At the beginning of the week, the euro extended gains against the greenback, which probably aroused the doubts of many investors about further declines. It could even tempt them to close short positions. Currency bears, however, knew how to use all the available factors to take EUR/USD to lower levels and erase the earlier increase. What else can they do if they show unwavering determination?

EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

GBP/USD: none

USD/JPY: long (a stop-loss order at 111.15; the initial upside target at 113.50)

USD/CAD: none

USD/CHF: none

AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

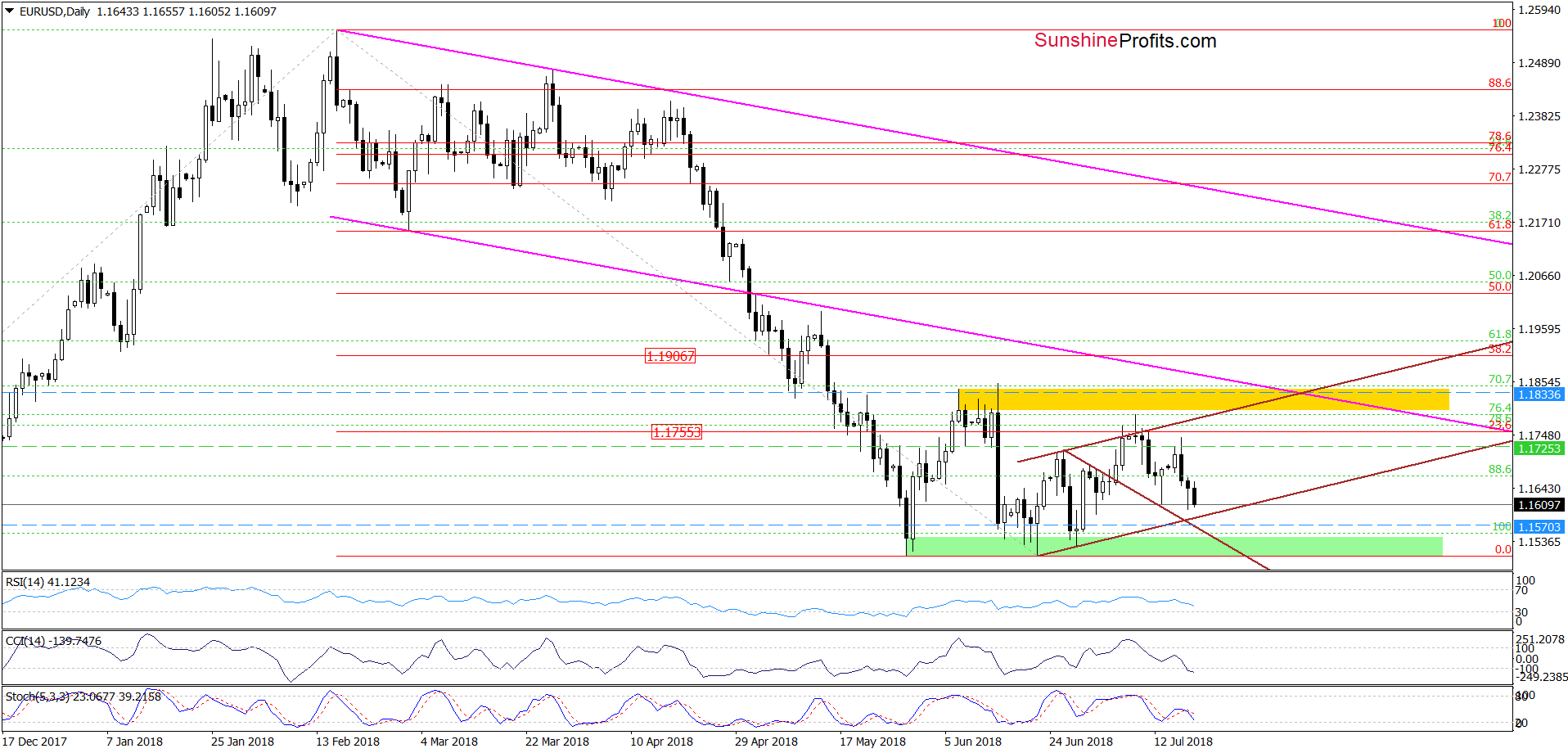

EUR/USD

Quoting our Tuesday’s alert:

(…)EUR/USD is still trading inside the brown rising trend channel, which suggests that as long as there is no breakout above the upper line of the formation higher values of EUR/USD are not likely to be seen and another attempt to move lower should not surprise us (…)

If this is the case, and currency bears show their claws once again, the first downside target will be the lower border of the brown rising trend channel (currently around 1.1588).

Yesterday, we added:

(…) currency bears attacked earlier today, while the Stochastic Oscillator re-generated the sell signal, suggesting that we’ll see a realization of the above scenario in the very near future.

From today’s point of view, we see that although currency bulls tried to took EUR/USD higher during yesterday’s session, their efforts ended in failure because their opponents took control earlier today, making our short positions even more profitable.

As a result, the exchange rate came back to yesterday’s lows, which in combination with the sell signal generated by the Stochastic Oscillator and the medium-term picture (we’ll comment on it in a moment) suggests that further deterioration is still ahead of us.

Therefore, in our opinion, the pair can not only test the above-mentioned initial downside target, but also the recent lows (the green support zone).

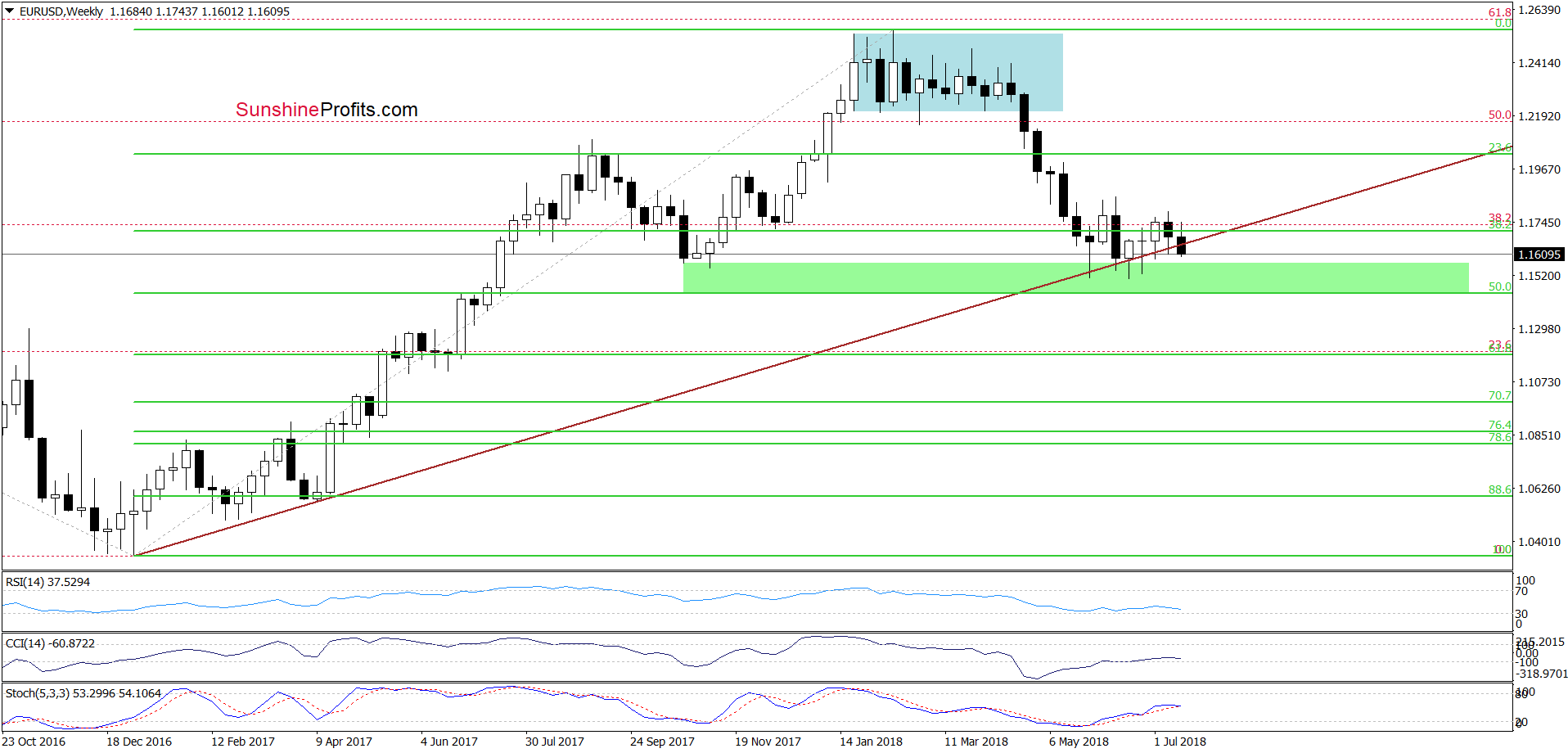

Returning, however, to the medium-term chart…

From this perspective, we see that EUR/USD slipped under the long-term brown rising support line once again, while the Stochastic Oscillator is very close to re-generate the sell signal, which together increase the probability of (at least) one more downswing.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

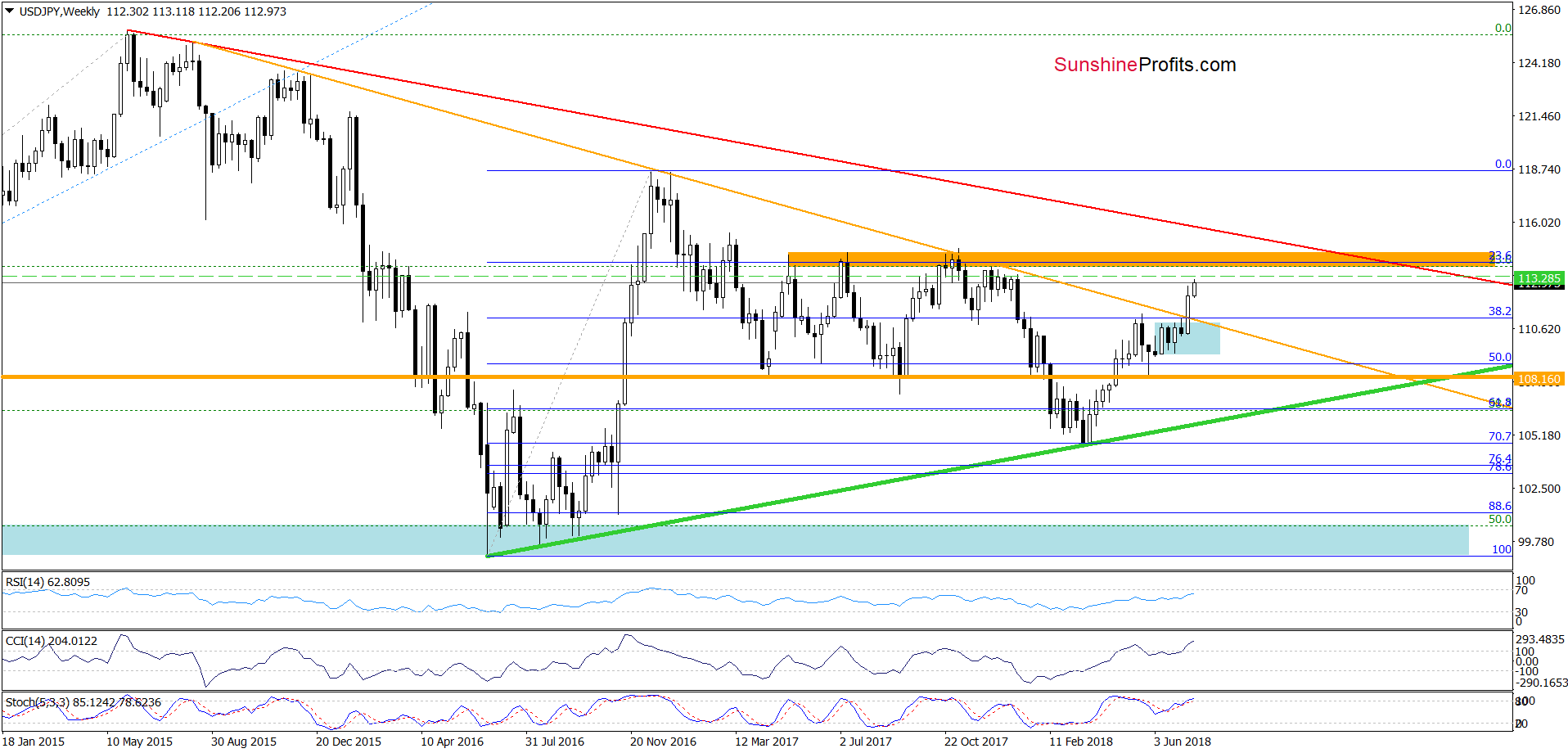

USD/JPY

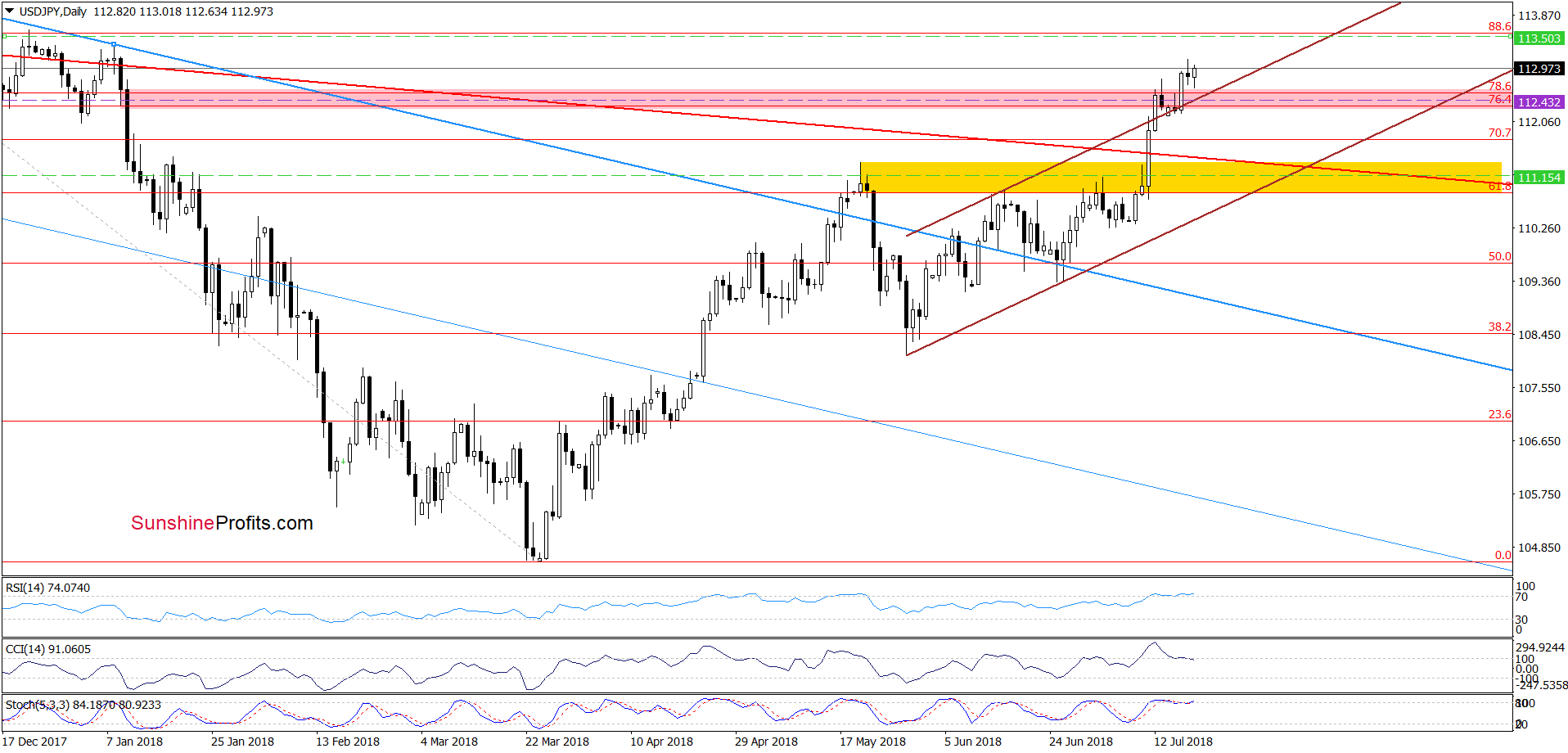

On the medium-term chart, we see that USD/JPY extended gains above the last week’s high and moved away from the previously-broken major resistance (the orange declining line based on the August 2015, December 2015 and January 2017 peaks), which increases the likelihood of higher values of USD/JPY.

How high could the exchange rate climb?

In our opinion, if the pair extends gains from current levels, we could see even a test of the orange resistance zone in the following week(s).

Additionally, this pro-bullish scenario is also reinforced by the short-term picture of the exchange rate. Let’s take a closer look at the daily chart below.

From this perspective, we see that although USD/JPY moved lower at the end of the previous week, the previously-broken upper border of the brown rising trend channel finally withstood the selling pressure.

On Tuesday, currency bulls triggered a quite sharp rebound, invalidating the earlier tiny breakdown under this line, which resulted in a fresh multi-month high. Such price action looks like a verification of the breakout above the brown rising trend channel, suggesting a test of our upside targets in the very near future.

Trading position (short-term; our opinion): profitable long positions with a stop-loss order at 111.15 and the initial upside target at 113.50 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

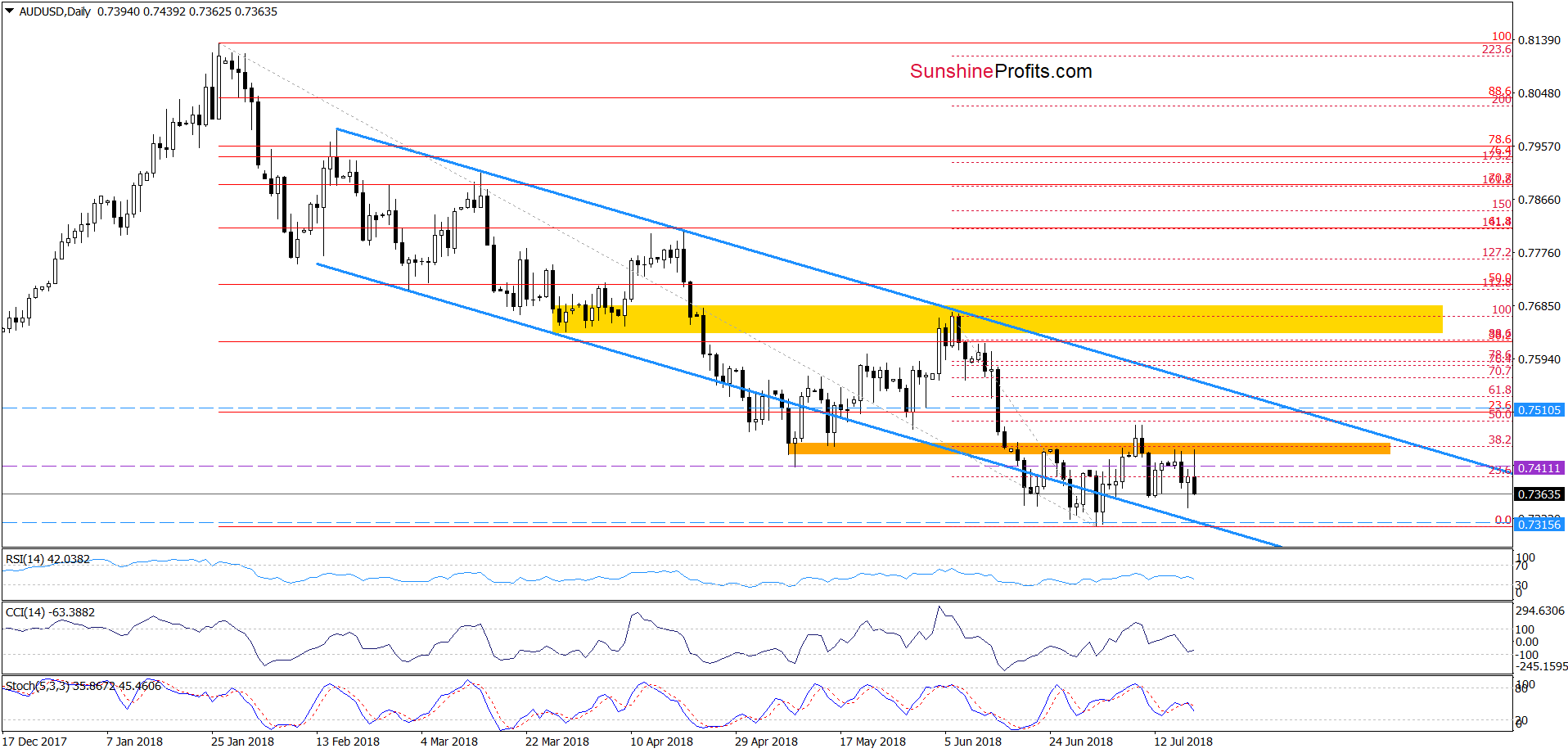

AUD/USD

At the beginning of the week, AUD/USD extended its trip to the north, but despite that“improvement”, the orange resistance zone stopped the buyers, triggering a move to the downside during yesterday’s session.

Although the pair rebounded before the session’s closure, today’s price action clearly showed currency bulls’ weakness. Why? Because, the orange resistance area managed to stop them once again, which encouraged their opponents to act.

Thanks to their determination, AUD/USD erased almost entire earlier move to the upside, which together with the re-generated by the Stochastic Oscillator sell signal, suggests further deterioration and (at least) a decline to our downside targets from previous alerts.

What levels are we writing about?

If the pair extends losses from here, we’ll likely see not only a test of the lower border of the blue declining trend channel, but also a decrease to last month’s lows in the following days.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at 0.7510 and the initial downside target at 0.7315 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts