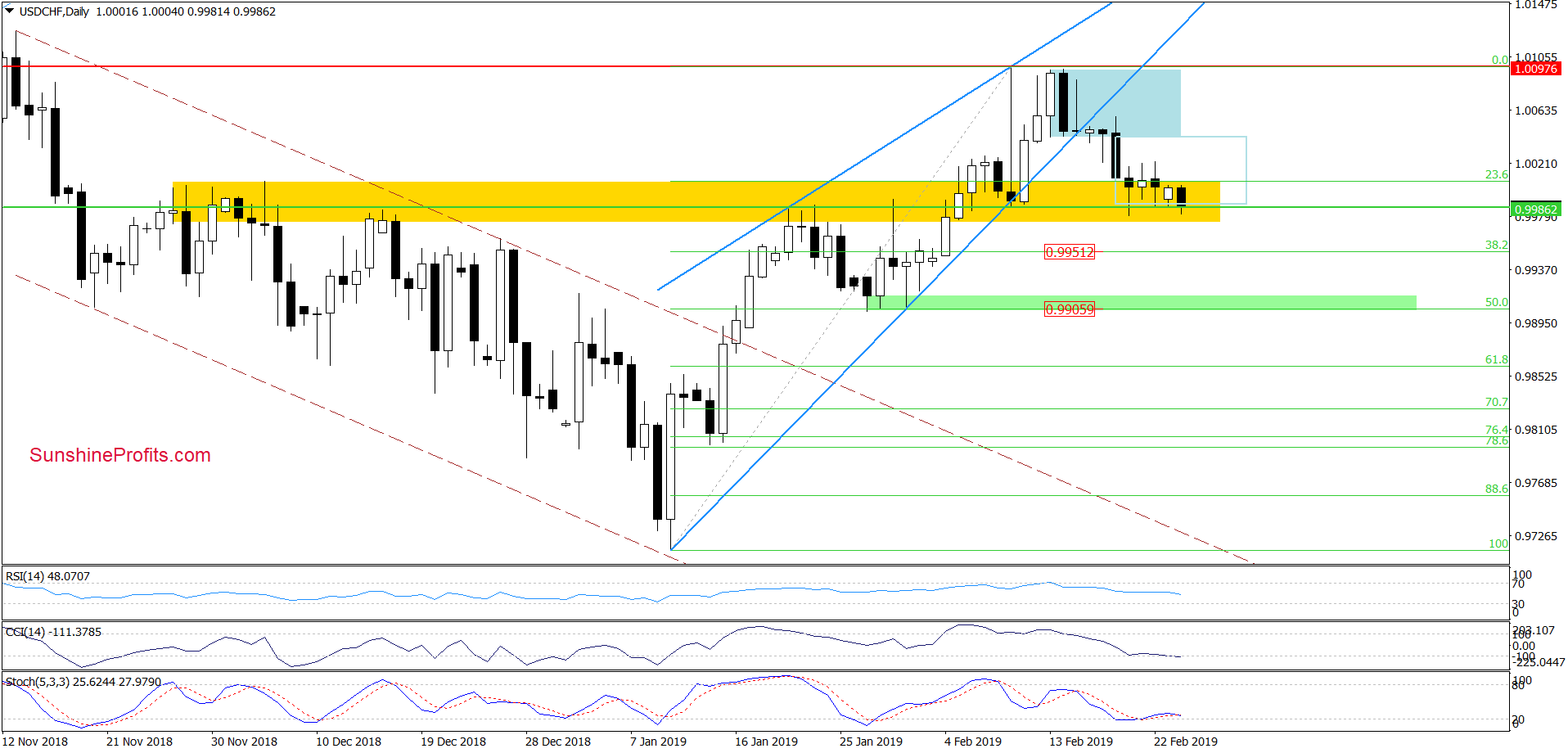

USD/CHF

Although USD/CHF bounced off the bottom of the Feb 10th pullback and the yellow support zone, currency bears didn’t give up and pushed the pair lower earlier today. The pair is trading currently in the blue rectangle area (the one that has no filling inside), where the size of the downward move corresponds to the height of the blue previous consolidation,

This retest of the last week’s lows can translate into a double bottom formation. Nevertheless, considering the current position of the daily indicators (there are no buy signals) it seems that sellers can still try to push the exchange rate lower.

If they succeed, USD/CHF will likely test the 38.2% Fibonacci retracement based on the entire January-February upward move in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

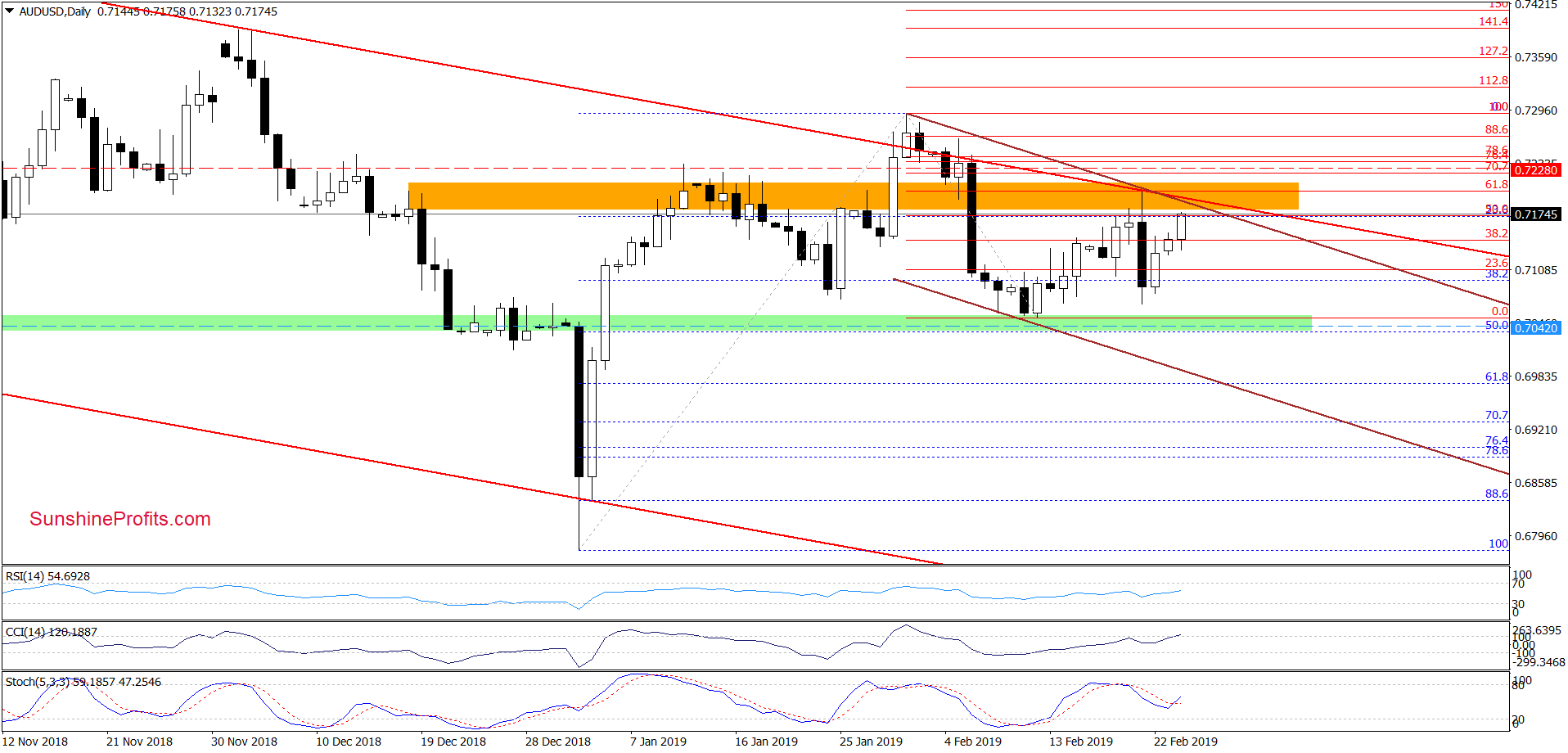

AUD/USD

Earlier today, AUD/USD extended gains and came back to the major orange resistance area that is further supported by the 61.8% Fibonacci retracement based on the entire February decline, the upper border of the long-term red declining trend channel and the upper line of the short-term brown declining trend channel.

The combination of these resistances was strong enough to stop the buyers and trigger a sharp downswing in the previous week. It suggests that history can repeat itself once again in the very near future.

If the situation develops in tune with our assumptions and AUD/USD turns south, it’ll likely retest the green support zone or even slip to/below our exit downside target in the following day(s).

Trading position (short-term; our opinion): Half of profitable short positions (with a stop-loss order at our entry level at 0.7228 and the exit target at 0.7042) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist