During yesterday’s session, the euro moved sharply lower against the greenback, which resulted in a drop below the lower border of the declining trend channel. Additionally, EUR/USD finished the day under this line, which doesn’t bode well for currency bulls. How low could the exchange rate go in the following days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1437; an initial downside target at 1.1196)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

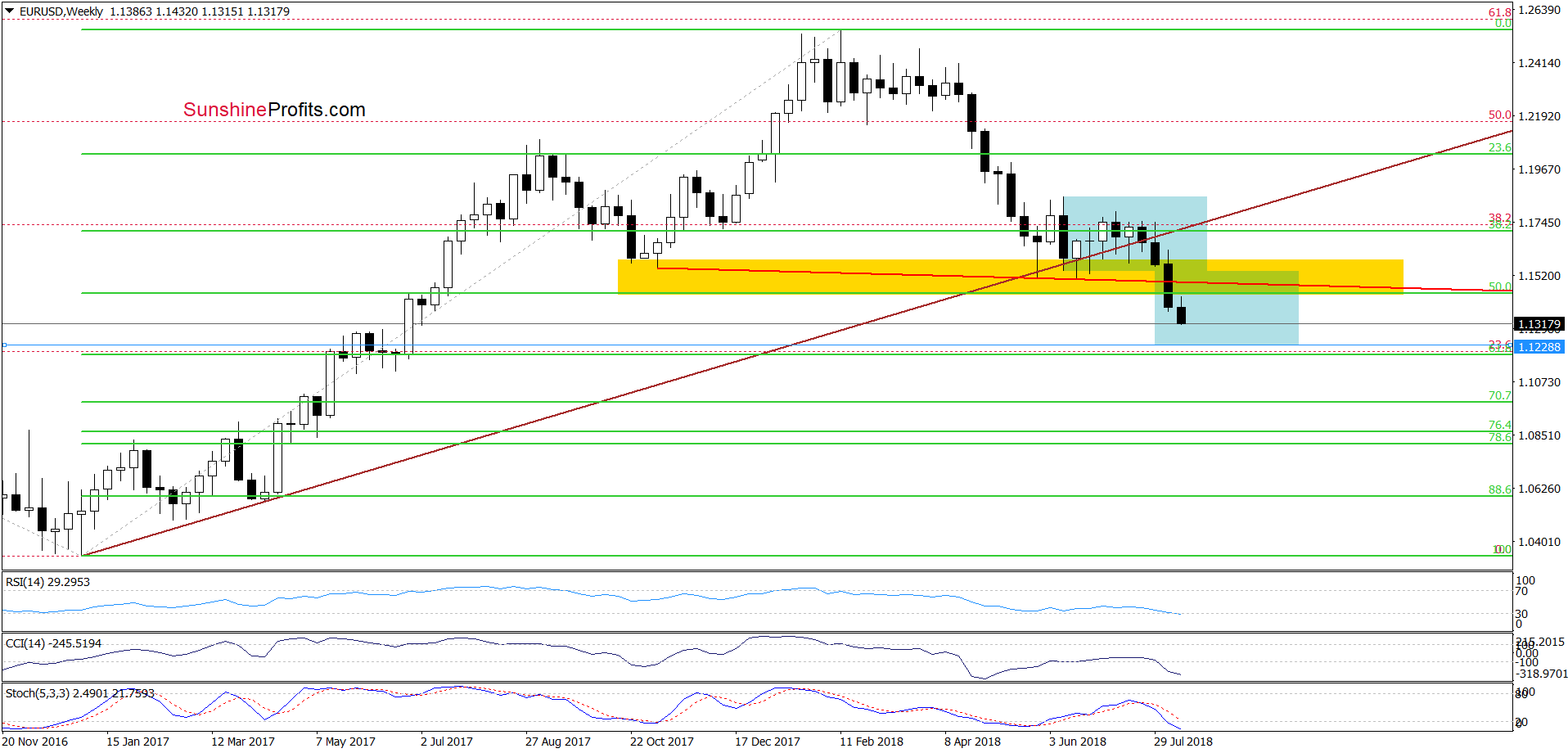

The first thing that catches the eye on the daily chart is breakdown under the lower border of the red declining trend channel. Such bearish development suggests further deterioration and a drop to (at least) the 61.8% Fibonacci retracement (based on the entire 2017-2018 upward move, which is seen more clearly on the weekly chart below).

From this perspective, we also see that in this area the size of the downward move will correspond to the height of the blue consolidation, which increases the probability that currency bears will test this area in the following days.

Taking all the above into account, we think that opening short positions is justified from the risk/reward perspective. All needed details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1437 and an initial downside target at 1.1196 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

In our last commentary on this currency pair, we wrote the following:

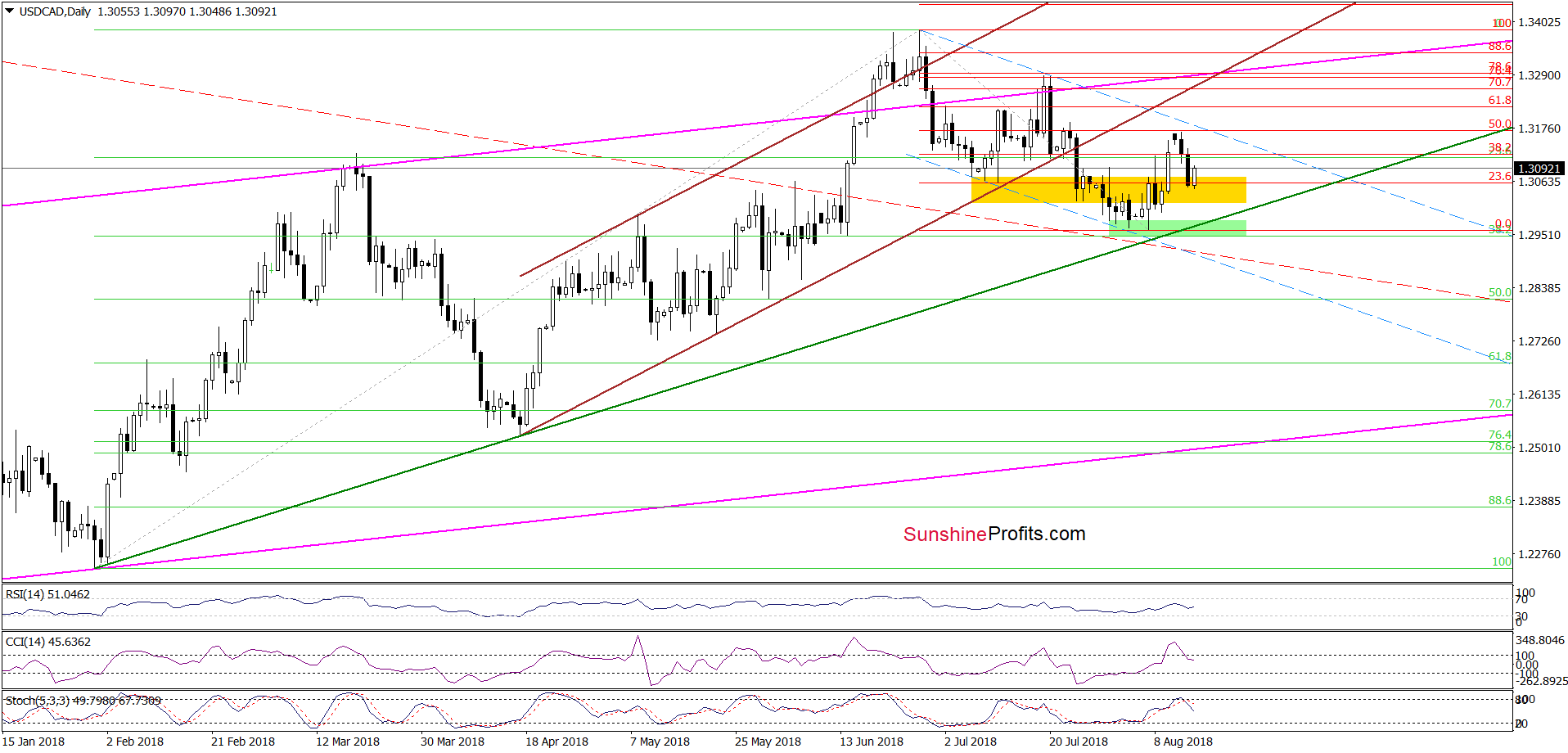

(…) the exchange rate approached the next retracement, the July 24 high and the upper border of the blue declining trend channel (marked with dashed lines).

Will this resistance area stop the buyers in the coming week?

Looking only at the current position of the daily indicators, it’s very likely, because the RSI, the CCI and the Stochastic Oscillator climbed to their highest levels since the formation of the July peaks. Back then, they preceded a sharp reversal, which suggests that the history could repeat itself once again and we’ll see a move to the south.

As you see on the above chart, the situation developed in line with the above-assumption and currency bears pushed USD/CAD to the previously-broken yellow zone.

Although the exchange rate bounced it off earlier today, the sell signals generated by the daily indicators remain in the cards, suggesting that another attempt to move lower is likely - especially if currency bulls do not manage to break above the upper border of the blue declining trend channel (marked with dashed lines) in the very near future.

If this is the case and the pair drops once again, we could see a test of the medium-term green line based on February and April lows in the following days (at this point it is worth noting that this support intersects the green support zone based on recent lows), which increases its importance for currency bulls and further moves.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

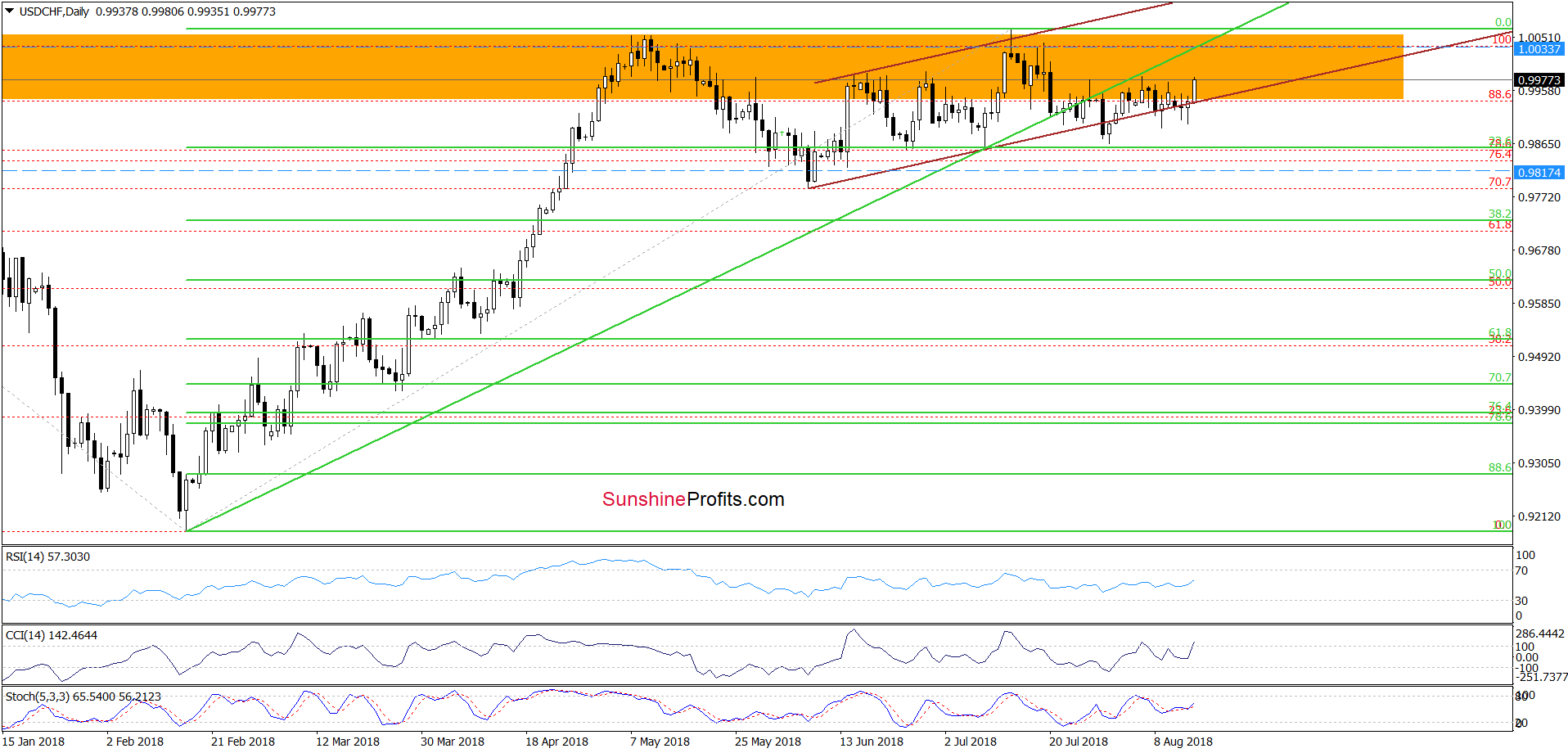

Looking at the daily chart, we see that USD/CHF invalidated the earlier breakdown under the lower border of the brown rising trend channel once again, which suggests a test of the previously-broken medium-term green line in the following days.

If the situation develops in line with this scenario we’ll also likely see a test of the recent highs, which are slightly above this resistance line.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts