Earlier today, currency bears pushed the euro lower against the greenback, which resulted in another test of the short-term support zone. Third time lucky or a show of the sellers’ weakness?

- EUR/USD: none (in other words, we decided to close our short positions and take profits off the table)

- GBP/USD: short (a stop-loss order at 1.3316; the exit downside target at 1.2930)

- USD/JPY: long (a stop-loss order at 111.11; the initial upside target at 113.40)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (with a stop-loss order at 0.7208; the exit downside target at 0.7051)

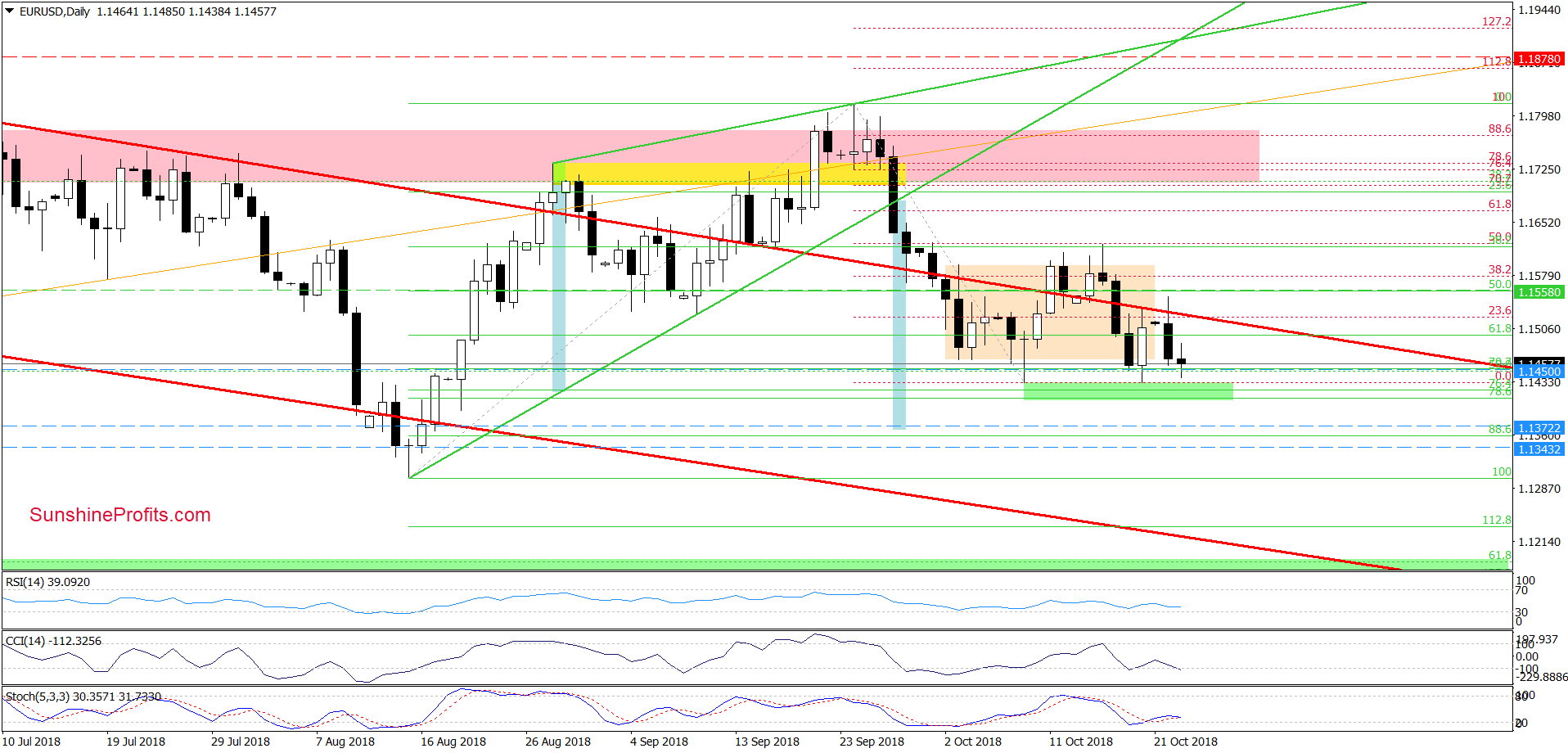

EUR/USD

From today’ point of view, we see that the overall situation in EUR/USD hasn’t changed much as the exchange rate is still trading between the green zone and the previously-broken upper border of the red declining trend channel.

Earlier today, currency bears tried to push the pair lower once again, but their opponents stopped them, triggering another rebound. Such price action suggests that as long as there is no successful breakdown under the green area another bigger move to the downside is not likely to be seen.

Therefore, we think that closing our short positions and taking profits off the table (as a reminder, we opened them when EUR/USD was trading at around 1.1558) is justified from the risk/reward perspective.

Nevertheless, if currency bears show more strength and manage to push the exchange rate in the following days, we’ll consider re-opening short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

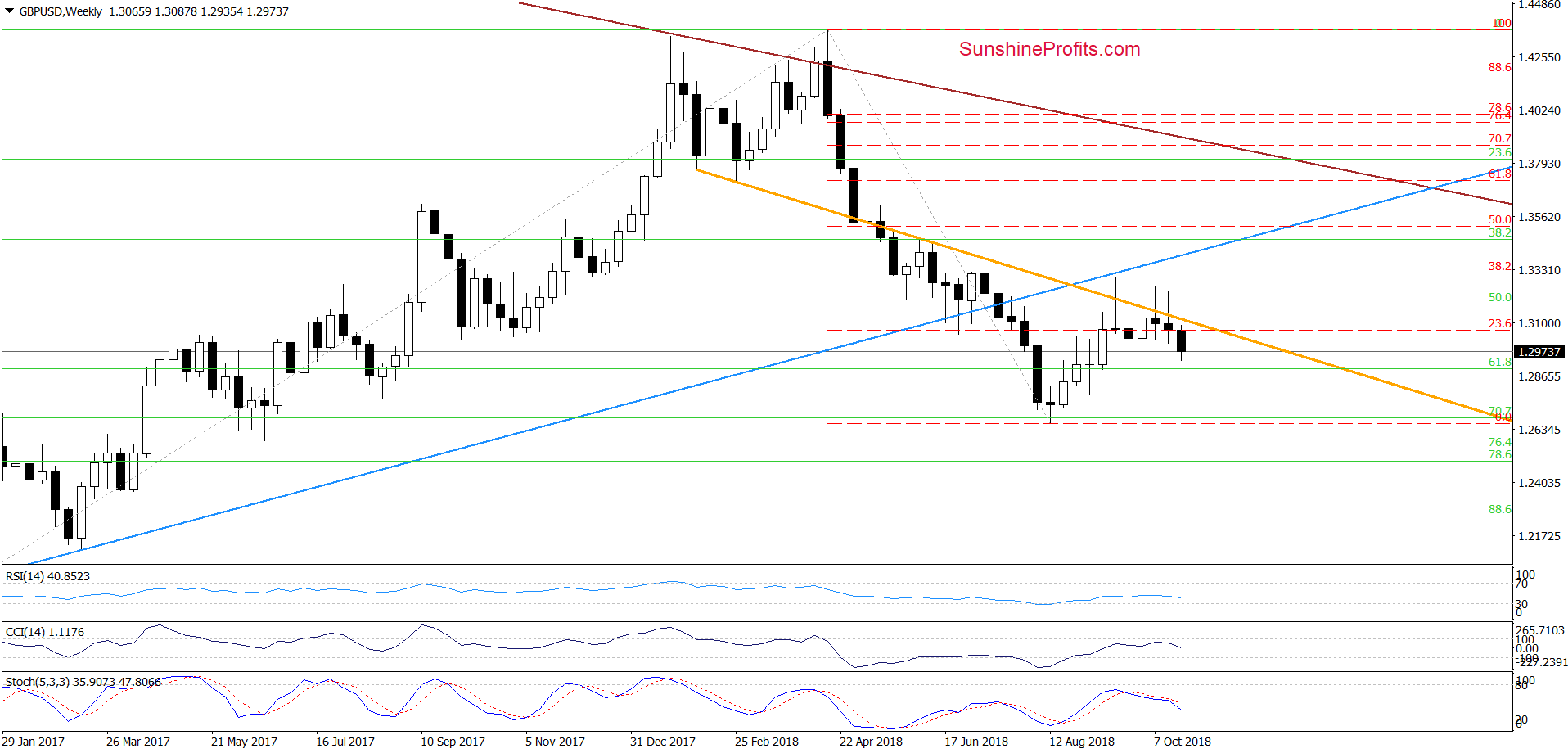

GBP/USD

Looking at the medium-term chart, we see that the overall situation in the medium term hasn’t changed much as GBP/USD is still trading under the orange resistance line, which means that our last commentary is up-to-date:

The first thing that catches the eye on the weekly chart is another invalidation of the earlier small breakout above the orange line. As you see, currency bulls have quite big problems with this resistance for many weeks, which increases its importance for the future of this currency pair.

In other words, we believe that as long as there is no successful breakout above it lower values of GBP/USD are more likely than another upswing. This scenario is also reinforced by the sell signal generated by the Stochastic Oscillator and the short-term picture of the exchange rate.

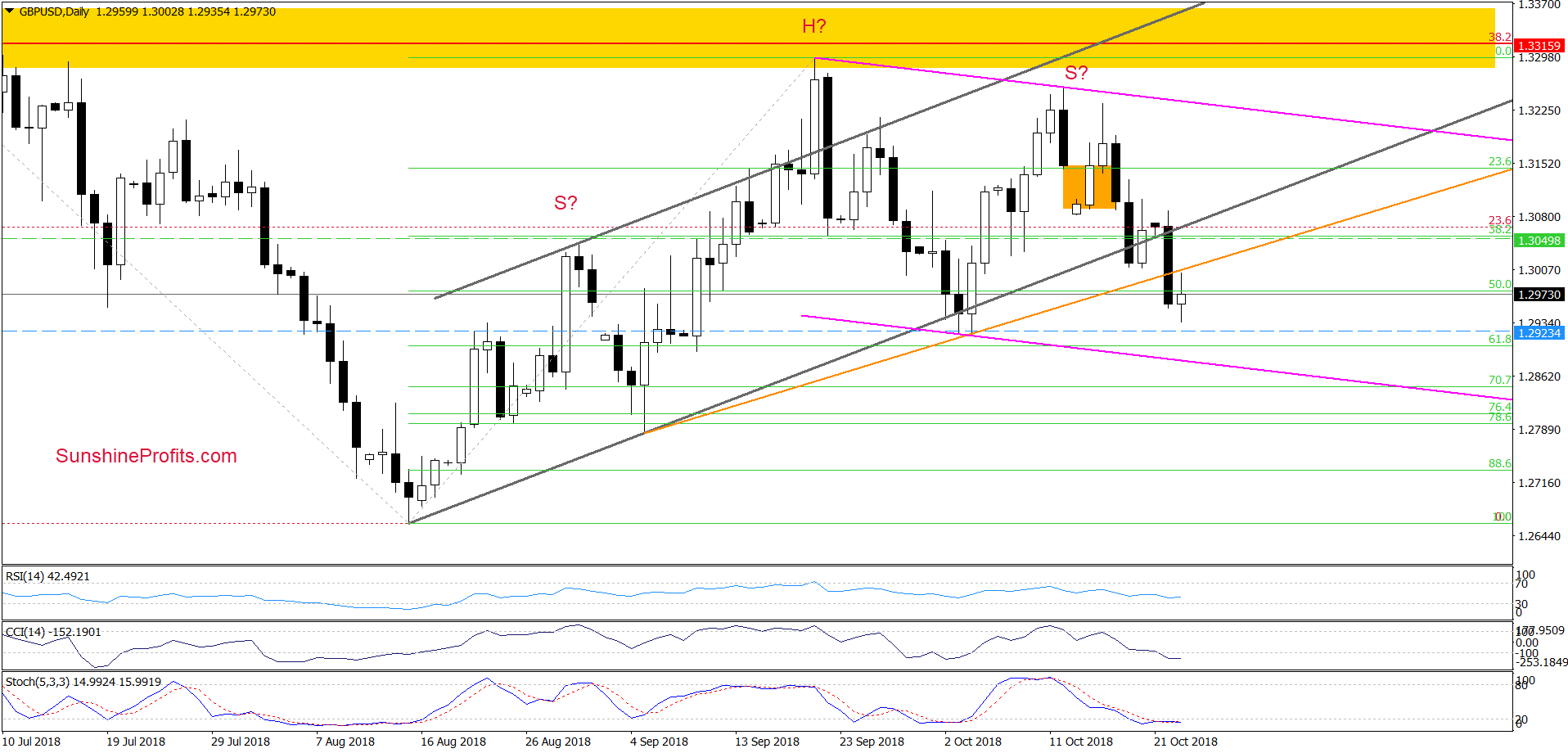

Why? Before, we answer to this question, let’s recall the quote from Friday:

(…) GBP/USD declined quite sharply in recent days, which resulted in a drop a daily closure under the lower border of the grey rising trend channel.

Earlier today, we noticed a small rebound, (…) it looks like a verification of yesterday’s breakdown and suggests further deterioration in the following days – especially when we factor in the sell signals generated by the indicators and the above-mentioned medium-term picture of the exchange rate.

How low could GBP/USD go at the beginning of the coming week?

In our opinion, currency bulls will test the orange support line based on the early-September and early-October lows. Why this line? Because, when we take a closer look at the chart, we can see a potential head and shoulders formation and read the last downswings as shaping the right arm of the pattern.

Looking at the daily chart, we see that currency bears not only tested, but also broke below the orange support line yesterday. Earlier today, the pair moved a bit higher, which looks like a verification of yesterday’s breakdown.

If this is the case, the sellers will likely trigger another move to the downside and we’ll see a test of the early-October lows during the following sessions.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3316 (we decided to lower it as the pair remains below the lower border of the grey rising trend channel) and the exit downside target at 1.2930 (we’ll close our short positions and take profits off the table if the pair hits this level) are justified from the risk/reward perspective.

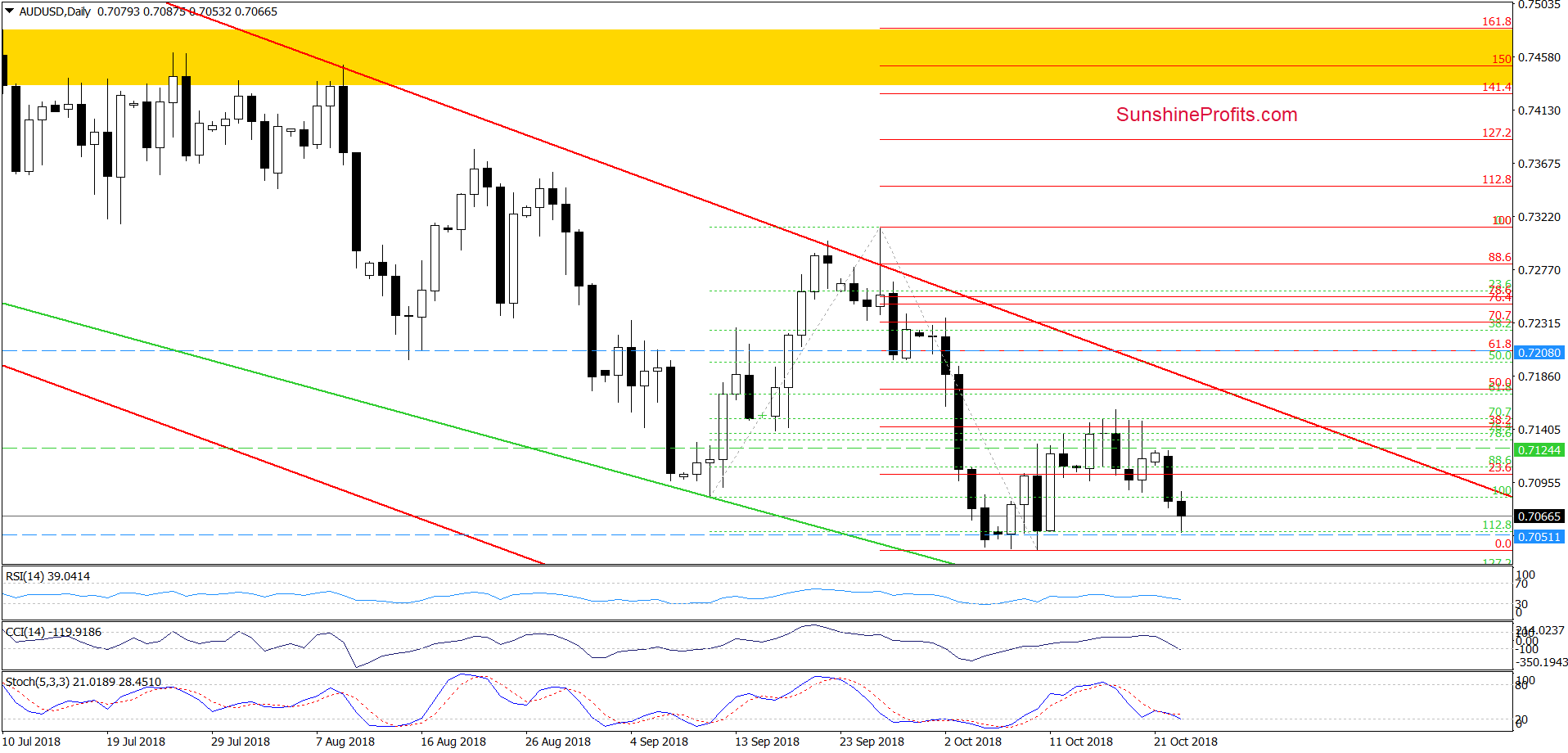

AUD/USD

In our Forex Trading Alert posted on Oct. 17, 2018, we wrote the following:

(…) although AUD/USD climbed to the 38.2% Fibonacci retracement on Monday, currency bulls didn’t manage to trigger further improvement in the following days.

Earlier today, we noticed one more upswing, which took the pair above this resistance, however, as it turned out it was very temporary, and the exchange pulled back in the following hours.

Additionally, the Stochastic Oscillator climbed to its overbought area and is very close to generate a sell signal, which increases the likelihood of another decline. If this is the case and we see such price action, AUD/USD will likely test the recent lows in the coming day(s).

As you see on the daily chart, the situation developed in line with our assumptions and AUD/USD extended losses since our alert was posted, making our short positions profitable.

Earlier today, the pair approached our initial downside target, but then rebounded slightly. Nevertheless, taking into account the sell signal re-generated by the Stochastic Oscillator, we think that one more downswing is just ahead of us.

Therefore, we believe that short positions are justified from the risk/reward perspective. Nevertheless, if AUD/USD hits the level of 0.7051 (or initial downside target), we’ll close our short positions and take profits off the table. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 0.7208 and the exit downside target at 0.7051 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts